New York Balance Sheet Deposits are financial instruments that represent funds held by financial institutions in the state of New York. These deposits are recorded on the "liabilities" side of a bank's balance sheet as they represent the bank's obligations to its customers. There are several types of New York Balance Sheet Deposits: 1. Demand Deposits: These deposits are the most liquid form of balance sheet deposits. Also known as checking accounts, they allow customers to withdraw funds on demand through various channels such as checks, ATM withdrawals, debit cards, or online transfers. 2. Savings Deposits: This type of deposit is generally used by individuals to save money. Savings deposits usually offer a lower interest rate compared to other types of deposits, but they provide greater accessibility and flexibility for customers to deposit and withdraw funds. 3. Time Deposits: Also called certificates of deposit (CDs), time deposits are fixed-term deposits that offer a higher interest rate compared to demand and savings deposits. Customers agree to keep the funds deposited for a specified period, ranging from a few months to several years. Premature withdrawal may result in penalties. 4. Negotiable Order of Withdrawal (NOW) Accounts: NOW accounts are a blend of demand and interest-earning accounts. They offer limited check-writing capabilities, typically require a higher minimum balance, and provide interest payments based on the account balance. 5. Money Market Deposit Accounts (Midas): Midas are interest-bearing accounts that usually require a higher minimum balance. These accounts offer both limited check-writing capabilities and higher interest rates compared to savings deposits. 6. Foreign and Domestic Interest-Bearing Deposits: Financial institutions also offer various types of interest-bearing deposits to both foreign and domestic customers. These deposits cater to individuals or entities seeking competitive interest rates on deposits held with New York institutions. New York Balance Sheet Deposits play a crucial role in the state's economy, as they represent a significant portion of the funds available for lending and investment. These deposits provide customers with a safe place to store their money while offering financial institutions a stable source of funding for their operations and activities.

New York Balance Sheet Deposits

Description

How to fill out New York Balance Sheet Deposits?

Are you inside a place the place you will need papers for both organization or specific reasons nearly every day time? There are plenty of legal record layouts available online, but finding types you can rely is not easy. US Legal Forms gives 1000s of develop layouts, just like the New York Balance Sheet Deposits, that are published to fulfill federal and state requirements.

Should you be previously knowledgeable about US Legal Forms website and have a free account, merely log in. Following that, it is possible to down load the New York Balance Sheet Deposits format.

If you do not offer an account and need to begin using US Legal Forms, adopt these measures:

- Find the develop you require and make sure it is for your correct city/region.

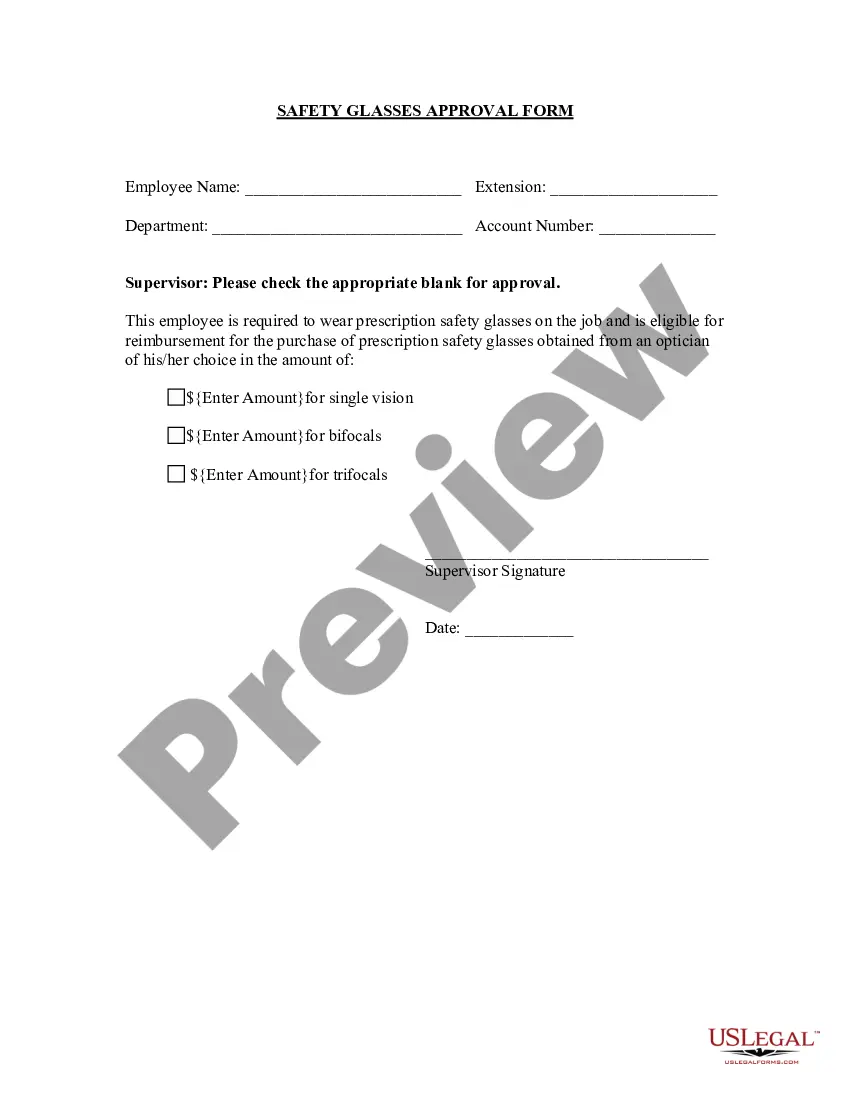

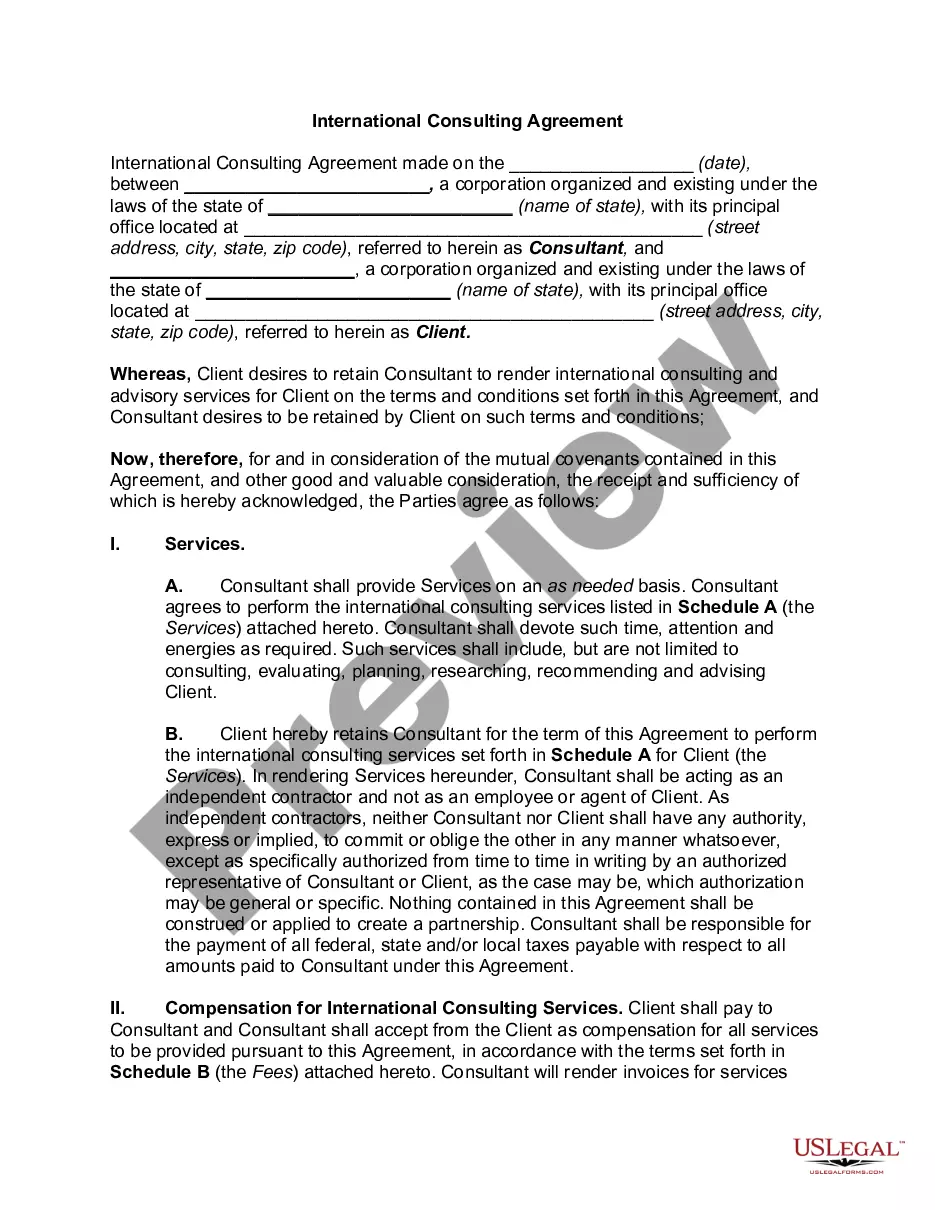

- Take advantage of the Review key to examine the form.

- Look at the information to ensure that you have chosen the appropriate develop.

- In case the develop is not what you are trying to find, take advantage of the Look for area to get the develop that suits you and requirements.

- Whenever you find the correct develop, click on Purchase now.

- Opt for the costs program you need, submit the required info to generate your bank account, and purchase the order making use of your PayPal or credit card.

- Pick a hassle-free paper formatting and down load your copy.

Locate all of the record layouts you have bought in the My Forms food selection. You may get a more copy of New York Balance Sheet Deposits any time, if needed. Just click the necessary develop to down load or produce the record format.

Use US Legal Forms, by far the most comprehensive selection of legal forms, to save lots of some time and steer clear of blunders. The services gives professionally produced legal record layouts that can be used for a selection of reasons. Make a free account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

A customer deposit is usually classified as a current liability, since the company typically provides services or goods within one year of the deposit being made. If the deposit is for a longer-term project that will not be resolved within one year, it could instead be classified as a long-term liability.

Cash and cash equivalents under the current assets section of a balance sheet represent the amount of money the company has in the bank, whether in the form of cash, savings bonds, certificates of deposit, or money invested in money market funds. It tells you how much money is available to the business immediately.

Deposits fall under the liability portion of the banks' balance sheet and are also mainly the most substantial liability for the bank. It includes money market. read more, savings, and current account and has both interest and non-interest bearing accounts.

Cash, stocks, bonds, mutual funds, and bank deposits are all are examples of financial assets.

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited. When someone opens a bank account and makes a cash deposit, he surrenders the legal title to the cash, and it becomes an asset of the bank.

In either case, on a bank's T-account, assets will always equal liabilities plus net worth. When bank customers deposit money into a checking account, savings account, or a certificate of deposit, the bank views these deposits as liabilities.

Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments.

It may appear counterintuitive that the deposits are in red and loans are in green. However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

The short answer is yes a term deposit is, indeed, an asset. Regardless that the funds are locked away for a fixed period, when it comes to the balance sheet, it's considered an asset.