The New York Resolution of Meeting of LLC Members to Dissolve the Company is an important process undertaken when members of a Limited Liability Company (LLC) in New York decide to dissolve the company. This formal resolution serves as a vital legal document that records the decision-making process and the subsequent steps required to dissolve the LLC in compliance with New York state laws and regulations. In order to initiate the dissolution of an LLC in New York, a meeting of the members must be convened, during which a resolution is proposed and ultimately adopted. This meeting may be held in person or through alternative means such as teleconference or video conference, as long as all members have the opportunity to participate and vote on the resolution. The New York Resolution of Meeting of LLC Members to Dissolve the Company typically includes the following key elements: 1. Title and Identification: The resolution should begin with a clear and concise title, such as "Resolution to Dissolve [LLC Name]." It should further specify the date and the place where the meeting is being held. 2. Membership Attendance: This section enumerates the members present during the meeting, along with their respective ownership percentages or interests in the LLC. It is vital to accurately document the attendance to affirm that the meeting complies with the required quorum and decision-making authority. 3. Purpose of the Meeting: Here, the resolution should outline the primary purpose of the meeting, which is to discuss and vote upon the dissolution of the LLC. This section serves as a reminder to all members of the intended outcome of the meeting. 4. Discussion and Decision-Making: The resolution should detail the discussions that occurred during the meeting regarding the dissolution of the LLC, including any concerns, alternatives proposed, or potential liabilities to address. Ultimately, it should reflect the final decision of the members to dissolve the company. 5. Dissolution Plan: This section is crucial as it outlines the required steps to dissolve the LLC in accordance with New York state laws. It should specify the individual or individuals responsible for managing the winding-up process, including notifying creditors, liquidating assets, settling liabilities, and distributing remaining assets to members. 6. Additional Considerations: Depending on the specific circumstances of the LLC, this section may address other relevant matters related to dissolution, such as dealing with pending contracts, resolving legal disputes, or ensuring compliance with tax obligations. Attention to detail in this section can help minimize potential risks or liabilities during the dissolution process. Different types of New York Resolution of Meeting of LLC Members to Dissolve the Company may include variations in elements mentioned above and could also refer to specific reasons for dissolution, such as: 1. Voluntary Dissolution: When members of the LLC voluntarily decide to dissolve the company due to changes in business circumstances, partnership disagreements, or the achievement of the LLC's intended purpose. 2. Judicial Dissolution: In some cases, LLC members may seek dissolution through a court order, typically due to irreconcilable disputes between members, fraudulent activities, or major misconduct. Ultimately, the New York Resolution of Meeting of LLC Members to Dissolve the Company is a critical legal document that encapsulates the decision-making process, subsequent steps, and responsibilities required to properly dissolve an LLC in New York state. Its careful and detailed construction ensures compliance with state laws and helps protect the interests of both members and stakeholders involved in the dissolution process.

New York Resolution of Meeting of LLC Members to Dissolve the Company

Description

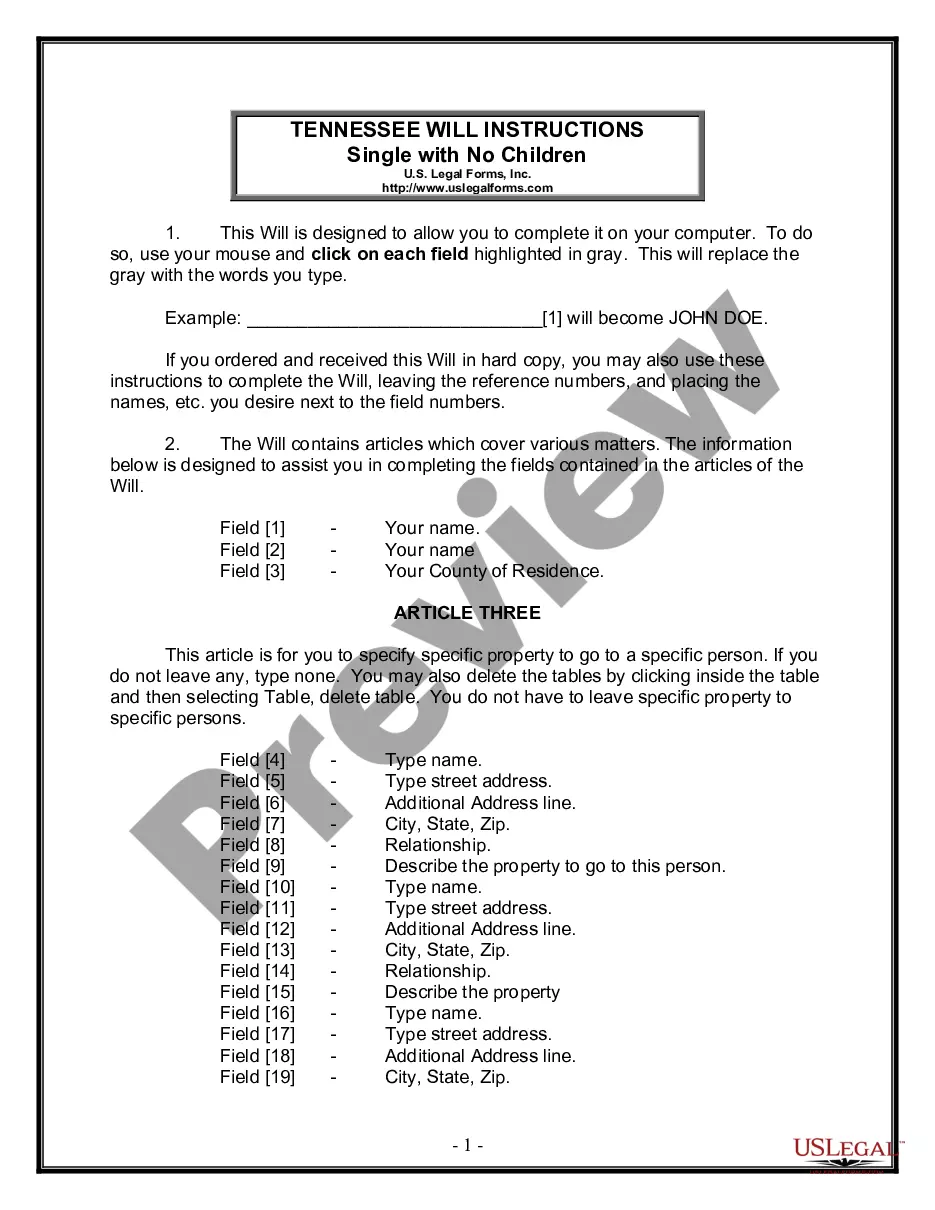

How to fill out New York Resolution Of Meeting Of LLC Members To Dissolve The Company?

You can devote time online searching for the lawful document format that meets the state and federal demands you need. US Legal Forms offers a large number of lawful forms which are reviewed by experts. It is simple to acquire or print the New York Resolution of Meeting of LLC Members to Dissolve the Company from your assistance.

If you currently have a US Legal Forms account, you are able to log in and click on the Obtain key. Following that, you are able to complete, change, print, or indicator the New York Resolution of Meeting of LLC Members to Dissolve the Company. Every single lawful document format you get is yours eternally. To acquire another version of the acquired kind, go to the My Forms tab and click on the related key.

Should you use the US Legal Forms web site for the first time, follow the simple recommendations listed below:

- First, make certain you have selected the right document format for the county/area that you pick. Look at the kind description to make sure you have picked the appropriate kind. If accessible, make use of the Preview key to look through the document format also.

- If you want to find another version from the kind, make use of the Research field to obtain the format that meets your needs and demands.

- When you have discovered the format you desire, simply click Get now to carry on.

- Find the costs plan you desire, enter your credentials, and register for your account on US Legal Forms.

- Total the deal. You can use your credit card or PayPal account to pay for the lawful kind.

- Find the format from the document and acquire it to the gadget.

- Make modifications to the document if needed. You can complete, change and indicator and print New York Resolution of Meeting of LLC Members to Dissolve the Company.

Obtain and print a large number of document templates utilizing the US Legal Forms Internet site, that offers the most important assortment of lawful forms. Use specialist and express-distinct templates to handle your company or personal requirements.

Form popularity

FAQ

Any 50 percent shareholder has a statutory right to wind up and dissolve the corporation, which, one way or another, will result in money being paid to the party moving for dissolution, assuming that the company has any value.

Voluntary dissolution is generally a two-step process:Obtaining written consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has filed all its returns)2; and.Filing paperwork with the New York Department of State, including a Certificate of Dissolution.

New York Limited Liability Company Dissolution FAQ There is a $60 fee to dissolve an LLC or corporation in New York. For expedited processing, there is an additional $25 fee.

The dissolution is initiated by a resolution by the board of directors who submit it at a meeting of the shareholders. The shareholders each vote and if the resolution is approved, the directors have the authorization to proceed with the dissolution process.

A shareholder may sue to dissolve a corporation if the board is deadlocked, the shareholders cannot break the deadlock and the assets of the corporation will suffer significant impairment; the directors are acting in a manner that is illegal, oppressive, or fraudulent; the shareholders cannot vote in new directors due

How to end your businessStep 1: Approval of the owners of the corporation or LLC.Step 2: Filing the Certificate of Dissolution with the state.Step 3: Filing federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notifying creditors your business is ending.Step 6: Settling creditors' claims.More items...?

Within 90 days following the dissolution and the commencement of winding up the limited liability company, or at any other time that there are no members, a domestic limited liability company shall file articles of dissolution pursuant to Section 705 of the New York State Limited Liability Company Law.

The first step in dissolving a corporation usually involves having your board of directors and shareholders vote to approve the dissolution. Under most state rules, you start by holding a meeting of the board of directors to vote on a resolution to approve the dissolution of the corporation.

In exchange for getting back their investment (in full or part), the shareholders return their shares to the company, which are then canceled. If a company returns any money to its shareholders while still having a debt outstanding, the creditor can sue, and the shareholders may have to return the received amounts.