New York Resident Information Sheet

Description

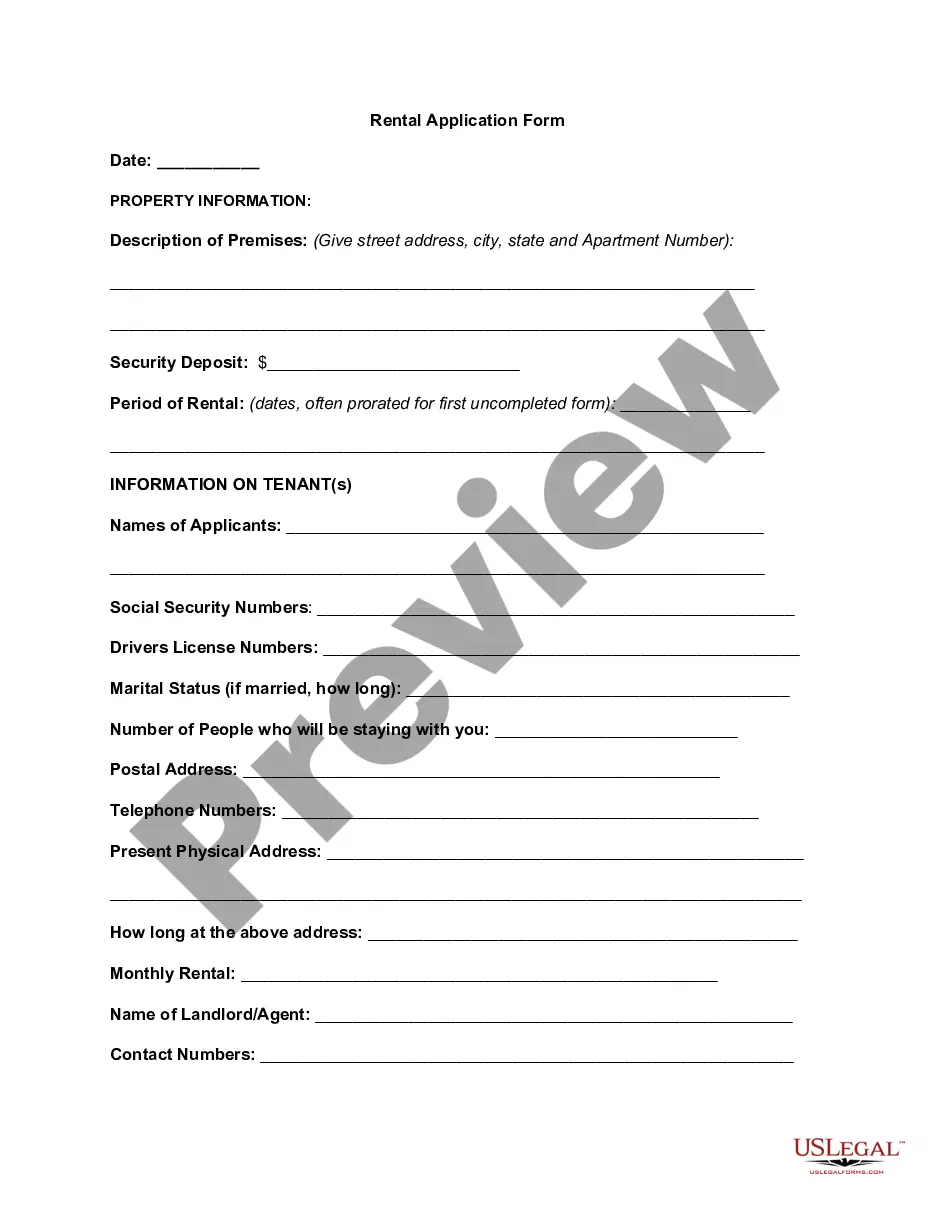

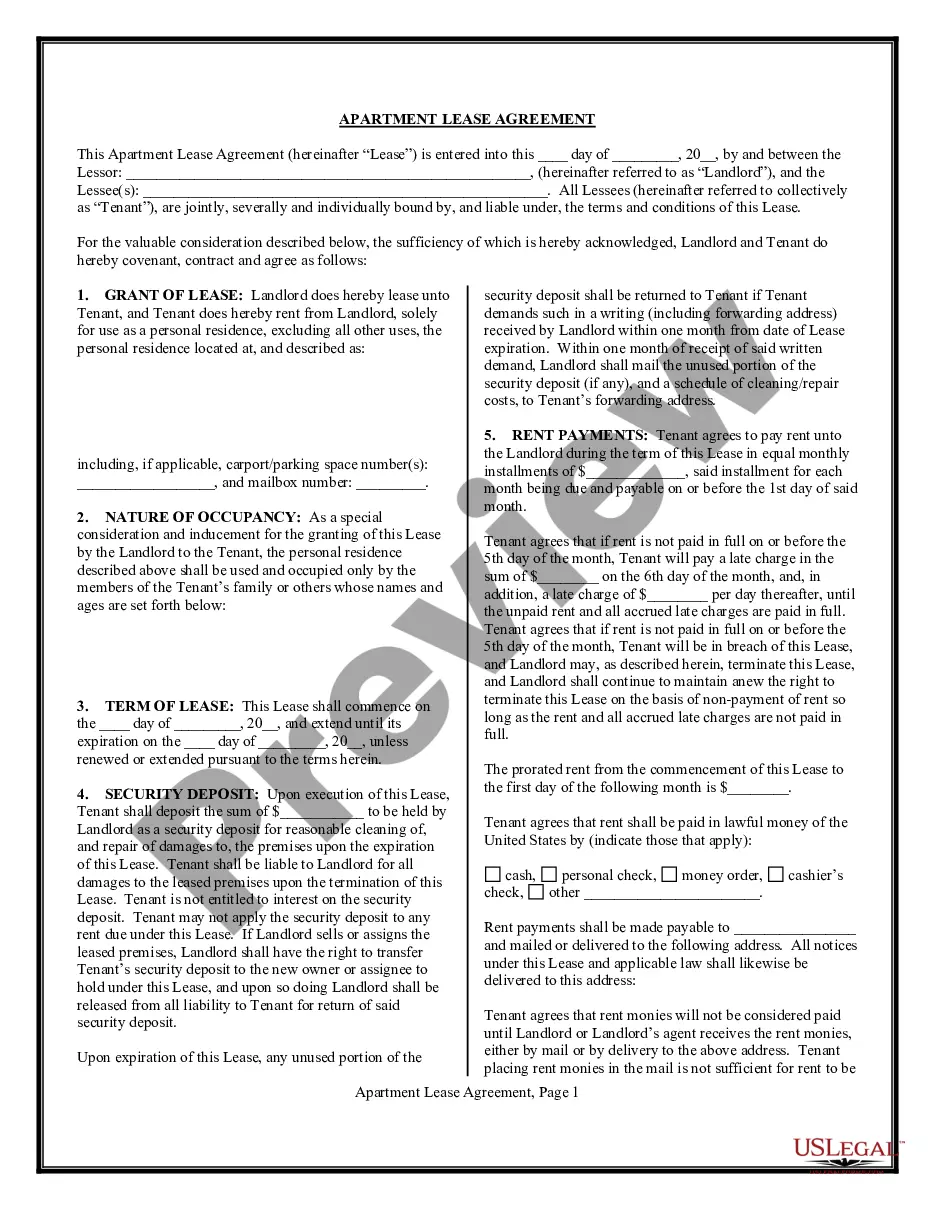

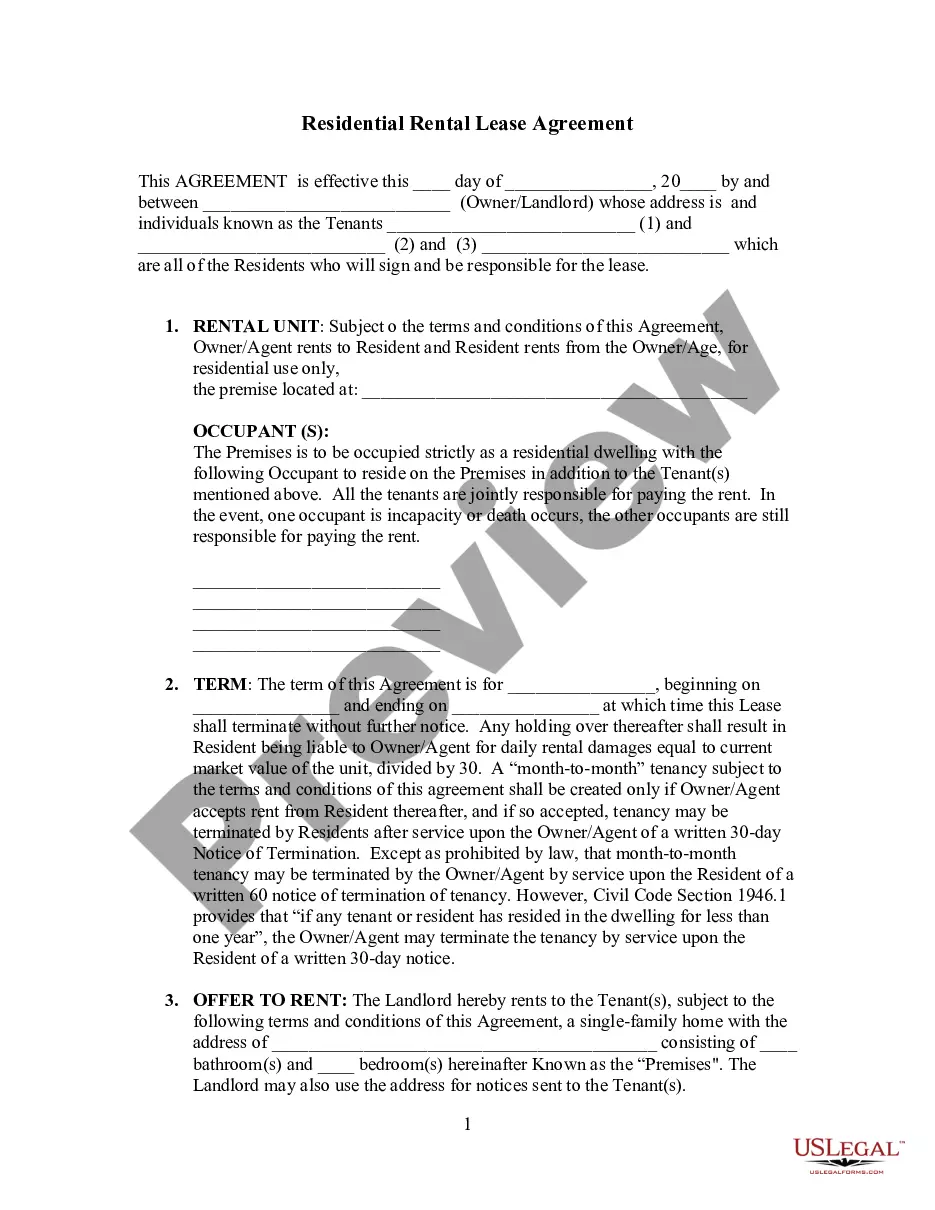

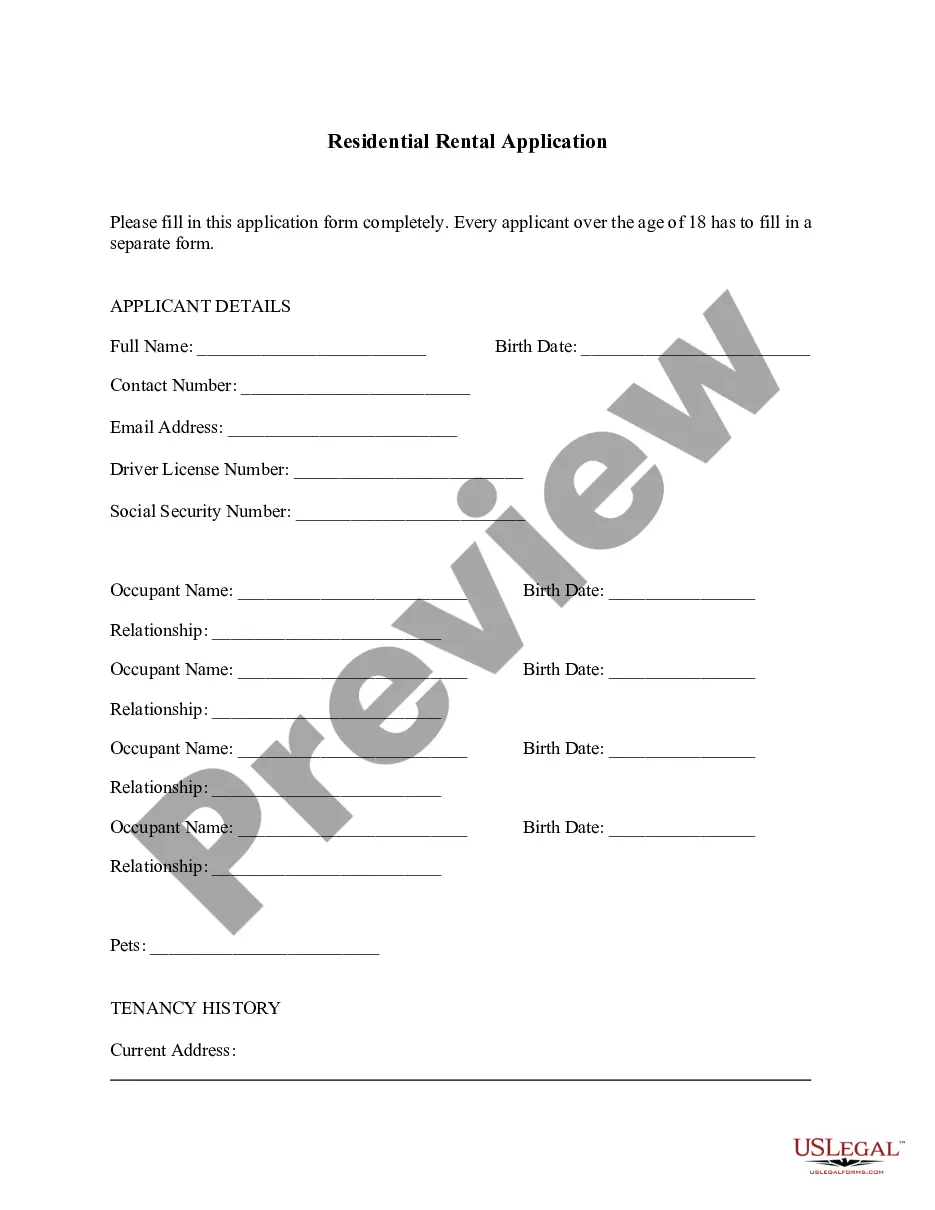

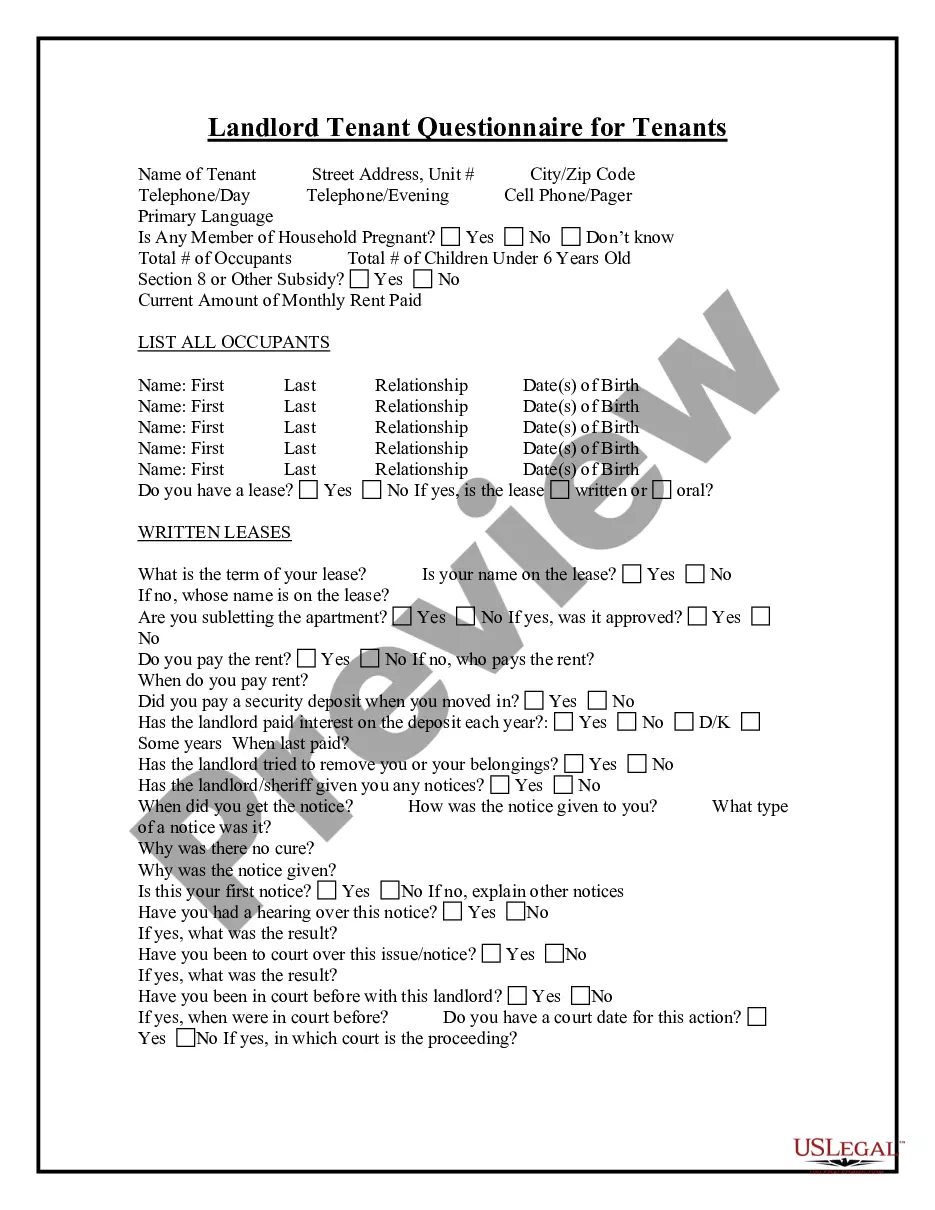

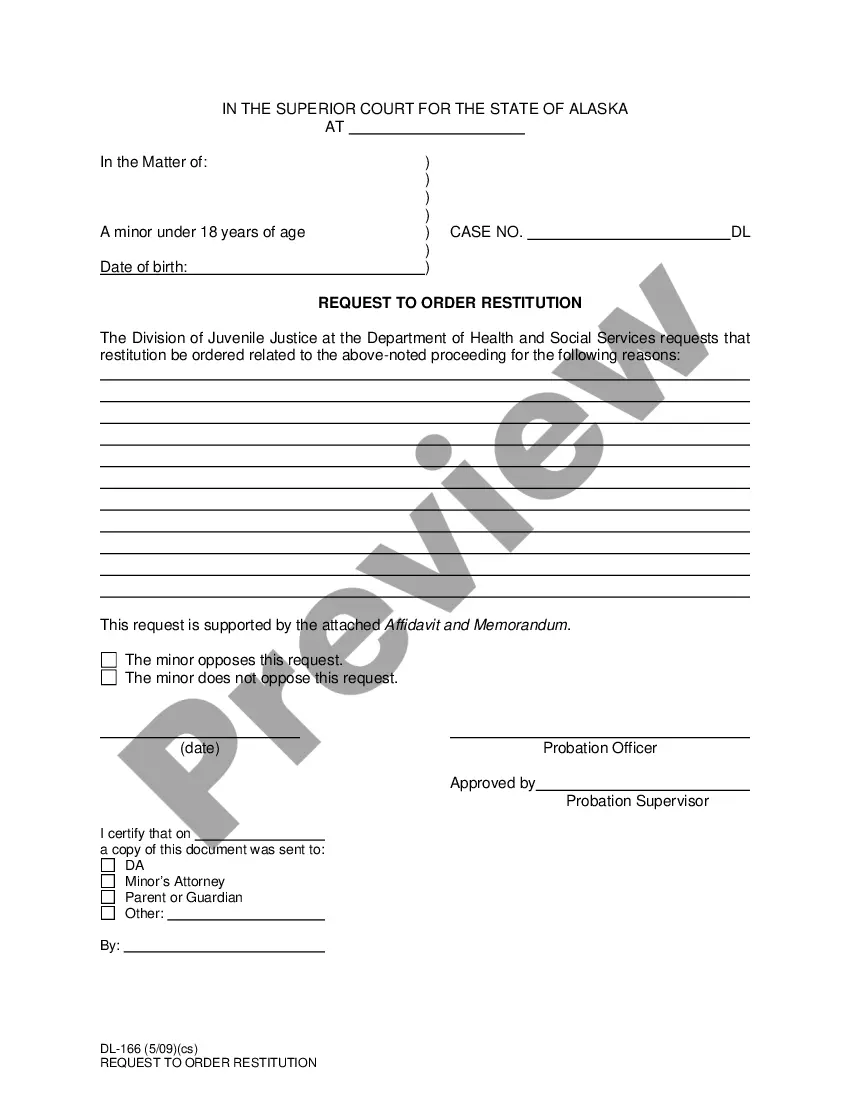

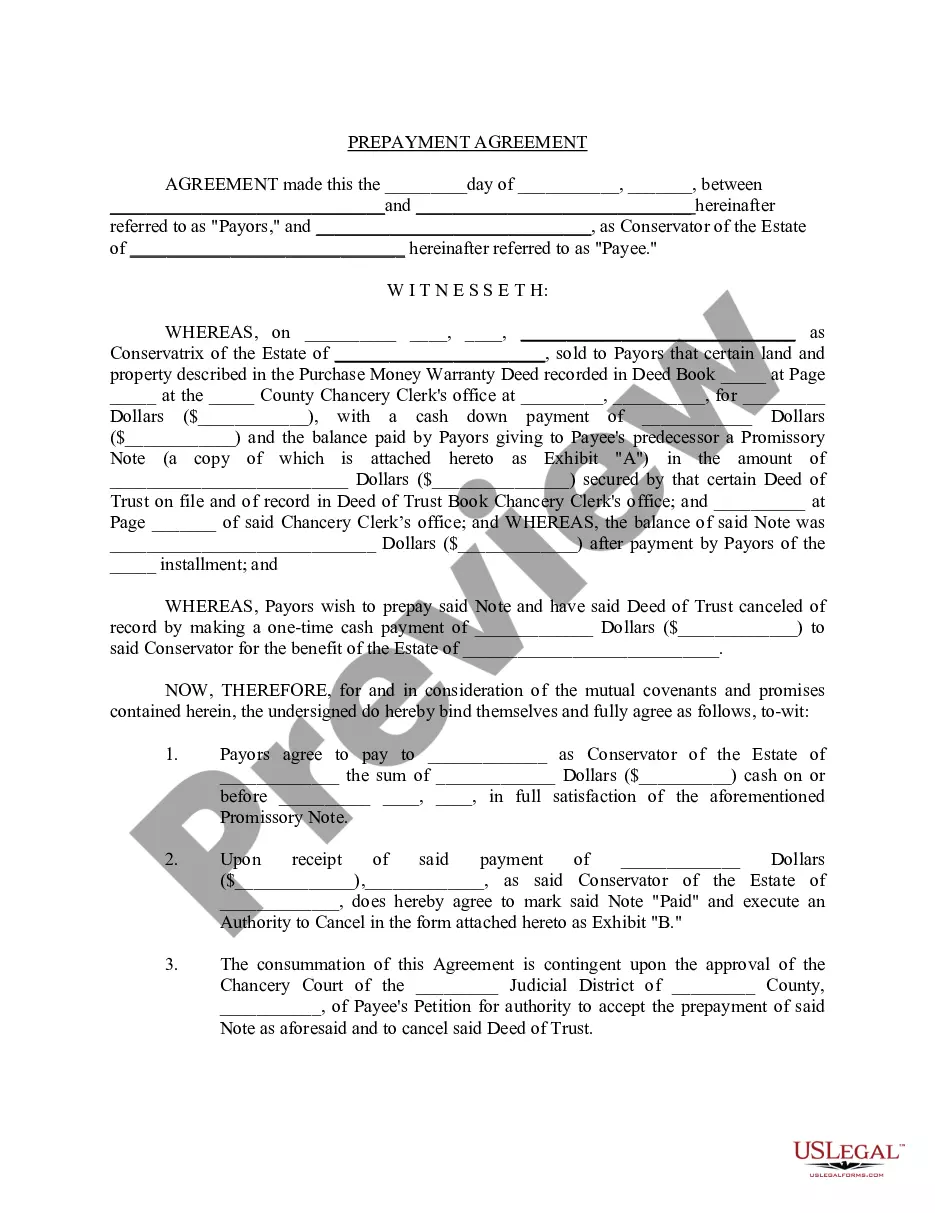

How to fill out Resident Information Sheet?

If you desire to compile, download, or produce official document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Numerous templates for commercial and individual purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Download now button. Choose the pricing plan you prefer and provide your credentials to set up an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the New York Resident Information Sheet with just a couple of clicks.

- If you are currently a US Legal Forms member, sign in to your account and click the Download button to retrieve the New York Resident Information Sheet.

- You can also access forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview option to review the form's content. Remember to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A statutory resident is one who is not domiciled in this state but maintains a permanent place of abode in New York State and spends in the aggregate more than 183 days of the taxable year in this state. Those are two separate requirements: A statutory resident must both maintain a permanent place of abode (PPA) in

A statutory resident is one who is not domiciled in this state but maintains a permanent place of abode in New York State and spends in the aggregate more than 183 days of the taxable year in this state. Those are two separate requirements: A statutory resident must both maintain a permanent place of abode (PPA) in

New York's fiscal 2021 budget decoupled the state's personal income tax from any amendments made to the IRC after March 1, 20202 including changes under the Coronavirus Aid, Relief, and Economic Security Act (P.L. 116-36) and any other federal amendments to the IRC.

At SUNY's State-operated campuses (University Centers, University Colleges, and Technology Colleges), students are generally considered New York State residents if they have established their domicile in New York State for at least twelve months prior to the last day of the registration period of a particular term.

Use Form 588, Nonresident Withholding Waiver Request, to request a waiver or a reduced withholding rate on payments of California source income to nonresident vendors/payees.

Understanding the 183-Day Rule Generally, this means that if you spent 183 days or more in the country during a given year, you are considered a tax resident for that year. Each nation subject to the 183-day rule has its own criteria for considering someone a tax resident.

According to the New York Department of Taxation and Finance: A New York Resident is an individual who is domiciled in New York or an individual that maintains a permanent place of abode in New York and spends 184 or more days in the state during the tax year.

Complete Form IT-558 and submit it with your return to report any New York State addition and subtraction adjustments required to recompute federal amounts using the rules in place prior to any changes made to the IRC after March 1, 2020.

New York State recently introduced a new form, Form IT-558, New York State Adjustments due to Decoupling from the IRC, which taxpayers will be required to use to make adjustments to their federal adjusted gross income for New York reporting purposes. For some taxpayers, these adjustments could be numerous.

You are a New York City resident if:your domicile is New York City; or.you have a permanent place of abode there and you spend 184 days or more in the city.