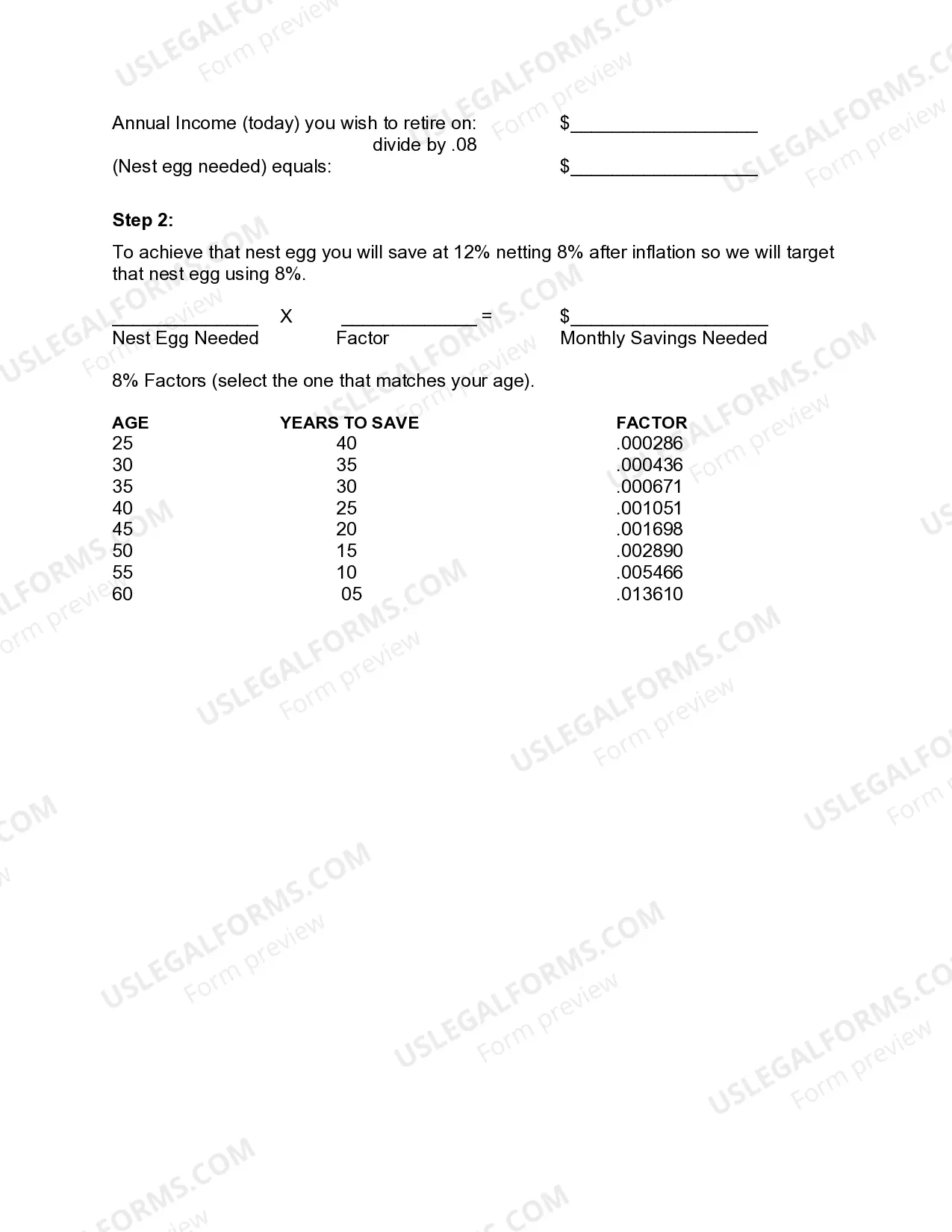

New York Monthly Retirement Planning is a comprehensive financial planning service specifically designed for individuals who are approaching or currently in their retirement years in the state of New York. This service assists individuals in effectively managing their finances so that they can achieve their retirement goals and live a comfortable and financially secure life. Keywords: New York, monthly retirement planning, financial planning, retirement goals, retirement years, financial security, comfortable retirement, retirement planning service. There are several types or aspects of New York Monthly Retirement Planning that individuals can consider, depending on their specific needs and preferences: 1. Investment Planning: New York Monthly Retirement Planning includes investment strategies tailored to the individual's retirement goals. By evaluating their risk tolerance, financial situation, and future income needs, a retirement planner can recommend suitable investment options such as stocks, bonds, mutual funds, real estate, or annuities. 2. Estate Planning: This aspect of New York Monthly Retirement Planning involves creating a comprehensive plan for the distribution of assets and properties after the individual's passing. It includes drafting a will, establishing trusts, or setting up beneficial arrangements to minimize estate taxes and ensure a smooth transfer of wealth to beneficiaries. 3. Social Security Optimization: New York Monthly Retirement Planning takes into account the nuances of the Social Security system and helps individuals maximize their social security benefits. The retirement planner analyzes various claiming strategies and advises on the optimal time to start receiving benefits based on factors like age, health, and lifestyle. 4. Tax Planning: New York Monthly Retirement Planning focuses on providing strategies to minimize tax liabilities during retirement. This includes taking advantage of tax-efficient investment vehicles, understanding retirement account distributions, and capitalizing on deductions and credits. 5. Healthcare Planning: Healthcare costs can significantly impact retirement finances. New York Monthly Retirement Planning includes analyzing healthcare needs, evaluating Medicare coverage options, and exploring long-term care insurance to mitigate the financial burdens associated with medical expenses. 6. Income Planning: This aspect of New York Monthly Retirement Planning focuses on determining how to generate a steady and reliable income stream during retirement. Retirement planners assess various income sources such as pensions, Social Security, retirement accounts, and investment portfolios to create a sustainable income plan that meets the individual's needs throughout retirement. By considering these various aspects of New York Monthly Retirement Planning, individuals can gain clarity and confidence in their retirement strategy. It ensures that they can make informed decisions, maximize their financial resources, and enjoy a secure and fulfilling retirement in the vibrant state of New York.

New York Monthly Retirement Planning

Description

How to fill out New York Monthly Retirement Planning?

If you have to total, down load, or print out authorized papers themes, use US Legal Forms, the most important collection of authorized forms, which can be found on the Internet. Use the site`s basic and handy search to find the paperwork you will need. Different themes for organization and specific uses are categorized by categories and says, or key phrases. Use US Legal Forms to find the New York Monthly Retirement Planning within a number of mouse clicks.

Should you be currently a US Legal Forms customer, log in in your bank account and then click the Download option to have the New York Monthly Retirement Planning. Also you can access forms you previously downloaded within the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the proper town/land.

- Step 2. Make use of the Review solution to check out the form`s content material. Never forget about to read the outline.

- Step 3. Should you be not happy using the develop, utilize the Look for field at the top of the screen to get other models in the authorized develop template.

- Step 4. When you have discovered the shape you will need, click the Purchase now option. Pick the pricing strategy you prefer and put your qualifications to sign up for an bank account.

- Step 5. Process the deal. You may use your credit card or PayPal bank account to perform the deal.

- Step 6. Find the format in the authorized develop and down load it on your system.

- Step 7. Complete, revise and print out or signal the New York Monthly Retirement Planning.

Every authorized papers template you purchase is the one you have forever. You possess acces to each develop you downloaded inside your acccount. Click on the My Forms area and select a develop to print out or down load once more.

Compete and down load, and print out the New York Monthly Retirement Planning with US Legal Forms. There are thousands of skilled and status-distinct forms you may use for your organization or specific needs.

Form popularity

FAQ

Regular Pension EligibilityYou can receive a Regular Pension, which is not reduced for age, as early as age 55 if you have at least 10 Years of Vesting Service or 10 Pension Credits.

FISCAL NOTE. --Pursuant to Legislative Law, Section 50: This bill (A5088-A) would provide a temporary retirement incentive during fiscal year 2021-2022.

The New York State and Local Retirement System (NYSLRS) pays retirement benefits monthly. For most members, you will receive your first pension payment at the end of the month that follows the month in which you retired. However, certain situations may delay your first payment.

Tier 1 members may retire at any age with 35 years of service, or at age 55 with five or more years of service. Retirement may also occur at age 55 with less than five years of NYS service, if two years of NYS service are rendered after their current membership date and since they reached age 53.

The New York State Common Retirement Fund is one of the largest public pension plans in the United States, providing retirement security for over one million New York State and Local Retirement System (NYSLRS) members, retirees and beneficiaries.

NYSLRS is one of the largest retirement systems in the United States with more than 1 million members, retirees and beneficiaries. NYSLRS has long been recognized as one of the best-managed and best-funded public retirement systems in the nation.

Your pension is based on your years of credited service, your age at retirement and your final average salary (FAS). FAS is the average of the wages you earned during any 36 consecutive months of service when your earnings were highest. This is usually the last three years of employment.

Members are considered vested when they have earned enough service credit to qualify for a pension. Tier 1, 2, 3 or 4 members who have at least five years of credited service are vested. Tier 5 and 6 members must have ten years of credited service to be vested.

Retirement ProgramNYS Employee's Retirement System (ERS) is designed to provide income after retirement from State service. The plan also provides supplemental benefits such as loan privileges, disability retirement benefits, and death benefits for eligible employees.

If you are eligible to receive a full benefit, your pension will equal: 0.83 percent of your Final Average Salary (FAS) for each year of credited service; plus. 1.66 percent of your FAS for each year of prior service credit; and. An annuity based on your contributions, plus interest.