New York Bond to Secure against Defects in Construction: A Detailed Description Introduction: In the world of construction, ensuring the quality and integrity of a project is of paramount importance. To provide assurance to stakeholders, contractors in New York often obtain bonds to secure against defects in construction. These bonds serve as a financial guarantee that the contractor will rectify any faults or defects that may arise during or after the construction process, ensuring the satisfaction of project owners and compliance with local laws and regulations. Types of New York Bonds to Secure against Defects in Construction: 1. New York Performance Bonds: Performance bonds are a common type of bond used in construction projects. In the context of securing against defects, New York performance bonds ensure that the contractor will complete the project according to the agreed-upon terms, specifications, and quality standards. If any defects are discovered during construction or within a specified warranty period, the contractor must rectify them at their own expense. 2. New York Payment Bonds: Payment bonds protect project owners against non-payment by contractors to subcontractors, suppliers, and laborers involved in the construction project. In cases where defects arise due to non-payment issues, these bonds can be an essential tool for ensuring that those affected can still receive compensation for rectifying the defects, even if the initial contractor fails to comply. 3. New York Maintenance Bonds: Maintenance bonds function as an extension of performance bonds. They specifically cover defects that become apparent after the project is completed and handed over to the owner. These bonds usually provide coverage for a specified period, commonly one to two years, during which the contractor is responsible for any necessary repairs or replacements. 4. New York Warranty Bonds: Similar to maintenance bonds, warranty bonds secure against defects during a designated warranty period. However, unlike maintenance bonds, warranty bonds are typically issued by third-party insurers or financial institutions, rather than the contractor themselves. These bonds reassure project owners that they will receive compensation for any defects discovered within the specified warranty period. Benefits and Requirements of New York Bonds to Secure against Defects in Construction: — Project Owner Confidence: Bonds instill confidence in project owners, assuring them that the contractor will fulfill their obligations and rectify any defects promptly. — Legal Compliance: Many New York construction projects, especially public and government-funded ones, require bonds as a statutory requirement to meet local laws and regulations. — Financial Protection: Bonds protect project owners by providing a source of funds to rectify defects, making it less likely for owners to incur additional costs. Conclusion: New York bonds to secure against defects in construction play a crucial role in ensuring the successful completion of projects while maintaining quality and accountability. Performance bonds, payment bonds, maintenance bonds, and warranty bonds provide financial safeguards and legal compliance, which ultimately benefit all project stakeholders. Construction experts and project owners should carefully consider obtaining the appropriate bond types to protect their interests and uphold the highest standards of quality in construction projects throughout New York.

New York Bond to Secure against Defects in Construction

Description

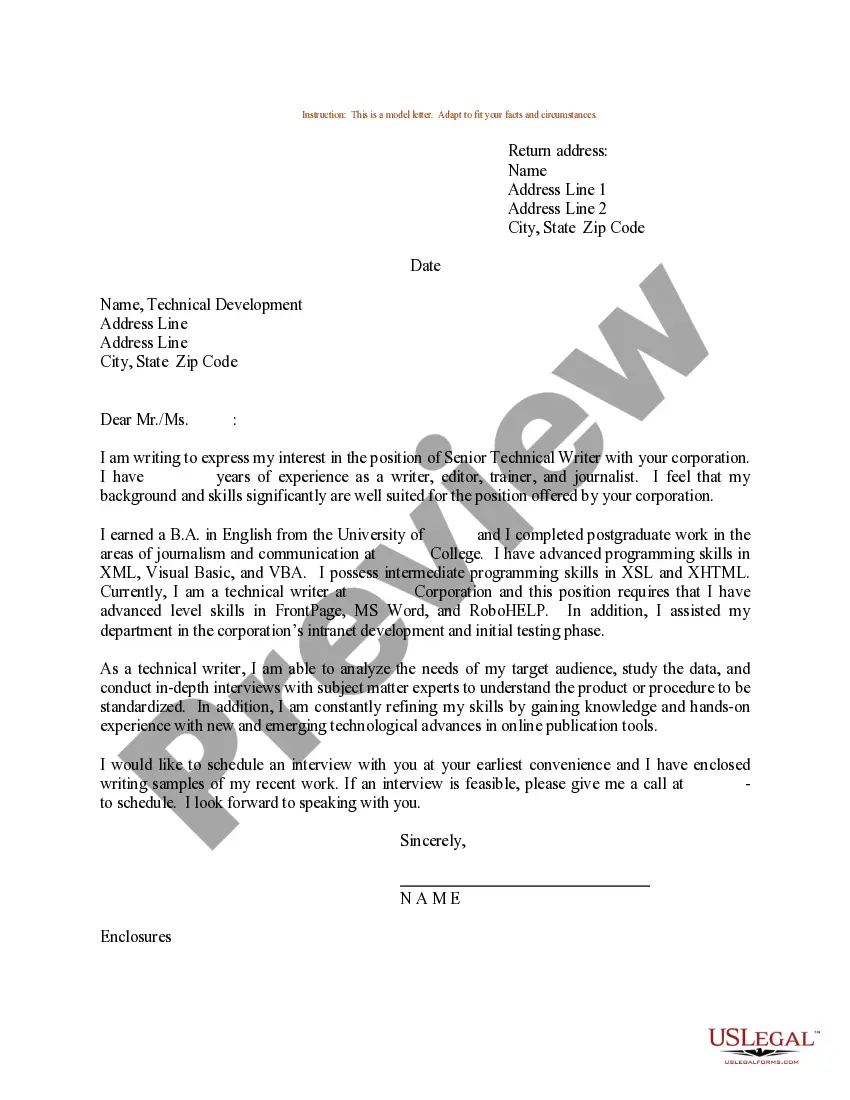

How to fill out New York Bond To Secure Against Defects In Construction?

Choosing the right lawful papers format might be a battle. Obviously, there are plenty of web templates accessible on the Internet, but how will you discover the lawful kind you want? Utilize the US Legal Forms web site. The service delivers a huge number of web templates, including the New York Bond to Secure against Defects in Construction, which can be used for business and personal requires. All the types are checked out by pros and satisfy federal and state requirements.

When you are currently listed, log in in your account and click on the Down load button to have the New York Bond to Secure against Defects in Construction. Utilize your account to look throughout the lawful types you might have purchased earlier. Proceed to the My Forms tab of your account and acquire an additional copy from the papers you want.

When you are a whole new end user of US Legal Forms, here are basic instructions so that you can adhere to:

- Initial, be sure you have chosen the right kind to your metropolis/county. You are able to look through the form making use of the Review button and read the form outline to make certain this is the best for you.

- If the kind fails to satisfy your preferences, utilize the Seach area to discover the correct kind.

- Once you are certain that the form is proper, select the Purchase now button to have the kind.

- Choose the prices strategy you would like and enter the necessary info. Make your account and purchase the order with your PayPal account or charge card.

- Select the data file structure and obtain the lawful papers format in your gadget.

- Complete, change and printing and sign the obtained New York Bond to Secure against Defects in Construction.

US Legal Forms will be the greatest library of lawful types for which you can see various papers web templates. Utilize the service to obtain expertly-created papers that adhere to state requirements.