New York Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee: A Comprehensive Overview Introduction: In New York, a split-dollar insurance agreement with a policy jointly owned by an employer and employee offers a unique way to structure life insurance benefits. This arrangement is often used as an executive compensation tool, allowing employers to provide valuable benefits while retaining some control over the policy. In this detailed description, we will explore the key aspects, benefits, and different types of New York split-dollar insurance agreements with policies jointly owned by employers and employees. Key Elements of a New York Split-Dollar Insurance Agreement: 1. Joint Policy Ownership: Unlike traditional life insurance policies, split-dollar insurance agreements entail joint ownership between the employer and employee. Both parties have a vested interest in the policy, which helps define the agreement's terms. 2. Premiums and Ownership Split: The agreement stipulates how premiums will be paid and allocated between the employer and employee. Typically, the employer pays a portion of the premium, while the employee is responsible for the remaining balance. The ownership split might be 50/50 or any other agreed-upon proportion. 3. Death Benefit Allocation: The allocation of the death benefit can be structured in various ways. It may be predetermined, based on a formula, or tied to certain milestones and can be modified by the agreement terms. 4. Employers Collateral Interest: To secure their premium contributions and protect their investment, employers often take a collateral interest in the policy's cash value. This ensures that their payments are recoverable if the arrangement terminates before the insured employee's death. Benefits of New York Split-Dollar Insurance Agreements: 1. Competitive Employee Benefits: Split-dollar insurance agreements provide powerful benefits to employees, making them an attractive compensation tool. These agreements can supplement employees' retirement savings, provide death benefit protection, and serve as a key retention tool. 2. Tax Advantages: Split-dollar life insurance arrangements offer favorable tax treatment. Employers can deduct their premium contributions, while employees generally do not face immediate income tax consequences. 3. Flexibility and Customization: Split-dollar insurance agreements can be tailored to meet the specific needs of both employers and employees. The joint ownership structure allows for flexibility in policy design, premium payment schedules, and policy termination options. Different Types of New York Split-Dollar Insurance Agreements: 1. Equity Split-Dollar: This type of split-dollar arrangement focuses on providing the employee with potential equity in the policy's cash value growth. The employee assumes the responsibility of paying for the pure insurance costs, while the employer funds the equity portion. 2. Endorsement Split-Dollar: In endorsement split-dollar agreements, the employer endorses the policy, providing the employee with access to additional insurance coverage. This endorsement can be utilized to protect a key employee or enhance executive compensation. 3. Loan Regime Split-Dollar: This type of split-dollar arrangement incorporates loan provisions, allowing employers to recoup their premium contributions by lending funds to the employee. The loan is repaid either with policy proceeds or via other pre-determined methods. Conclusion: New York split-dollar insurance agreements with policies owned jointly by employers and employees offer a flexible and beneficial mechanism for structuring executive compensation and providing attractive employee benefits. With various types of split-dollar arrangements available, employers can customize their agreements to align with their objectives and meet employees' specific needs. Seeking guidance from insurance and legal professionals is crucial to establish a well-structured and compliant New York split-dollar insurance agreement.

New York Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

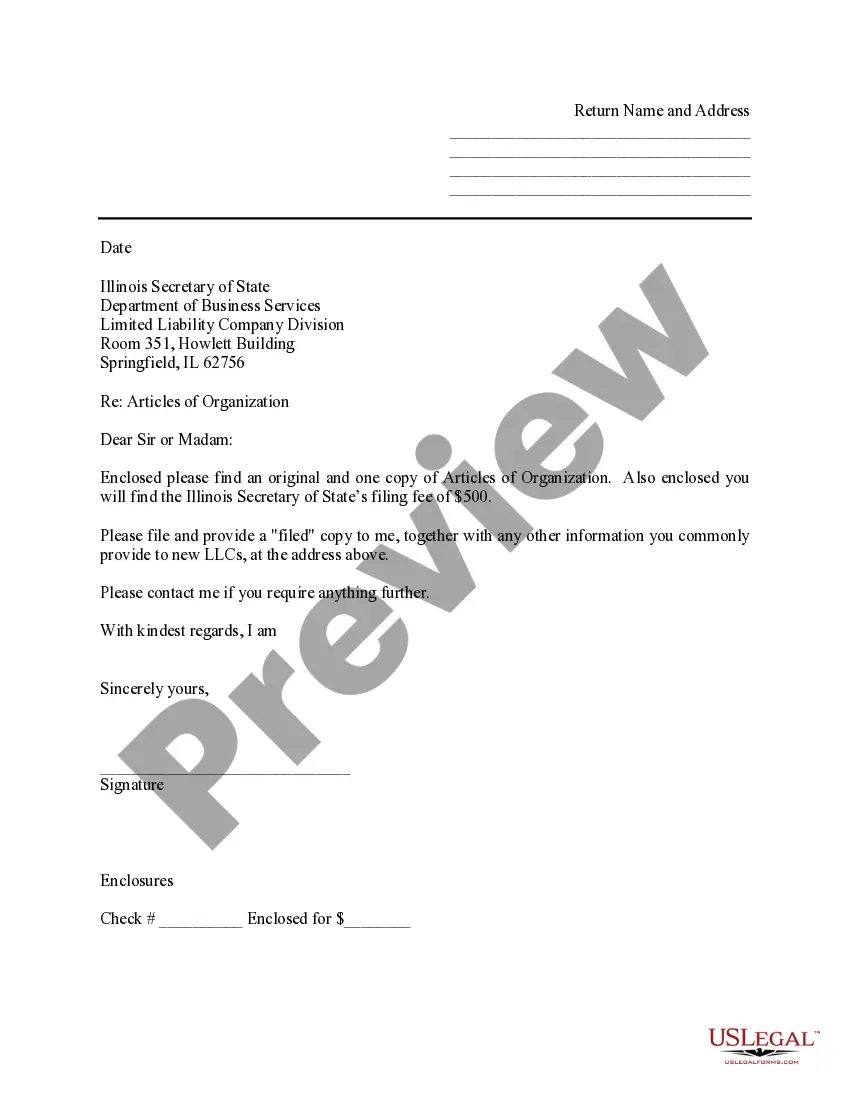

How to fill out New York Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

Finding the right legitimate document format can be quite a have difficulties. Obviously, there are plenty of web templates accessible on the Internet, but how do you obtain the legitimate form you want? Use the US Legal Forms website. The service gives a large number of web templates, for example the New York Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee, which can be used for enterprise and private requirements. All the types are inspected by pros and meet up with federal and state requirements.

If you are previously listed, log in in your profile and click the Down load key to get the New York Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee. Make use of profile to look from the legitimate types you may have acquired in the past. Go to the My Forms tab of the profile and obtain another version from the document you want.

If you are a new customer of US Legal Forms, listed here are simple guidelines that you can adhere to:

- Initially, make certain you have selected the right form for your personal town/region. You are able to look over the form using the Preview key and study the form information to guarantee this is the best for you.

- In case the form is not going to meet up with your requirements, take advantage of the Seach discipline to get the proper form.

- When you are certain that the form is proper, click on the Get now key to get the form.

- Select the costs prepare you desire and type in the necessary information. Build your profile and pay money for the order making use of your PayPal profile or Visa or Mastercard.

- Select the submit format and obtain the legitimate document format in your gadget.

- Full, edit and print and sign the received New York Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee.

US Legal Forms will be the greatest catalogue of legitimate types in which you will find a variety of document web templates. Use the company to obtain expertly-produced files that adhere to status requirements.

Form popularity

FAQ

Collateral assignment / loan regime The employee owns the policy and the employer lends the premium required to pay for it. The employee is taxed on the interest-free element of the loan.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability.

Under an endorsement split dollar arrangement, the business purchases an insurance policy on the life of a key employee. The employee then names the beneficiary while the company retains ownership of the policy and pays the premiums. The employee is taxed on the fair market value of the life insurance policy.

There are 2 types of split dollar plans. Collateral assignment / loan regime. Endorsement split dollar / economic benefit regime.

Reverse Split Dollar is an arrangement in which an employee owns a life insurance policy on her own life and endorses death benefit to her employer. How it works during life.

Employer-Sponsored Health Insurance These are also called group plans. Your employer will typically share the cost of your premium with you. Advantages of an employer plan: Your employer often splits the cost of premiums with you.

Split-dollar insurance plans: In an economic benefit arrangement, the employer owns the policy, covers the premiums, and has the authority to grant the rights and benefits. For example, an employer may permit the employee to name their beneficiaries, ensuring that the employee control who receives their death benefits.

Under a collateral assignment split dollar arrangement, the business loans a key employee money to pay the premium on a life insurance policy. The employee pledges the policy as collateral for the loan.