New York Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer)

Description

How to fill out Sample Asset Purchase Agreement Between Third Tier Subsidiary Of Corporation (Seller) And Second Tier Subsidiary Of Unrelated Corporation (Buyer)?

Are you presently in a position where you will need files for sometimes organization or person reasons just about every working day? There are a variety of legitimate file themes available on the Internet, but getting types you can trust is not straightforward. US Legal Forms delivers thousands of form themes, like the New York Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer), that happen to be published to meet federal and state requirements.

Should you be currently informed about US Legal Forms site and have your account, merely log in. After that, it is possible to download the New York Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) template.

If you do not offer an profile and want to start using US Legal Forms, abide by these steps:

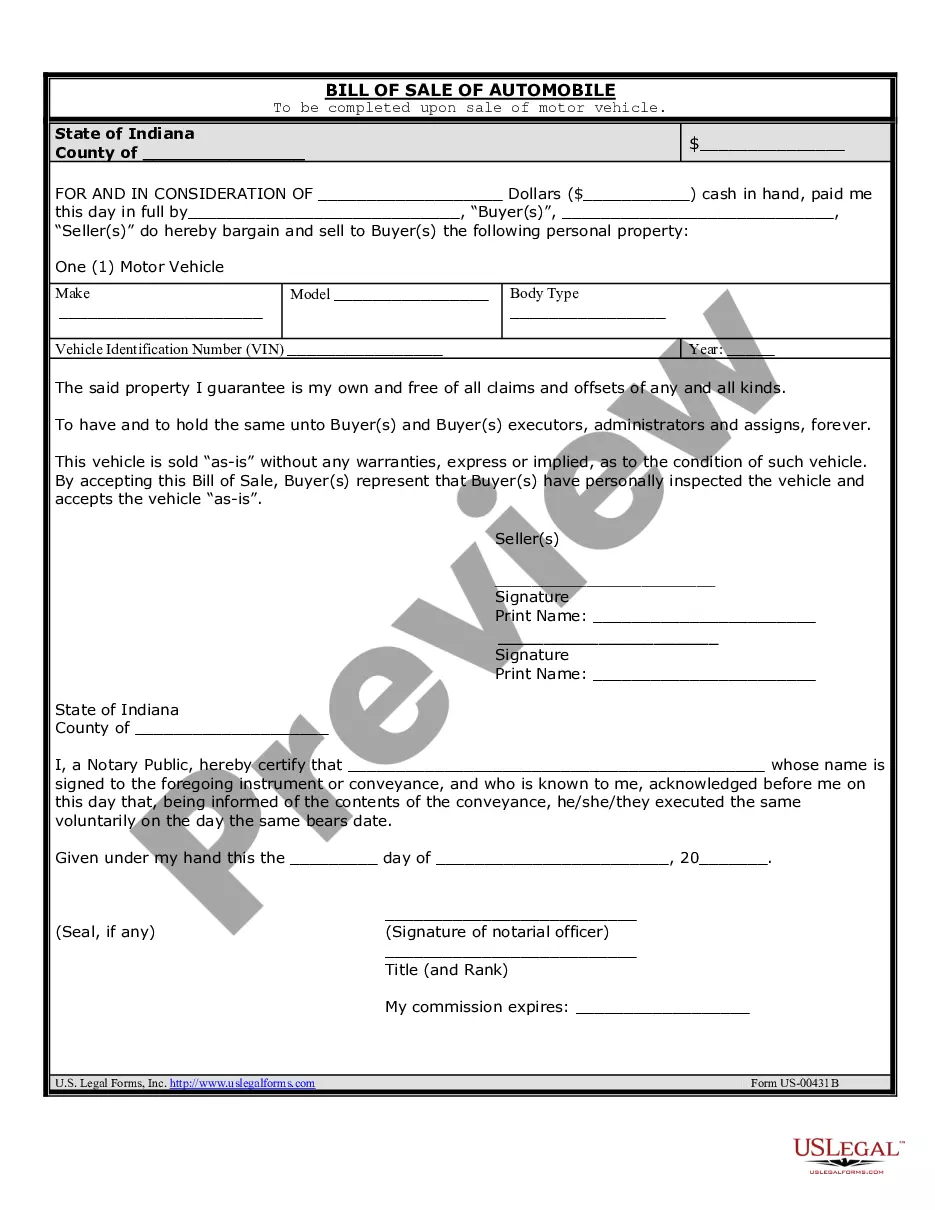

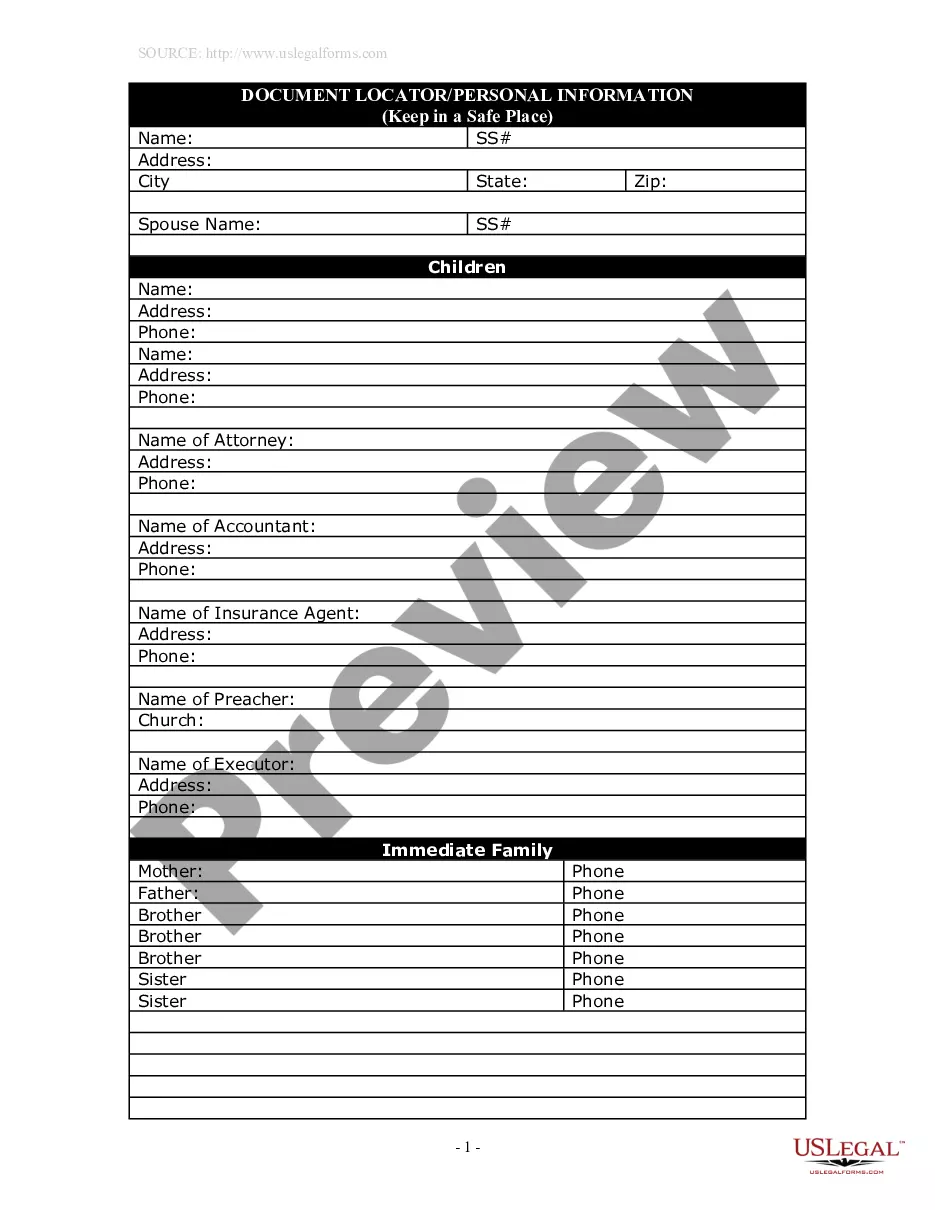

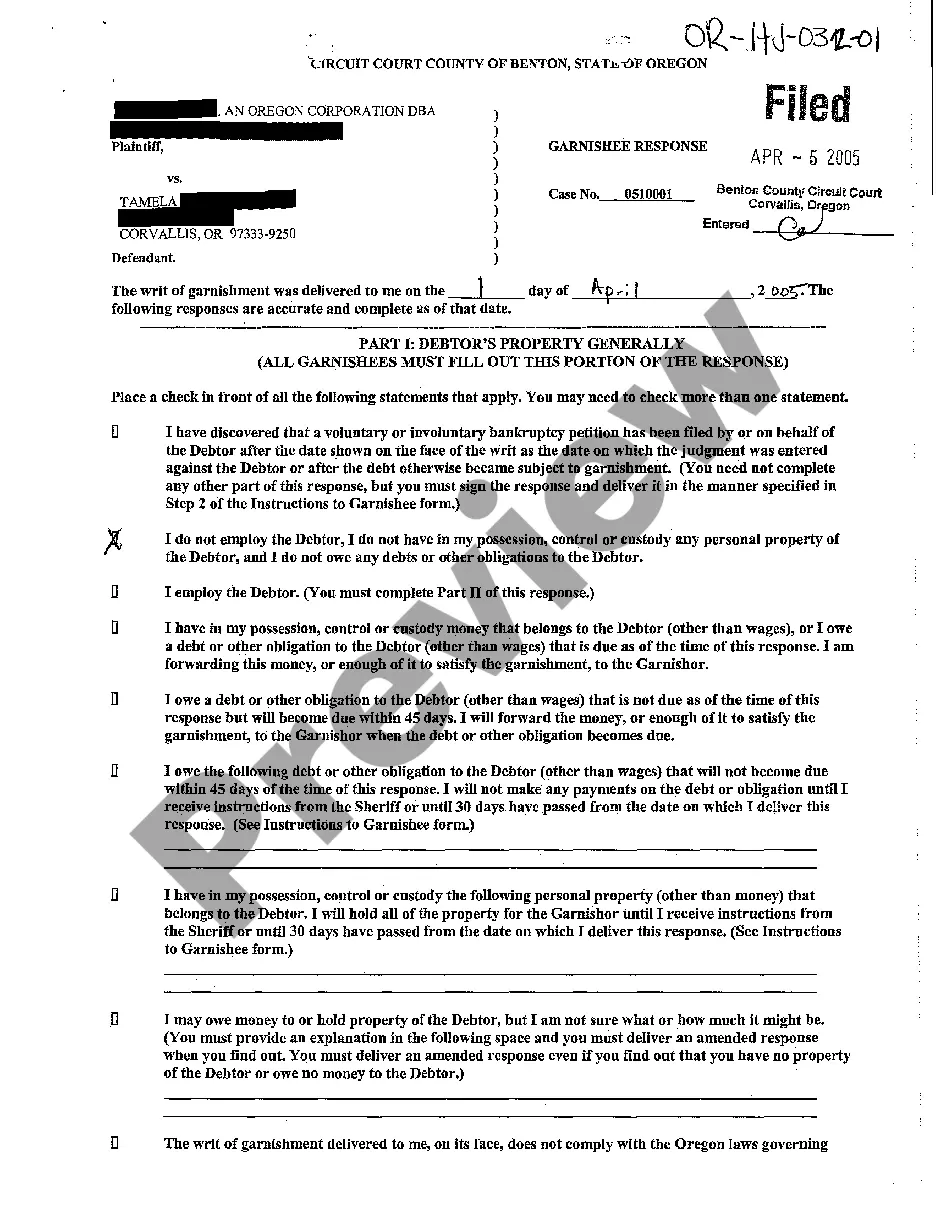

- Discover the form you will need and ensure it is for the proper area/area.

- Use the Review option to examine the shape.

- Read the outline to actually have selected the right form.

- In the event the form is not what you`re searching for, utilize the Look for industry to get the form that meets your requirements and requirements.

- When you obtain the proper form, click Acquire now.

- Opt for the prices prepare you desire, complete the specified details to produce your money, and pay for an order making use of your PayPal or charge card.

- Pick a practical data file formatting and download your version.

Locate each of the file themes you have bought in the My Forms menus. You can get a more version of New York Sample Asset Purchase Agreement between third tier subsidiary of corporation (Seller) and second tier subsidiary of unrelated corporation (Buyer) anytime, if needed. Just click the needed form to download or print out the file template.

Use US Legal Forms, by far the most comprehensive collection of legitimate kinds, to conserve efforts and prevent mistakes. The assistance delivers skillfully made legitimate file themes which you can use for a variety of reasons. Make your account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

Unlike asset sales, where the sale of certain assets can result in the recognition of ordinary income, equity sales allow sellers (who own their equity for more than a year) to receive long-term capital gains tax treatment on all proceeds received from the sale of their equity.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

There are two core methods to buy or sell a business: an asset purchase or a share purchase. An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

The answer is pretty simple. In an equity purchase, the big company assumes the assets AND the liabilities of the company they buy, vs in an asset purchase they only buy the assets and the liabilities stay with the owners of the purchased company.

Key considerations for an asset purchase. Unlike a share purchase, where the buyer takes on all of the seller's liabilities, an asset purchase means that the buyer only assumes the risk from the specific assets and liabilities it is acquiring.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.