Title: New York Letter Requesting Transfer of Property to Trust — A Comprehensive Guide Introduction: In the state of New York, when individuals or families wish to establish a trust to protect their assets and plan for the future, a crucial step is to initiate the transfer of property to the trust. This process involves preparing and submitting a Letter Requesting Transfer of Property to Trust. In this article, we will delve into the various aspects of this letter, including its purpose, key elements, and different types. Types of New York Letters Requesting Transfer of Property to Trust: 1. Revocable Living Trust Letter Requesting Transfer of Property: This type of letter is used for transferring property to a revocable living trust, which allows the granter(s) to maintain control over the assets during their lifetime while ensuring a smooth transition after their passing. 2. Irrevocable Trust Letter Requesting Transfer of Property: For individuals or families seeking to establish an irrevocable trust, this type of letter is essential. An irrevocable trust is designed to protect assets from estate taxes, creditor claims, and potential lawsuits. 3. Testamentary Trust Letter Requesting Transfer of Property: Testamentary trusts are created as per the instructions in the granter's will upon their death. This letter initiates the transfer of property into a trust that becomes effective only after the granter passes away. Key Elements of a New York Letter Requesting Transfer of Property to Trust: 1. Correct Identification of Parties: Clearly state the names and addresses of both the granter (property owner) and the trustee (person responsible for managing the trust and its assets). 2. Detailed Description of the Property: Provide a thorough description of the property intended for transfer, including its address, legal description, and any associated property identification numbers. 3. Reference to Trust Agreement or Declaration: Include references to the specific trust agreement or declaration where the property transfer is outlined, ensuring the document is duly executed and legally sound. 4. Request for Property Transfer: State your request to transfer ownership of the mentioned property from the granter's name to the trust's name. Clearly mention any conditions or terms attached to the transfer, if applicable. 5. Supporting Documentation: Attach relevant documents validating the property's ownership, such as deeds, titles, surveys, or any other legal paperwork needed to ensure a lawful and seamless transfer. Conclusion: A properly drafted and executed New York Letter Requesting Transfer of Property to Trust is a crucial step in safeguarding assets and ensuring their seamless transition. Whether it is for a revocable living trust, an irrevocable trust, or a testamentary trust, understanding the key elements of this letter is essential for anyone considering establishing a trust in the state of New York. Seek professional advice to ensure compliance with legal requirements and a smooth transfer process.

New York Letter Requesting Transfer of Property to Trust

Description

How to fill out New York Letter Requesting Transfer Of Property To Trust?

Have you been within a placement in which you will need documents for both company or specific functions virtually every day? There are a variety of authorized papers layouts accessible on the Internet, but discovering types you can rely is not straightforward. US Legal Forms gives thousands of type layouts, such as the New York Letter Requesting Transfer of Property to Trust, which are published to satisfy state and federal requirements.

Should you be previously informed about US Legal Forms site and get a merchant account, basically log in. After that, you can download the New York Letter Requesting Transfer of Property to Trust design.

If you do not provide an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is to the right town/county.

- Use the Preview key to check the form.

- Look at the information to ensure that you have selected the right type.

- If the type is not what you`re trying to find, make use of the Research industry to discover the type that meets your needs and requirements.

- When you get the right type, click on Purchase now.

- Select the rates program you would like, submit the required info to produce your money, and purchase the order using your PayPal or bank card.

- Pick a hassle-free document file format and download your backup.

Locate every one of the papers layouts you might have purchased in the My Forms menu. You can obtain a more backup of New York Letter Requesting Transfer of Property to Trust at any time, if necessary. Just click the essential type to download or print the papers design.

Use US Legal Forms, by far the most extensive assortment of authorized kinds, to save lots of efforts and avoid errors. The service gives professionally created authorized papers layouts that can be used for an array of functions. Create a merchant account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

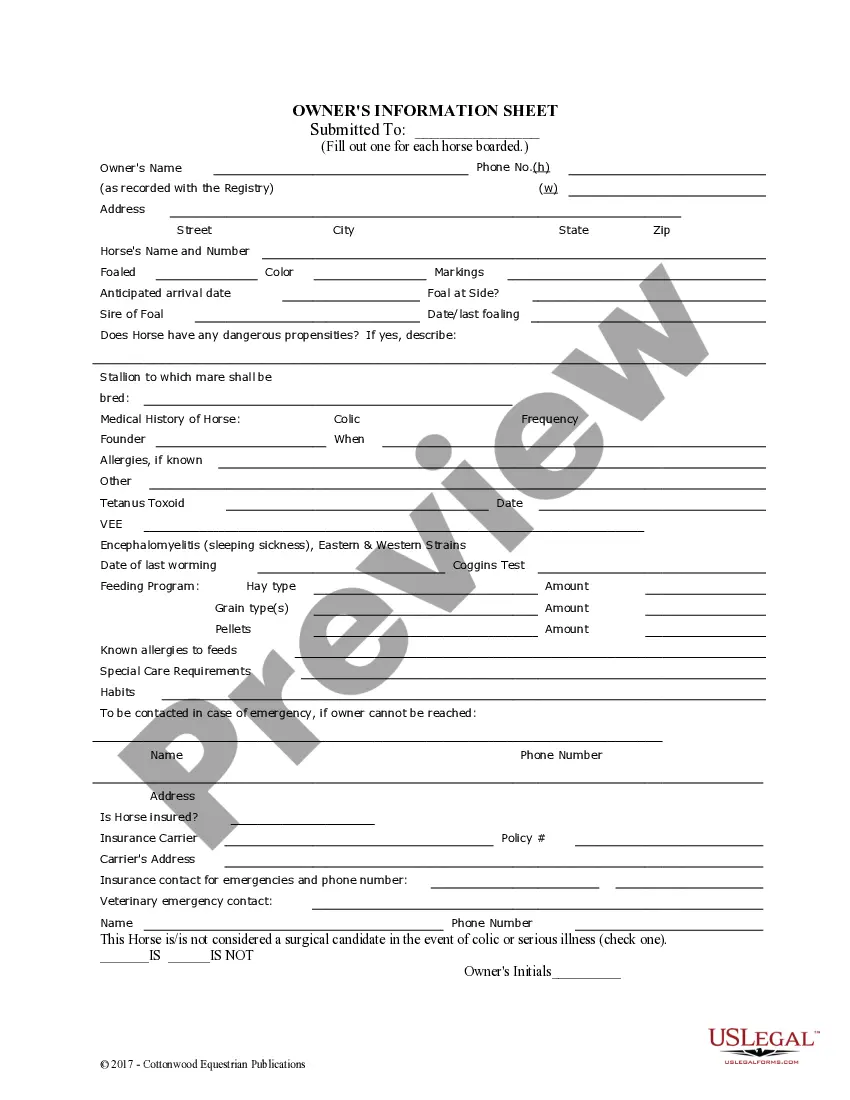

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

Potential DisadvantagesEven modest bank or investment accounts named in a valid trust must go through the probate process. Also, after you die, your estate may face more expense, as the trust must file tax returns and value assets, potentially negating the cost savings of avoiding probate.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

In New York, a trust does not have to be signed by two witnesses. But it could be. A trust does need to be signed by the person making the trust and by the trustee.

A swap power is also called a power to substitute. It is a special right reserved to you (or someone else) in a trust you create while you are alive. This right gives you the power to swap an asset of yours, say cash, for an asset held in the trust you created.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

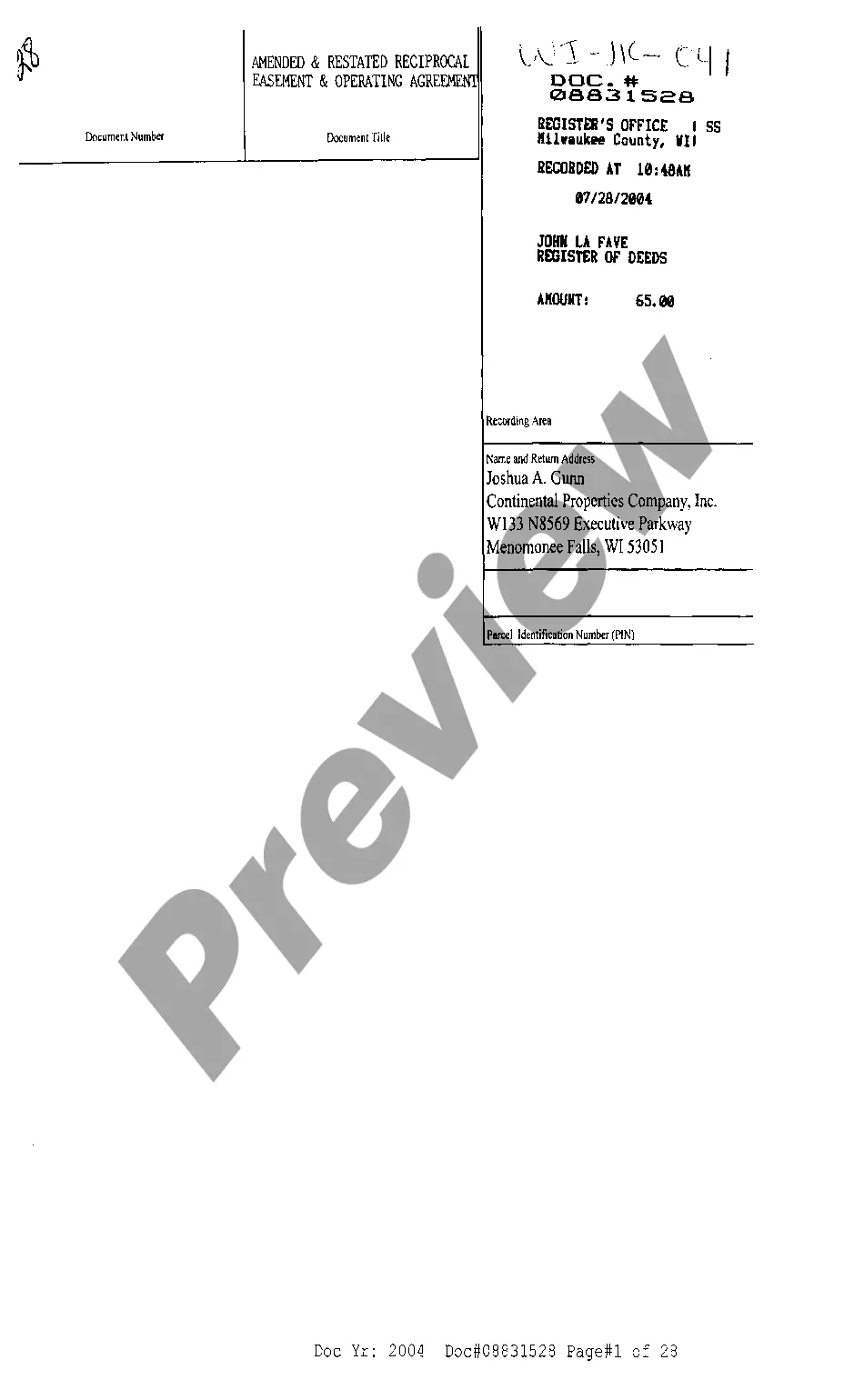

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.