New York Job Share Proposal and Agreement

Description

How to fill out Job Share Proposal And Agreement?

US Legal Forms - one of many greatest libraries of lawful forms in America - offers a wide array of lawful papers themes you may obtain or produce. Making use of the web site, you may get 1000s of forms for enterprise and personal reasons, categorized by categories, states, or keywords and phrases.You will find the most recent variations of forms much like the New York Job Share Proposal and Agreement within minutes.

If you already possess a registration, log in and obtain New York Job Share Proposal and Agreement from your US Legal Forms local library. The Acquire button can look on every single kind you look at. You get access to all in the past saved forms from the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, allow me to share easy directions to help you get began:

- Make sure you have picked the proper kind for your personal area/state. Click on the Review button to examine the form`s content. Look at the kind information to actually have chosen the appropriate kind.

- If the kind doesn`t suit your specifications, use the Lookup discipline towards the top of the screen to get the one who does.

- If you are content with the shape, affirm your selection by clicking on the Get now button. Then, opt for the pricing plan you want and supply your credentials to sign up to have an account.

- Procedure the financial transaction. Utilize your bank card or PayPal account to perform the financial transaction.

- Pick the format and obtain the shape on the gadget.

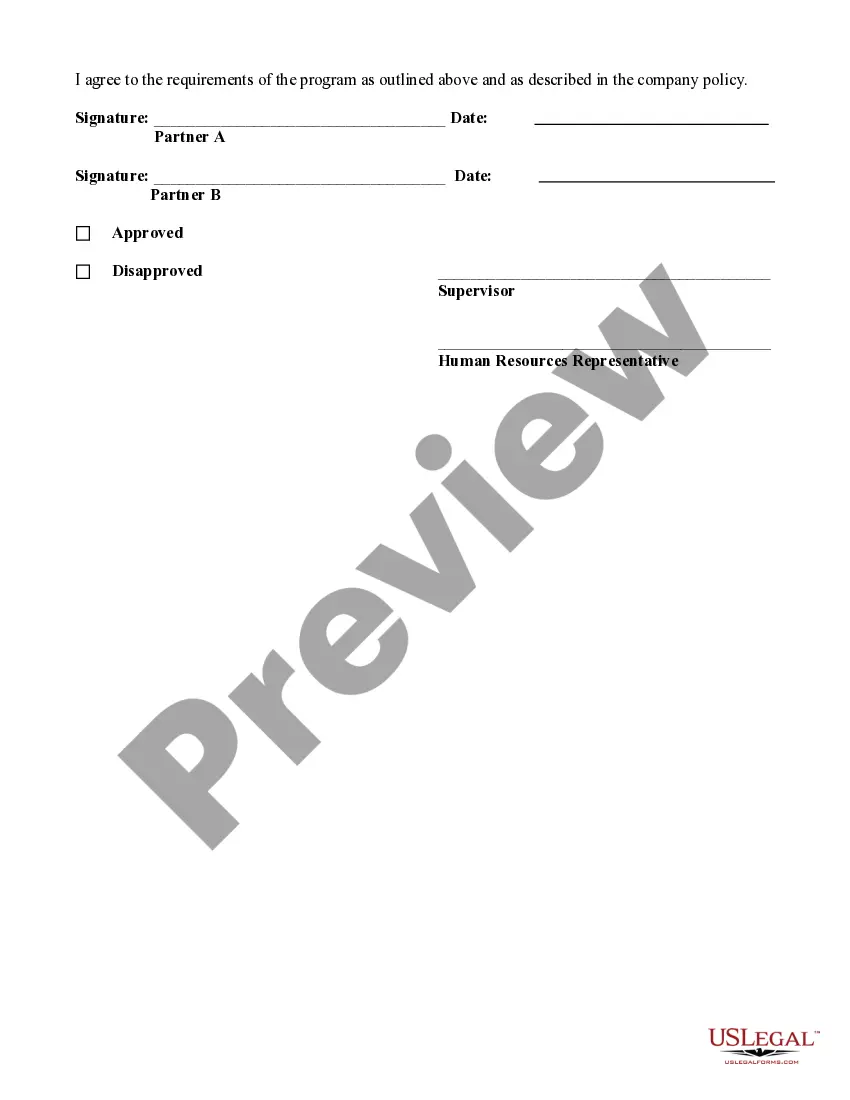

- Make alterations. Fill out, edit and produce and indicator the saved New York Job Share Proposal and Agreement.

Each and every format you put into your account does not have an expiry day and it is your own for a long time. So, if you want to obtain or produce yet another backup, just check out the My Forms section and then click on the kind you will need.

Gain access to the New York Job Share Proposal and Agreement with US Legal Forms, the most extensive local library of lawful papers themes. Use 1000s of professional and express-specific themes that satisfy your small business or personal needs and specifications.

Form popularity

FAQ

Work sharing provides employers with an alternative to layoffs when they are faced with a temporary decline in business. Instead of laying off a portion of the workforce to cut costs, an employer may reduce the hours and wages of all employees or a particular group of workers.

A: Yes. Under NYS DOL's new partial unemployment system, ten hours of work in a week - regardless of the total days worked - is equivalent to less than one day worked for certification purposes, as long as you do not earn more than $504 in gross pay (excluding earnings from self-employment) for those ten hours worked.

In New York, the current maximum weekly benefit rate is $504. The minimum PUA benefit rate is 50% of the average weekly benefit amount in New York. For January 27, 2020 - March 31, 2020, the minimum benefit rate is $172. For April 1, 2020 - June 30, 2020, the minimum benefit rate is $182.

NYS DOL's new partial unemployment system uses an hours-based approach. Under the new rules, you can work up to 7 days per week without losing full unemployment benefits for that week, if you work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

A: NYS DOL's new partial unemployment system uses an hours-based approach. Under the new rules, claimants can work up to 7 days per week without losing full unemployment benefits for that week if they work 30 hours or fewer and earn $504 or less in gross pay excluding earnings from self-employment.

Under California's Work Sharing program, an employer facing the same situation could file a Work Sharing plan with EDD reducing the work week of all employees from five days to four days (a 20 percent reduction). The employees would be eligible to receive 20 percent of their weekly Unemployment Insurance benefits.

The voluntary Shared Work program was developed to help Texas employers and employees withstand a slowdown in business such as the impact of COVID-19. Shared Work allows employers to supplement their employees' wages lost because of reduced work hours with partial unemployment benefits.

For What Reasons Can You Be Denied Unemployment?Failing to Meet the Earnings Requirements. To qualify for benefits in New York (as in most states), you must have earned a minimum amount in wages during a 12-month stretch called the "base period."Getting Fired for Misconduct.Quitting Your Last Job.

Hours in Day New York doesn't impose overtime pay at the daily level. Employers must offer a 4-hour minimum shift.

The Shared Work Program helps keep trained, productive employees on the job during temporary business downturns, meaning New York businesses can gear up quickly when conditions improve, and New York workers get to stay on the job. Full-time, part-time and seasonal employees are eligible.