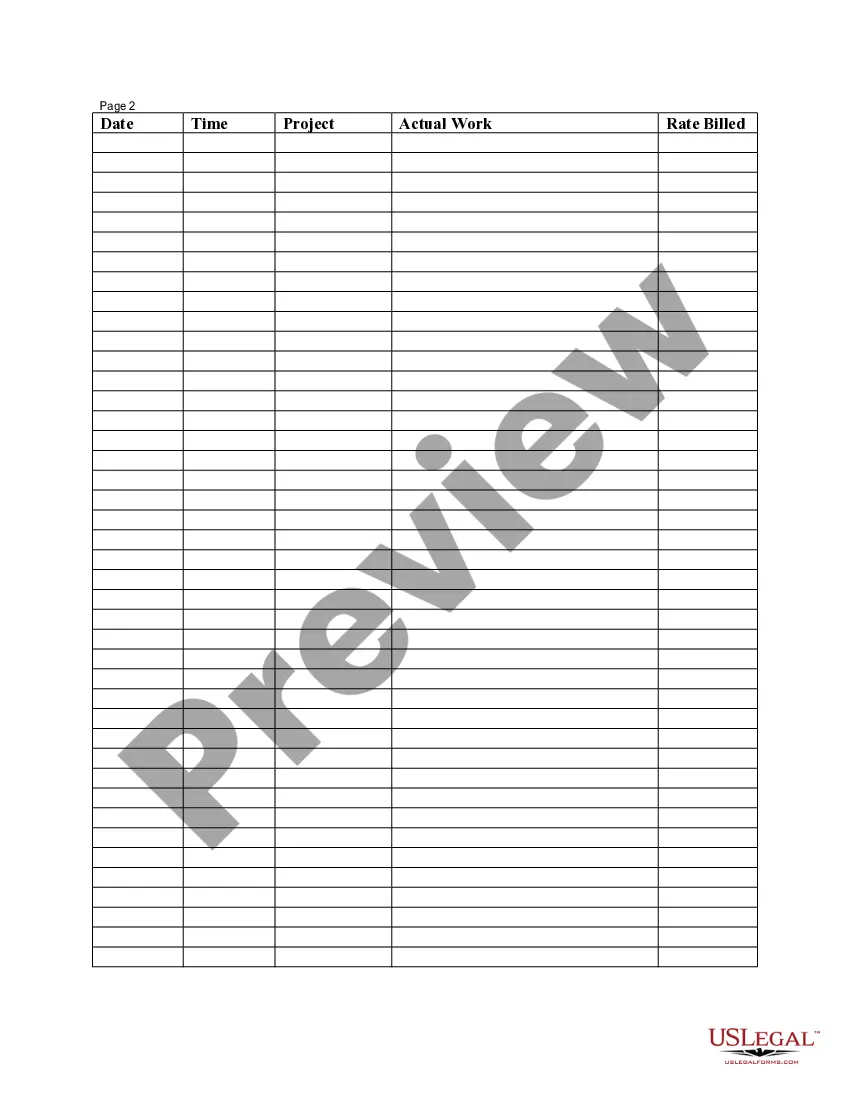

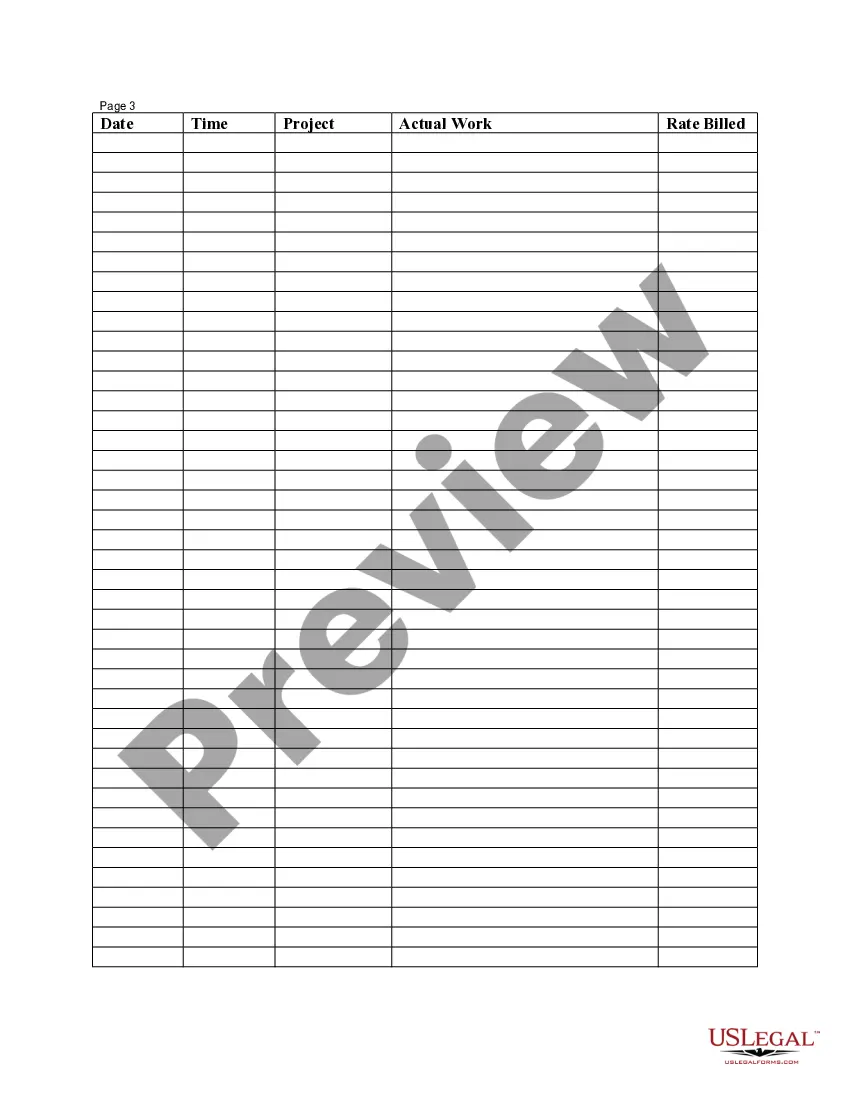

New York Employee Time Sheet

Description

How to fill out Employee Time Sheet?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template options that you can download or print. By using the site, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest templates like the New York Employee Time Sheet in just a few minutes.

If you already hold a subscription, Log In and download the New York Employee Time Sheet from the US Legal Forms library. The Download button will be visible on every template you view. You gain access to all previously saved templates under the My documents section of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the template to your device. Edit. Fill out, modify, print, and sign the saved New York Employee Time Sheet. Each template you added to your account does not have an expiration date and is yours permanently. Therefore, if you want to download or print another copy, just visit the My documents section and click on the template you need. Gain access to the New York Employee Time Sheet with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure to select the appropriate template for your city/state.

- Click the Preview button to review the content of the template.

- Read the template description to ensure you have selected the correct one.

- If the template does not fit your needs, use the Search box at the top of the page to find one that does.

- Once you find a suitable template, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

How to Fill Out a TimesheetEnter the Employee's Name. Here you should fill out the employee's full, legal name whose hours you are recording.Provide the Date or the Date Range. Next up you need to add the date.Fill in the Task Details.Add Hours Worked.Calculate Your Total Hours.Approve the Timesheet.

New to NYS Payroll Online?Go to this web address: psonline.osc.ny.gov.Enter your NY.gov account (government issued) username and password.Complete the verification process the first time you log in with your nine-digit NYS Employee ID which is found on your pay stub.More items...

Can we hold an employee's paycheck because he or she didn't turn in a timesheet? No. Many employers struggle to get their employees to turn in their timesheets on time and without errors, but wage-payment laws require employers to pay employees for all hours worked on regularly scheduled paydays set by the employer.

Oftentimes, employers ask if they can dock the pay of employees who fail to clock in or out -- or withhold pay entirely that day. They cannot. Employees must be paid for the exact number of hours they worked, regardless of whether or not they remembered to clock in.

You will be penalized with a payroll tax late payment tax penalty. Besides for the penalty itself, you will also incur interest on the missed payments. Interest rates can vary from 3% to 6% of the total amount owed.

NYS EMPLID: This is your employee I.D. number. You can find it on the top of your pay stub, in the middle section, 3 lines down under your name. It can also be found through your myGeneseo SUNY Self-Serv portal.

Workers who have seen their paycheck reduced or delayed because they failed to timely submit their timesheet can file a wage and hour lawsuit. They can also file a federal complaint with the Department of Labor (DOL).

So, even though many companies rely on employees to complete timesheets or punch in and out with a time clock, the employer is ultimately the responsible party. This means that employers must pay all employees for all hours worked, even if they do not complete or turn in timesheets.

Information included on timesheetsEmployee's name.Pay period.Date worked.Day worked.Hours worked.Total workweek hours.

How to Fill Out a TimesheetEnter the Employee's Name. Here you should fill out the employee's full, legal name whose hours you are recording.Provide the Date or the Date Range. Next up you need to add the date.Fill in the Task Details.Add Hours Worked.Calculate Your Total Hours.Approve the Timesheet.