New York Checklist for Corporate Minutes

Description

How to fill out Checklist For Corporate Minutes?

Are you currently in a role where you require documentation for either organizational or particular purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms provides an extensive array of form templates, such as the New York Checklist for Corporate Minutes, designed to meet federal and state regulations.

Once you obtain the correct form, click Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and purchase your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the New York Checklist for Corporate Minutes template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

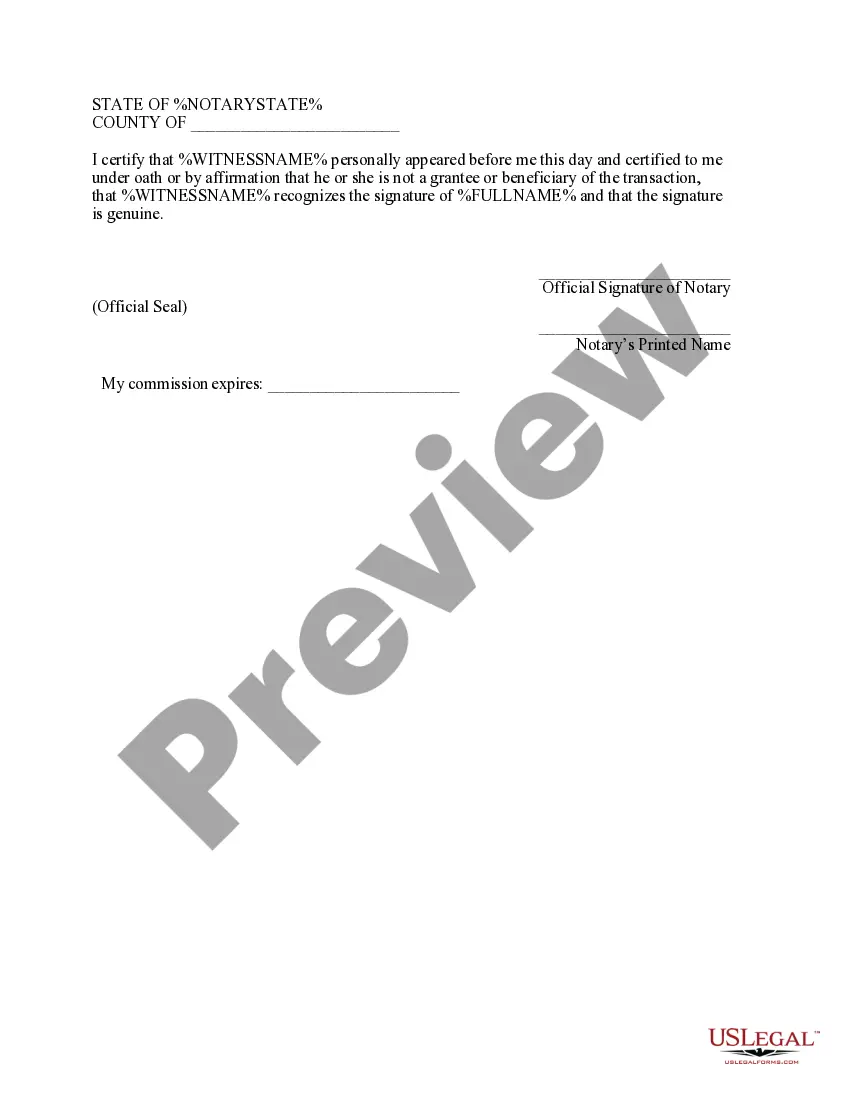

- Utilize the Preview option to review the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Search box to find the document that meets your needs and requirements.

Form popularity

FAQ

How to Write Meeting Minutesthe name of the company, date, and location of the meeting.the type of meeting (annual board of directors meeting, special meeting, and so on.)the names and titles of the person chairing the meeting and the one taking minutes.the names of attendees and the names of those who did not attend.More items...

2. What Should Be Included in Meeting Minutes?Date and time of the meeting.Names of the meeting participants and those unable to attend (e.g., regrets)Acceptance or corrections/amendments to previous meeting minutes.Decisions made about each agenda item, for example: Actions taken or agreed to be taken. Next steps.

Companies must prepare, approve, and then file official meeting minutes with the company and sometimes with the state of incorporation.Prepare corporate minutes.Approve corporate minutes.File the minutes with internal corporate records.In limited circumstances, file the corporate minutes with the state.

How to Write Meeting Minutesthe name of the company, date, and location of the meeting.the type of meeting (annual board of directors meeting, special meeting, and so on.)the names and titles of the person chairing the meeting and the one taking minutes.the names of attendees and the names of those who did not attend.More items...

The minutes should include the title of the group that is meeting; the date, time, and venue; the names of those in attendance (including staff) and the person recording the minutes; and the agenda.

What not to include in meeting minutes1 Don't write a transcript.2 Don't include personal comments.3 Don't wait to type up the minutes.4 Don't handwrite the meeting minutes.1 Use the agenda as a guide.2 List the date, time, and names of the attendees.3 Keep minutes at any meeting where people vote.4 Stay objective.More items...?4 Sept 2020

Meeting minutes can be signed electronically. Board meetings can be held by video/telephone conference or by means of unanimous written resolutions, even if the Articles of Association provide otherwise. Meeting minutes can be signed electronically.

Meeting minutes are typically taken by the organization's secretary. If the Secretary is not present, another officer or director should be chosen to record the minutes. Meeting minutes also need to be signed by the individual who took the minutes at the conclusion of the board meeting.

In addition to recording the time the meeting adjourns, the person who recorded the minutes should sign them. The words Submitted by followed by the signature is acceptable according to Robert's Rules of Order, Newly Revised, says Bowie.

Helpful Tips for Taking Board Meeting MinutesUse a template.Check off attendees as they arrive.Do introductions or circulate an attendance list.Record motions, actions, and decisions as they occur.Ask for clarification as necessary.Write clear, brief notes-not full sentences or verbatim wording.More items...?