Title: New York Qualifying Event Notice Information for Employer to Plan Administrator Introduction: In the state of New York, employers are required to provide timely and accurate notices to plan administrators regarding qualifying events. These events, which impact employees' benefits eligibility and coverage, must be promptly communicated to ensure compliance with state regulations and maintain employee satisfaction. This article will delve into various types of New York Qualifying Event Notice Information that employers should be aware of, shedding light on the necessary procedures and relevant keywords surrounding this crucial process. 1. Marriage and Spousal Coverage: When an employee gets married, it is essential for the employer to notify the plan administrator promptly. This notice should include relevant details such as the employee's name, the spouse's name, and the effective date of the marriage. Keywords: marriage, spousal coverage, employee benefits, notification requirements. 2. Divorce or Legal Separation: In the event of a divorce or legal separation, employers must provide information concerning the change in marital status to the plan administrator. This notice includes the employee's details, the former spouse's name, and the effective date of the divorce or separation. Keywords: divorce, legal separation, marital status change, employee benefits update. 3. Birth or Adoption of a Child: Following the birth or adoption of a child, employers must promptly inform the plan administrator about this qualifying event. The notice should include the employee's details, the child's name, birth or adoption date, and any information necessary to add the child to the employee's benefit plans. Keywords: birth of a child, adoption, child's details, employee benefits update. 4. Loss of Dependent Status: In the event of a dependent child reaching the age limit for coverage or no longer meeting the eligibility conditions, the employer should notify the plan administrator. This notice includes the employee's name, dependent's name, reason for loss of dependent status, and effective date of the change. Keywords: dependent status, age limit, ineligibility, employee benefits adjustment. 5. Change in Employment Status: Employers need to inform the plan administrator when an employee experiences a significant change in employment status. This would include instances such as termination, resignation, retirement, or a significant reduction in work hours. Keywords: change in employment status, termination, resignation, retirement, reduction in work hours, employee benefits modification. 6. Commencement of COBRA Coverage: If an employee initiates COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage due to qualifying events such as termination, reduction in work hours, or divorce, the employer must promptly provide relevant information to the plan administrator. This includes the employee's name, reason for COBRA initiation, and effective date of coverage. Keywords: COBRA coverage, qualifying events, employee benefits continuation. Conclusion: Employers in New York have a legal obligation to provide accurate and timely Qualifying Event Notice Information to the plan administrator. By understanding the different types of qualifying events and the relevant keywords associated with each, employers can ensure compliance with state regulations, maintain employee satisfaction, and effectively manage their employee benefit plans.

New York Qualifying Event Notice Information for Employer to Plan Administrator

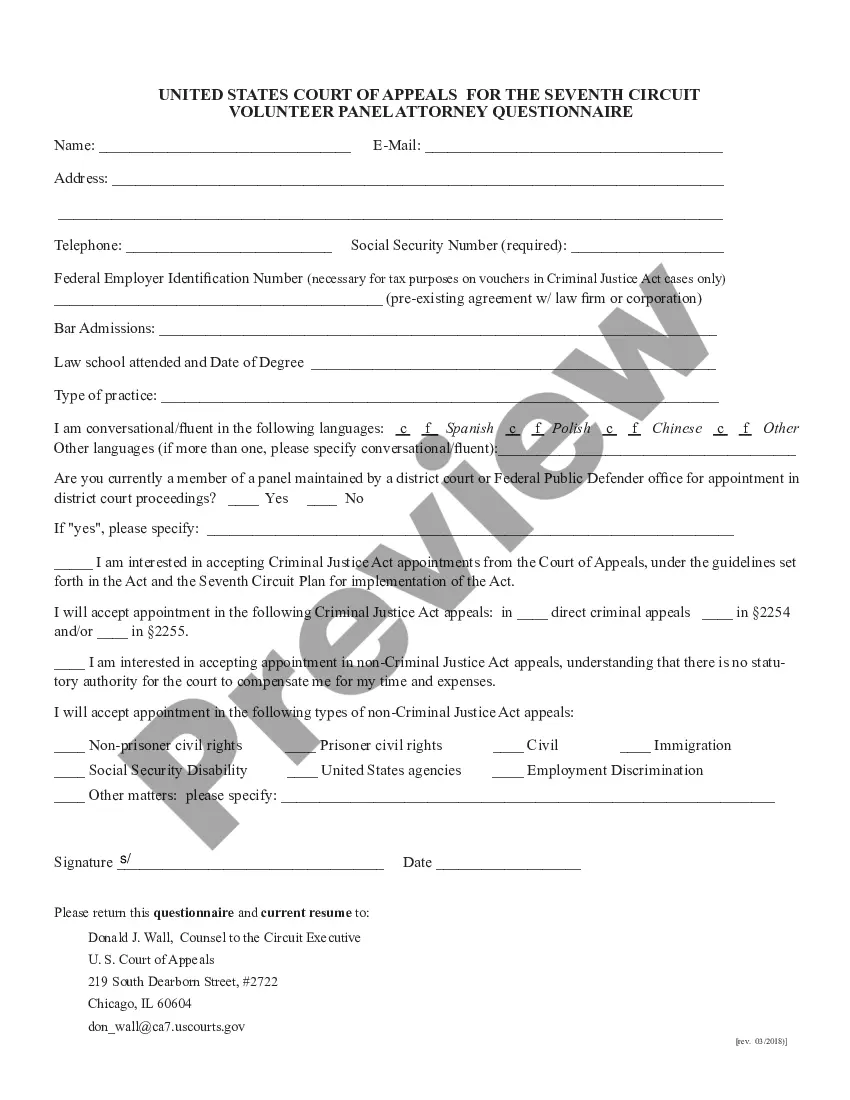

Description

How to fill out New York Qualifying Event Notice Information For Employer To Plan Administrator?

If you need to comprehensive, acquire, or produce legitimate file themes, use US Legal Forms, the most important selection of legitimate types, that can be found on-line. Utilize the site`s simple and easy convenient research to obtain the papers you need. A variety of themes for company and specific uses are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the New York Qualifying Event Notice Information for Employer to Plan Administrator with a handful of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your account and click the Down load switch to get the New York Qualifying Event Notice Information for Employer to Plan Administrator. Also you can access types you earlier downloaded in the My Forms tab of your account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that correct city/region.

- Step 2. Take advantage of the Review option to check out the form`s articles. Never forget to read through the description.

- Step 3. Should you be not happy using the kind, use the Look for industry near the top of the display to locate other models from the legitimate kind web template.

- Step 4. Once you have identified the shape you need, click the Buy now switch. Select the rates strategy you prefer and add your qualifications to sign up on an account.

- Step 5. Procedure the financial transaction. You may use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the file format from the legitimate kind and acquire it on the product.

- Step 7. Full, change and produce or indicator the New York Qualifying Event Notice Information for Employer to Plan Administrator.

Every single legitimate file web template you purchase is your own property forever. You might have acces to every single kind you downloaded in your acccount. Select the My Forms section and select a kind to produce or acquire yet again.

Contend and acquire, and produce the New York Qualifying Event Notice Information for Employer to Plan Administrator with US Legal Forms. There are many specialist and condition-distinct types you can use for your company or specific requirements.