New York Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

Are you presently within a position in which you will need paperwork for both organization or person purposes virtually every day? There are tons of legitimate papers themes accessible on the Internet, but discovering kinds you can rely on is not straightforward. US Legal Forms gives a large number of type themes, just like the New York Stock Option and Award Plan, which are written in order to meet federal and state requirements.

When you are previously informed about US Legal Forms site and possess a free account, basically log in. Next, you may acquire the New York Stock Option and Award Plan format.

Unless you provide an account and want to begin to use US Legal Forms, abide by these steps:

- Obtain the type you need and ensure it is for your right metropolis/region.

- Utilize the Preview button to check the form.

- See the outline to ensure that you have selected the proper type.

- If the type is not what you are trying to find, use the Look for industry to get the type that suits you and requirements.

- If you discover the right type, click on Get now.

- Choose the costs strategy you want, submit the specified information to make your bank account, and pay for an order making use of your PayPal or bank card.

- Pick a convenient data file formatting and acquire your duplicate.

Get all of the papers themes you have purchased in the My Forms food list. You can aquire a additional duplicate of New York Stock Option and Award Plan whenever, if necessary. Just go through the necessary type to acquire or produce the papers format.

Use US Legal Forms, the most substantial selection of legitimate forms, to conserve some time and steer clear of errors. The assistance gives professionally created legitimate papers themes which can be used for a selection of purposes. Produce a free account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

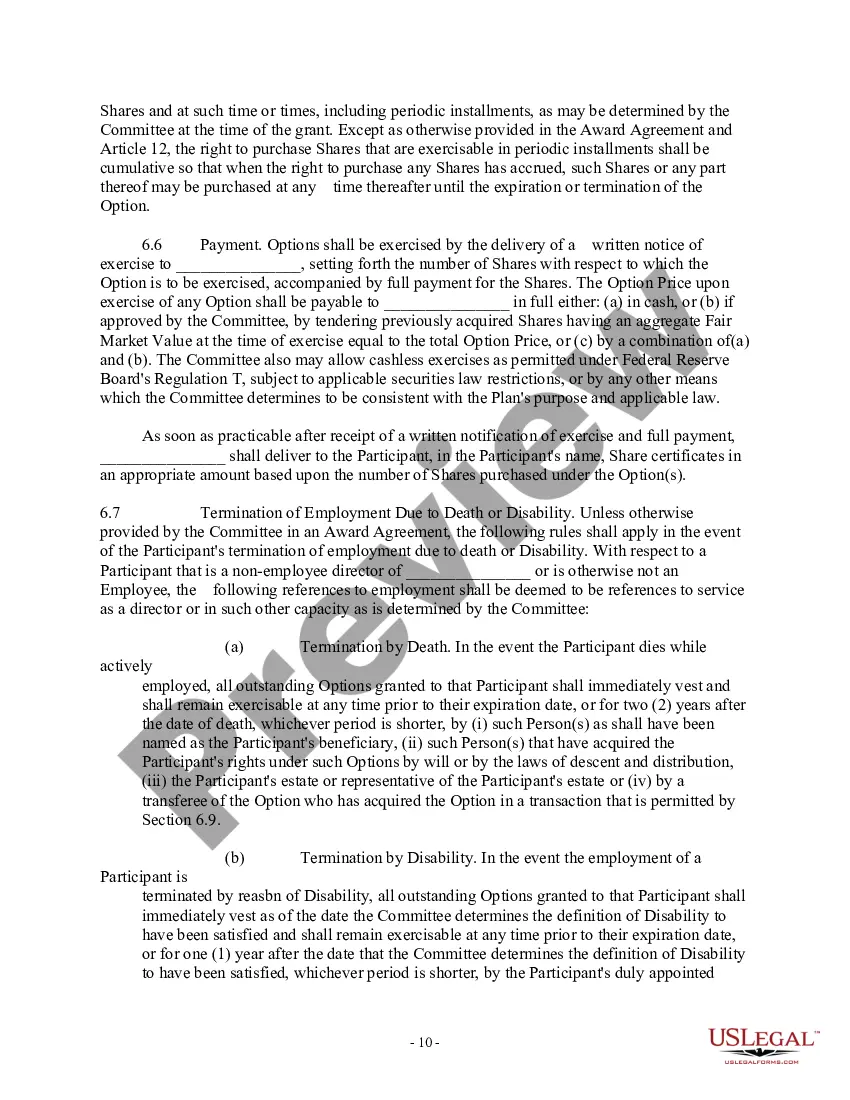

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

An employee stock option is a contract that grants an employee the right to buy shares in his or her employer at a specific, fixed price, known as the exercise price, after a designated date.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

A Restricted Stock Award Share is a grant of company stock in which the recipient's rights in the stock are restricted until the shares vest (or lapse in restrictions). The restricted period is called a vesting period.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

An award that gives you the ability to purchase shares of company stock at a specified price for a fixed period of time.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

Stock Awards means any rights granted by the Company to Executive with respect to the common stock of the Company, including, without limitation, stock options, stock appreciation rights, restricted stock, stock bonuses and restricted stock units.