The New York Nonemployee Director Stock Plan is a specialized compensation program offered by Donnelly Enterprise Solutions, Inc. to its nonemployee directors based in New York. This plan allows eligible directors to receive company stock as part of their overall remuneration package. Designed to incentivize nonemployee directors and align their interests with the long-term success of the company, the New York Nonemployee Director Stock Plan provides an opportunity for directors to share in the company's growth. It serves as a mechanism to motivate directors to contribute their expertise and guidance towards the company's strategic goals. Under this plan, nonemployee directors are granted stock options or restricted stock units (RSS) as a form of compensation. Stock options give directors the right to purchase company stock at a predetermined price, enabling them to benefit from potential stock price appreciation. On the other hand, RSS represent a promise to award company stock at a future date once certain vesting conditions have been met. This stock plan helps foster a sense of ownership among nonemployee directors, as they become shareholders in the company they serve. By acquiring company stock, directors have a vested interest in the company's performance and are more likely to act in the best interest of the shareholders at large. This arrangement can positively impact boardroom discussions and decision-making processes. By implementing the New York Nonemployee Director Stock Plan, Donnelly Enterprise Solutions, Inc. ensures that its nonemployee directors have a direct stake in the company's successes and failures. This aligns their interests with those of shareholders and enhances their commitment to promoting the company's long-term growth. Different types of the New York Nonemployee Director Stock Plan may include variations in the structure of stock options or RSS offered. These variations can be specific to grant size, vesting periods, exercise prices, or performance-based conditions. Each type may have distinct terms and conditions that cater to the unique requirements and goals of nonemployee directors participating in the program. Keywords: New York Nonemployee Director Stock Plan, Donnelly Enterprise Solutions, Inc., compensation program, nonemployee directors, stock options, restricted stock units, remuneration package, long-term success, incentivize directors, company growth, expertise, guidance, strategic goals, stock price appreciation, RSS, vesting conditions, ownership, shareholders, boardroom discussions, decision-making, structure, grant size, vesting periods, exercise prices, performance-based conditions.

New York Nonemployee Director Stock Plan of Donnelley Enterprise Solutions, Inc.

Description

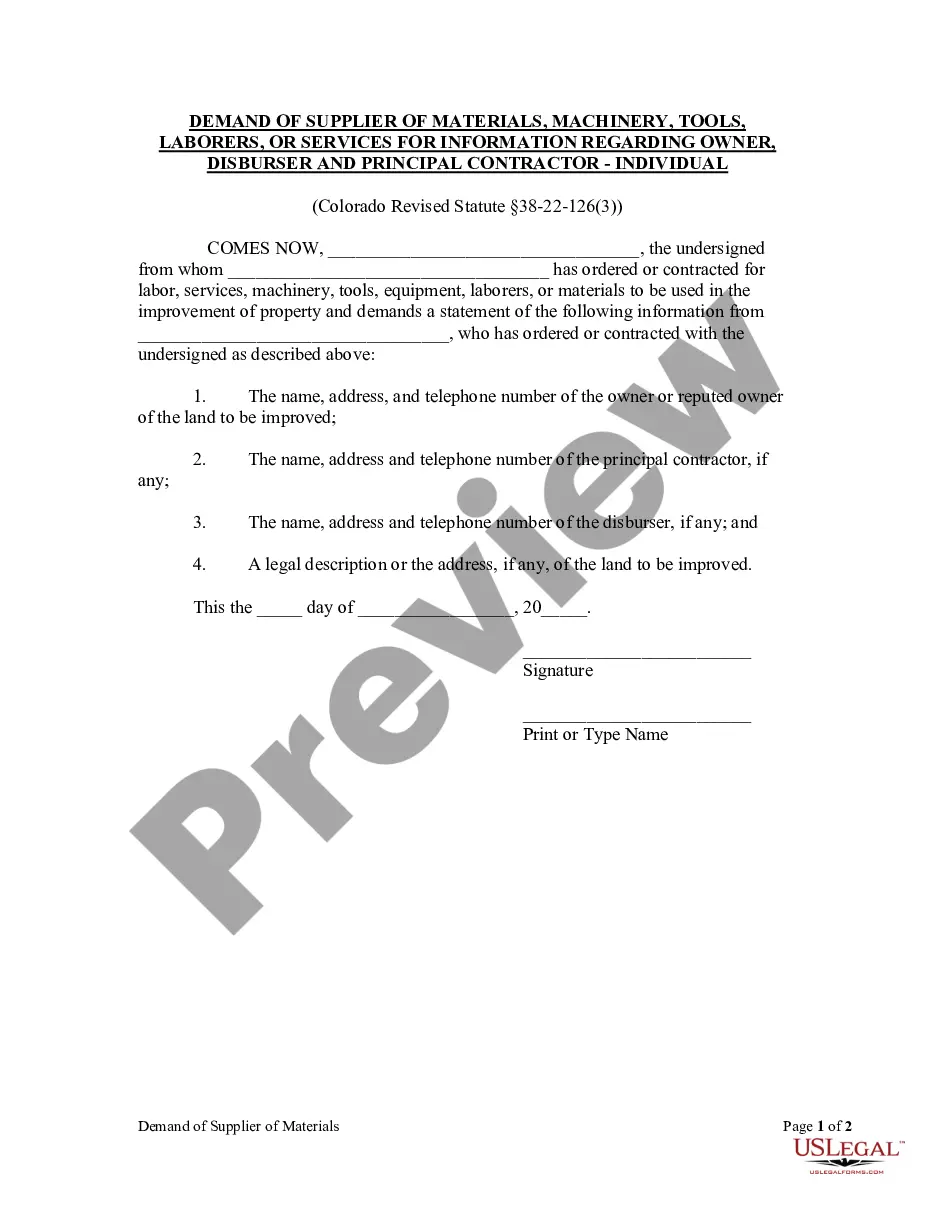

How to fill out Nonemployee Director Stock Plan Of Donnelley Enterprise Solutions, Inc.?

If you wish to comprehensive, download, or produce authorized record themes, use US Legal Forms, the most important selection of authorized varieties, that can be found on the web. Use the site`s simple and hassle-free search to discover the files you require. Various themes for company and person uses are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the New York Nonemployee Director Stock Plan of Donnelley Enterprise Solutions, Inc. in a couple of mouse clicks.

If you are already a US Legal Forms customer, log in to your bank account and click on the Down load switch to get the New York Nonemployee Director Stock Plan of Donnelley Enterprise Solutions, Inc.. You may also accessibility varieties you earlier acquired inside the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for your right town/nation.

- Step 2. Use the Review option to look through the form`s articles. Don`t forget to learn the outline.

- Step 3. If you are not satisfied together with the form, take advantage of the Look for industry towards the top of the display screen to locate other models of the authorized form format.

- Step 4. When you have located the form you require, select the Get now switch. Pick the rates prepare you choose and add your accreditations to register for an bank account.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the formatting of the authorized form and download it on your own device.

- Step 7. Complete, modify and produce or indication the New York Nonemployee Director Stock Plan of Donnelley Enterprise Solutions, Inc..

Each and every authorized record format you acquire is yours eternally. You have acces to every form you acquired inside your acccount. Go through the My Forms area and decide on a form to produce or download once again.

Remain competitive and download, and produce the New York Nonemployee Director Stock Plan of Donnelley Enterprise Solutions, Inc. with US Legal Forms. There are thousands of specialist and status-specific varieties you can use to your company or person requirements.