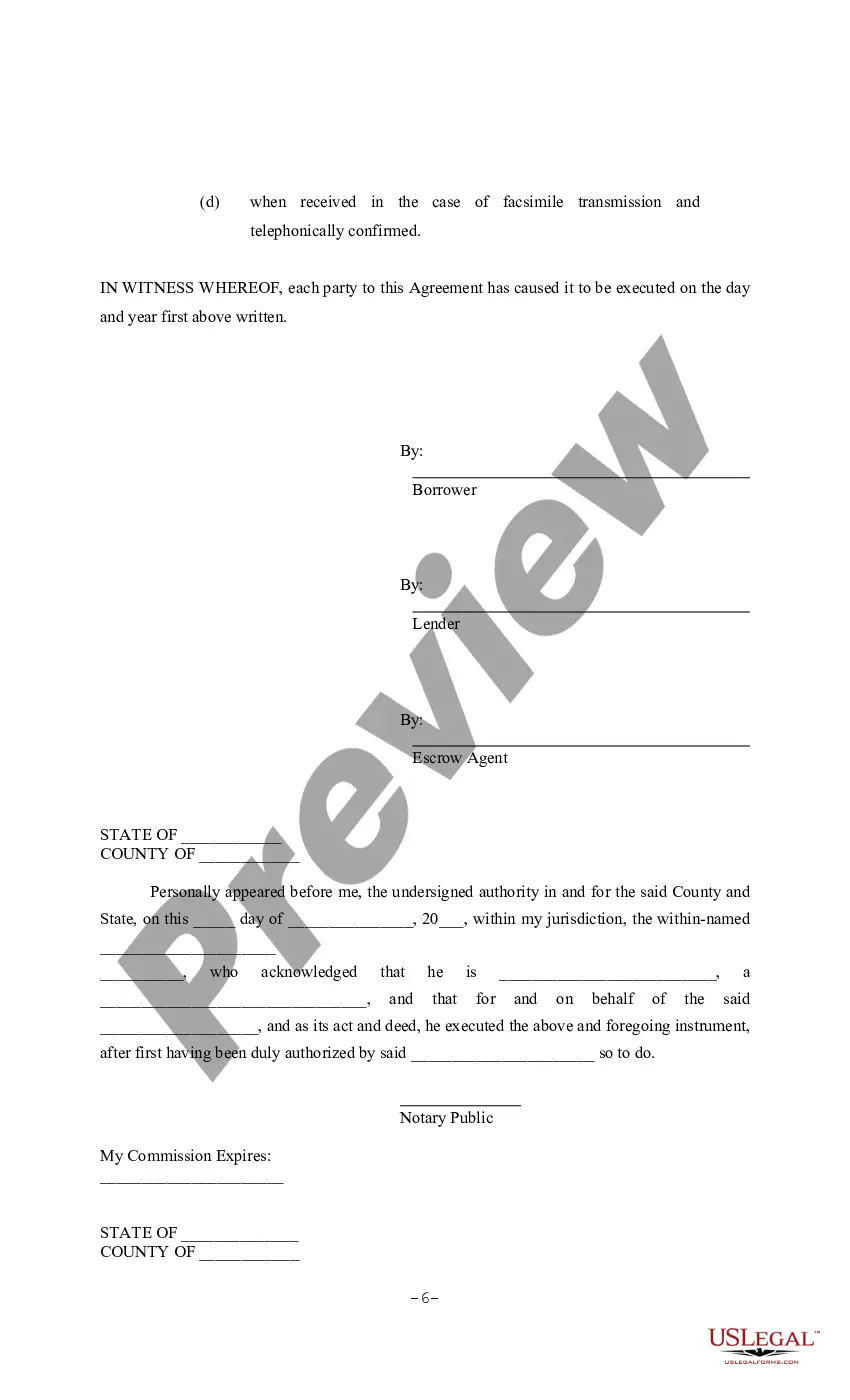

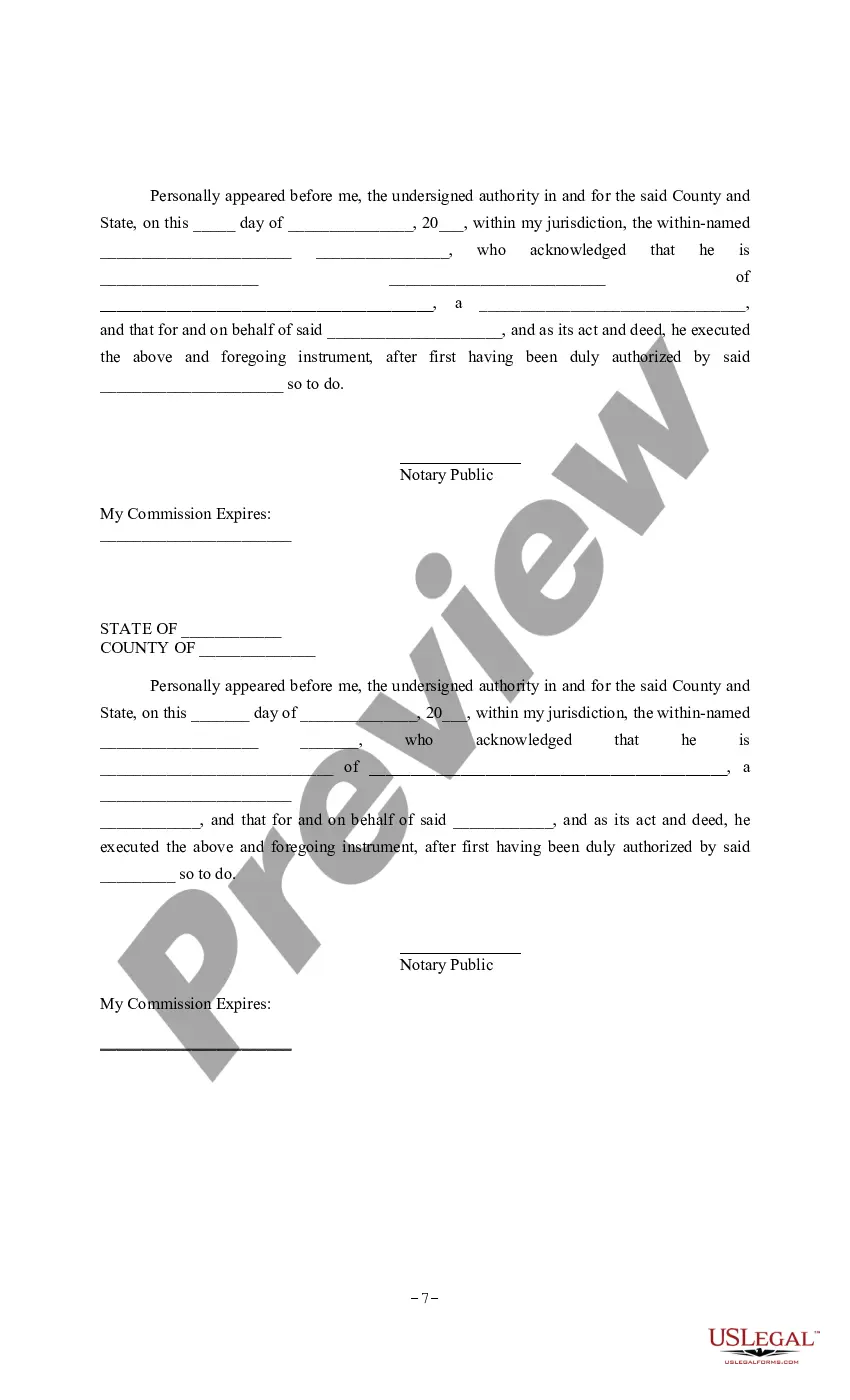

New York Tenant Refitting Escrow Agreement

Description

How to fill out Tenant Refitting Escrow Agreement?

Finding the appropriate legal documents web template can be a challenge.

Certainly, there are countless web templates accessible online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions you should follow.

- The platform offers a multitude of templates, such as the New York Tenant Refitting Escrow Agreement, which you can utilize for both business and personal purposes.

- All of the documents are evaluated by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the New York Tenant Refitting Escrow Agreement.

- Use your account to consult the legal documents you have purchased previously.

- Visit the My documents tab in your account and obtain another copy of the documents you need.

Form popularity

FAQ

The escrow account is liquidated of funds and documents when certain contingencies, such as items identified in a home inspection in need of repair, have been completed. If such repairs haven't taken place, the sale process can be paused until those repairsor any other unmet contingenciesare satisfied.

Tenants have the right to receive 90 days written notice of eviction following the foreclosure. Tenants with a rental subsidy cannot be evicted until their lease expires, unless the new owner is going to live there.

Consumers in New York State are frequently required to participate in escrow transactions.

All funds are held in the escrow until they are needed to pay one or more of the expenses. All money that is placed into your escrow deposit or account will all be eventually credited to you at closing.

If a landlord is renting out a property with six or more units, the account they use to store security deposits must also earn interest. (There is no requirement for landlords with fewer than six units to earn interest on security deposits.) A tenant is entitled to any interest earned on their security deposit.

It is best known in the United States in the context of the real estate industry (specifically in mortgages where the mortgage company establishes an escrow account to pay property tax and insurance during the term of the mortgage).

Your landlord must then place your security deposit in a bank or trust company account to be held until you move out of the property. Your landlord can choose to put your deposit into an escrow account run by an escrow agent, but he is not required to do so by New York law.

Landlords of buildings with six or more apartments must put all security deposits in a New York bank account earning interest at the prevailing rate. Each tenant must be informed in writing of the bank's name and address and the amount of the deposit.

You must give the landlord proper notice and adequate time to make the repairs before you have the right to place rent in escrow. The escrow account can only be set up by the court. You can ask a court to establish a rent escrow by filing a Complaint for Rent Escrow (DC-CV-083).

Yes, at the initial renting of the apartment to the tenant, the owner may collect a security deposit. The amount of a security deposit for rent regulated apartments can be no more than one month's rent. The security deposit must be kept by the owner in an interest bearing account in a NYS bank.