New York Termination and Severance Pay Policy

Description

How to fill out Termination And Severance Pay Policy?

Have you ever encountered a circumstance where you required documents for both business or specific purposes nearly every time.

There is a plethora of legitimate document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the New York Termination and Severance Pay Policy, that are designed to meet federal and state requirements.

Once you find the right form, click on Purchase now.

Select the pricing plan you prefer, provide the required information to create your account, and pay for the transaction using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Termination and Severance Pay Policy template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is suited for the appropriate area/region.

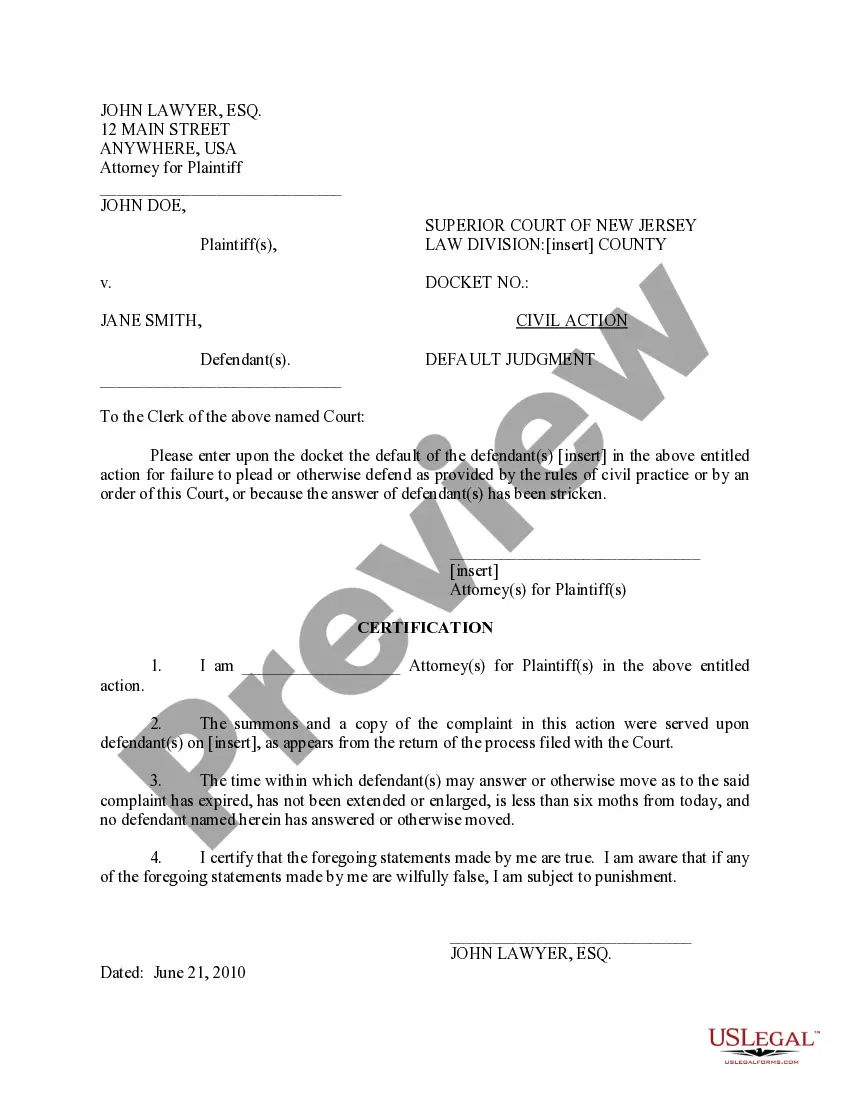

- Use the Preview button to review the form.

- Check the overview to confirm you have selected the correct form.

- If the form does not match your needs, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, in New York, you can collect both unemployment benefits and severance pay, but there are important nuances to consider. The New York Termination and Severance Pay Policy allows you to receive severance while still being eligible for unemployment, as long as the severance does not cover the same period as the unemployment benefits. It’s important to report any severance payments to the unemployment office when you apply for benefits.

Severance pay is not a legal requirement in New York when an employee is fired. Under the New York Termination and Severance Pay Policy, it is at the discretion of the employer whether to offer severance. Employees are encouraged to review their contracts and company policies to understand their entitlement to severance.

Similar to New York City, receiving severance after being terminated in New York State depends largely on your employer's policies. The New York Termination and Severance Pay Policy does not require severance pay, but many organizations provide it to facilitate a smooth transition. Always check your employment contract for specific clauses regarding severance benefits.

In New York City, eligibility for severance pay upon being fired can vary based on the company’s policies and your employment agreement. While NYC laws do not mandate severance, many employers offer it as part of their New York Termination and Severance Pay Policy. It is worthwhile to consult your HR department to understand your options if you're facing termination.

In many cases, employees can receive a severance package even if they are fired. The distinction often lies in the terms of the employment contract and specific company policies. Under the New York Termination and Severance Pay Policy, employers are not legally required to grant severance; however, they may choose to do so to maintain goodwill. Reviewing your employment agreement can help clarify your eligibility.

To receive a severance package in New York, you typically need to negotiate this benefit with your employer. Many organizations outline their policies regarding severance in employee handbooks under the New York Termination and Severance Pay Policy. If you think you are eligible, engage in discussions with your HR department or management as soon as possible. Understanding your rights can lead to better outcomes.

In New York, employers must adhere to specific guidelines when terminating an employee. The New York Termination and Severance Pay Policy stipulates that the termination must be lawful and not discriminatory. Additionally, employers should provide employees with any due wages and, in certain cases, a severance package. Familiarizing yourself with these requirements can help you understand your rights.

In New York, eligibility for unemployment benefits after being fired depends on the circumstances of your termination. If you were fired due to misconduct, you may be disqualified from receiving these benefits. However, if the firing was not related to misconduct, you might qualify under the New York Termination and Severance Pay Policy. It’s best to apply for benefits to determine your eligibility.

In New York, rules regarding severance primarily depend on the employer's policies rather than state law. The New York Termination and Severance Pay Policy indicates that companies can create their own criteria for severance pay. It's crucial to familiarize yourself with these rules and to seek clarification from your employer if needed. Utilizing a platform like uslegalforms can provide valuable resources to help you navigate this area.

Quitting a job and securing a severance package can be tricky but possible. To increase your chances, you should review your employment contract and know your company's policies outlined in the New York Termination and Severance Pay Policy. It’s important to communicate effectively with your employer, stating your reasons for leaving while emphasizing your contributions. Consulting with a professional can also guide you through the process.