New York Stock Option Agreement of Key Tronic Corporation

Description

How to fill out Stock Option Agreement Of Key Tronic Corporation?

You can spend time on the Internet trying to find the authorized papers design that fits the state and federal specifications you require. US Legal Forms provides 1000s of authorized varieties that happen to be reviewed by pros. You can actually obtain or print the New York Stock Option Agreement of Key Tronic Corporation from your service.

If you have a US Legal Forms accounts, you can log in and click the Obtain switch. Afterward, you can comprehensive, revise, print, or sign the New York Stock Option Agreement of Key Tronic Corporation. Every authorized papers design you purchase is your own property eternally. To get another copy associated with a purchased type, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site initially, follow the simple instructions under:

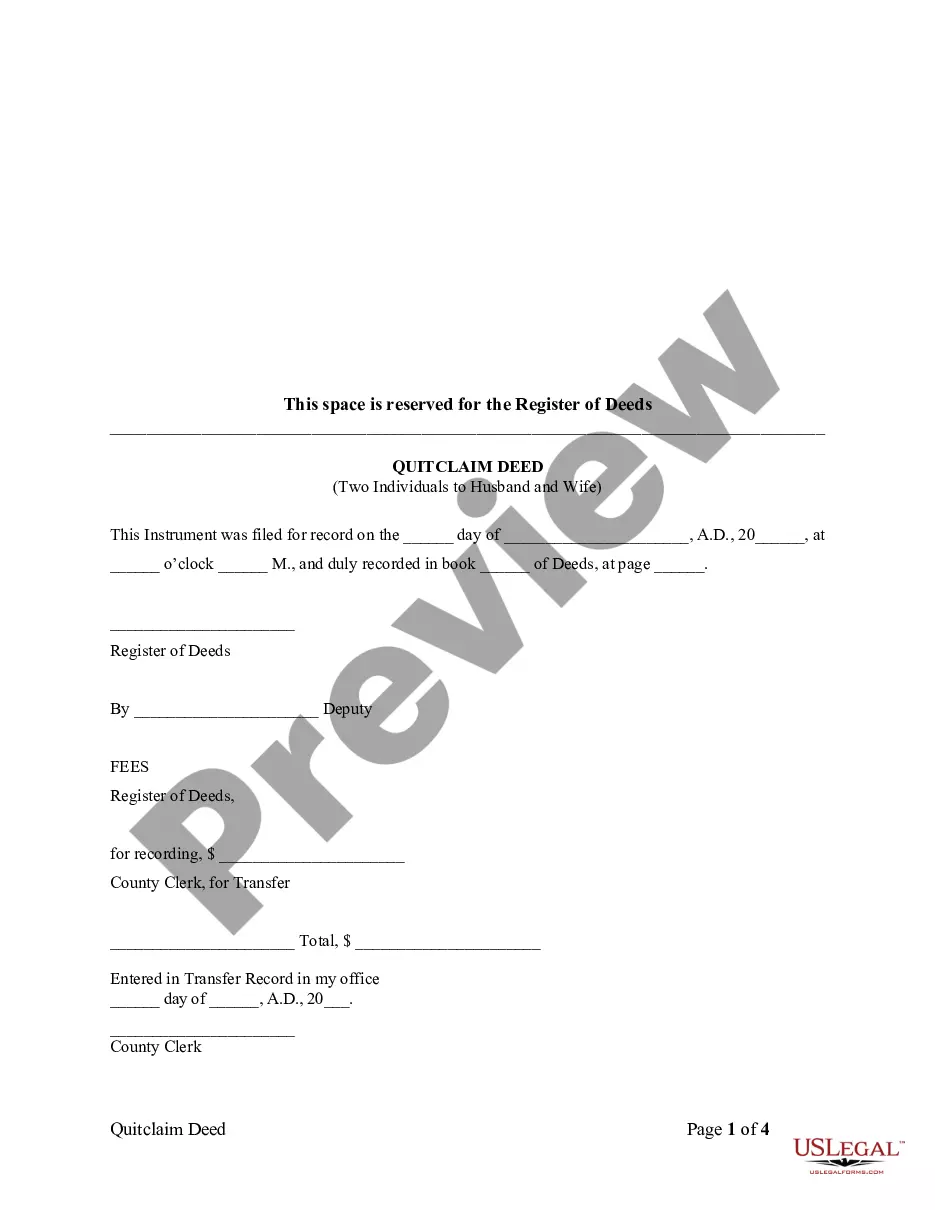

- Initial, make sure that you have chosen the best papers design to the region/metropolis that you pick. Look at the type outline to make sure you have picked the appropriate type. If available, take advantage of the Preview switch to search with the papers design at the same time.

- In order to locate another model of your type, take advantage of the Search discipline to obtain the design that suits you and specifications.

- Upon having found the design you need, just click Buy now to continue.

- Pick the rates plan you need, enter your qualifications, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal accounts to cover the authorized type.

- Pick the structure of your papers and obtain it to your product.

- Make changes to your papers if possible. You can comprehensive, revise and sign and print New York Stock Option Agreement of Key Tronic Corporation.

Obtain and print 1000s of papers web templates making use of the US Legal Forms site, that offers the most important collection of authorized varieties. Use skilled and status-distinct web templates to tackle your business or specific demands.

Form popularity

FAQ

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

A share option agreement is an agreement between the holder of shares and a third party giving one party the right (but not the obligation) to purchase or sell shares at a future date, at an agreed price. If the option is exercised, the other party is obliged to purchase or sell those shares.

The stock options plan is drafted by the company's board of directors and contains details of the grantee's rights. The options agreement will provide the key details of your option grant such as the vesting schedule, how the ESOs will vest, shares represented by the grant, and the strike price.

8 Things to Look for in an Employee Stock Options Agreement Number of Shares. Exercise Price. Grant Date. Vesting Schedule. Early Exercise Option. Expiration Date. Incentive Stock Options. Non-Qualified Stock Options.

A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

An option contract is an agreement used to facilitate a possible transaction between two parties. It governs the right to buy or sell an underlying asset or security, such as a stock, at a specific price. This is called the strike price, and it's fixed until the contract's expiration date.

In short, a stock option gives you the right to buy company shares at a pre-set price that's hopefully lower than the current share price. In this article, we'll talk about what employer stock options are, how they work, and how to calculate what your stock options might be worth.

An employee stock option agreement (sometimes known as a share option agreement) is a contract between an employer and employee that guarantees the employee's right to purchase stock in the employer's company at a specified price after a certain period of continuous employment.