Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

New York Insurers Rehabilitation and Liquidation Model Act

Description

How to fill out Insurers Rehabilitation And Liquidation Model Act?

Are you in the position the place you require files for both company or specific reasons virtually every day? There are tons of lawful file layouts accessible on the Internet, but getting kinds you can rely is not straightforward. US Legal Forms provides thousands of type layouts, much like the New York Insurers Rehabilitation and Liquidation Model Act, which are composed to satisfy state and federal requirements.

If you are already knowledgeable about US Legal Forms internet site and possess your account, basically log in. Afterward, you can obtain the New York Insurers Rehabilitation and Liquidation Model Act template.

If you do not provide an bank account and wish to start using US Legal Forms, adopt these measures:

- Obtain the type you need and make sure it is to the proper metropolis/county.

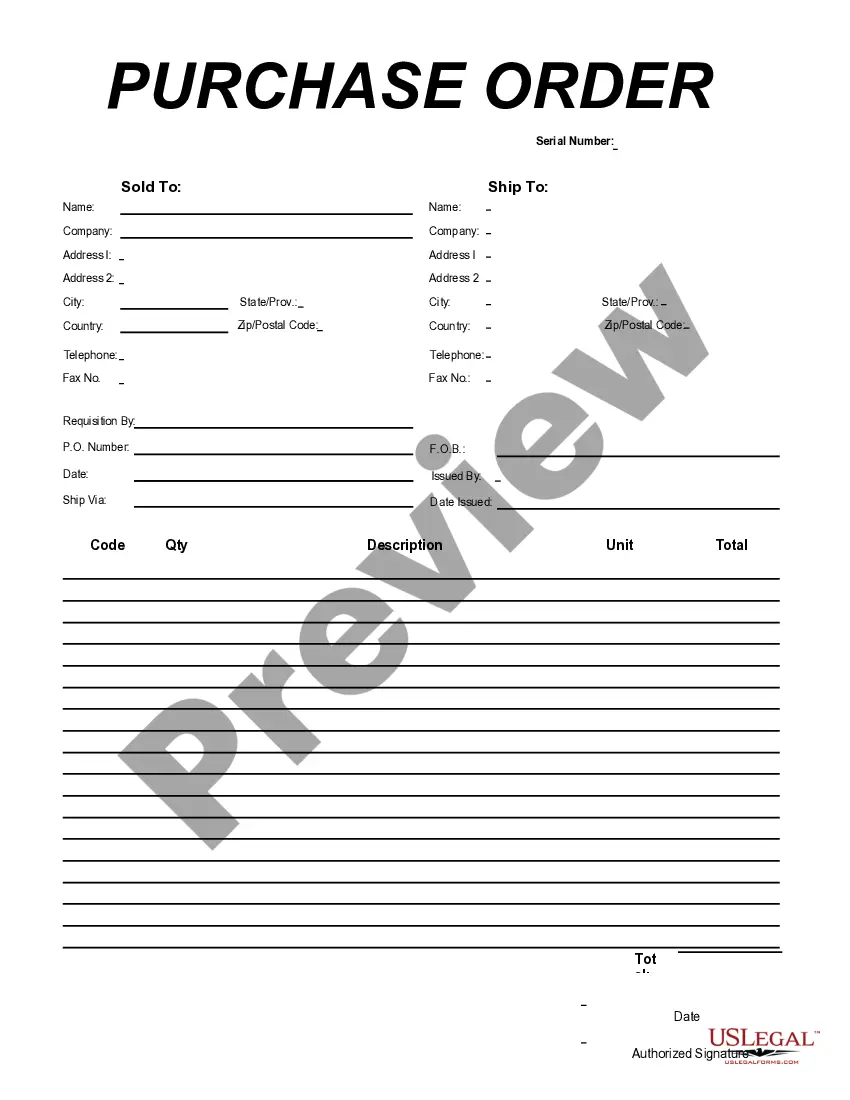

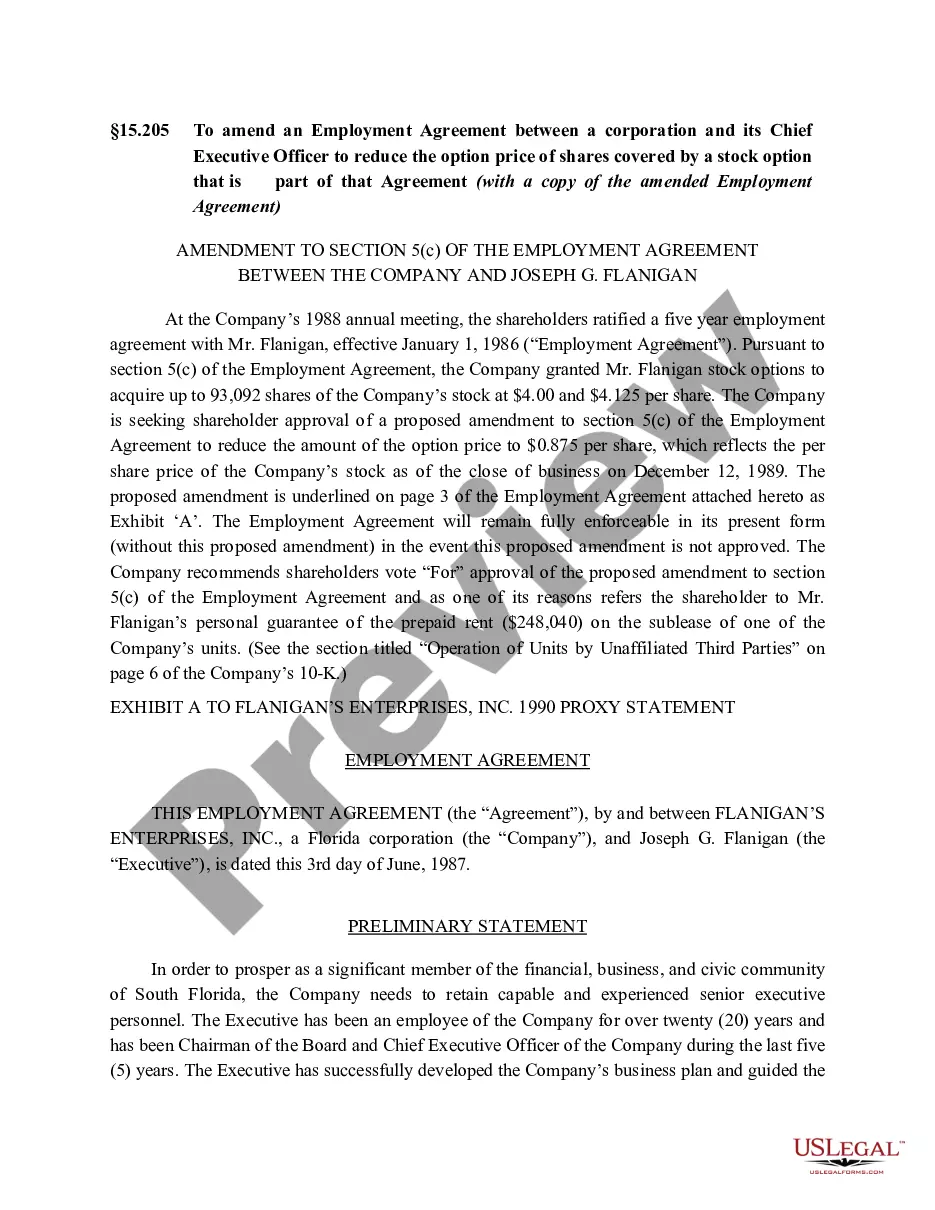

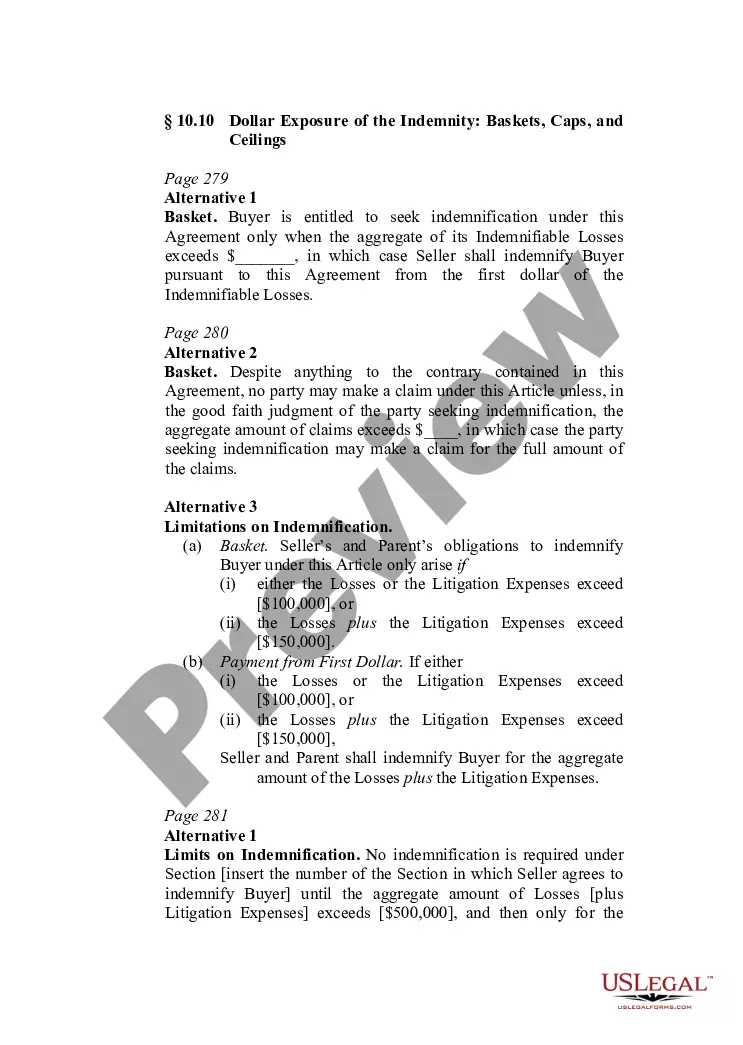

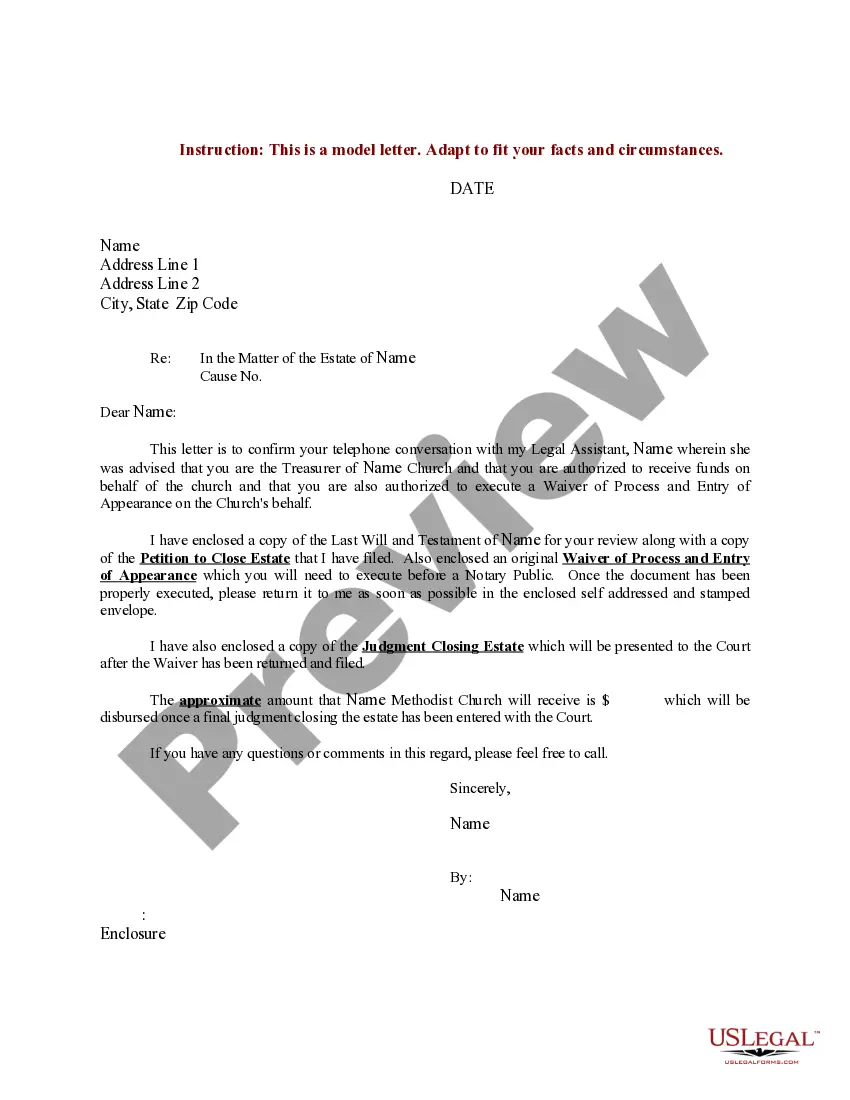

- Utilize the Review option to analyze the form.

- Browse the information to ensure that you have selected the correct type.

- In the event the type is not what you are searching for, make use of the Search field to obtain the type that suits you and requirements.

- Whenever you get the proper type, click Get now.

- Opt for the costs program you want, fill out the required info to create your bank account, and pay for the transaction utilizing your PayPal or bank card.

- Choose a handy data file formatting and obtain your copy.

Find all of the file layouts you have bought in the My Forms food selection. You may get a more copy of New York Insurers Rehabilitation and Liquidation Model Act at any time, if needed. Just select the essential type to obtain or printing the file template.

Use US Legal Forms, probably the most comprehensive assortment of lawful forms, to save time and stay away from errors. The service provides expertly created lawful file layouts which can be used for a range of reasons. Produce your account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

You say the guaranty funds pay these claims. Where do they get the money to pay them? Guaranty funds largely are funded by industry assessments, which are usually collected following insolvencies.

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

A guarantee fund provides a loan or credit guarantee, i.e. it enables a borrower to approach a bank for a loan. Guarantees are particularly useful for borrowers who do not have sufficient collateral, such as land or other assets. Small borrowers almost always lack (sufficient) collateral.

Claims against insolvent insurers are paid by the funds from assessments on companies licensed in their states. Assessments are made only when a property;'casualty insurer fails. In New York insurers pay a yearly amount into the guaranty fund; the fund then keeps the money in resen-e for when it is needed.