The New York Affiliate Letter in Rule 145 Transaction is an important document that plays a crucial role in certain types of corporate transactions, specifically those regulated by Rule 145 of the Securities Act of 1933. This particular rule governs the treatment of securities issued in connection with mergers, acquisitions, or other business combinations involving affiliates of the issuer. The New York Affiliate Letter serves as a written representation by the New York affiliates of the participating companies, confirming their compliance with certain requirements and conditions set forth by the Securities and Exchange Commission (SEC) and the New York Stock Exchange (NYSE). This letter is typically requested by the issuer or the underwriters, and it verifies that the New York affiliates have received appropriate disclosure and have both the knowledge and ability to evaluate the risks involved in the transaction. It also confirms that these affiliates are not engaging in any manipulative or deceptive practices and that they will not engage in any resales without meeting specific conditions. There are two main types of New York Affiliate Letters in Rule 145 Transactions: 1. New York Affiliate Investor Letter: This type of letter is required when one or more New York affiliates are acting as investors in the transaction. The letter highlights that the affiliates are making an informed investment decision and are aware of any potential risks associated with the securities being issued. It affirms that the affiliates are acquiring the securities for their own account and not with the intention of distributing them to other parties. 2. New York Affiliate Resale Letter: This letter is necessary when the New York affiliates intend to engage in resales of the securities received in the transaction. It confirms that any subsequent resales will only take place in compliance with applicable securities laws and regulations. The letter also outlines any specific restrictions or requirements imposed by the SEC or the NYSE on the resale of these securities. In summary, the New York Affiliate Letter in Rule 145 Transaction demonstrates the New York affiliates' active participation and understanding of the transaction's intricacies. It ensures that the affiliates are fully aware of their obligations and responsibilities, facilitating a transparent and compliant transaction process.

New York Affiliate Letter in Rule 145 Transaction

Description

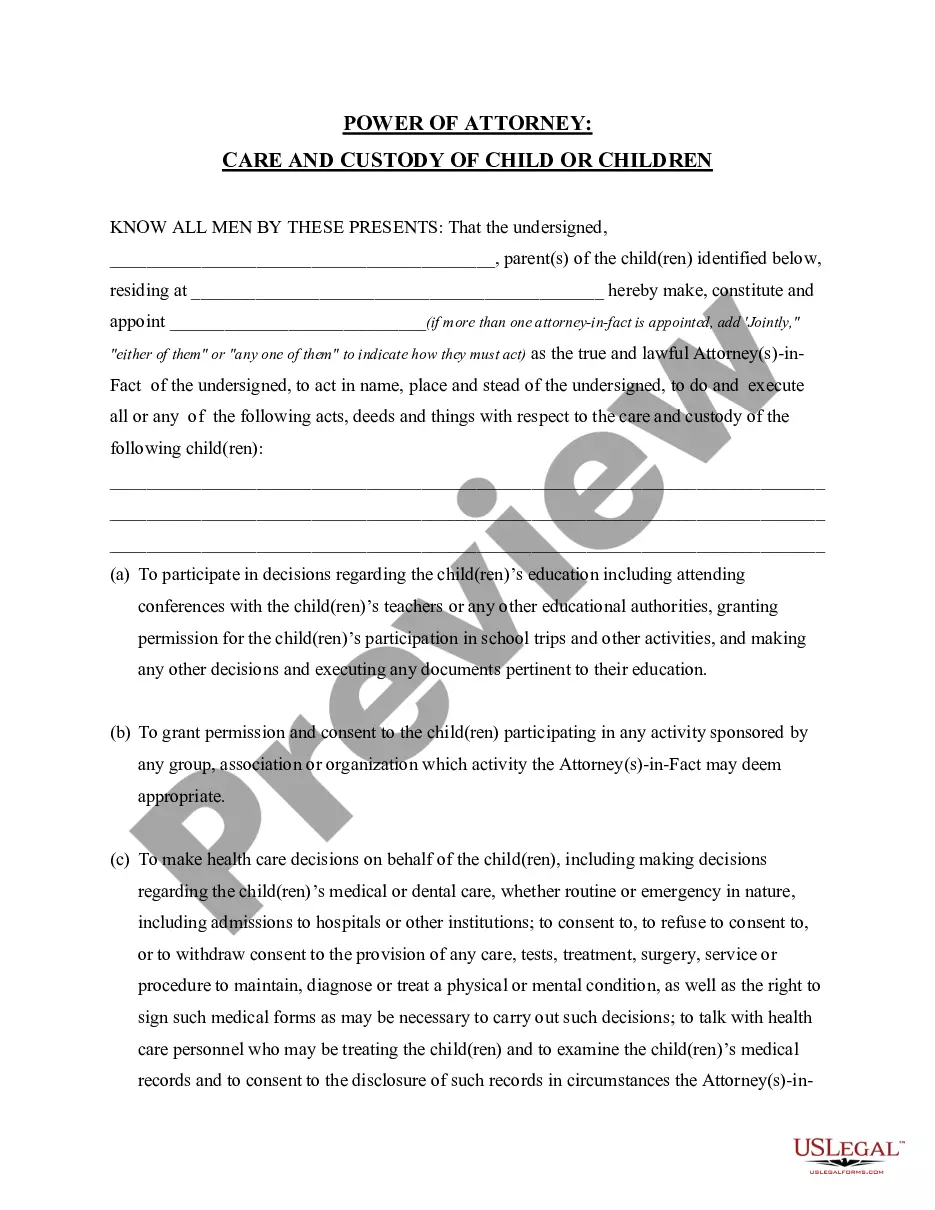

How to fill out New York Affiliate Letter In Rule 145 Transaction?

Are you currently in the situation in which you need paperwork for both company or individual uses just about every day? There are tons of authorized record web templates available online, but discovering kinds you can rely is not effortless. US Legal Forms gives thousands of kind web templates, like the New York Affiliate Letter in Rule 145 Transaction, that happen to be created to fulfill federal and state needs.

If you are previously knowledgeable about US Legal Forms website and have a free account, simply log in. Following that, you are able to down load the New York Affiliate Letter in Rule 145 Transaction web template.

If you do not have an bank account and wish to begin to use US Legal Forms, follow these steps:

- Discover the kind you want and ensure it is for the correct area/region.

- Take advantage of the Preview switch to review the form.

- Read the explanation to actually have selected the appropriate kind.

- In case the kind is not what you`re trying to find, make use of the Look for industry to obtain the kind that meets your needs and needs.

- When you get the correct kind, simply click Get now.

- Select the pricing prepare you want, fill out the required details to generate your account, and pay for the order making use of your PayPal or credit card.

- Pick a hassle-free data file file format and down load your version.

Locate every one of the record web templates you might have purchased in the My Forms menus. You can get a extra version of New York Affiliate Letter in Rule 145 Transaction anytime, if possible. Just click on the required kind to down load or print the record web template.

Use US Legal Forms, the most substantial collection of authorized varieties, in order to save efforts and prevent errors. The support gives expertly produced authorized record web templates which can be used for an array of uses. Create a free account on US Legal Forms and commence making your lifestyle a little easier.

Form popularity

FAQ

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

The Commission raised the Form 144 filing thresholds so that affiliates must file Form 144 if their proposed sales in reliance on Rule 144 within a three-month period exceed 5,000 shares or $50,000. Non-affiliates no longer need to file Form 144.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.