New York Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

You can spend hours online attempting to locate the sanctioned document template that complies with the federal and state requirements you may require.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

You can actually acquire or create the New York Liquidation of Partnership with Sale of Assets and Assumption of Liabilities through our services.

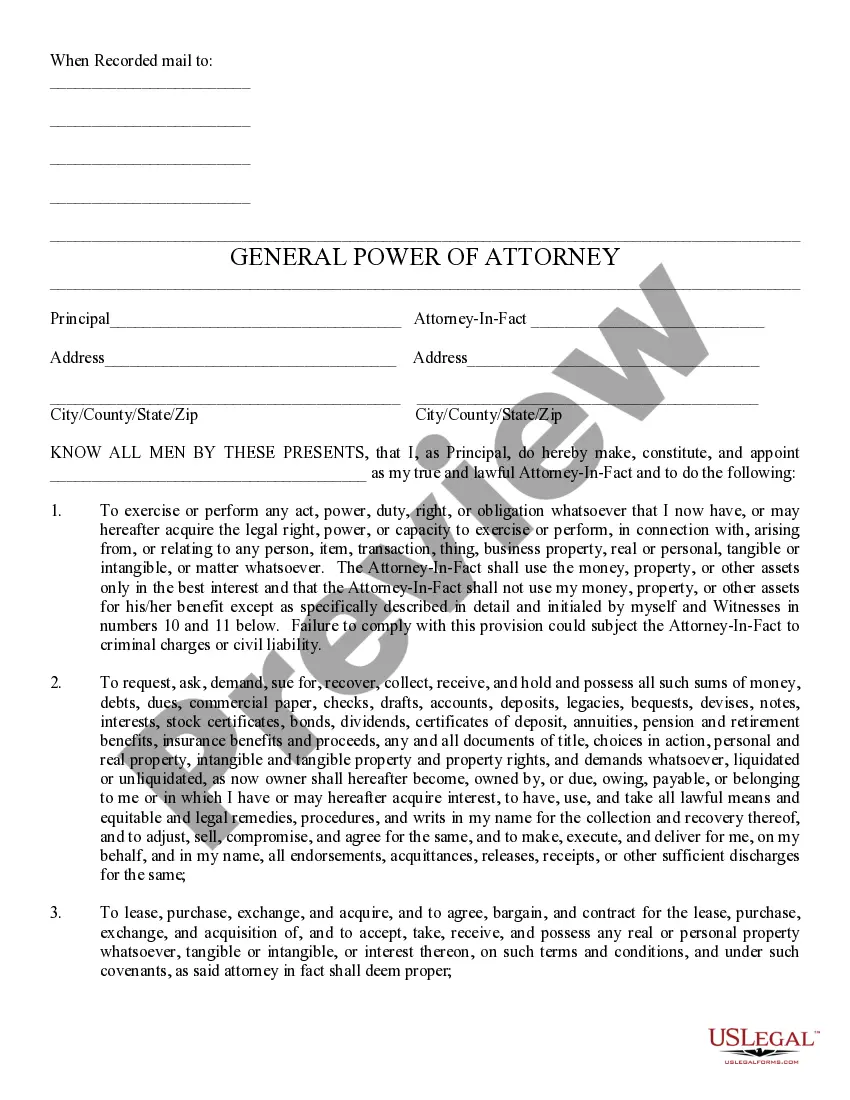

If available, use the Review button to browse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Afterward, you can complete, modify, print, or sign the New York Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents section and click on the appropriate button.

- If you are utilizing the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your choice.

- Review the document summary to confirm you have picked the appropriate form.

Form popularity

FAQ

Solution. If an asset is taken over by partner from firm his capital account will be debited. Explanation: When an asset is taken over by a partner, then the Realisation A/c is credited and the Concerned Partner's Capital A/c is debited with the agreed price at which the asset is taken over by him.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

The basis of property (other than money) distributed by a partnership to a partner in liquidation of the partner's interest shall be an amount equal to the adjusted basis of such partner's interest in the partnership reduced by any money distributed in the same transaction.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

Cases. A dividend may be referred to as liquidating dividend when a company: Goes out of business and the net assets of the company (after all liabilities have been paid) are distributed to shareholders, or. Sells a portion of its business for cash and the proceeds are distributed to shareholders.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).