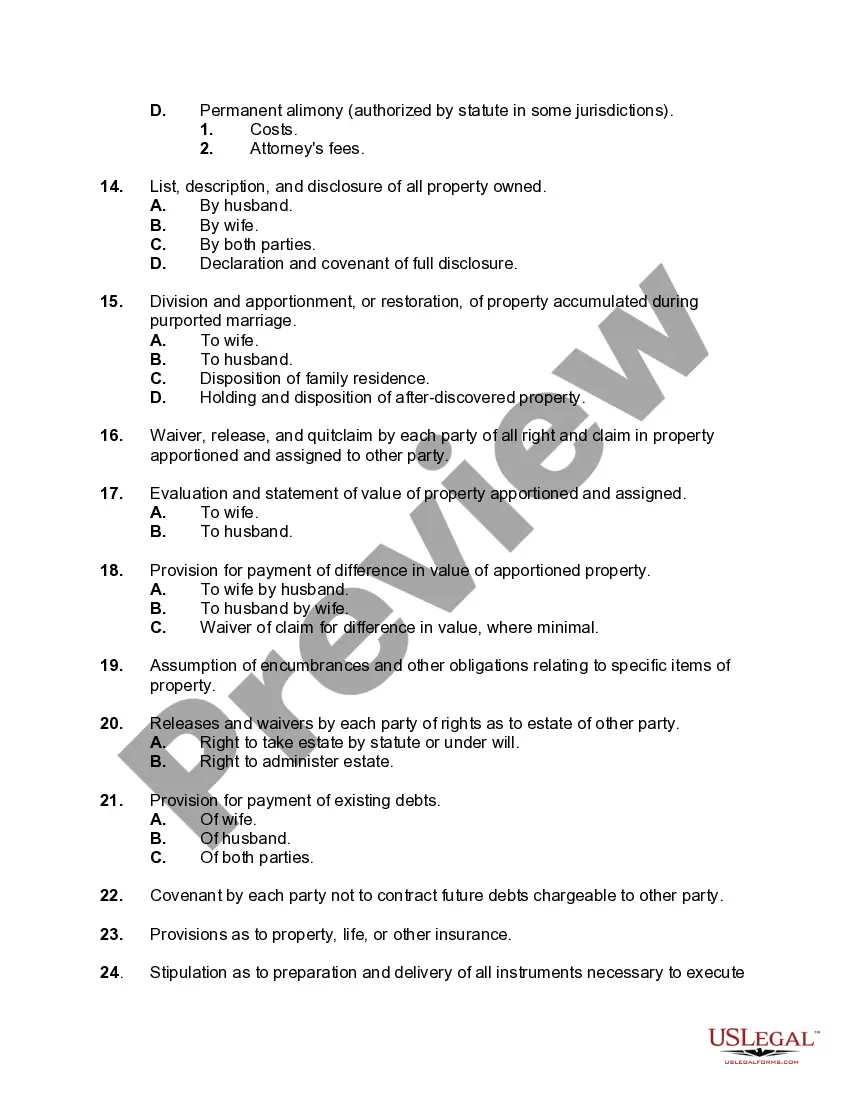

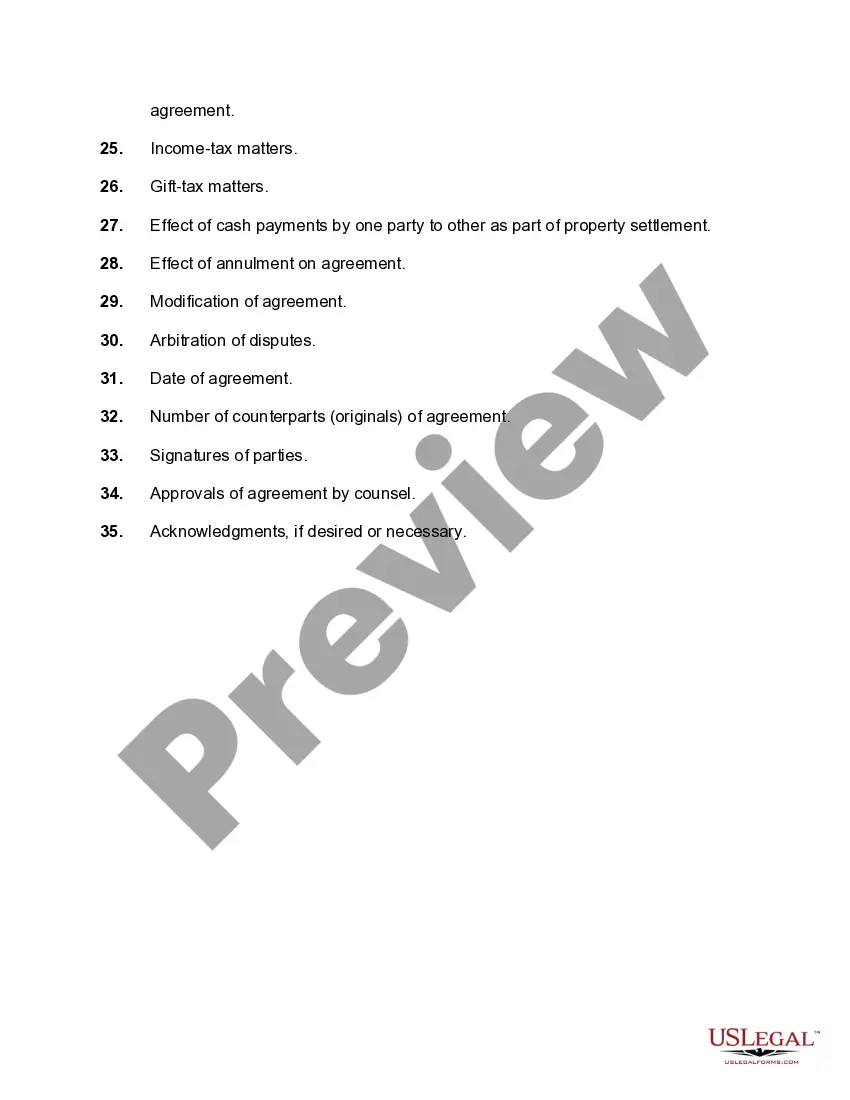

New York Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

Are you inside a place where you require documents for possibly organization or specific reasons virtually every time? There are a variety of authorized papers templates available on the net, but locating kinds you can rely on isn`t simple. US Legal Forms delivers a large number of kind templates, just like the New York Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage, which can be composed to meet state and federal specifications.

When you are already informed about US Legal Forms website and have a free account, merely log in. Following that, you may download the New York Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage design.

If you do not provide an accounts and need to begin to use US Legal Forms, abide by these steps:

- Discover the kind you want and ensure it is for that correct city/county.

- Make use of the Review switch to examine the shape.

- Read the explanation to actually have selected the correct kind.

- In the event the kind isn`t what you`re trying to find, take advantage of the Research area to discover the kind that fits your needs and specifications.

- When you obtain the correct kind, simply click Acquire now.

- Select the prices program you need, fill out the specified info to generate your account, and purchase your order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free document structure and download your backup.

Discover all of the papers templates you might have bought in the My Forms menus. You can aquire a more backup of New York Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage whenever, if required. Just go through the required kind to download or printing the papers design.

Use US Legal Forms, by far the most considerable variety of authorized forms, to conserve time as well as avoid blunders. The support delivers expertly manufactured authorized papers templates which can be used for a variety of reasons. Create a free account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

The cost of a simple annulment on consent is $2,175 (our fee is $1,820 and the court fees are $355). Call us at (718) 625-0800 to schedule a free consultation.

New York law has very specific grounds for civil annulments. Those are an undissolved previous marriage, one spouse was underage at the time of marriage, one spouse is physically incapable of having sexual relations, consent to marriage by force, consent to marriage by fraud, or incapability of consent to marriage.

There is no time limit, minimum or maximum, for an annulment in Georgia. You just have to meet one of the requirements for an annulment under Georgia statute, which are fairly narrow. Can We Get an Annulment If We Were Only Married for a Short Time/Failed to Consummate the Marriage?

Fees NameFeeUnitAnnulment filing fee$200eachAnnulment surcharge$15eachAnnulment summons fee$5each

(2) Where either party was 16 or 17 years of age and lacked the consent of parent or guardian or express authorization of the court and has not subsequently ratified the marriage upon reaching 18 years of age and an action for annulment is commenced within 60 days after the marriage ceremony.

What's the Annulment Time Frame? There is no time frame to get an annulment in New York City. You can ask the Court for an annulment whether you have been married for 2 years or for 25 years as long as some of the grounds for annulment are met.