New York Check Requisition Worksheet

Description

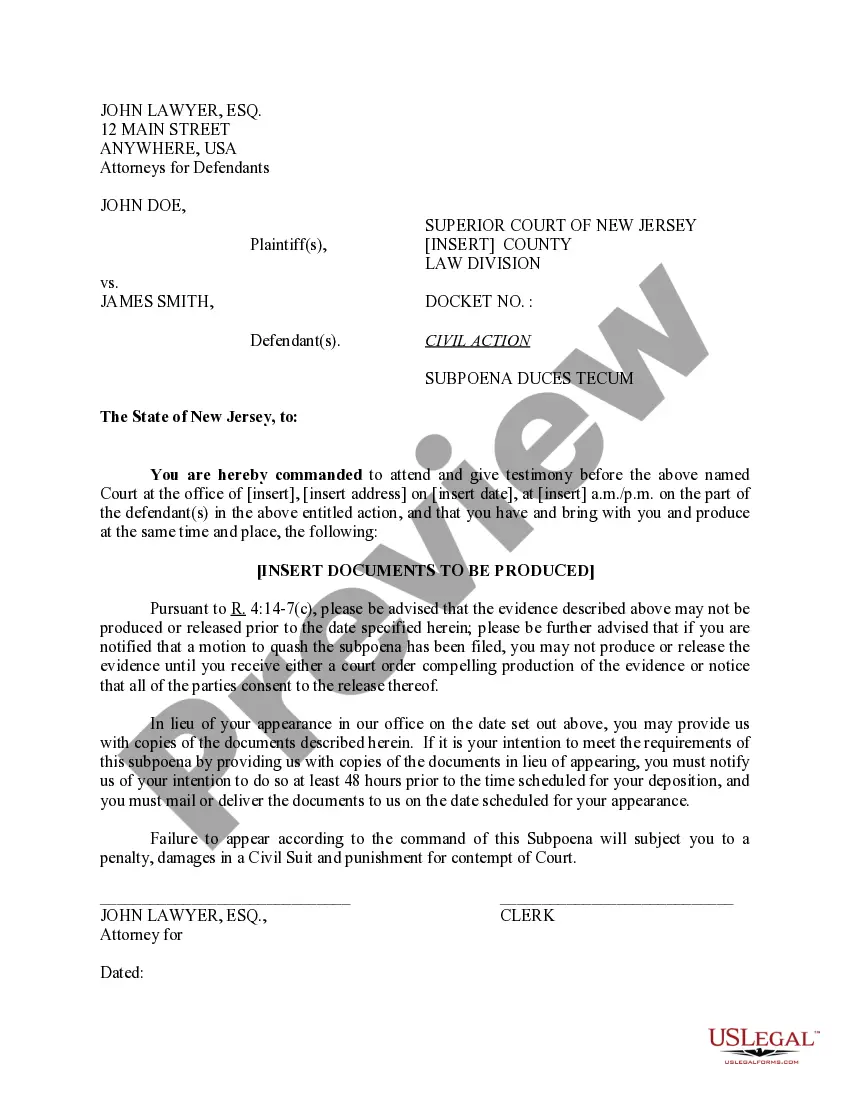

How to fill out Check Requisition Worksheet?

If you need to fill out, download, or create legal document templates, utilize US Legal Forms, the premier selection of legal documents available online.

Take advantage of the website's straightforward and convenient search function to find the forms you require. Various templates for business and personal applications are organized by categories and states, or keywords.

Employ US Legal Forms to locate the New York Check Requisition Worksheet with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, and print the New York Check Requisition Worksheet with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Acquire button to download the New York Check Requisition Worksheet.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's contents. Don't forget to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the New York Check Requisition Worksheet.

Form popularity

FAQ

You can file NY form IT-370 electronically through the New York State Department of Taxation and Finance website for faster processing. Alternatively, you may mail a paper version of this form to the address outlined in the instructions included with the form. Always ensure you keep a copy of your submission for your records.

A planning worksheet focuses on forecasting future needs based on inventory levels, while a requisition worksheet is designed to request specific items directly for procurement. In the context of the New York Check Requisition Worksheet, this means you generate a clear outline of what needs to be ordered based on actual demand, rather than just projections. Understanding this distinction helps you manage resources more effectively.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

Make your check or money order payable to New York State Income Tax. Be sure to write your social security number, the tax year, and Income Tax on your payment. Before mailing in your payment, consider paying online.

Make your check or money order payable to New York State Income Tax. Be sure to write your social security number, the tax year, and Income Tax on it. Be sure to complete all information on the voucher. If filing a joint return, include information for both spouses.

Make your check, money order or cashier's check payable to U.S. Treasury.

If you want more tax withheld, you may claim fewer allowances. If you claim more than 14 allowances, your employer must send a copy of your Form IT-2104 to the New York State Tax Department. You may then be asked to verify your allowances.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

The total number of allowances you are claiming is important; the more tax allowances you claim, the less income tax will be withheld from a paycheck; the fewer allowances you claim, the more tax will be withheld.