New York Statement of Social Security Number

Description

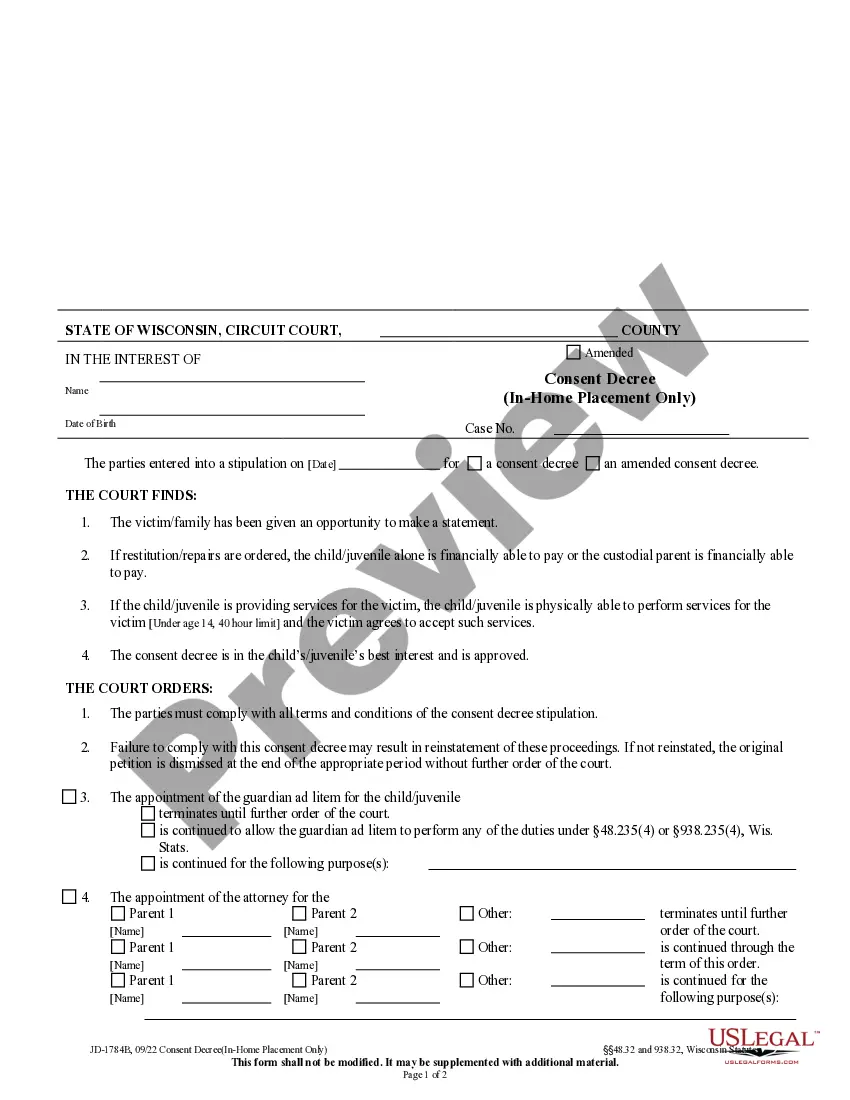

How to fill out Statement Of Social Security Number?

Are you in the position in which you need to have papers for sometimes organization or personal reasons nearly every day time? There are plenty of legitimate file web templates available on the Internet, but discovering types you can rely is not simple. US Legal Forms delivers 1000s of develop web templates, like the New York Statement of Social Security Number, which can be composed in order to meet federal and state specifications.

Should you be already acquainted with US Legal Forms web site and also have a free account, simply log in. Afterward, you can acquire the New York Statement of Social Security Number web template.

Should you not come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is to the right town/state.

- Utilize the Review key to analyze the form.

- Read the description to actually have chosen the proper develop.

- In case the develop is not what you`re seeking, make use of the Look for industry to discover the develop that fits your needs and specifications.

- Whenever you find the right develop, simply click Acquire now.

- Opt for the pricing strategy you desire, fill out the specified details to generate your account, and buy the order with your PayPal or Visa or Mastercard.

- Select a practical document formatting and acquire your duplicate.

Get every one of the file web templates you might have bought in the My Forms menu. You may get a extra duplicate of New York Statement of Social Security Number at any time, if needed. Just click the essential develop to acquire or print out the file web template.

Use US Legal Forms, by far the most considerable collection of legitimate kinds, to conserve time and stay away from mistakes. The assistance delivers professionally made legitimate file web templates which can be used for a range of reasons. Create a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

Your Social Security number often appears on tax documents and financial statements. Check tax forms such as your old W-2s, 1099s, or tax returns to see if your SSN is on one of them. If you don't have access to your tax forms, look at other financial documents you have available.

If you want to verify SSNs for other than wage reporting purposes you must use our Consent Based SSN Verification Service (CBSV) which you can access from our website at .socialsecurity.gov/cbsv. If you want to verify your own SSN, you must have proof of identity and visit your local Social Security Field Office.

A Social Security card is legal proof of an SSN. In most cases, the actual card is not necessary but, if your agency or organization requires proof, and the person can't produce a card, there are other documents that show their SSN. If other documents are not available, that person will need a replacement card.

Your Social Security Statement shows how much you have paid in Social Security and Medicare taxes. It explains about how much you would get in Social Security benefits when you reach full retirement age.

Verification Documents A social security card. A W-2 form. A SSA-1099 form. A Non-SSA-1099 form. A paystub showing full SSN.

You'll need to show us a U.S. driver's license, a state issued non-driver identification card, or a U.S. passport to prove your identity. Sometimes you may also need to prove your current U.S. citizenship or lawful noncitizen status with a birth certificate or passport.

Structure of Social Security Numbers information contributed by Jerry Crow (crow@anasaz.com) and Barbara Bennett A Social Security Number (SSN) consists of nine digits, commonly written as three fields separated by hyphens: AAA-GG-SSSS. The first three-digit field is called the "area number".

Proof of Social Security Number (SSN) Your Social Security card. Tax form(s). Benefit or income statement from Social Security containing the Social Security number. Pending application for an SSN.