New York Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

If you wish to full, down load, or print out lawful file layouts, use US Legal Forms, the largest selection of lawful types, that can be found on-line. Use the site`s simple and easy convenient research to find the documents you need. Various layouts for company and individual reasons are categorized by classes and says, or key phrases. Use US Legal Forms to find the New York Agreement to Sell Partnership Interest to Third Party in a handful of clicks.

In case you are already a US Legal Forms client, log in to your account and click on the Acquire option to obtain the New York Agreement to Sell Partnership Interest to Third Party. You can also entry types you in the past downloaded within the My Forms tab of your respective account.

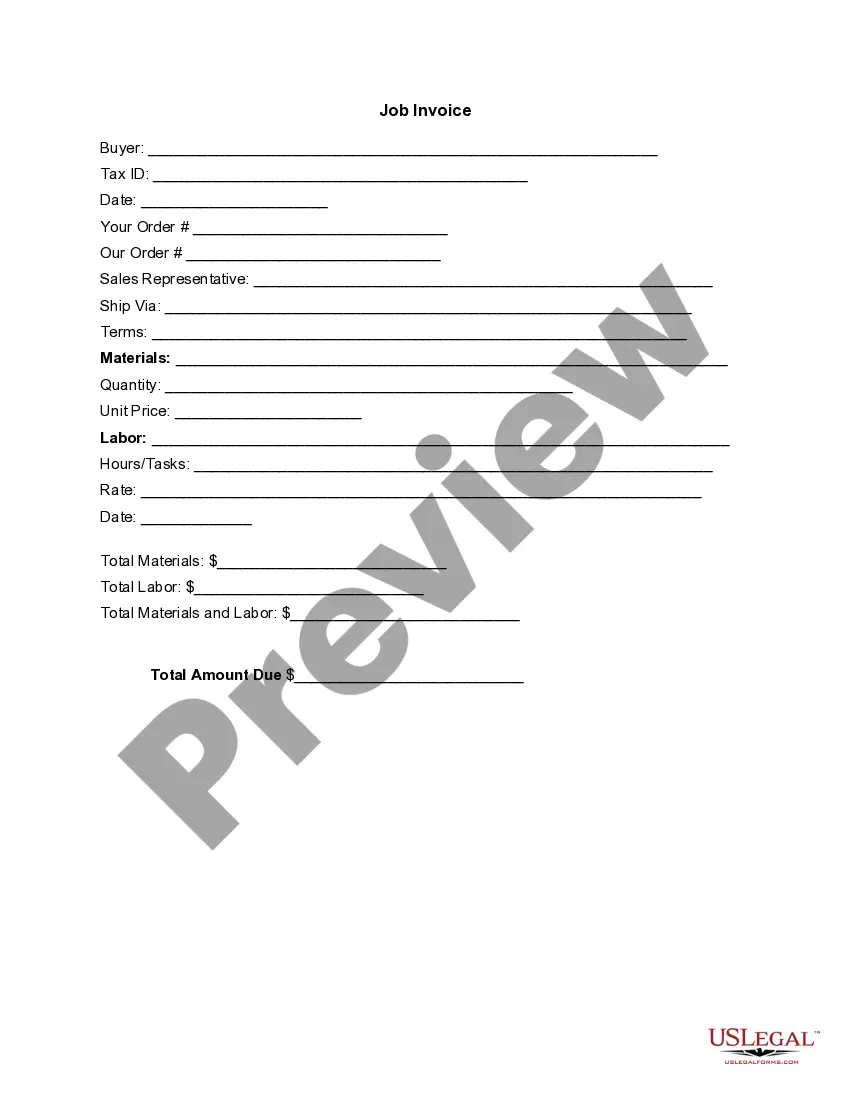

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the form for your right city/land.

- Step 2. Make use of the Preview method to look over the form`s content material. Do not overlook to see the information.

- Step 3. In case you are not satisfied with all the develop, utilize the Look for field towards the top of the display screen to locate other versions of the lawful develop format.

- Step 4. When you have identified the form you need, click on the Acquire now option. Opt for the prices strategy you prefer and put your accreditations to sign up for the account.

- Step 5. Method the purchase. You should use your credit card or PayPal account to perform the purchase.

- Step 6. Find the format of the lawful develop and down load it on your own system.

- Step 7. Total, revise and print out or indication the New York Agreement to Sell Partnership Interest to Third Party.

Every single lawful file format you acquire is yours for a long time. You might have acces to every develop you downloaded inside your acccount. Select the My Forms section and choose a develop to print out or down load once again.

Remain competitive and down load, and print out the New York Agreement to Sell Partnership Interest to Third Party with US Legal Forms. There are thousands of professional and condition-specific types you may use for the company or individual demands.

Form popularity

FAQ

2212 If a partner is selling his entire partnership interest, then his share of partnership liabilities will be reduced to zero and thus his amount realized will increase by at least the entire amount of his former share of partnership liabilities.

Here's an overview of what those steps entail:Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.09-Oct-2013

In general, as noted earlier, the transferee of a partnership interest must withhold a tax equal to 10% of the amount realized by the transferor on any transfer of a partnership interest unless an applicable exception applies (as discussed below).

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

How to Sell Limited Partnership InterestRealize the interest's value immediately.Convert a non-functioning tax shelter into cash.Eliminate future k-1 reporting.Avoid ongoing annual payment of income tax on the investment in question.Simplify your tax return and estate planning.More items...?30-Aug-2021

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.