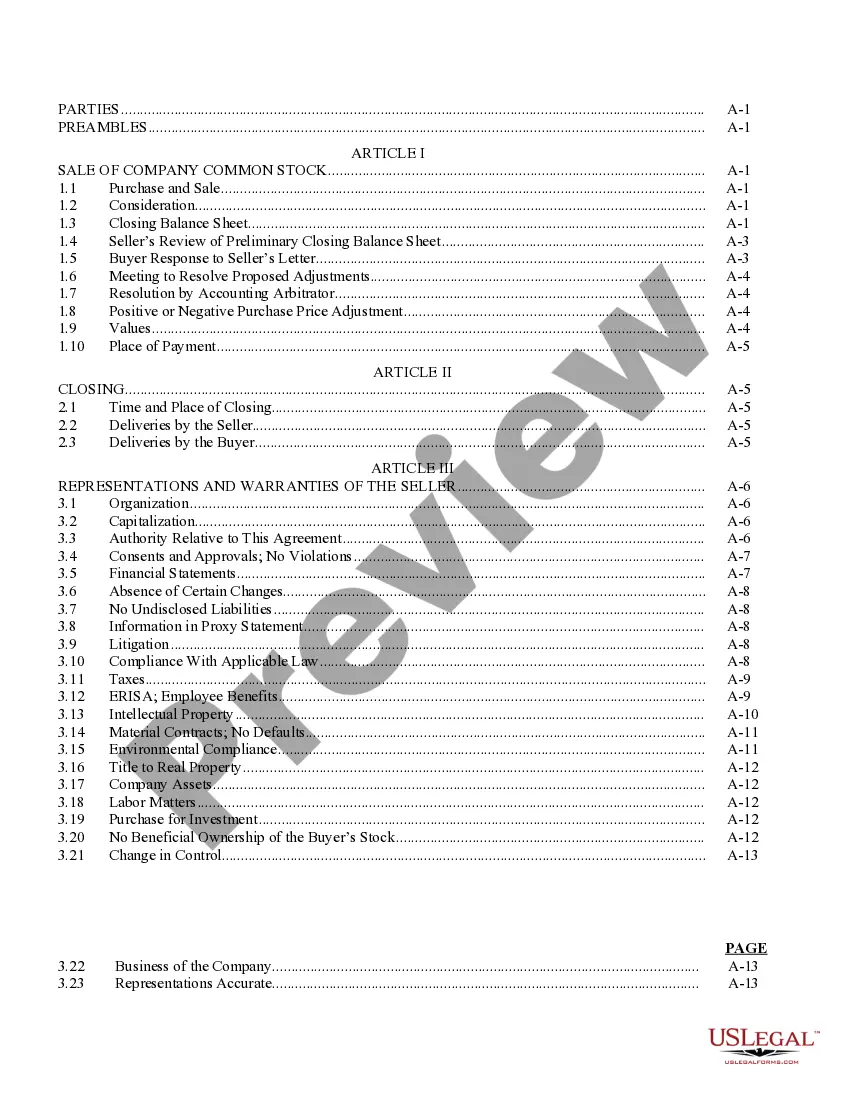

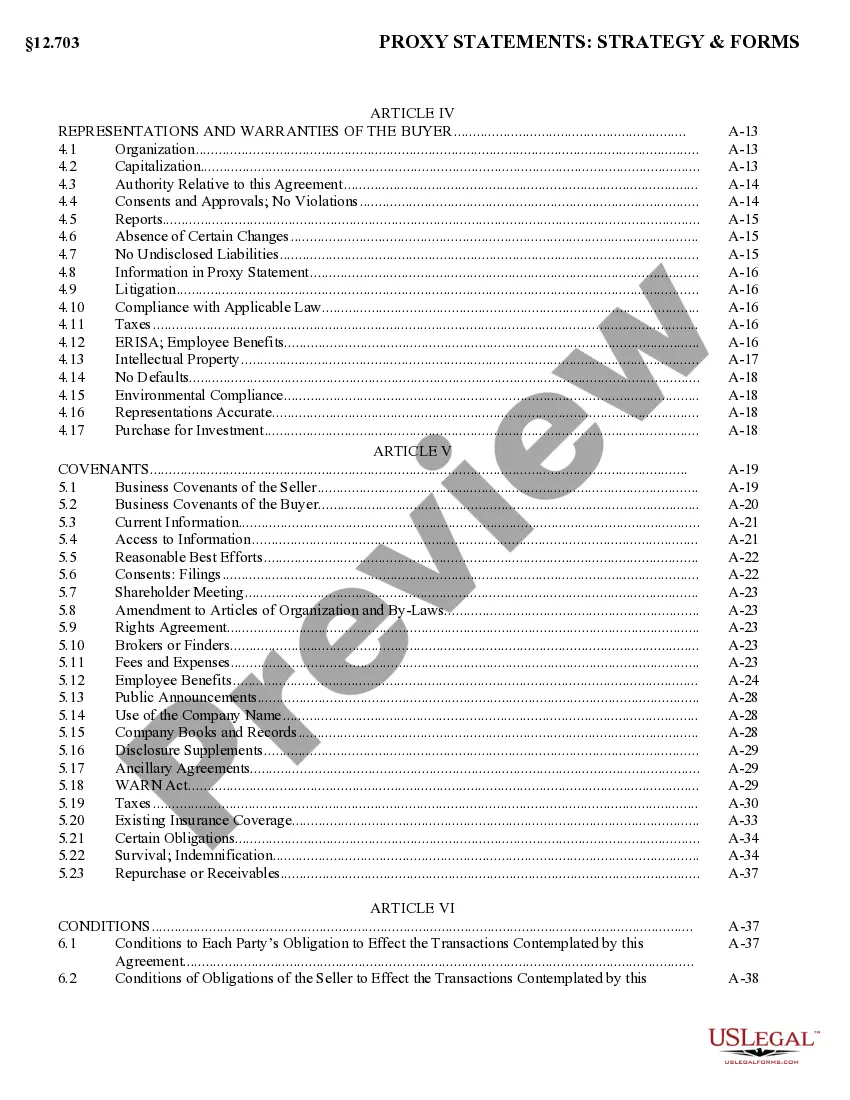

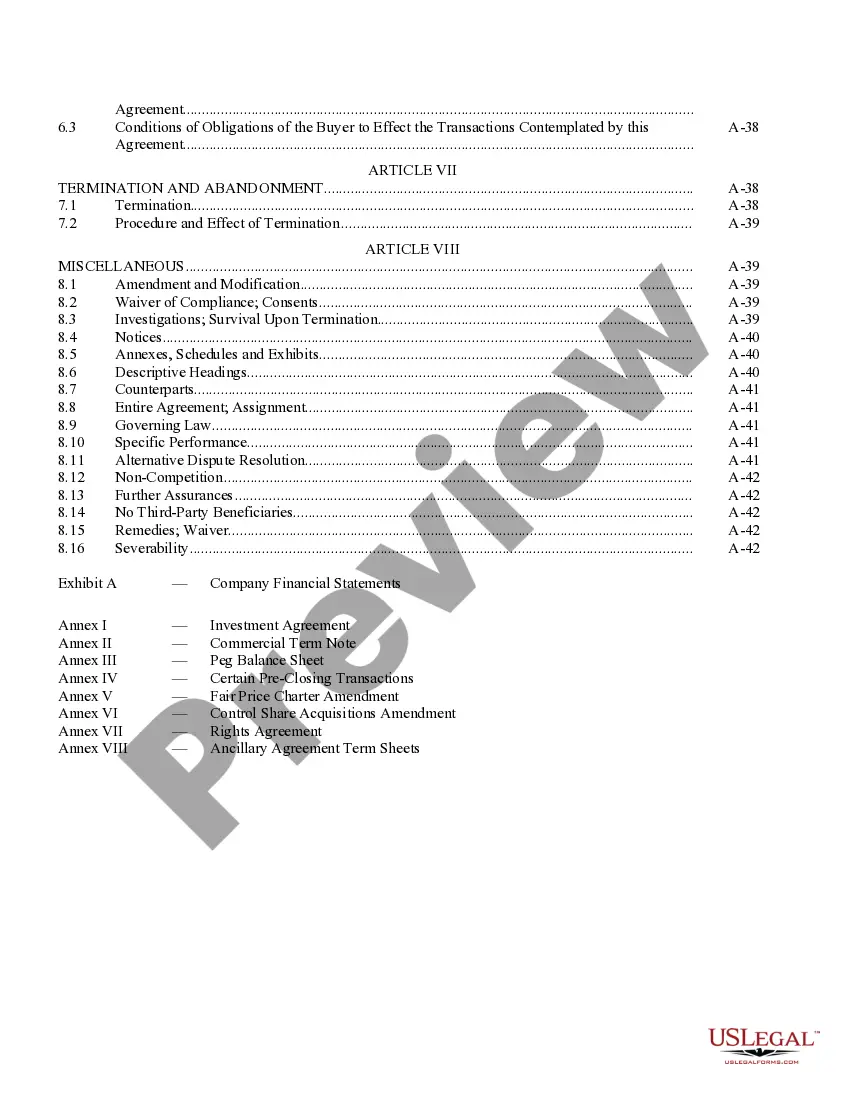

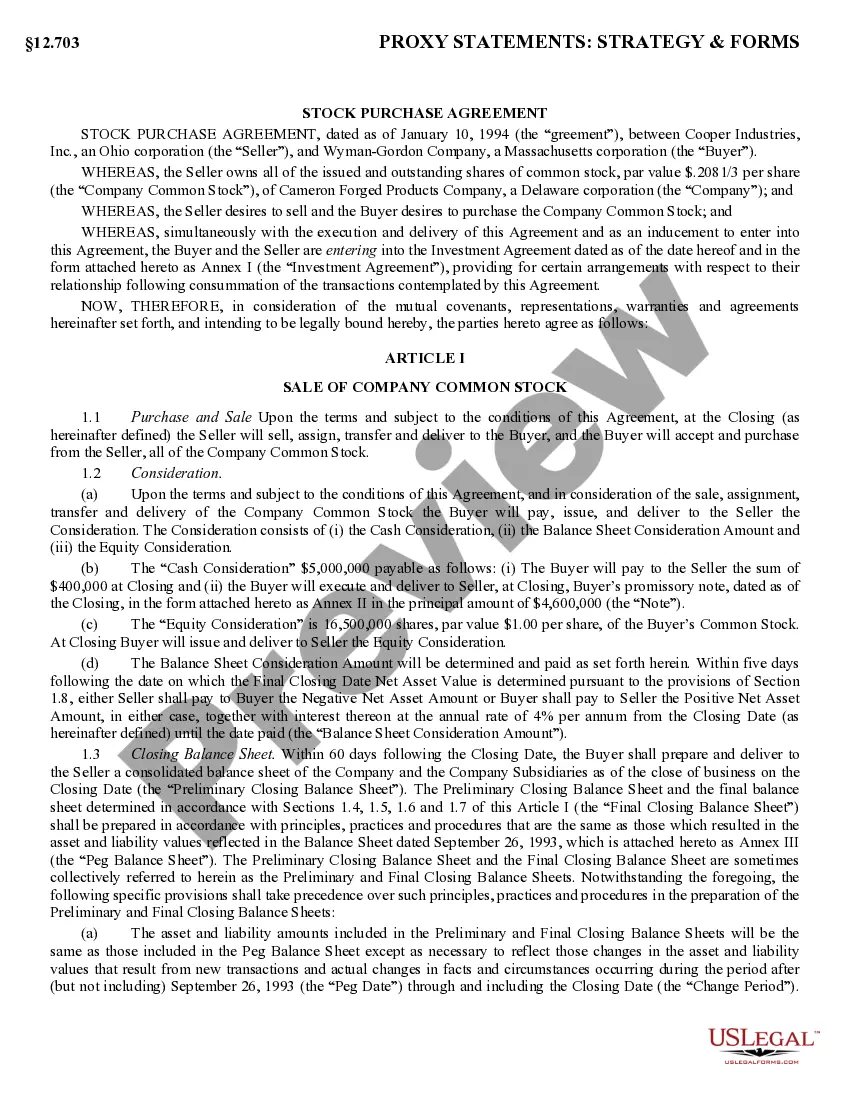

A New York Sample Stock Purchase Agreement general form is a legal document that outlines the terms and conditions of a stock purchase transaction between a buyer and a seller. It is designed to be used across the United States, providing a standardized template for such agreements, although it's important to consult legal professionals to adapt the form, if necessary, to comply with specific state laws or regulations. Keywords: New York, Sample Stock Purchase Agreement, general form, United States, legal document, terms and conditions, stock purchase transaction, buyer, seller, standardized template, legal professionals, state laws, regulations. Different types of New York Sample Stock Purchase Agreement general forms may exist with minor variations for certain specific purposes. Here are a few examples: 1. New York Sample Stock Purchase Agreement for Private Companies: This form is tailored for stock purchase transactions involving privately held companies. It includes provisions that address the unique needs and considerations typical in such transactions, such as buyer representations, warranties, and indemnification clauses. 2. New York Sample Stock Purchase Agreement for Public Companies: This form is specifically designed for stock purchase transactions involving publicly traded companies. It includes additional provisions related to securities laws, regulatory compliance, and disclosure requirements associated with publicly traded securities. 3. New York Sample Stock Purchase Agreement with Earn-Out Provision: This form includes an earn-out provision that allows for additional payments to the seller contingent upon the achievement of specified financial or operational targets after the closing of the transaction. This provision can help bridge valuation gaps between the buyer and seller. 4. New York Sample Stock Purchase Agreement with Financing Contingency: This form includes a financing contingency clause, which is common in transactions where the buyer intends to obtain external financing to fund the purchase. It outlines the conditions that need to be met for the agreement to remain binding, such as the successful procurement of financing within a specified timeframe. 5. New York Sample Stock Purchase Agreement with Non-Compete Clause: This form includes a non-compete clause that restricts the seller from engaging in a competing business within a specified geographical area for a certain period after the transaction's completion. This clause aims to protect the buyer's investment and prevent potential conflicts of interest. These variations cater to different scenarios and specific requirements within stock purchase agreements. It is important to carefully consider the specific needs and circumstances of each transaction to determine which form or customization is appropriate. Seeking legal advice from professionals is recommended to ensure compliance with state and federal laws and the protection of parties' interests.

New York Sample Stock Purchase Agreement general form to be used across the United States

Description

How to fill out New York Sample Stock Purchase Agreement General Form To Be Used Across The United States?

US Legal Forms - among the greatest libraries of legal forms in the United States - gives a variety of legal document layouts you may acquire or print. Making use of the site, you may get 1000s of forms for organization and individual purposes, sorted by classes, states, or search phrases.You will discover the most recent types of forms just like the New York Sample Stock Purchase Agreement general form to be used across the United States in seconds.

If you already have a membership, log in and acquire New York Sample Stock Purchase Agreement general form to be used across the United States from the US Legal Forms collection. The Down load button will appear on every single type you view. You gain access to all earlier downloaded forms from the My Forms tab of your respective bank account.

If you want to use US Legal Forms the very first time, listed below are simple directions to help you started off:

- Be sure you have picked the best type to your area/area. Click on the Preview button to review the form`s content. Browse the type information to actually have chosen the correct type.

- If the type does not fit your demands, utilize the Look for area at the top of the display screen to discover the one that does.

- If you are happy with the form, validate your choice by clicking on the Get now button. Then, opt for the rates program you prefer and provide your accreditations to sign up for the bank account.

- Method the transaction. Utilize your Visa or Mastercard or PayPal bank account to perform the transaction.

- Select the file format and acquire the form in your gadget.

- Make alterations. Fill out, change and print and indication the downloaded New York Sample Stock Purchase Agreement general form to be used across the United States.

Each web template you included in your money does not have an expiration particular date which is the one you have for a long time. So, if you wish to acquire or print another version, just proceed to the My Forms area and click on on the type you will need.

Obtain access to the New York Sample Stock Purchase Agreement general form to be used across the United States with US Legal Forms, the most considerable collection of legal document layouts. Use 1000s of skilled and condition-specific layouts that meet up with your small business or individual demands and demands.