New York Finance Lease of Equipment

Description

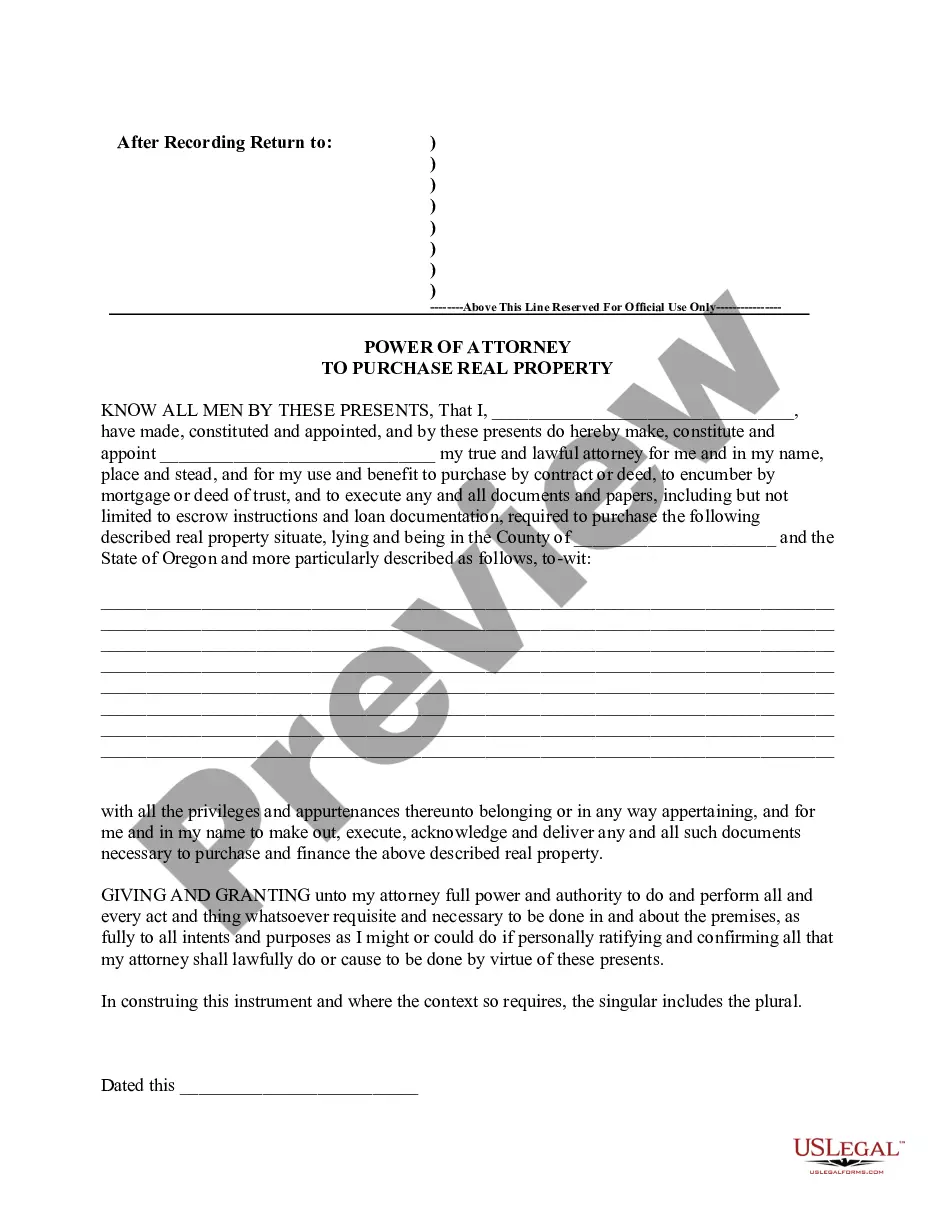

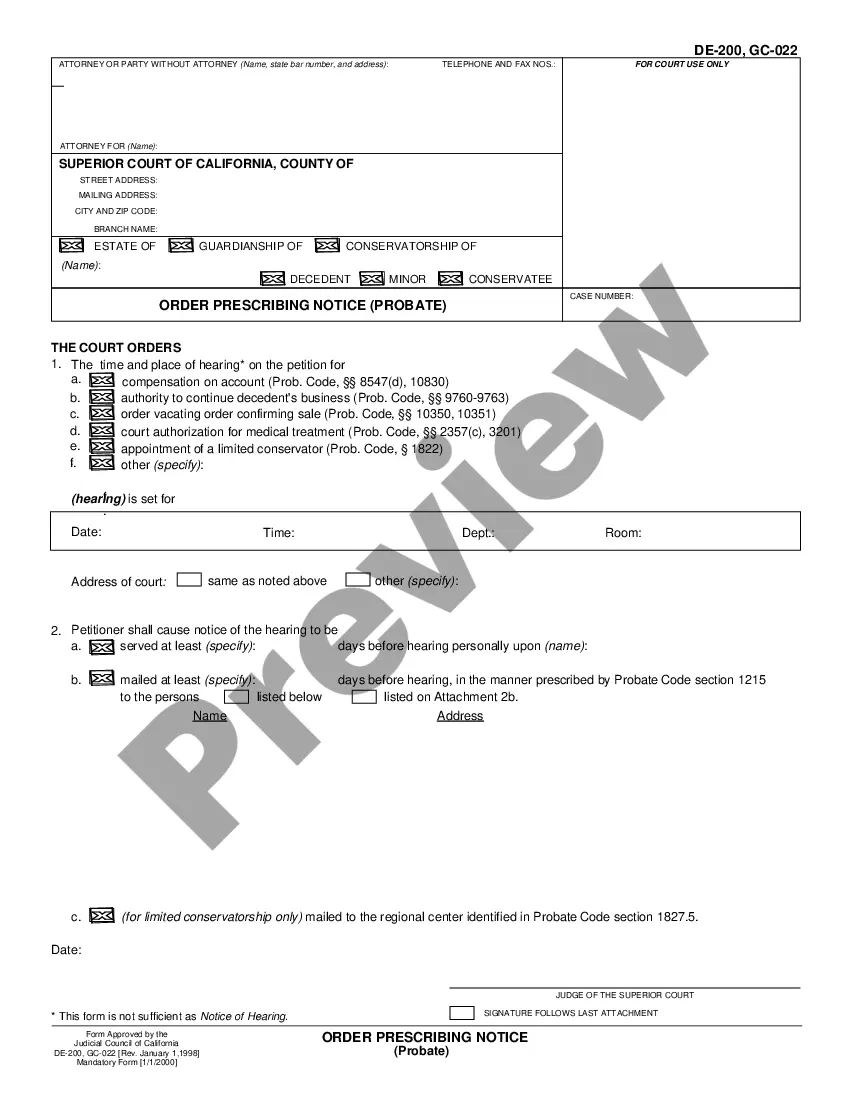

How to fill out Finance Lease Of Equipment?

It is feasible to spend several hours online searching for the authorized document template that fulfills the federal and state requirements you require.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can easily download or print the New York Finance Lease of Equipment from the service.

If you want to obtain another version of the form, make use of the Search field to find the template that meets your requirements and specifications.

- If you have a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can fill out, modify, print, or sign the New York Finance Lease of Equipment.

- Every legal document template you obtain is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/town of preference.

- View the form description to make sure you have picked the suitable document. If available, utilize the Review option to examine the document template as well.

Form popularity

FAQ

The main tax advantage to equipment leasing is the fact that you can write off the full amount of the equipment without paying the full amount. In this way, the amount you save in taxes may actually exceed the lease payments.

A finance lease (also known as a capital lease or a sales lease) is a type of lease in which a finance company is typically the legal owner of the asset for the duration of the lease, while the lessee not only has operating control over the asset, but also some share of the economic risks and returns from the change in

Lease payments can be treated as an expense rather than depreciating your equipment as a capital cost. Lease payments are usually tax deductible against your income each year of your lease term. In this way, both your money and your equipment are working for you at the same time!

If your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental payments as long as you are using the leased property in your business.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

You can deduct the entire cost of the equipment if you financed it. You can also deduct the interest you paid.

A finance lease is a contract between a lessor (a funder or finance company) and a lessee (your business), where the lessee requires the use of business equipment, vehicles, or machinery. The lessor provides the use of such equipment in exchange for pre-agreed regular payments.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.