New York Resolution of Meeting of Corporation to Make Specific Loan

Description

How to fill out Resolution Of Meeting Of Corporation To Make Specific Loan?

You can spend hours online looking for the valid document template that satisfies the federal and state requirements you will require.

US Legal Forms offers thousands of valid forms that can be reviewed by experts.

It is easy to download or print the New York Resolution of Meeting of Corporation to Make Specific Loan from the service.

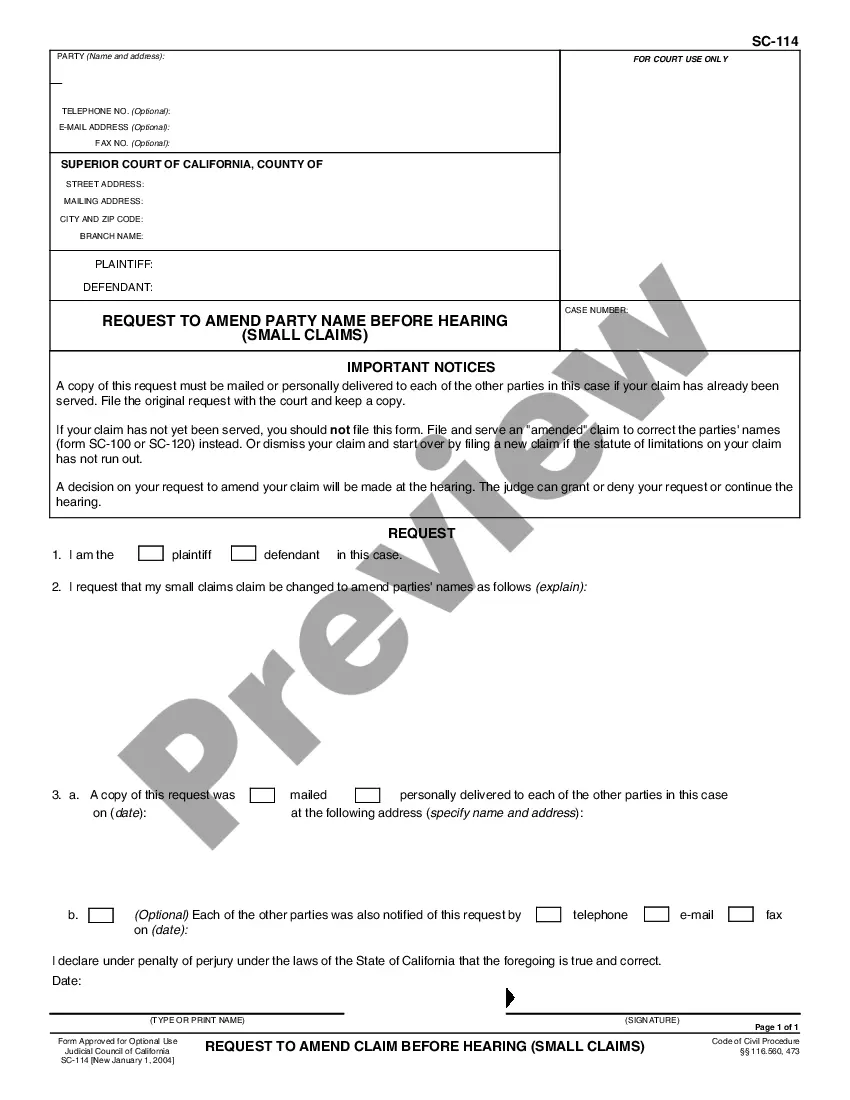

If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and hit the Download button.

- Then, you can complete, modify, print, or sign the New York Resolution of Meeting of Corporation to Make Specific Loan.

- Every valid document template you acquire is yours permanently.

- To obtain another copy of a purchased form, head to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

To write a simple board resolution, start with the title that clearly states the purpose, perhaps a New York Resolution of Meeting of Corporation to Make Specific Loan. Lay out the key elements of the decision, such as the date and names of the approving members. Keep the language straightforward, focusing on clarity and conciseness, and ensure signatures are collected to formalize the resolution.

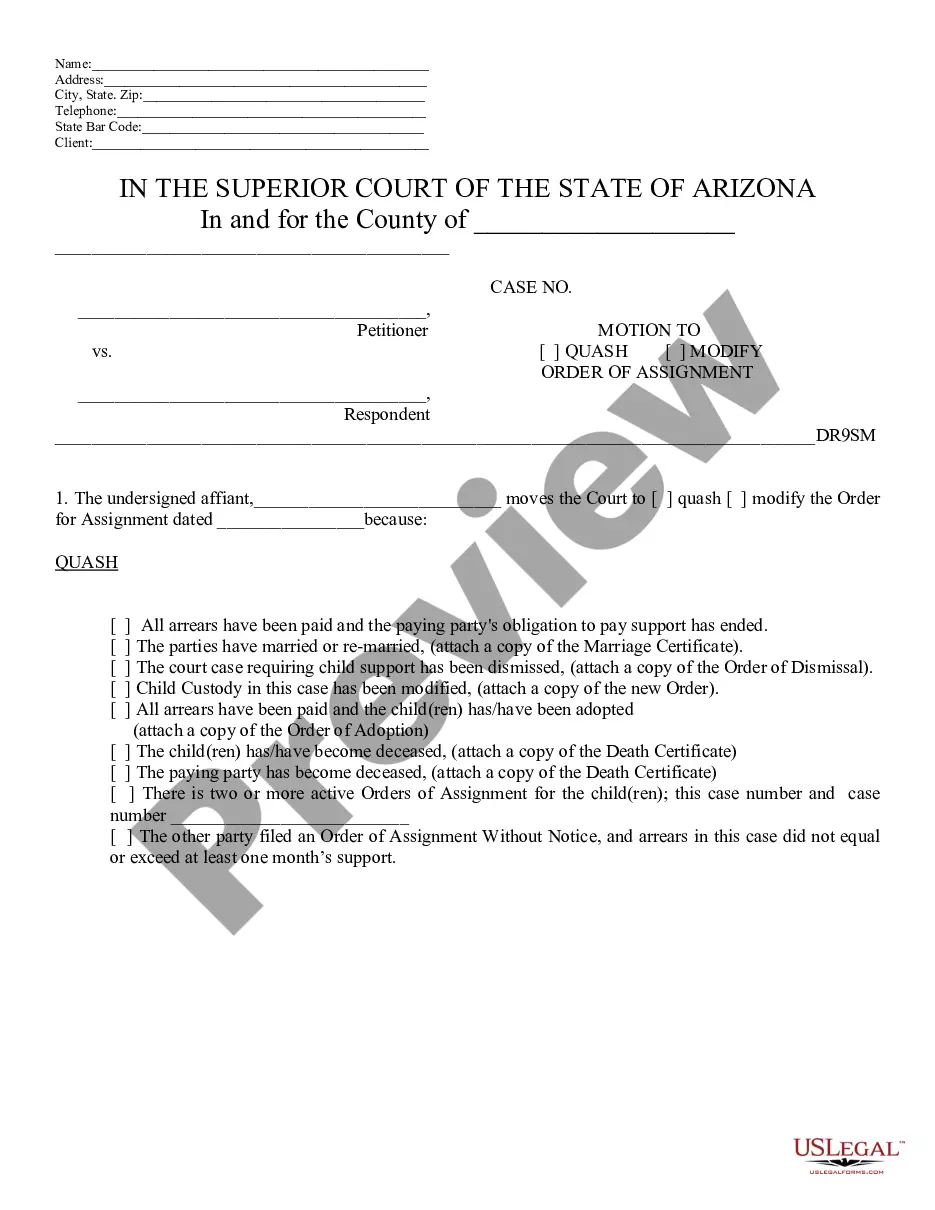

Typically, corporate resolutions are created by the board of directors or authorized officers within the corporation. This may involve discussions during meetings where key decisions are made, such as in a New York Resolution of Meeting of Corporation to Make Specific Loan setting. Documenting these resolutions ensures that the corporation operates within its legal requirements and maintains a clear record of its decisions.

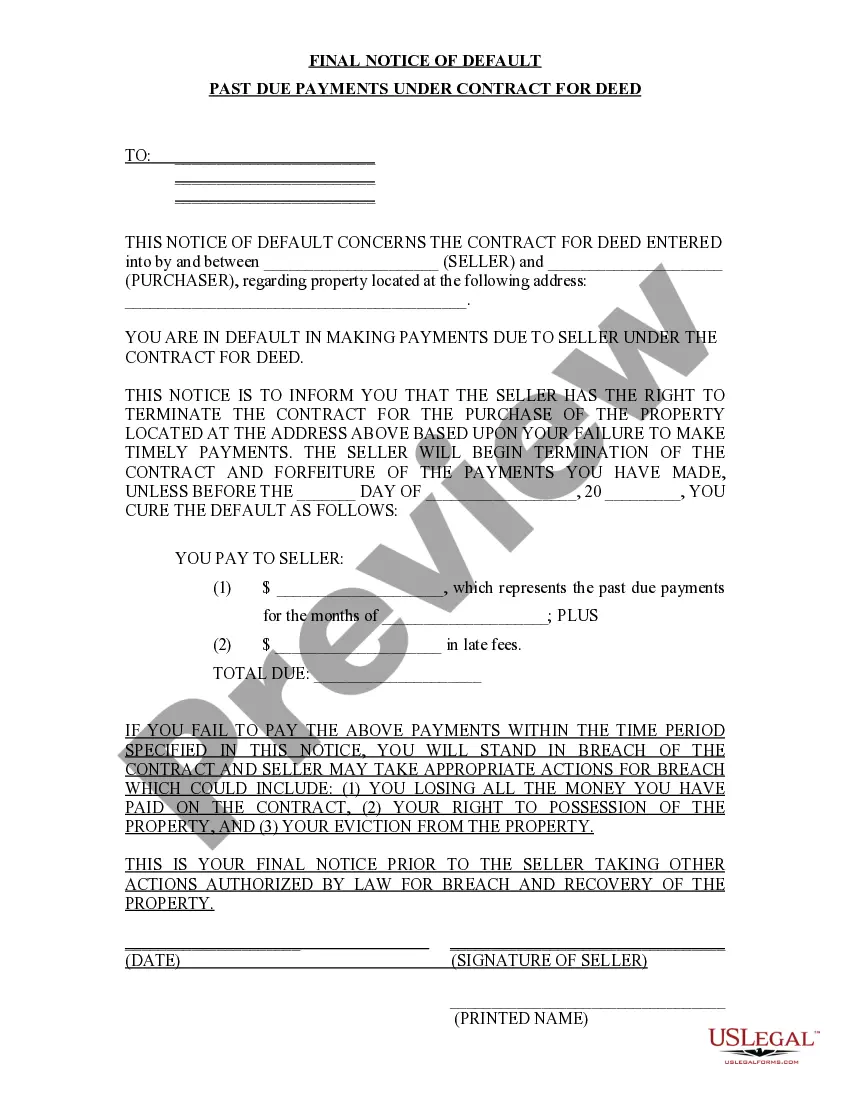

To write a resolution to borrow, first specify the exact loan amount and the intended use of the funds, such as for a New York Resolution of Meeting of Corporation to Make Specific Loan. Detail the repayment terms and any collateral involved. It's important to ensure that the resolution is signed by the appropriate corporate officers to authenticate the decision and affirm the company's commitment.

Drafting a shareholder resolution involves outlining the proposal's intent, which might relate to a New York Resolution of Meeting of Corporation to Make Specific Loan. Clearly articulate the reasons behind the resolution and its implications for shareholders. Don’t forget to include a voting process for shareholders to express their approval or disapproval, ensuring transparency in your corporate governance.

When writing a board resolution to a bank, start by stating the purpose of the loan clearly, such as in the New York Resolution of Meeting of Corporation to Make Specific Loan context. Include details about the borrowing terms, such as the loan amount and repayment schedule. Be sure to have board members approve the resolution and include their signatures to demonstrate consensus and strengthen your appeal to the bank.

To create a company resolution, begin by identifying the specific matter at hand, such as a New York Resolution of Meeting of Corporation to Make Specific Loan. Next, outline the resolution's key components, including the meeting's date, participants, and purpose. Finally, document the decision in clear language, ensuring that all necessary signatures are obtained to validate the resolution.

To make a resolution in a meeting, begin by clearly defining the issue at hand. Engage participants in discussion, gathering insights to reach a consensus. Once the agreement is reached, formally state the resolution, for instance, the New York Resolution of Meeting of Corporation to Make Specific Loan, and ensure that it is documented in the meeting minutes. This structured approach encourages transparency and accountability in decision-making.

Writing a corporate resolution letter requires clarity and precision. Start with the company's name, followed by the specific resolution being proposed, such as the New York Resolution of Meeting of Corporation to Make Specific Loan. Clearly state the purpose, details, and any resolutions passed during the meeting. This document serves as an official record and should be signed by authorized individuals to validate the resolution.

In the Corporations Act, certain actions require a special resolution, which involves a higher level of approval from shareholders. For example, decisions such as changing the company’s name, altering share capital, or approving loans fall under this category. The New York Resolution of Meeting of Corporation to Make Specific Loan is a crucial aspect of this process, ensuring that such decisions are made transparently and with proper stakeholder involvement.

Writing a resolution to borrow requires clarity and precision. Begin with the purpose of the loan, including the amount and intended use, while referencing any relevant meetings or approvals. Incorporating a New York Resolution of Meeting of Corporation to Make Specific Loan streamlines the process and ensures all details are aligned with legal requirements, making it a central component of your corporate governance.