New York Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

If you wish to total, obtain, or print authorized file web templates, use US Legal Forms, the most important selection of authorized kinds, that can be found online. Make use of the site`s simple and handy lookup to discover the documents you need. A variety of web templates for company and specific functions are categorized by types and states, or search phrases. Use US Legal Forms to discover the New York Agreement between Co-lessees as to Payment of Rent and Taxes within a handful of click throughs.

Should you be currently a US Legal Forms buyer, log in for your bank account and click on the Down load button to find the New York Agreement between Co-lessees as to Payment of Rent and Taxes. You can also access kinds you earlier acquired within the My Forms tab of your bank account.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the form for your right town/land.

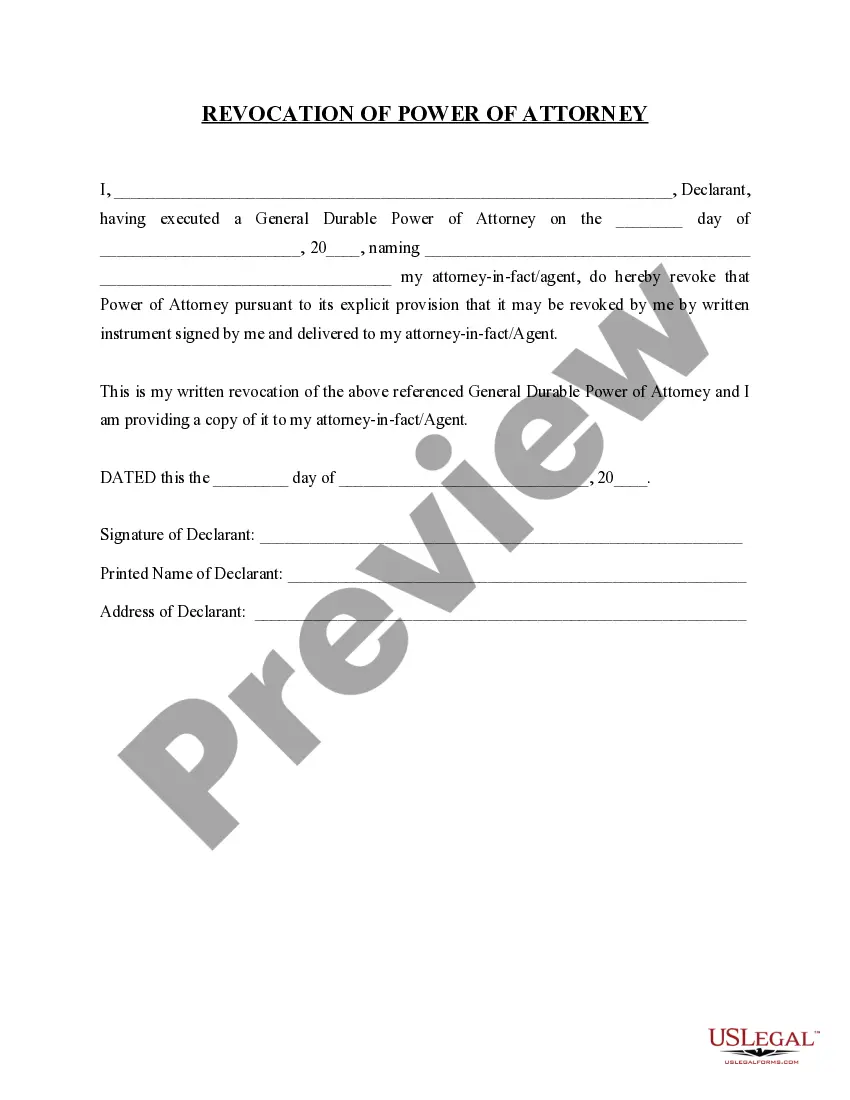

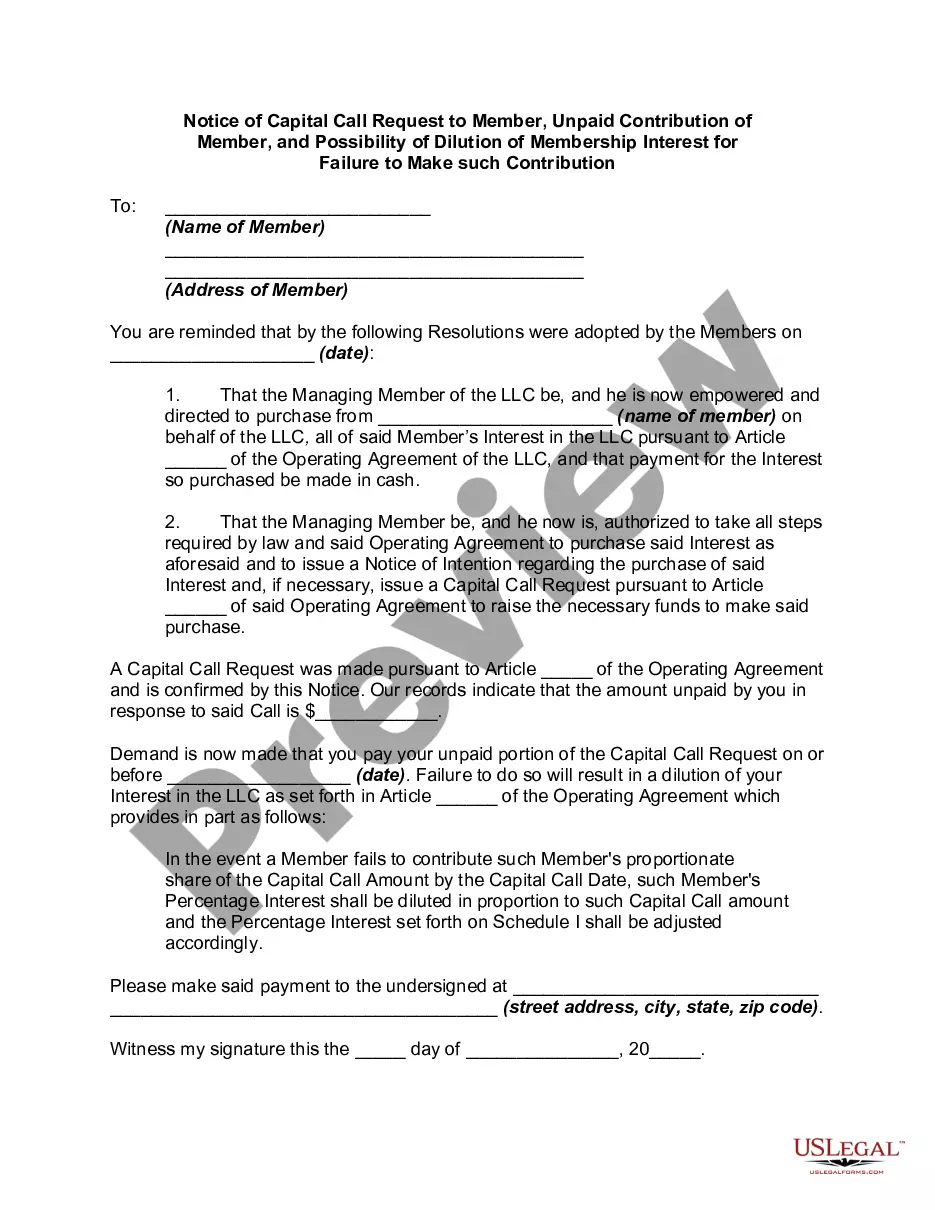

- Step 2. Use the Preview choice to examine the form`s content. Never neglect to read through the description.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Search discipline near the top of the screen to find other versions of the authorized kind template.

- Step 4. When you have discovered the form you need, click the Get now button. Pick the costs prepare you like and add your references to sign up for an bank account.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Select the formatting of the authorized kind and obtain it in your gadget.

- Step 7. Comprehensive, modify and print or sign the New York Agreement between Co-lessees as to Payment of Rent and Taxes.

Every single authorized file template you acquire is your own property for a long time. You might have acces to each kind you acquired within your acccount. Go through the My Forms section and decide on a kind to print or obtain once again.

Compete and obtain, and print the New York Agreement between Co-lessees as to Payment of Rent and Taxes with US Legal Forms. There are millions of expert and condition-certain kinds you can use for the company or specific demands.

Form popularity

FAQ

The lease agreement is between the landlord and tenant only. Occupants are not tenants; they are not named on the lease, but you can authorize them to stay on the property as a landlord. Occupants do not have financial responsibility for the lease and have no specific rights under landlord/tenant law.

Lessors and lessees enter into a binding contract, known as the lease agreement, that spells out the terms of their arrangement. While any sort of property can be leased, the practice is most commonly associated with residential or commercial real estate?a home or office. Lessor: Definition, Types, Vs. Landlord and Lessee - Investopedia investopedia.com ? terms ? lessor investopedia.com ? terms ? lessor

A lease is a contract outlining the terms under which one party agrees to rent an asset?in this case, property?owned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.

Yes, the landlord must paint occupied apartments in multiple dwellings (buildings with three or more apartments) every three years. (NYC Administrative Code §27-2013). Tenant occupied apartments in private dwellings are also required to be painted as necessary. Tenant Rights and Responsibilities - HPD - NYC.gov nyc.gov ? hpd ? services-and-information nyc.gov ? hpd ? services-and-information

A lessee is a person who rents land or property from a lessor. The lessee is also known as the ?tenant? and must uphold specific obligations as defined in the lease agreement and by law.

While ?lessee? and ?tenant? might be used interchangeably in everyday language, they carry subtle distinctions in the legal and financial realms. A lessee is someone who enters into a formal lease agreement, while a tenant refers to someone occupying a property, regardless of the presence of a lease. Lessee vs. Tenant: Demystifying the Difference - Visual Lease visuallease.com ? lessee-vs-tenant-demystifying-th... visuallease.com ? lessee-vs-tenant-demystifying-th...

A lease agreement is an arrangement between two parties ? lessor and lessee, by which the lessor allows the lessee the right to use a property owned or managed by the lessor for a specified period of time, in exchange for periodic payment of rentals. The agreement does not provide ownership rights to the lessee. Lease Agreement ? Format, Contents and Terms ? Download Template cleartax.in ? lease-deed-sample-download cleartax.in ? lease-deed-sample-download

While a leasehold estate grants the tenant interest in the property, it does not transfer any ownership to them. Usually, this type of estate is a legally binding agreement laid out in a written lease signed by both the property owner (the lessor), and the tenant (the lessee).