The New York Discharge of Joint Debtors — Chapter — - updated 2005 Act form is a legal document specific to bankruptcy cases in the state of New York. This form is used when joint debtors, typically a married couple, file for Chapter 7 bankruptcy and are seeking a discharge of their debts. In Chapter 7 bankruptcy, the court has the power to discharge certain debts, allowing debtors to get a fresh financial start. The New York Discharge of Joint Debtors form is an essential component of this process, as it enables joint debtors to request the discharge of their shared liabilities. This particular form was updated in 2005 to comply with the changes made to bankruptcy laws. It is crucial to use the most recent version of the form to ensure compliance with legal requirements. The key components of the New York Discharge of Joint Debtors — Chapter — - updated 2005 Act form include: 1. Case Information: This section requires the debtors' names, case numbers, and the name of the bankruptcy court handling the case. It ensures accurate identification and proper filing of the form within the bankruptcy proceedings. 2. Debt Information: In this section, joint debtors must provide a detailed list of all debts they are seeking to discharge through Chapter 7 bankruptcy. It is crucial to include the creditor's name, account number, and outstanding balance for each debt. 3. Joint Debtor's Certification Section: Here, both joint debtors must sign and certify that the information provided in the form is true and complete to the best of their knowledge. This section establishes the joint debtors' responsibility and commitment to honest disclosure during the bankruptcy process. It is important to note that there are no different types of the New York Discharge of Joint Debtors — Chapter — - updated 2005 Act form. However, variations exist in the filing process based on the nature and complexity of individual bankruptcy cases. By using the New York Discharge of Joint Debtors — Chapter — - updated 2005 Act form correctly, joint debtors can formally request the discharge of their shared debts and work towards their financial recovery. It is recommended to consult with a qualified bankruptcy attorney to ensure the accurate completion and submission of the form, as well as to navigate the complexities of the bankruptcy process effectively.

New York Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

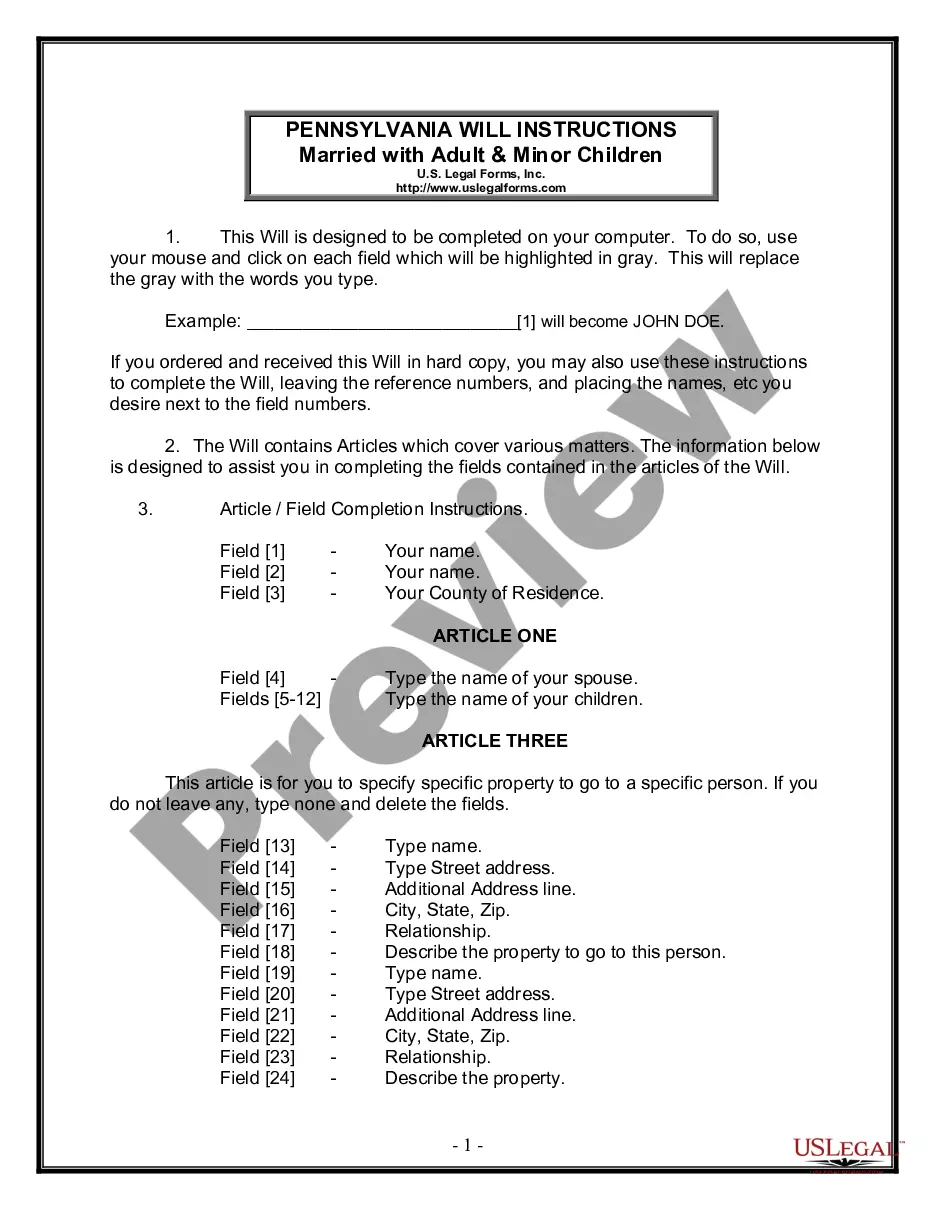

How to fill out New York Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Are you presently within a place where you need to have files for both organization or specific reasons nearly every time? There are plenty of legal papers templates accessible on the Internet, but getting ones you can depend on is not easy. US Legal Forms delivers a large number of develop templates, just like the New York Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, which can be composed to fulfill state and federal requirements.

In case you are previously knowledgeable about US Legal Forms site and get your account, simply log in. Afterward, you can obtain the New York Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form format.

Unless you provide an account and would like to start using US Legal Forms, abide by these steps:

- Find the develop you will need and make sure it is for that correct town/area.

- Utilize the Preview key to review the form.

- Browse the explanation to actually have chosen the proper develop.

- When the develop is not what you`re trying to find, utilize the Search field to find the develop that meets your needs and requirements.

- Once you obtain the correct develop, click Get now.

- Select the prices strategy you desire, complete the necessary information and facts to generate your money, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Choose a convenient paper formatting and obtain your copy.

Get each of the papers templates you might have bought in the My Forms food selection. You can aquire a more copy of New York Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form at any time, if possible. Just click on the needed develop to obtain or produce the papers format.

Use US Legal Forms, the most substantial assortment of legal forms, to conserve time as well as stay away from errors. The services delivers appropriately created legal papers templates that can be used for an array of reasons. Produce your account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

CHAPTER 7 BANKRUPTCY TIMELINE Day 1: File Bankruptcy Petition with Court & Pay Filing Fees. Day 13 to 33: (7 Days BEFORE Meeting of Creditors) Deadline to Provide Tax Returns to Trustee. Day 20 to 40: Meeting of Creditors - also called 341(a) Meeting. Day 80 to 100: (60 Days AFTER First Date Set. ... DISCHARGE GRANTED.

Of the two options, Chapter 7 is more popular because filers don't have to pay back part of their debts. Chapter 13 may be a better solution if you're in arrears on your mortgage because you can keep your house in Chapter 13 and have time to get caught up on payments.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

The biggest difference between Chapter 7 and Chapter 13 is that Chapter 7 focuses on discharging (getting rid of) unsecured debt such as credit cards, personal loans and medical bills while Chapter 13 allows you to catch up on secured debts like your home or your car while also discharging unsecured debt.