A New York Private Annuity Agreement is a legally binding contract between two parties, where one party transfers ownership of an asset, usually real estate or a business, to the other party in exchange for regular annuity payments. These annuity payments are typically made for the lifetime of the transferring party or for a predetermined number of years. Private annuity agreements are commonly used as a tool for estate planning and wealth transfer. They enable the transferring party to receive income during their lifetime, while also providing tax advantages and potential estate tax reduction. In New York, these agreements are governed by specific rules and regulations that must be followed to ensure their validity and to take advantage of the associated benefits. One type of New York Private Annuity Agreement is a Lifetime Private Annuity. In this scenario, the transferring party relinquishes ownership of the asset and starts receiving regular annuity payments immediately, which continue for the duration of their life. This type of agreement can be an effective method to transfer assets while ensuring a steady income stream for the transferring party. Another type is the Term Certain Private Annuity. This agreement establishes a fixed period during which the transferring party will receive annuity payments. The duration of these payments can be determined based on the transferring party's needs or preferences, such as a set number of years or until a specific event occurs. This type of private annuity can be advantageous when the transferring party desires a reliable income for a predetermined period. It is important to note that New York Private Annuity Agreements should be carefully structured and follow specific guidelines to comply with tax regulations. The Internal Revenue Service (IRS) has established requirements concerning the fair market value of the transferred asset, interest rates used for calculating annuity payments, and potential gift tax implications. Adhering to these guidelines is crucial to ensure the tax efficiency and legality of the agreement. Additionally, it is wise to seek professional advice when considering a New York Private Annuity Agreement. Consulting with an experienced attorney or financial advisor who specializes in estate planning and taxation can help ensure that the agreement meets the specific needs and goals of both parties involved. In conclusion, a New York Private Annuity Agreement is a legally binding contract used for transferring assets in exchange for regular annuity payments. There are different types of agreements available, such as Lifetime Private Annuities or Term Certain Private Annuities. It is essential to carefully structure and comply with tax regulations to maximize the benefits and navigate potential tax implications. Seeking professional guidance throughout the process can help ensure that the agreement aligns with the specific needs and goals of the parties involved.

New York Private Annuity Agreement

Description

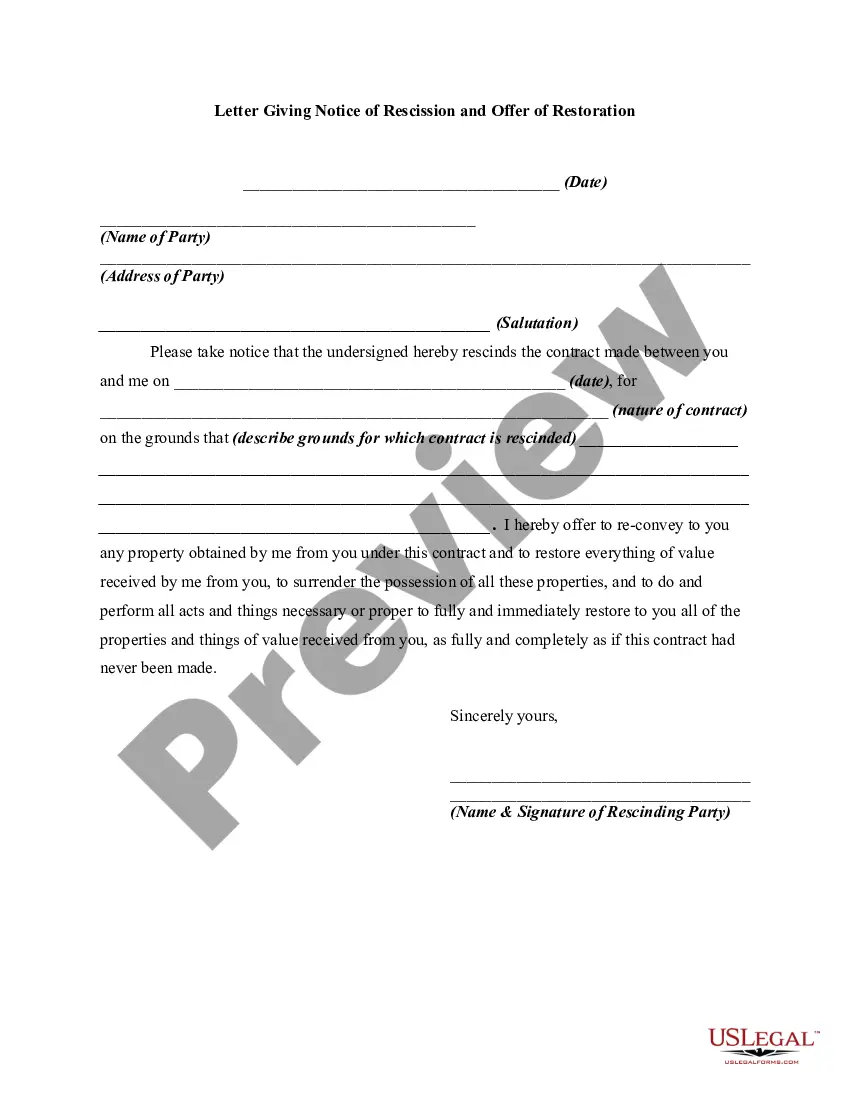

How to fill out New York Private Annuity Agreement?

Finding the right legitimate papers template can be quite a battle. Of course, there are a variety of layouts available on the net, but how can you get the legitimate type you require? Use the US Legal Forms internet site. The services provides thousands of layouts, including the New York Private Annuity Agreement, that you can use for company and personal needs. Each of the types are checked out by specialists and satisfy federal and state needs.

In case you are previously authorized, log in for your profile and click on the Obtain option to find the New York Private Annuity Agreement. Make use of your profile to search throughout the legitimate types you might have ordered in the past. Check out the My Forms tab of your own profile and obtain an additional backup in the papers you require.

In case you are a whole new end user of US Legal Forms, listed here are easy instructions so that you can stick to:

- Initially, make certain you have selected the proper type to your area/county. It is possible to look over the form utilizing the Preview option and browse the form outline to make certain it is the best for you.

- When the type is not going to satisfy your preferences, use the Seach industry to obtain the appropriate type.

- Once you are positive that the form is acceptable, click the Purchase now option to find the type.

- Select the rates prepare you want and enter in the needed details. Build your profile and purchase an order using your PayPal profile or bank card.

- Opt for the document format and obtain the legitimate papers template for your system.

- Total, modify and print out and indicator the received New York Private Annuity Agreement.

US Legal Forms is definitely the most significant library of legitimate types for which you will find different papers layouts. Use the company to obtain appropriately-manufactured paperwork that stick to express needs.