New York Joint Venture Agreement - Purchase and Operation of Apartment Building

Description

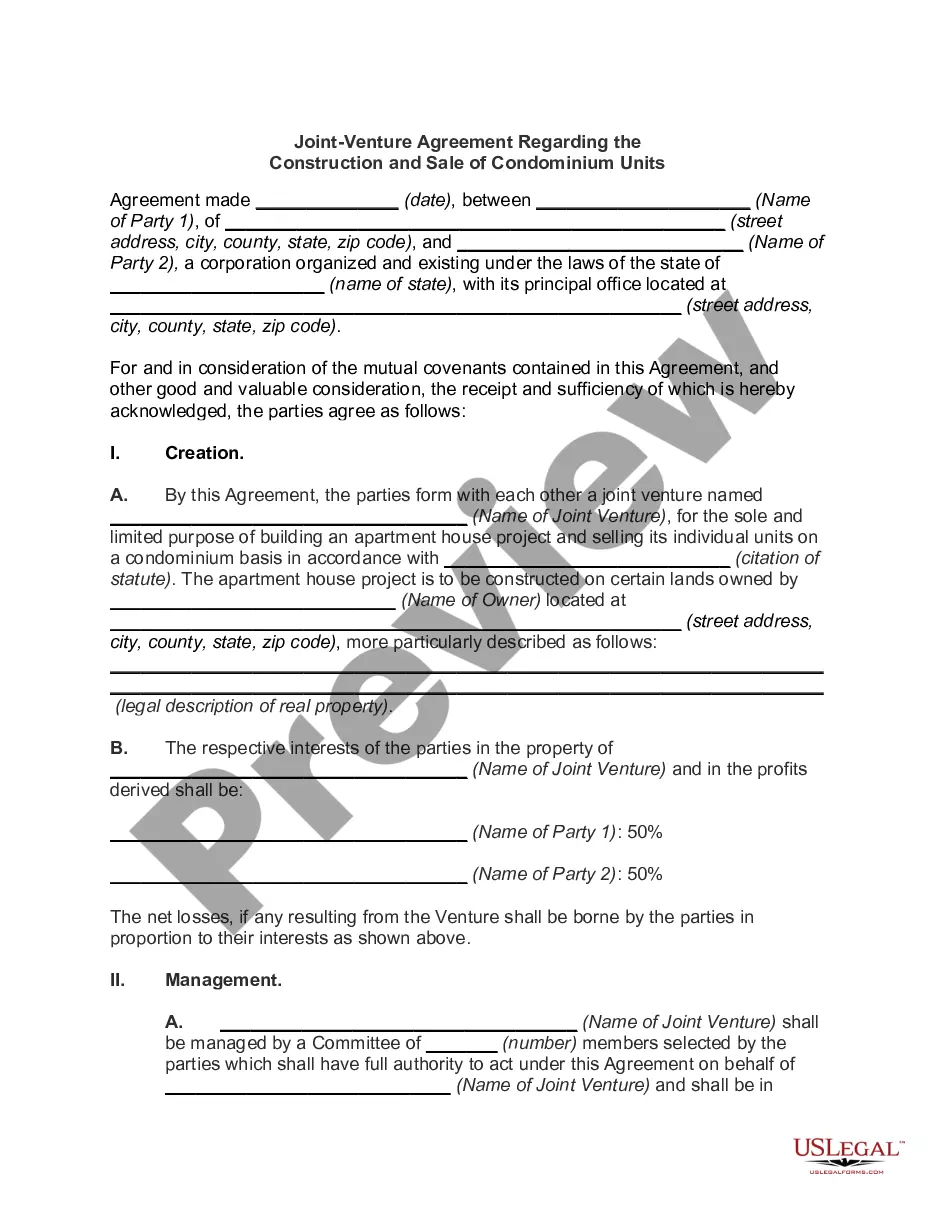

How to fill out Joint Venture Agreement - Purchase And Operation Of Apartment Building?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal record templates that you can purchase or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the New York Joint Venture Agreement - Purchase and Operation of Apartment Building in just moments.

If you already have a monthly subscription, Log In to acquire the New York Joint Venture Agreement - Purchase and Operation of Apartment Building from the US Legal Forms library. The Download button will be available on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make edits. Fill out, modify, and print out the downloaded New York Joint Venture Agreement - Purchase and Operation of Apartment Building. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the New York Joint Venture Agreement - Purchase and Operation of Apartment Building with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements and needs.

- Ensure you have selected the correct form for your city/region.

- Click the Review button to check the content of the form.

- Examine the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance.

Structuring a real estate JVThe 'investor' will typically be structured as a limited partnership managed by a general partner or other tax efficient vehicle. The investor vehicle will contract with the asset managerowned by the operator investment vehicleto form the JV entity.

Bringing on a joint venture (JV) partner for a real estate investor is a major decision. Partners can infuse capital and help take your business to the next level. In fact, many investors believe that creating a partnership is the best business decision they ever made.

The Joint Operating Agreements (JOA) is a contractual agreement between two or more parties with shared interests in a tract or leasehold that outlines coordinated exploration, development and production activities in a designated contract area.

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

A real estate joint venture contract is an agreement between two or more individuals or businesses who have decided to put their money and other resources together to purchase real estate.

Joint venture agreements, also called JV agreements, are contractual consortiums of two parties. They usually seek to join both party's resources to achieve a specific objective. The party's benefit by receiving proportionately split profits and distributed ventures.

What is included in a Joint Venture Agreement?Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items...

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal.