New York Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

Are you currently in a situation where you frequently require documents for either business or personal purposes? There are numerous legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms offers thousands of document templates, such as the New York Employment of Executive with Stock Options and Rights in Discoveries, which are crafted to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the New York Employment of Executive with Stock Options and Rights in Discoveries template.

You can find all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the New York Employment of Executive with Stock Options and Rights in Discoveries at any time, if needed. Just click on the desired document to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers professionally created legal document templates that can be used for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the document you need and ensure it is for the correct city/county.

- Use the Preview option to review the form.

- Read the description to confirm you have selected the correct document.

- If the document is not what you're searching for, use the Search field to find the document that suits your needs and requirements.

- Once you find the right document, click on Buy now.

- Choose the pricing plan that you prefer, provide the necessary information to set up your account, and complete your purchase using PayPal or your Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

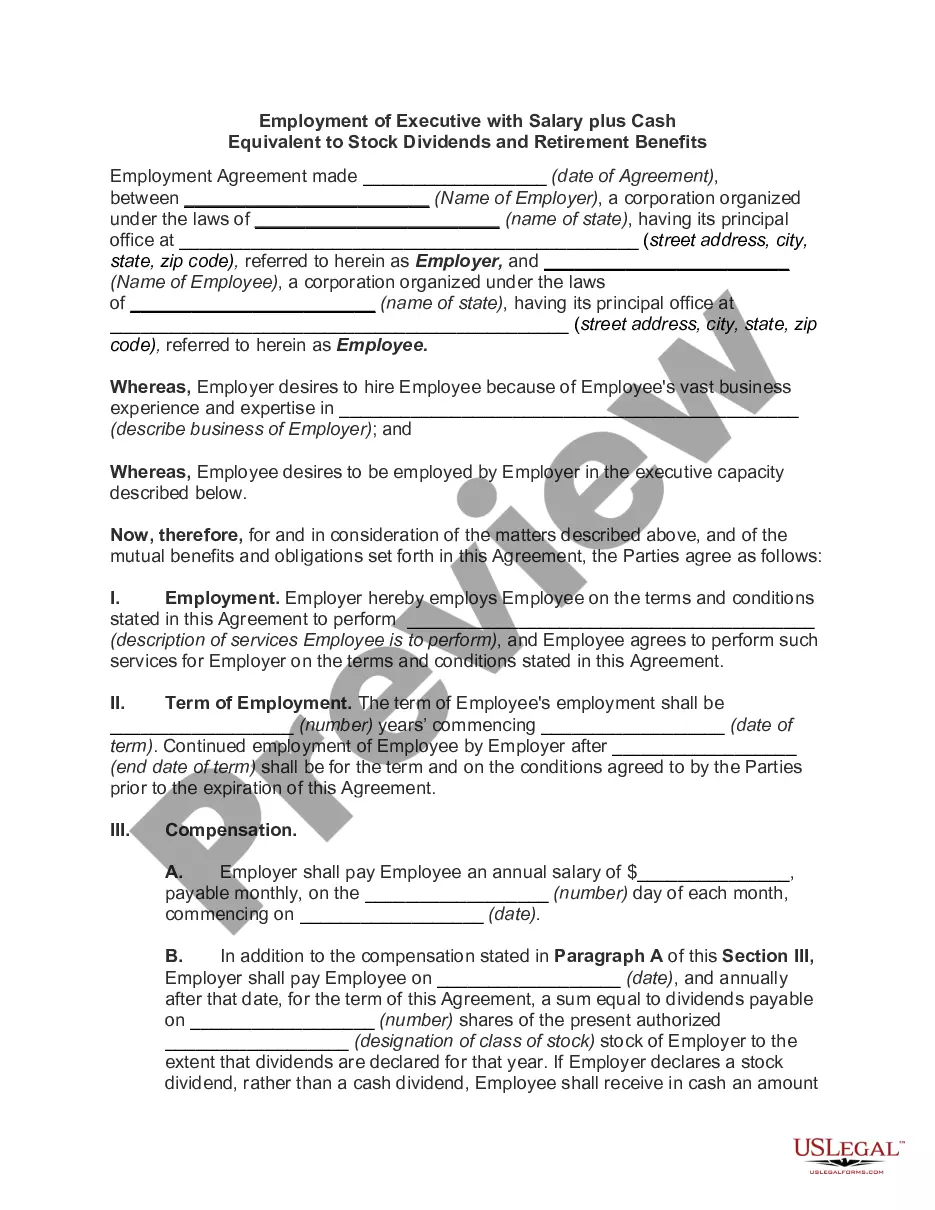

An executive employment contract is an employment agreement between a company and an executive. These written contracts outline things like an executive's compensation, duties, bonuses, as well as competition, and confidentiality.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and Executive agree as follows:Employment; Duties and Responsibilities.Term.Board of Directors.Location.Base Salary.Incentive Compensation.Executive Benefits.Termination.More items...

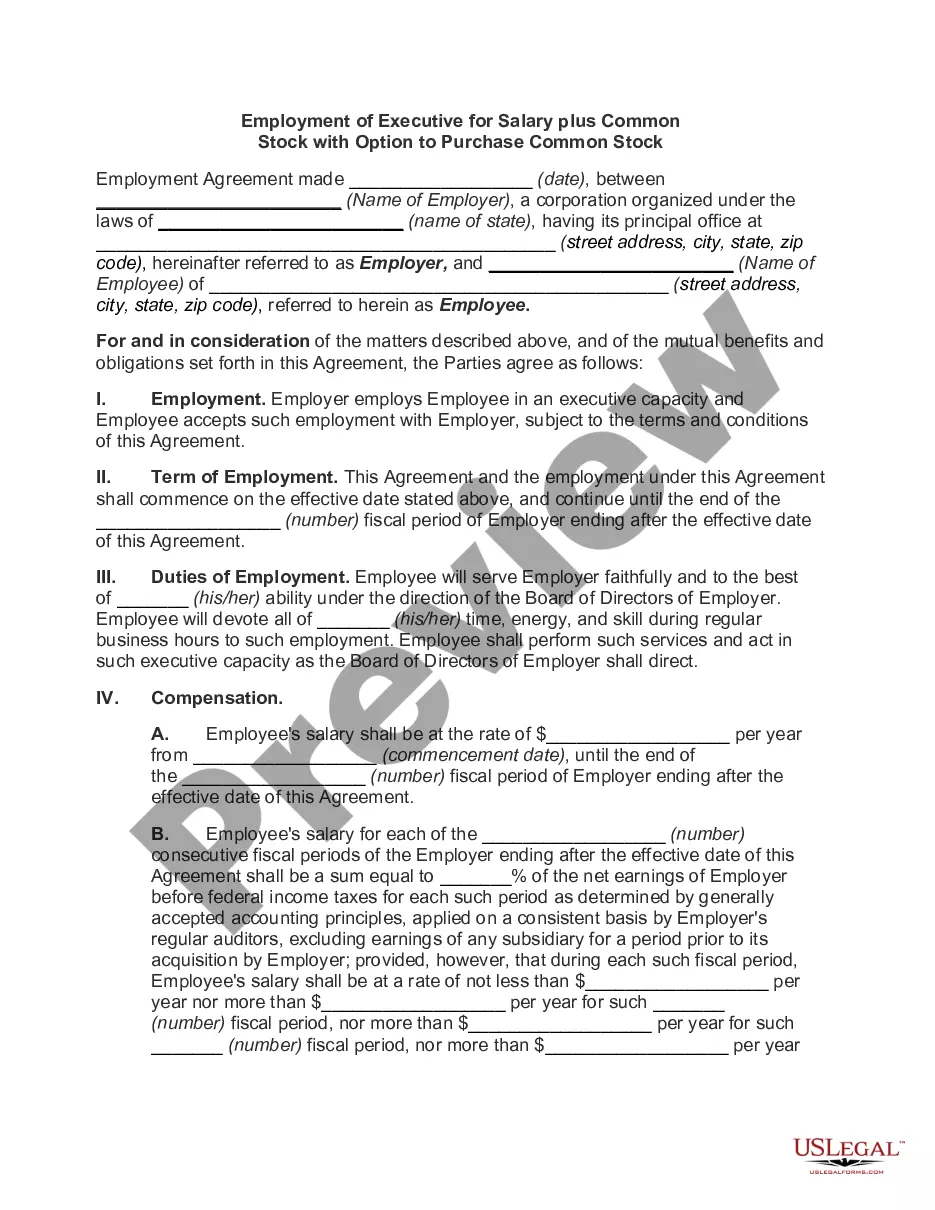

In a private company setting, after the founders have been issued fully vested or restricted stock under their stock purchase agreements, the employees, consultants, advisors and directors who are subsequently hired commonly receive equity compensation through stock options.

ESOP (Employee stock option plan) is an employee benefit plan offering employees the ownership interest in the organization. It is similar to a profit sharing plan. Under these plans the company, who is an employer , offers its stocks at negligible or low prices.

Employee option pools can range from 5% to 30% of a startup's equity, according to Carta data. Steinberg recommends establishing a pool of about 10% for early key hires and 10% for future employees. But relying on rules of thumb alone can be dangerous, as every company has different cash and talent requirements.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying assetthe company's stockat a specified price for a finite period of time.

As executives at a company receive yearly option grants, they begin to amass large amounts of stock and unexercised options. The value of those holdings appreciates greatly when the company's stock price rises and depreciates just as greatly when it falls.

The Employee acknowledges and agrees that he is being offered a position of employment by the Company with the understanding that the Employee possesses a unique set of skills, abilities, and experiences which will benefit the Company, and he agrees that his continued employment with the Company, whether during the

An executive stock option is a contract that grants the right to buy a specified number of shares of the company's stock at a guaranteed "strike price" for a period of time, usually several years.

A stock option is a financial contract that basically allows someone the right but not the obligation to buy a certain number of company shares in the future, at today's market price. Thus, stock options allow CEOs to benefit if the company's stock price rises, but not lose out if the stock price falls.