New York Security Agreement is a legally binding document used to secure a creditor's interest in goods, equipment, inventory, and other assets owned by a debtor. This agreement provides protection and ensures repayment in case of default or non-payment. Here is a detailed description of the New York Security Agreement covering goods, equipment, inventory, etc.: 1. Definition and Purpose: A New York Security Agreement is a contract between a debtor (usually a borrower) and a secured party (usually a lender), where the debtor pledges specific collateral as security for a loan or other financial obligation. The collateral can include goods, equipment, inventory, vehicles, personal property, or other assets. 2. Scope and Coverage: The agreement typically outlines the specific goods, equipment, inventory, or other assets that are being used as collateral. It mentions the quantity, quality, and description of each item to be covered by the agreement. This ensures that all parties involved understand which assets are being pledged against the loan or financial obligation. 3. Parties Involved: In a New York Security Agreement, the debtor is the individual or entity borrowing money or entering into a financial transaction. The secured party is the lender or creditor who provides the funds or extends credit. Other relevant parties may include guarantors, co-signers, or third-party beneficiaries, depending on the circumstances. 4. Types of New York Security Agreement: There can be different types of agreements depending on the nature of the collateral being pledged. Some common types include: — Equipment Security Agreement: This agreement covers machinery, tools, vehicles, or any other equipment being used as collateral. — Inventory Security Agreement: It secures inventory, typically referring to goods held for sale, raw materials, or supplies. — Accounts Receivable Security Agreement: This agreement pertains to the borrower's accounts receivable, which includes unpaid invoices or money owed by customers. — General Security Agreement: This covers a broader range of assets, including goods, equipment, inventory, accounts receivable, and other personal property. 5. Clauses and Provisions: A New York Security Agreement will typically include clauses on default, remedies, and enforcement provisions. These clauses outline the actions the secured party can take in case of non-payment or breach of terms. They may include provisions regarding repossession, sale of collateral, or other remedies available under New York law. 6. Perfection and Filing: To protect the secured party's interest, the New York Security Agreement often requires the filing of a UCC-1 financing statement with the appropriate state authority. This filing serves as a public notice that the secured party has a security interest in the collateral, protecting their rights against third parties. In conclusion, a New York Security Agreement covering goods, equipment, inventory, etc. is a crucial legal document that protects a creditor's interest in specific assets owned by a debtor. It ensures that the creditor has a legal right to the collateral and outlines provisions for default, remedies, and enforcement if needed. Different types of agreements can cover equipment, inventory, accounts receivable, or a broader range of assets. Proper filing and adherence to New York laws and regulations are vital for the agreement's effectiveness.

New York Security Agreement Covering Goods, Equipment, Inventory, Etc.

Description

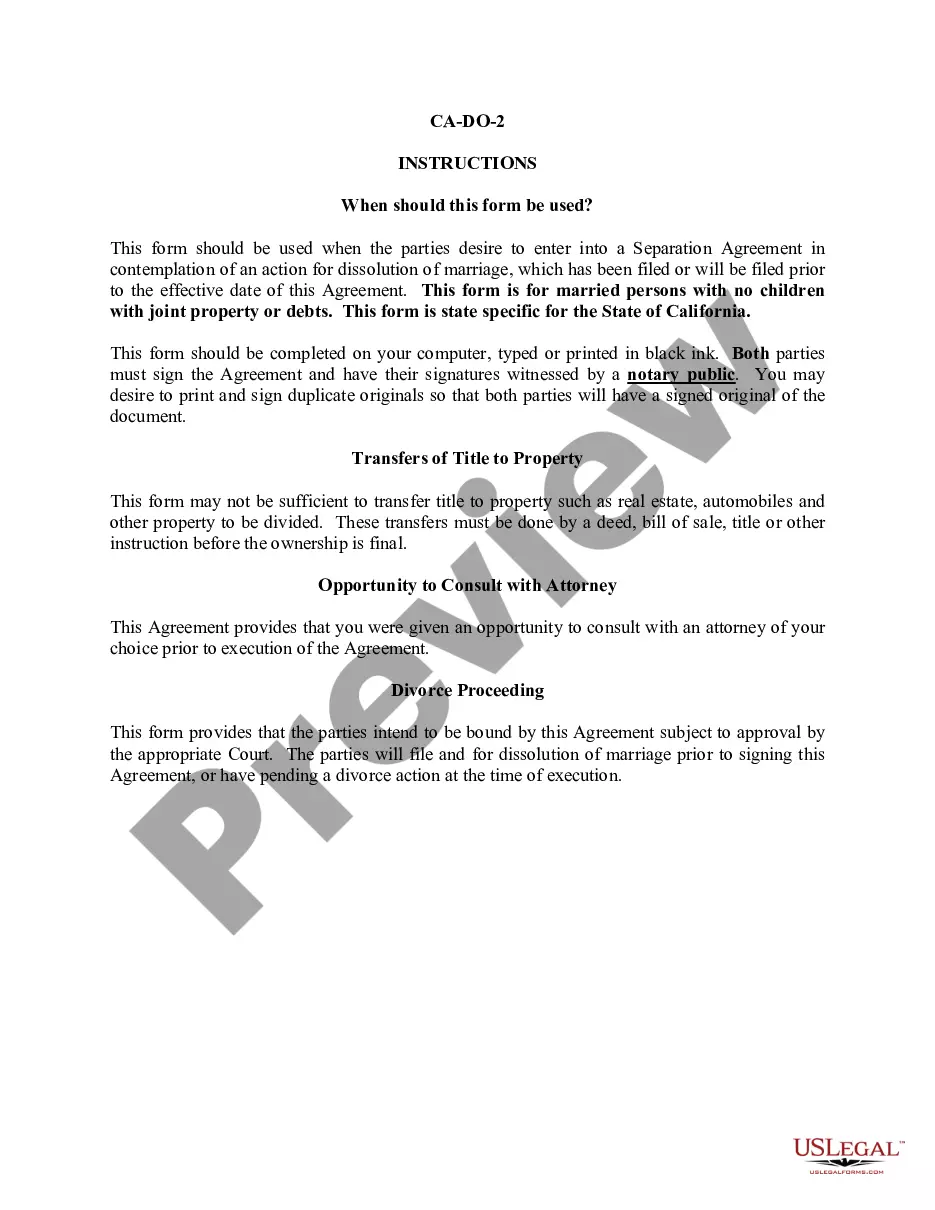

How to fill out New York Security Agreement Covering Goods, Equipment, Inventory, Etc.?

If you wish to complete, acquire, or printing legal document templates, use US Legal Forms, the greatest collection of legal types, that can be found on the Internet. Make use of the site`s simple and convenient lookup to discover the papers you want. A variety of templates for enterprise and personal functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the New York Security Agreement Covering Goods, Equipment, Inventory, Etc. with a few clicks.

In case you are currently a US Legal Forms customer, log in for your accounts and then click the Acquire button to have the New York Security Agreement Covering Goods, Equipment, Inventory, Etc.. You may also entry types you in the past delivered electronically in the My Forms tab of your own accounts.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have chosen the shape for that correct town/country.

- Step 2. Utilize the Review solution to look through the form`s information. Never neglect to read through the information.

- Step 3. In case you are not happy with all the develop, make use of the Research discipline at the top of the display screen to locate other versions of the legal develop design.

- Step 4. After you have identified the shape you want, click the Purchase now button. Opt for the prices program you choose and add your credentials to register for the accounts.

- Step 5. Approach the deal. You can use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Choose the structure of the legal develop and acquire it on the device.

- Step 7. Total, revise and printing or signal the New York Security Agreement Covering Goods, Equipment, Inventory, Etc..

Every legal document design you acquire is the one you have permanently. You possess acces to each develop you delivered electronically within your acccount. Go through the My Forms portion and pick a develop to printing or acquire once more.

Contend and acquire, and printing the New York Security Agreement Covering Goods, Equipment, Inventory, Etc. with US Legal Forms. There are many expert and express-distinct types you may use to your enterprise or personal requirements.

Form popularity

FAQ

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

There are five ways a creditor may perfect a security interest: (1) by filing a financing statement, (2) by taking or retaining possession of the collateral, (3) by taking control of the collateral, (4) by taking control temporarily as specified by the UCC, or (5) by taking control automatically.

Methods to Remove a UCC Filing Ask the lender to terminate the lien upon payoff. Visit your secretary of state's office. Dispute any inaccurate information on your business credit report.

If two or more creditors are properly perfected, then the priorities among such competing secured creditors is spelled out in the UCC, but the general rule is that the first to perfect has priority, whether the competing security interests and liens are consensual or nonconsensual.

PMSI in Inventory Perfect the PMSI by filing a financing statement naming the borrower as debtor and seller as secured party, and properly identifying the goods to be sold as the collateral. Perform a UCC search in the appropriate jurisdiction to identify the borrower's secured creditors and their collateral.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

Let's briefly look at each of these requirements. Value is Given for the Security Interest. ... Debtor Has Rights in the Collateral. ... The Debtor Authenticates a Security Agreement. ... Filing a Financing Statement to Perfect the Security Interest. ... Possessing the Collateral to Perfect the Security Interest.

For new equipment, as long as the financier pays the equipment vendor directly and files a UCC within 20 days, PMSI is automatically established. This is how most equipment financing deals work ? the lender pays the manufacturer for the equipment directly, and the customer pays the lender back.