New York Exit - Termination Checklist

Description

How to fill out Exit - Termination Checklist?

If you wish to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access any form you obtained in your account by clicking on the My documents section and selecting a form to print or download again.

Fill, download, and print the New York Exit - Termination Checklist with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the New York Exit - Termination Checklist in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to get the New York Exit - Termination Checklist.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the legal form.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to process the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New York Exit - Termination Checklist.

Form popularity

FAQ

In New York, employees have the right to resign from their jobs at any time. However, it is advisable to give your employer notice, usually two weeks, to maintain a positive professional relationship. As part of your New York Exit - Termination Checklist, consider preparing your resignation letter to formally document your decision. Additionally, you may want to understand any applicable policies regarding your last paycheck and benefits.

Yes, your employer can fire you without a reason. However, under New York laws, employers cannot fire people for illegal reasons. While New York is an at-will employment state, meaning employers do not have to provide a just cause, the laws still protect employees from unlawful termination.

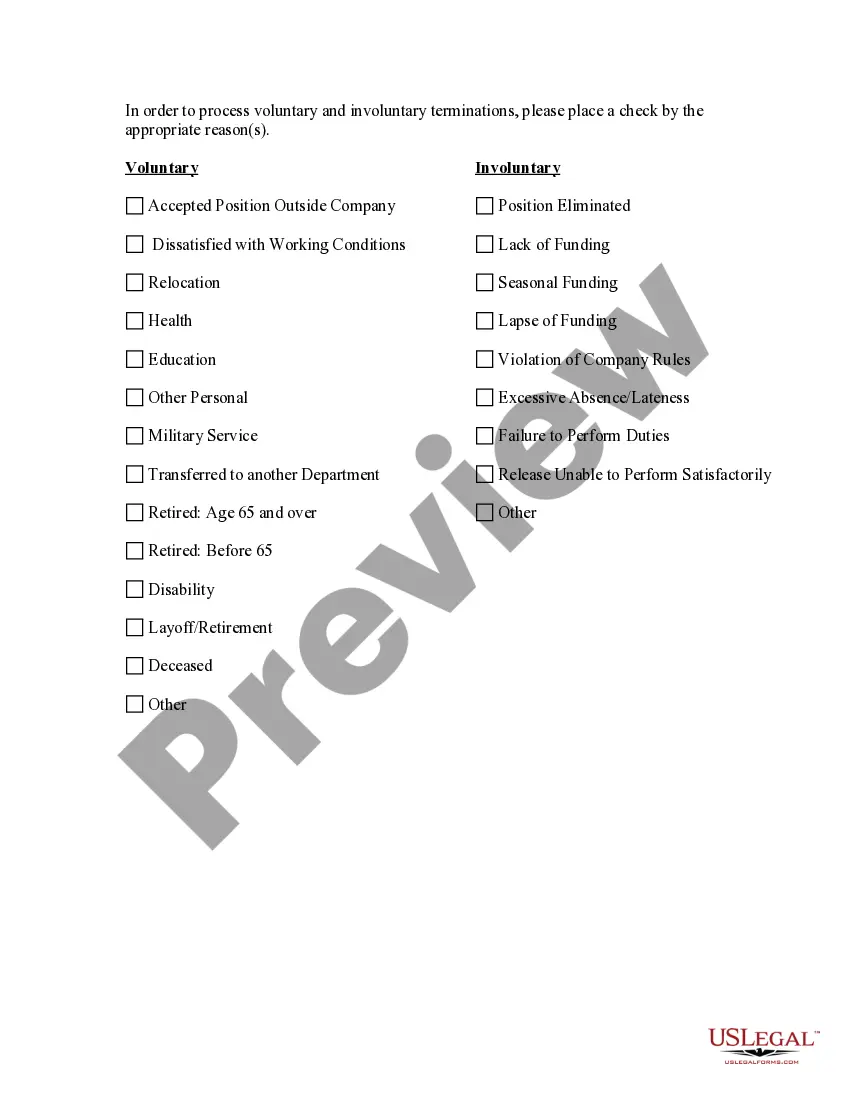

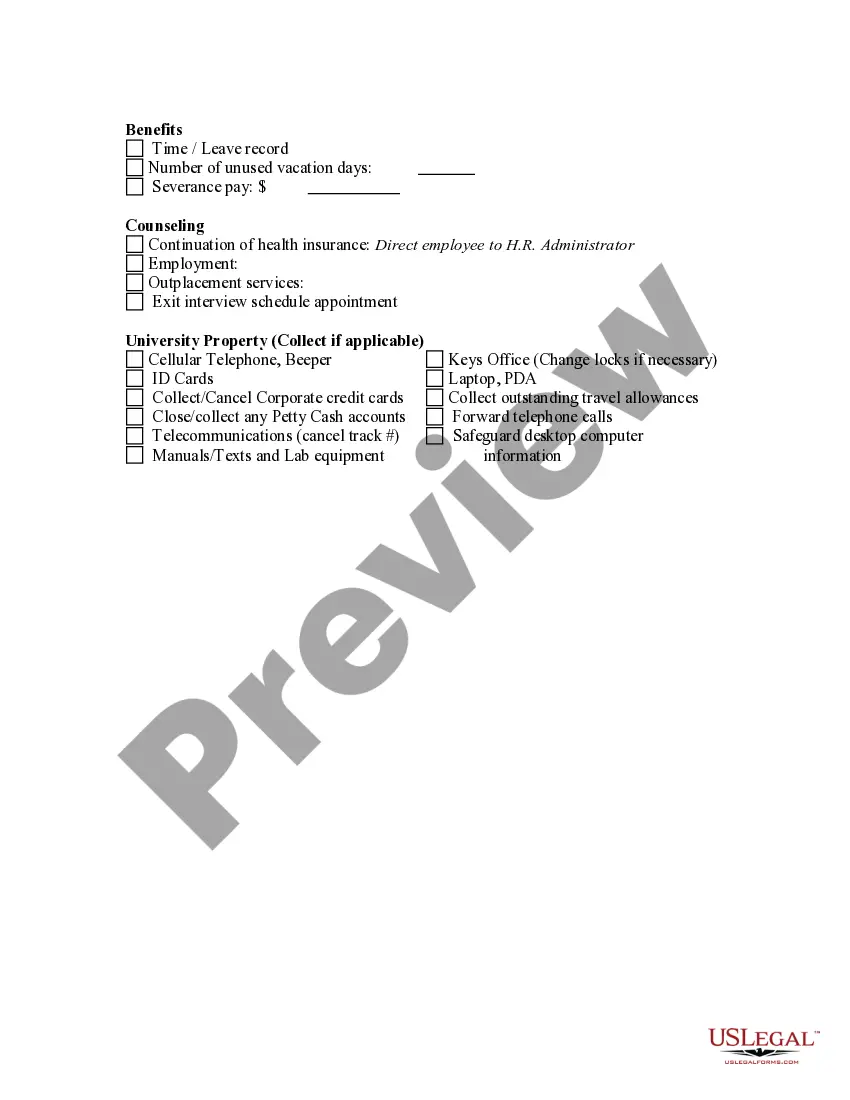

An employee termination checklist creates an outline for employee exit processes within your business. The checklist contains information you need to give terminated employees, items you need to retrieve from exiting employees, exit interview information, and more.

In other words, firing is "the final step in a fair and transparent process," as outlined below.Identify and Document the Issues.Coach Employees to Rectify the Issue.Create a Performance Improvement Plan.Terminate the Employee.Have HR Conduct an Exit Interview.

Put Documentation in Employee File: All documentation, including receipts for returned items and termination letters, need to go into that employee's file. You can include documentation for discipline, warnings, and performance reviews that help show why you're firing that employee.

New York requires employers to provide a written termination letter to employees, regardless of whether the employee's termination was voluntary or involuntary. The letter must state the date of termination of employment, and the date of termination of benefits.

New York requires employers to provide a written termination letter to employees, regardless of whether the employee's termination was voluntary or involuntary. The letter must state the date of termination of employment, and the date of termination of benefits.

Such documents may include, but are not limited to: attendance records, performance reviews, disciplinary records, signed employee acknowledgment of company handbook and other policies, offer letters, employment agreements, restrictive covenants, and incentive compensation plans. Procedures For The Termination Meeting.

A termination letter is mandatory. Any notice of termination, either by you or your employer, must be in writing. If you did not receive a termination letter, ask your employer to give you one. Otherwise, you are still considered as an employee of the company.

Employee termination checklistTalk to the employee. There are many ways an employee can tell you they're quitting.Collect company property.Remove employee access.Pass out paperwork.Have an exit interview.Let people know.Update records.Distribute final paycheck.