New York Compensation Administration Checklist is a comprehensive guide and tool used by businesses and organizations operating in New York to ensure compliance with state laws and regulations regarding compensation practices. This checklist serves as a roadmap for HR managers and compensation professionals to effectively administer and manage employee compensation in accordance with legal requirements. The New York Compensation Administration Checklist covers various key areas essential for establishing fair and compliant compensation policies. It includes a variety of relevant keywords such as: 1. Pay Equity Compliance: The checklist outlines steps to ensure equal pay for equal work, prohibiting any gender-based wage discrimination. 2. Minimum Wage Compliance: It provides guidelines on adhering to New York State's minimum wage law, including information on rates and any applicable exemptions. 3. Overtime Compliance: The checklist assists in correctly identifying employees eligible for overtime pay, calculating overtime rates, and ensuring compliance with New York State's overtime regulations. 4. Wage Theft Prevention Act (WPA) Compliance: This checklist helps organizations fulfill record-keeping and notification requirements under the WPA, such as providing wage notices and maintaining accurate payroll records. 5. Prevailing Wage Compliance: It provides guidance on complying with prevailing wage rates for public work projects, including documentation and reporting requirements. 6. Wage Deductions Compliance: The checklist outlines the permissible deductions that employers can make from employee wages, such as taxes, union dues, and benefit contributions, while ensuring compliance with state laws regarding deductions. 7. Commission and Bonus Payments Compliance: It offers guidance on properly structuring commission and bonus plans, including documentation, eligibility criteria, and payment schedules, in accordance with New York State laws. 8. Termination Pay Compliance: The checklist ensures compliance with New York's termination pay requirements, including guidelines for final wages, unused vacation pay, and severance agreements. 9. Record-Keeping Compliance: It emphasizes the importance of maintaining detailed records related to compensation administration, including time and attendance, payroll, and employee wage information, to meet legal requirements. Some specific types or variations of the New York Compensation Administration Checklist may include: — New York City Compensation Administration Checklist: This checklist is a more focused version tailored to New York City-specific wage and hour laws, including additional requirements such as the Fair Workweek legislation. — Nonprofit Organization Compensation Administration Checklist: A variation designed specifically for nonprofit organizations operating in New York, taking into account unique considerations related to compensation in the nonprofit sector. — Small Business Compensation Administration Checklist: A simplified version of the checklist targeting small businesses in New York, accounting for their specific needs and resources. In summary, the New York Compensation Administration Checklist is a vital resource for organizations operating in New York State, enabling them to navigate and comply with complex compensation regulations. By using this checklist, employers can ensure fair and legal compensation practices while minimizing the risk of penalties or lawsuits associated with non-compliance.

New York Compensation Administration Checklist

Description

How to fill out New York Compensation Administration Checklist?

It is possible to invest hours on the web trying to find the legal file template that suits the state and federal demands you need. US Legal Forms offers thousands of legal types which are reviewed by professionals. It is simple to download or print out the New York Compensation Administration Checklist from my service.

If you already have a US Legal Forms profile, you are able to log in and click on the Obtain button. Afterward, you are able to total, change, print out, or signal the New York Compensation Administration Checklist. Every legal file template you acquire is your own permanently. To obtain yet another duplicate for any acquired develop, go to the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms web site for the first time, stick to the easy instructions beneath:

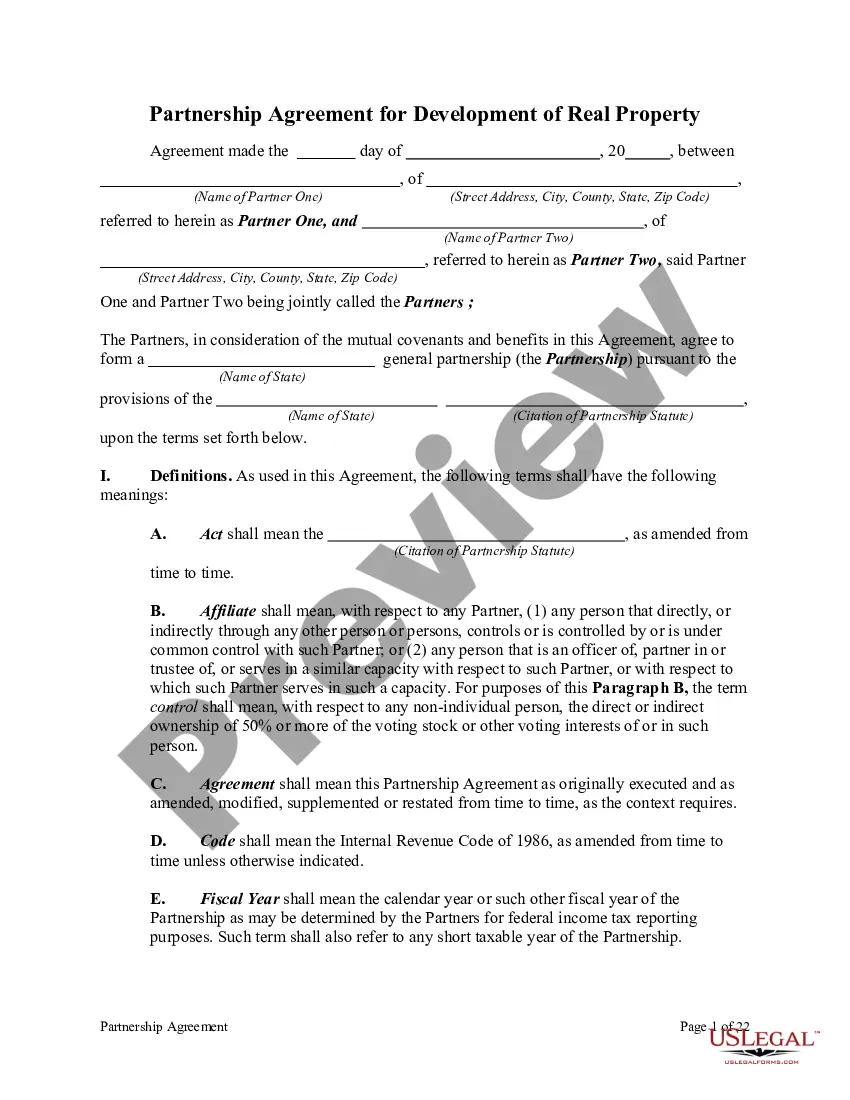

- First, make sure that you have chosen the best file template for that county/town that you pick. Look at the develop outline to make sure you have picked the correct develop. If available, take advantage of the Preview button to check from the file template also.

- In order to get yet another variation in the develop, take advantage of the Lookup field to find the template that fits your needs and demands.

- Upon having found the template you want, just click Get now to carry on.

- Find the rates strategy you want, type in your references, and register for an account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal profile to purchase the legal develop.

- Find the file format in the file and download it in your gadget.

- Make modifications in your file if possible. It is possible to total, change and signal and print out New York Compensation Administration Checklist.

Obtain and print out thousands of file layouts utilizing the US Legal Forms Internet site, that offers the biggest assortment of legal types. Use specialist and status-particular layouts to deal with your small business or individual needs.