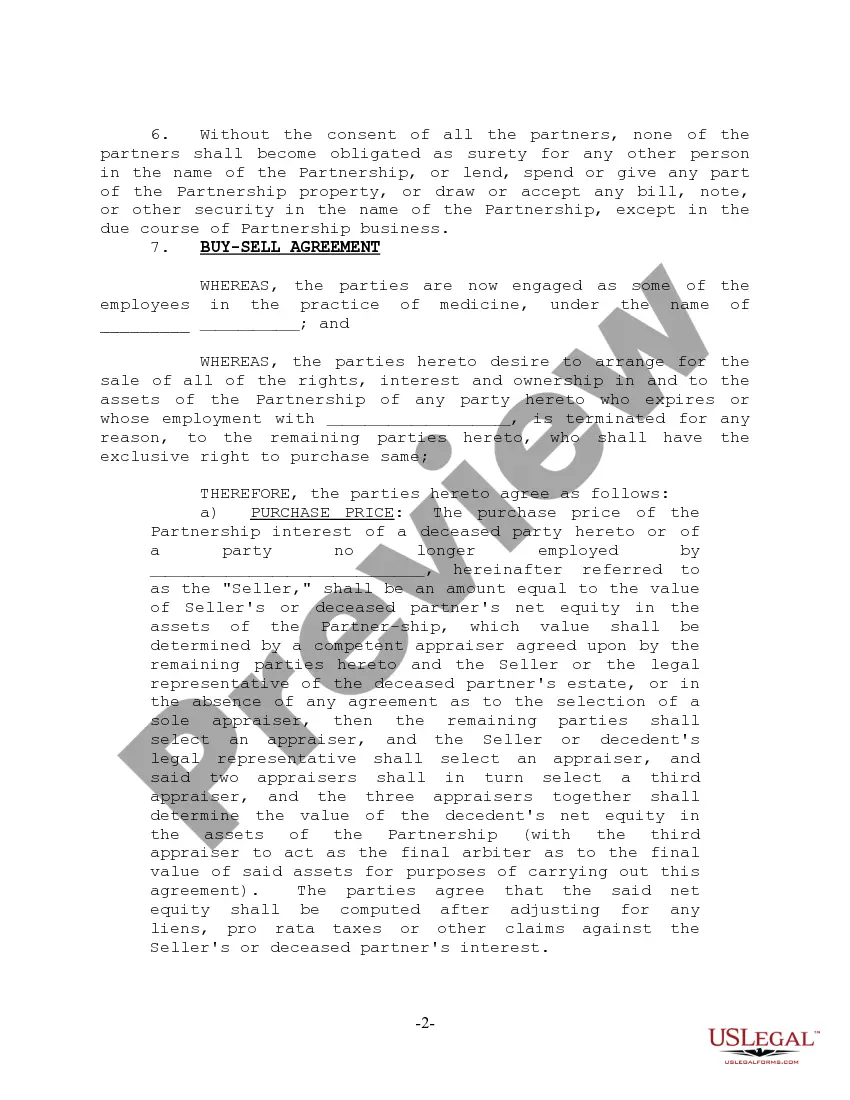

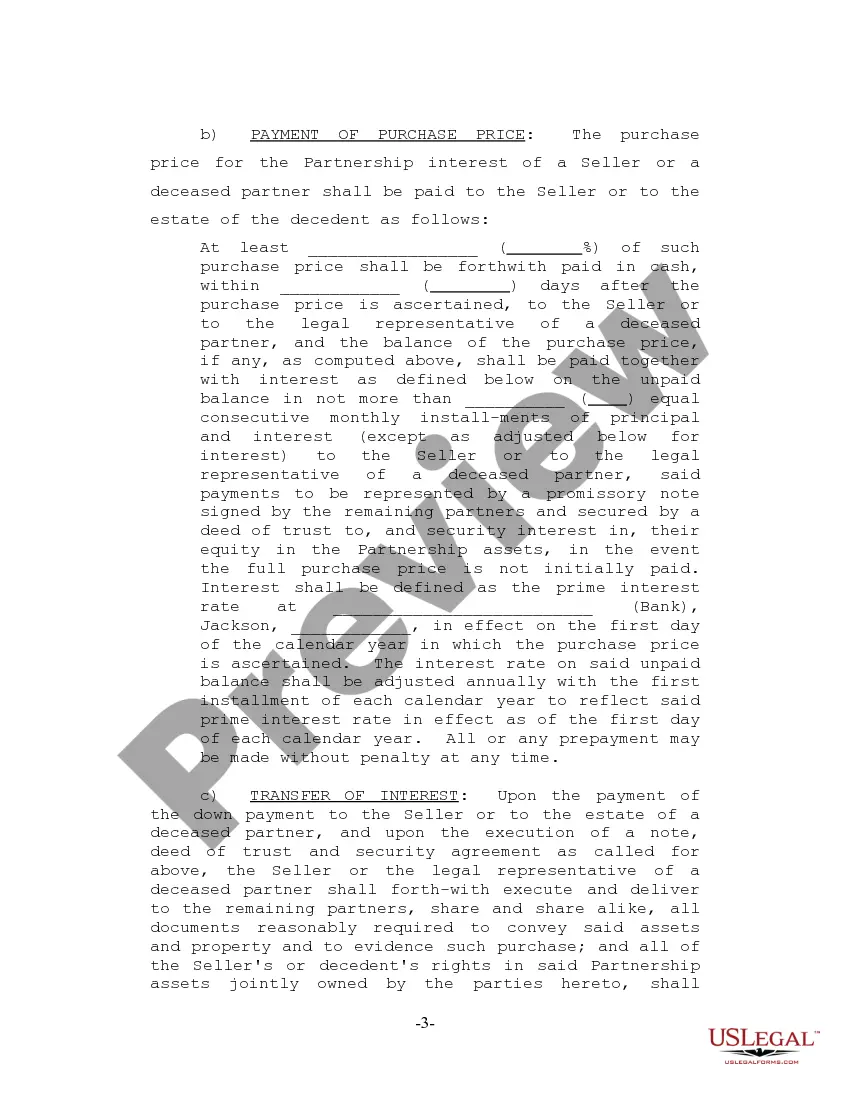

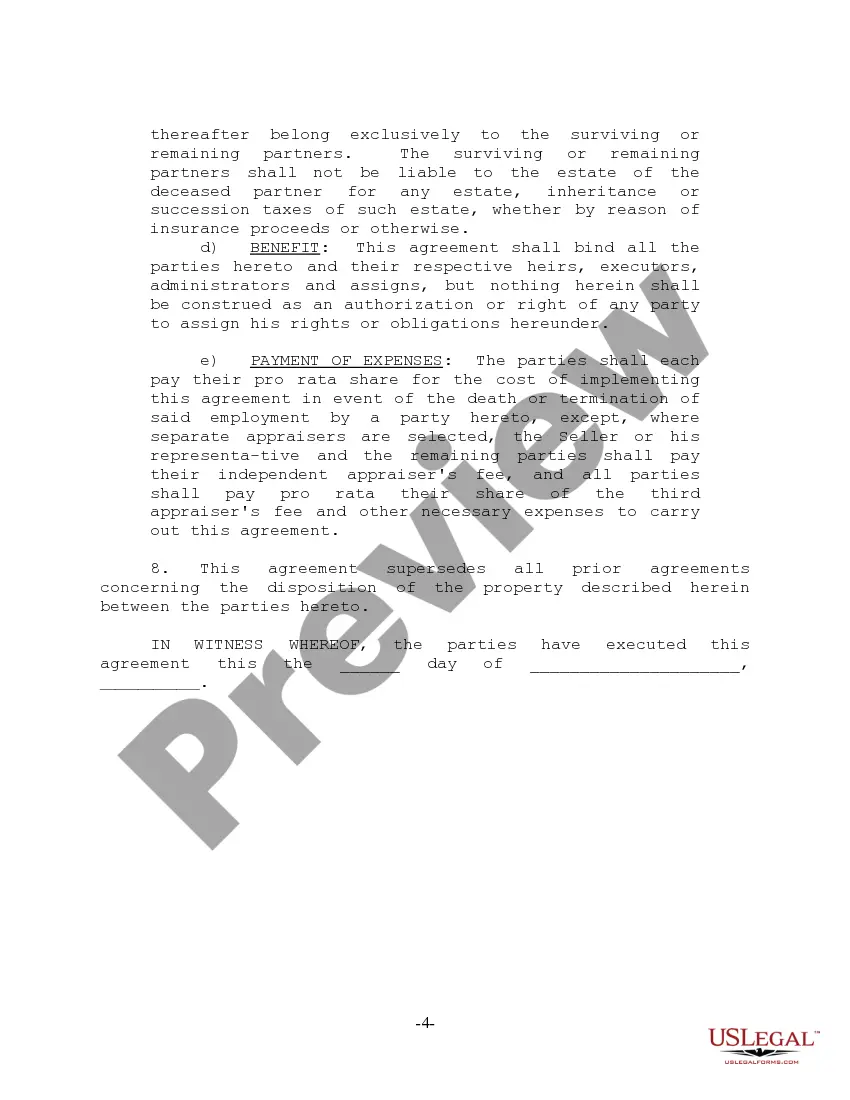

A New York Partnership Agreement for a Law Firm is a legal document that outlines the details and terms of the partnership between two or more attorneys who wish to establish a practice together in the state of New York. This comprehensive agreement serves as the foundation for the operation, management, and governance of the law firm. Keyword: New York Partnership Agreement for Law Firm The agreement covers various key aspects, including but not limited to: 1. Partnership Formation: It specifies the names and addresses of the partners, the date of formation, and the duration of the partnership. Additionally, it states the purpose and objectives of the law firm. 2. Capital Contributions: This section outlines the contributions made by each partner, which may include financial investments, office space, equipment, or other assets. It details the percentage of ownership allocated to each partner based on their contributions. 3. Allocation of Profits and Losses: The agreement determines how the firm's profits and losses will be allocated among the partners. This could be based on the capital contribution or on a predetermined percentage, considering factors like seniority or performance. 4. Management and Decision-making: It clarifies how the firm will be managed and operated, including the decision-making process for significant matters. This may involve unanimous or majority voting, designating managing partners, or establishing a management committee. 5. Roles and Responsibilities: The agreement defines the roles, responsibilities, and duties of each partner, such as client acquisition, case management, financial management, administration, or marketing activities. 6. Compensation and Draw: It outlines the partners' compensation structure, including salaries, bonuses, or distributions. This section may also cover the frequency and method of payment, such as monthly draws or quarterly distributions. 7. Withdrawal or Retirement: The agreement establishes the terms and conditions for a partner's withdrawal or retirement from the firm, including notice periods, buyout provisions, or non-compete clauses. 8. Dispute Resolution: It specifies how disputes among the partners will be resolved, whether through mandatory arbitration, mediation, or litigation. This ensures a structured process for resolving disagreements to avoid disrupting the firm's operations. Types of New York Partnership Agreement for Law Firm: 1. General Partnership Agreement: This is the most common type of partnership agreement, where all partners have equal rights and responsibilities in managing the law firm. 2. Limited Partnership Agreement: In this arrangement, there are two types of partners: general partners and limited partners. General partners have unlimited liability and actively participate in managing the firm, while limited partners have limited liability and play a more passive role. 3. Limited Liability Partnership (LLP) Agreement: This type of agreement provides each partner with limited liability protection, shielding their personal assets from the firm's obligations and debts. Laps are often preferred by law firms due to the added level of protection. In conclusion, a New York Partnership Agreement for Law Firm is a crucial legal document that establishes the framework and guidelines for the successful operation of a law practice in New York. It covers areas such as partnership formation, capital contributions, profit sharing, management, compensation, withdrawal, and dispute resolution. The three main types of partnership agreements are the general partnership agreement, limited partnership agreement, and limited liability partnership (LLP) agreement.

Sample Law Firm Partnership Agreement

Description law partnership agreement

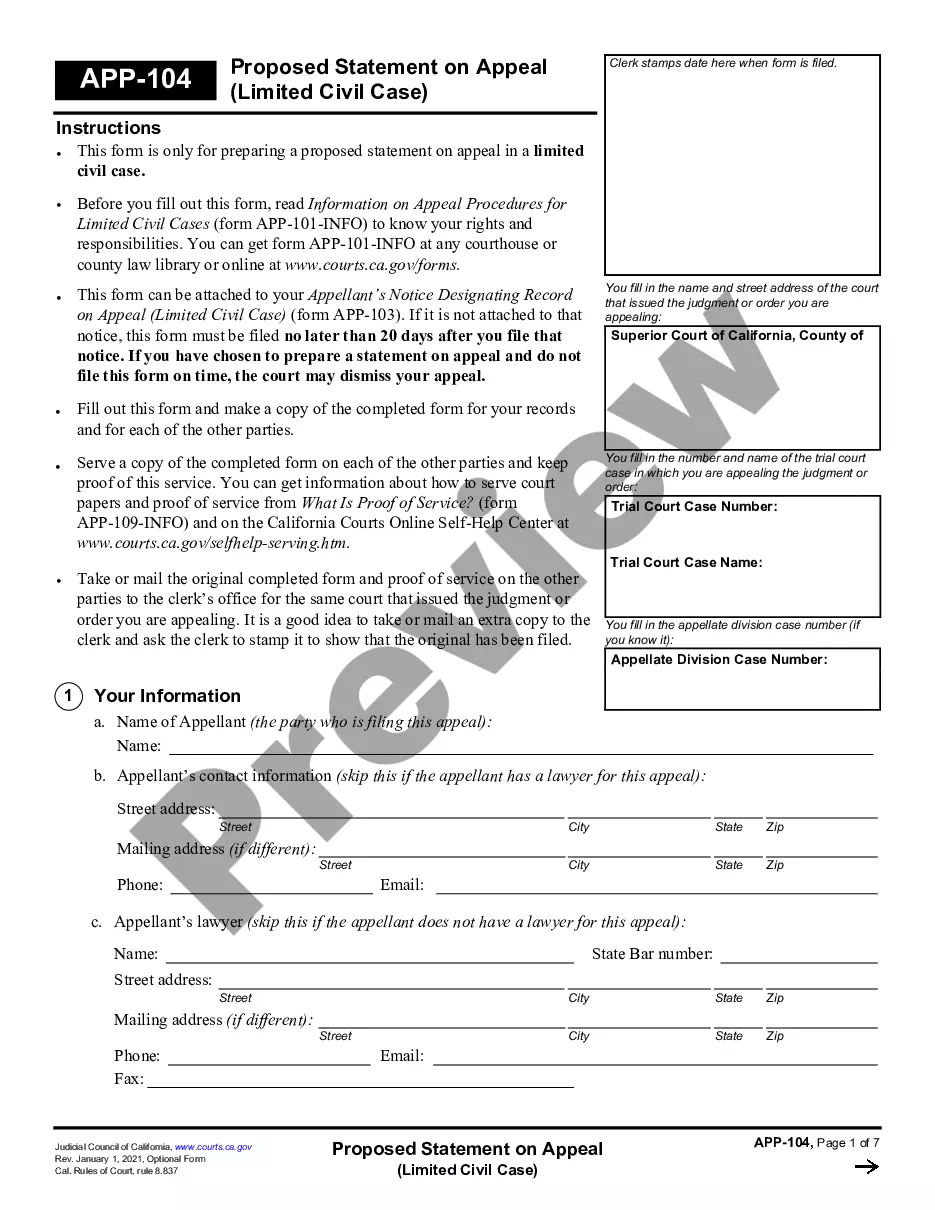

How to fill out New York Partnership Agreement For Law Firm?

Have you been in a place that you require files for sometimes enterprise or specific reasons nearly every day? There are plenty of authorized papers themes available online, but locating ones you can rely on isn`t straightforward. US Legal Forms delivers a large number of kind themes, much like the New York Partnership Agreement for Law Firm, which are created in order to meet state and federal demands.

In case you are presently acquainted with US Legal Forms site and have a free account, basically log in. After that, it is possible to download the New York Partnership Agreement for Law Firm format.

Should you not offer an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and ensure it is for the appropriate city/county.

- Take advantage of the Review key to check the shape.

- Look at the description to ensure that you have selected the proper kind.

- If the kind isn`t what you`re seeking, take advantage of the Look for area to obtain the kind that meets your requirements and demands.

- Once you find the appropriate kind, click Buy now.

- Select the prices strategy you want, submit the desired info to produce your account, and pay for the transaction with your PayPal or charge card.

- Select a practical paper structure and download your version.

Discover all the papers themes you possess bought in the My Forms menu. You may get a additional version of New York Partnership Agreement for Law Firm whenever, if necessary. Just select the essential kind to download or printing the papers format.

Use US Legal Forms, the most comprehensive selection of authorized kinds, in order to save some time and avoid faults. The service delivers appropriately made authorized papers themes that can be used for an array of reasons. Produce a free account on US Legal Forms and initiate producing your lifestyle a little easier.

lllp full form Form popularity

law firm partnership agreements Other Form Names

FAQ

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

While there are no formal filing or registration requirements needed to create a partnership, partnerships must comply with registration, filing, and tax requirements applicable to any business.

Features of partnership form of organisation are discussed as below:Two or More Persons:Contract or Agreement:Lawful Business:Sharing of Profits and Losses:Liability:Ownership and Control:Mutual Trust and Confidence:Restriction on Transfer of Interest:More items...

To form a partnership in New York, you should take the following steps:Choose a business name.File a fictitious business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

A partner in a law firm, accounting firm, consulting firm, or financial firm is a highly ranked position, traditionally indicating co-ownership of a partnership in which the partners were entitled to a share of the profits as "equity partners." The title can also be used in corporate entities where equity is held by

The state of New York does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

Traditionally, law firms have been run by partnerships a group of senior lawyers who put their own money into the firm in return for a share of the profits. However, in the modern legal profession there are many different types of partnership, with huge variety in terms of how firms are structured.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.09-Oct-2013