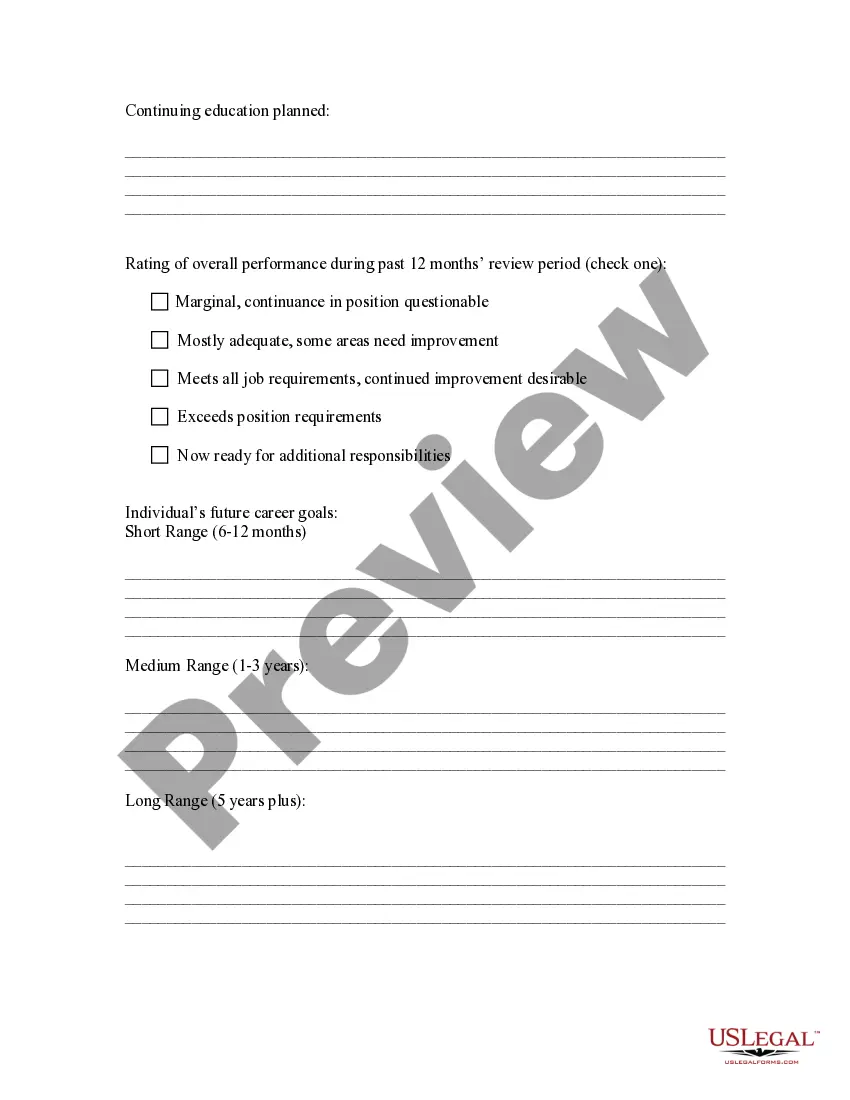

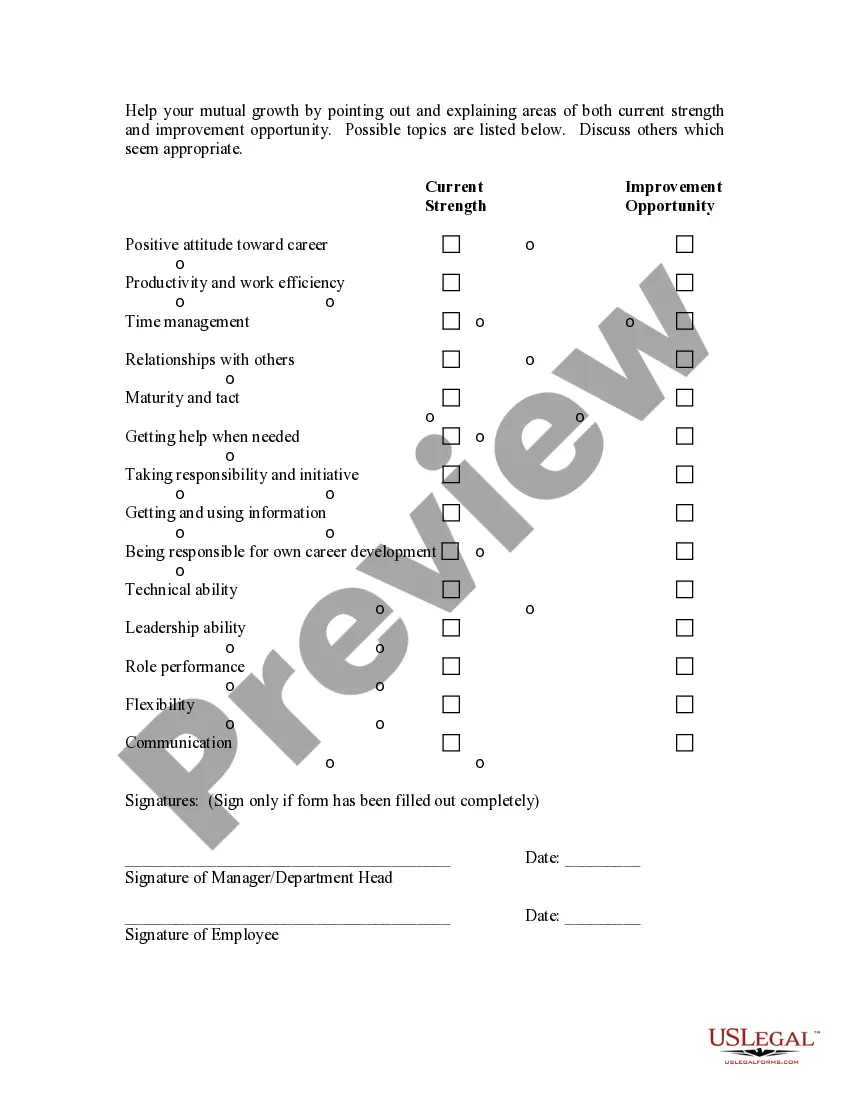

New York Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees

Description

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

Are you presently located in a situation where you need documents for either business or particular tasks nearly every day.

There is a multitude of legal document templates accessible online, but finding reliable forms isn’t easy.

US Legal Forms offers thousands of document templates, including the New York Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees, which are created to comply with state and federal regulations.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for your order using PayPal or a credit card.

Select a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents list. You can download a duplicate of the New York Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees anytime you need. Just select the document you need to download or print.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New York Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it pertains to the correct city/county.

- Utilize the Preview button to examine the form.

- Review the overview to confirm that you have selected the correct document.

- If the form isn’t what you are looking for, utilize the Search section to find the document that meets your needs and criteria.

- Once you obtain the right form, click Get now.

Form popularity

FAQ

The company form used to rate employee performance is typically an official evaluation document, often referred to as a performance appraisal form. Using the New York Model Performance Evaluation - Appraisal Form for Hourly, Exempt, Nonexempt, and Managerial Employees can streamline this process, offering a consistent method for assessments across different employee levels.

These are often employees who are crucial to business operations. Requirements include: You are paid a salary; You are responsible for the management or general business operations; and. Your primary duties include the discretion and independent judgment to make significant decisions for the company.

From time to time, employers may need to reclassify employees due to changes in job duties and responsibilities....Non-Exempt to Exempt:Apply federal and state tests first. Ensure the employee qualifies as exempt under federal and applicable state laws.Communicate the change in advance.Avoid improper deductions.

If you work a regular, 40-hour work week without an employment contract, you are probably non-exempt. No matter what your job title is, if you earn less than $913/week (gross), you are non-exempt. If you are not an executive, or an administrative or professional employee, you are probably non-exempt.

Employees who do not meet the requirements to be classified as exempt from the Minimum Wage Act are considered nonexempt. Nonexempt employees may be paid on a salary, hourly or other basis. Employees who do not qualify for an exemption but are paid on a salary basis are considered salaried nonexempt.

To be considered FLSA exempt, all of the below must be true for an employee:The employee receives pay on a salary basis (rather than hourly).The employee earns at least $35,568 per year, or $684 per week.The employee performs exempt job duties.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)

Tips For Drafting Job Descriptions for Exempt EmployeesAccuracy is King. The job description must be accurate.Accuracy Does Not Mean Exhaustion.Strong Verbs, Clear Impact.Focus on Exempt Functions.Don't Shy Away From Degree Requirements.Assist With Can Diminish a Role.Consider Requiring Acknowledgement.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

You select your own Federal tax exemptions, allowances and additional withholding (if any), and report it on the electronic W-4. You can change your W-4 exemptions and allowances any time by simply completing and submitting another electronic W-4 form in CLASS-Web.