Title: Understanding New York Accredited Investor Representation Letter: Types and Importance Introduction: In the realm of financial investments and securities offerings, New York Accredited Investor Representation Letters play a significant role. These letters serve as official documents that verify an individual's accreditation status, allowing them to participate in certain investment opportunities that are restricted to high-net-worth individuals. This detailed description aims to shed light on the key aspects of New York Accredited Investor Representation Letters, their types, and the importance they hold in the financial landscape. Types of New York Accredited Investor Representation Letters: 1. Individual Accredited Investor Representation Letters: This type of letter is issued to individual investors who meet predefined criteria set by the United States Securities and Exchange Commission (SEC). Eligibility usually requires a minimum income or net worth threshold, ensuring the investor has the financial capability and risk tolerance required for certain investment opportunities. 2. Entity Accredited Investor Representation Letters: This type of letter is issued to entities such as corporations, partnerships, limited liability companies (LCS), and trusts. Entities can acquire accredited investor status by meeting specific financial criteria or if their equity owners are themselves accredited investors. Key Components of a New York Accredited Investor Representation Letter: A. Official Letterhead: The letter should be printed on the company's letterhead or, in the case of individual representation letters, on the individual's personal letterhead, showcasing relevant contact information. B. Identification and Accreditation Recognition: The letter should explicitly state the investor's name, address, and acknowledgment of their accredited investor status while meeting the criteria specified by the SEC. C. Investor's Representation: The letter should include a declaration by the investor, affirming their understanding and compliance with relevant legal regulations and investment restrictions applicable to accredited investors. D. Jurisdictional Clauses: If the investor is investing in offerings or securities in multiple jurisdictions, the letter may contain clauses specifying the applicable jurisdiction(s) and the investor's compliance with their regulations. Importance and Significance: 1. Regulatory Compliance: New York Accredited Investor Representation Letters are vital for regulatory compliance and protect both issuers and investors involved in private placement offerings, ensuring adherence to federal and state securities laws. 2. Verification of Accreditation Status: These letters enable issuers to verify an investor's accredited status, granting them access to exclusive investment opportunities that require such credentials. 3. Risk Management: Accredited investor representation letters help mitigate potential legal risks and enhance transparency by providing documented evidence of an investor's comprehension of risks associated with high-risk investments, protecting issuers from liability. 4. Improved Investor Relations: By obtaining an accredited investor representation letter, investors can establish a bond of trust and credibility with issuers, potentially leading to enhanced communication, collaboration, and future investment opportunities. Conclusion: New York Accredited Investor Representation Letters are crucial documents that validate an individual or entity's accredited status. Whether they are individual or entity letters, they serve as verifications of financial eligibility for exclusive investment opportunities. By complying with legal requirements and addressing investor obligations, these letters play a pivotal role in the financial landscape, facilitating secure and transparent investment relations between issuers and accredited investors.

New York Accredited Investor Representation Letter

Description

How to fill out New York Accredited Investor Representation Letter?

US Legal Forms - one of the biggest libraries of lawful forms in the States - delivers a wide array of lawful file themes you can down load or print out. Making use of the site, you may get a huge number of forms for organization and individual uses, categorized by categories, claims, or search phrases.You can get the most recent variations of forms such as the New York Accredited Investor Representation Letter in seconds.

If you already possess a registration, log in and down load New York Accredited Investor Representation Letter through the US Legal Forms collection. The Obtain button will show up on every single develop you perspective. You get access to all previously saved forms from the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, allow me to share basic guidelines to get you started:

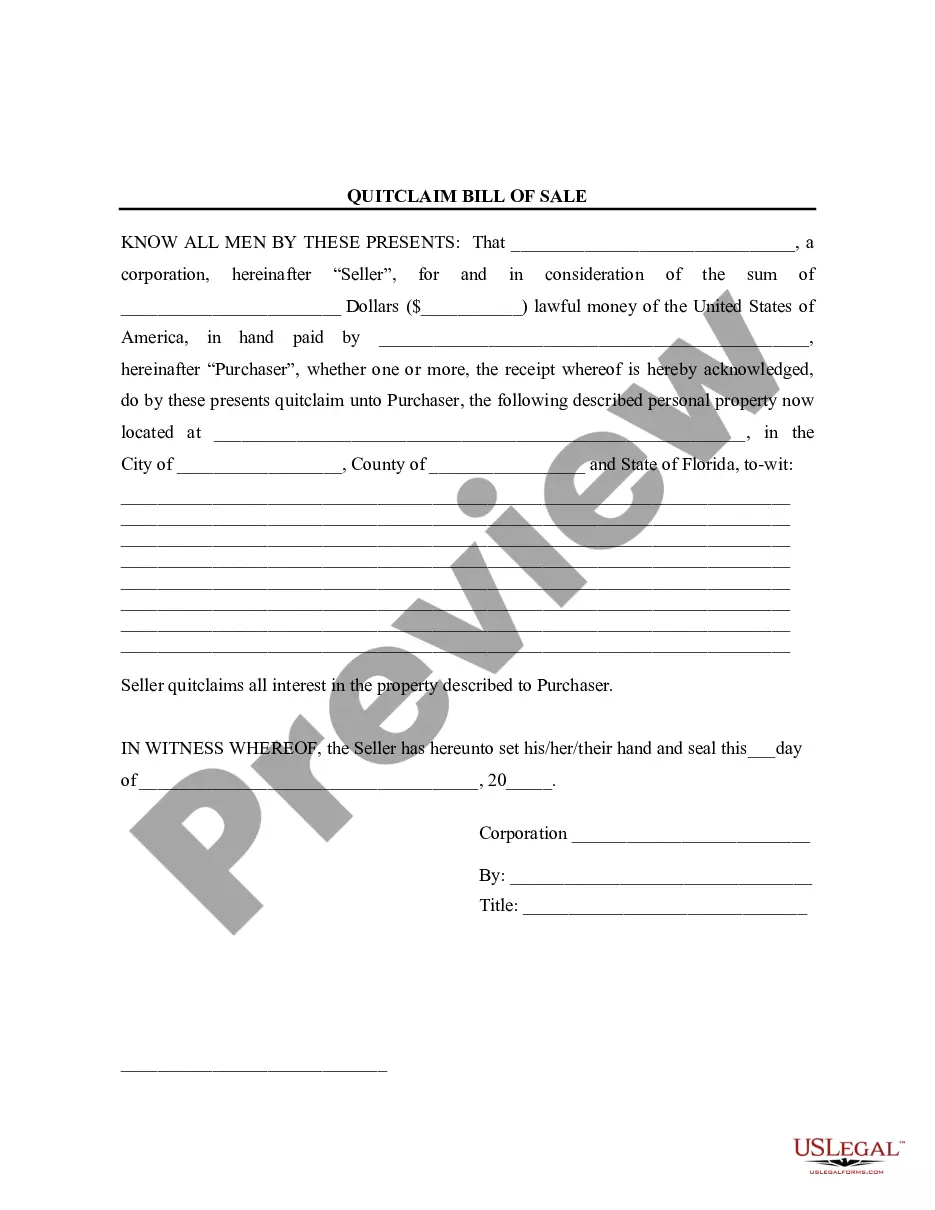

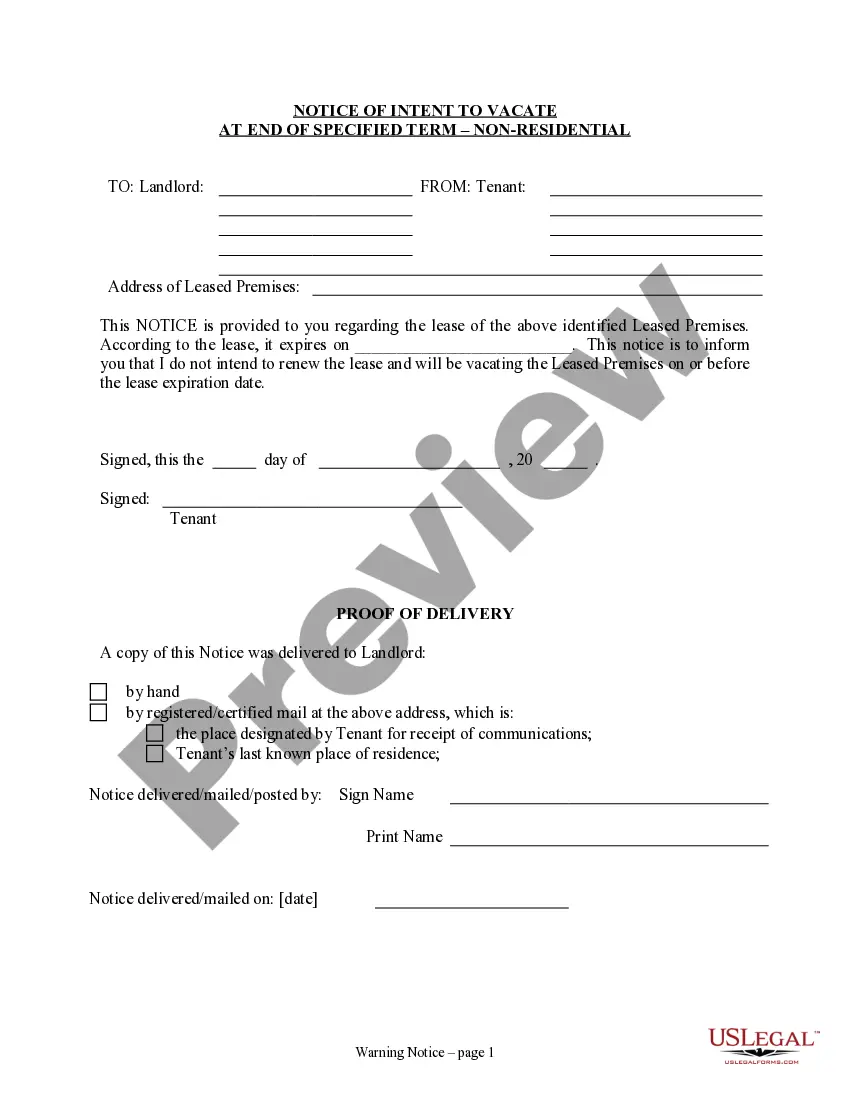

- Be sure you have picked out the right develop for your metropolis/area. Click the Preview button to analyze the form`s articles. Browse the develop information to actually have chosen the proper develop.

- In the event the develop does not satisfy your needs, make use of the Research area near the top of the screen to discover the the one that does.

- If you are happy with the shape, validate your option by visiting the Acquire now button. Then, opt for the costs prepare you prefer and give your qualifications to sign up for the profile.

- Method the deal. Make use of your bank card or PayPal profile to complete the deal.

- Pick the formatting and down load the shape on the system.

- Make changes. Complete, modify and print out and signal the saved New York Accredited Investor Representation Letter.

Each web template you added to your bank account lacks an expiry day and it is yours permanently. So, in order to down load or print out another duplicate, just visit the My Forms portion and then click on the develop you require.

Obtain access to the New York Accredited Investor Representation Letter with US Legal Forms, probably the most considerable collection of lawful file themes. Use a huge number of professional and state-particular themes that satisfy your company or individual needs and needs.

Form popularity

FAQ

Some documents that can prove an investor's accredited status include:Tax filings or pay stubs;A letter from an accountant or employer confirming their actual and expected annual income; or.IRS Forms like W-2s, 1040s, 1099s, K-1s or other tax documentation that report income.

In lieu of providing income or net assets information, you may provide a professional letter from a licensed CPA, attorney, investment advisor or registered broker-dealer. The letter should state that the professional service provider has a reasonable belief that you are an Accredited Investor.

A qualified institutional buyer (QIB) representation letter for an unlegended Rule 144A offering of securities by a Canadian issuer. The QIB representation letter relates to a concurrent public offering in Canada and an offering in the United States conducted in reliance on Rule 144A under the Securities Act.

A qualified institutional buyer (QIB) is a class of investor that by virtue of being a sophisticated investor, does not require the regulatory protection that the Securities Act's registration provisions gives to investors.

The Applicant's most recent publicly available information appearing in a recognized securities manual, provided that such information is as of a date within 16 months preceding the date of this Application in the case of a U.S. Applicant and within 18 months preceding such date for a non-U.S. Applicant.

Investor Representation Letter means a letter from initial investors of a Bond offering that includes but is not limited to a certification that they reasonably meet the standards of a Sophisticated Investor or Qualified Institutional Buyer, that they are purchasing Bonds for their own account, that they have the

Accredited Investor Definition Income: Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year. Professional: Is a knowledgeable employee of certain investment funds or holds a valid Series 7, 65 or 82 license.

In a Rule 506(b) offering, investors can self-certify, so this is where the opportunity for an investor to falsify their qualifications comes in. In a Rule 506(c) offering, investors must provide reasonable assurance to the Syndicator that they are accredited, which must be dated within 90 days of the investment.

A QIB can be an insurance company, a bank, a 401(k) plan, an employee benefit plan, a trust fund, a business development company (BDC), a charity, or even an entity owned by qualified investors.