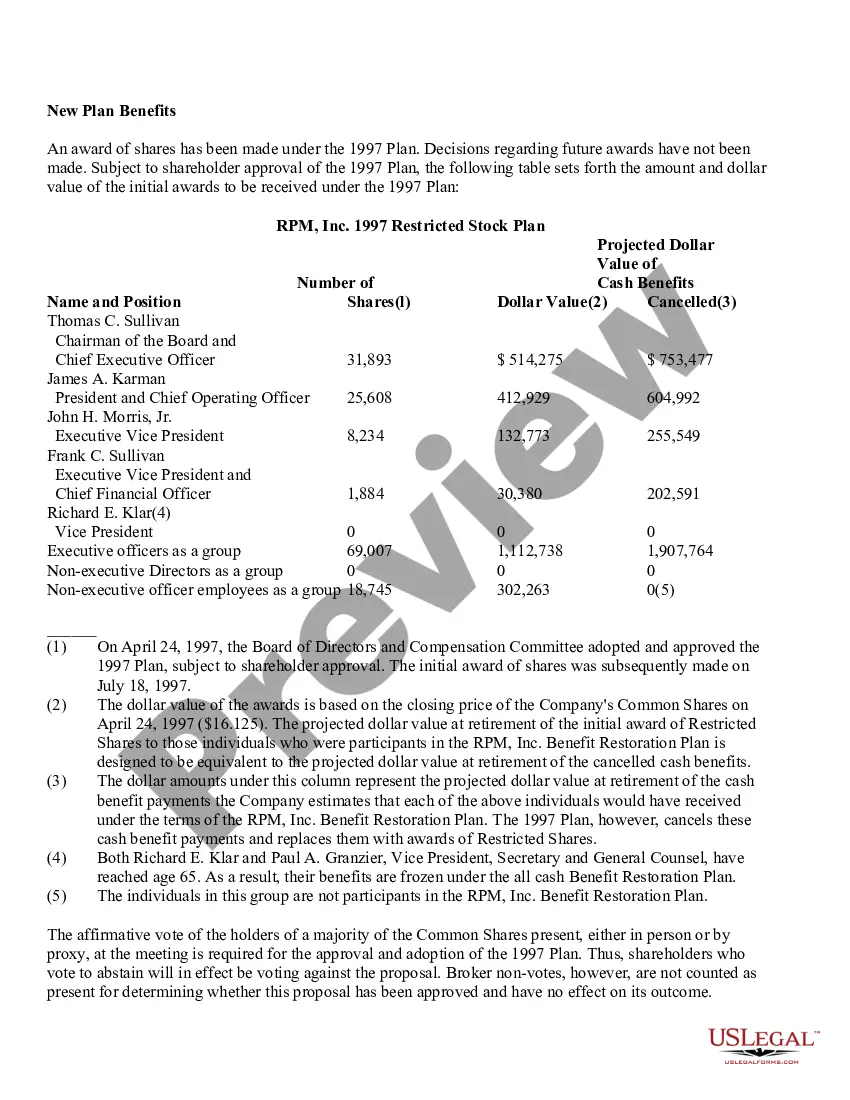

The New York Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive program designed to incentivize and reward employees of RPM, Inc. with equity ownership. This stock plan aims to align the interests of employees with the long-term success of the company by granting restricted stock as a form of compensation. With the New York Adoption of Restricted Stock Plan, eligible employees are granted restricted stock units (RSS) which symbolize ownership in the company. This RSS carry certain restrictions and conditions that must be met before they fully vest and can be converted into common stock. By awarding restricted stock, RPM, Inc. aims to motivate employees to contribute their best efforts towards the company's growth and success. Under this plan, the New York Adoption of Restricted Stock Plan of RPM, Inc. encompasses various types of restricted stock grants, such as time-based vesting, performance-based vesting, or a combination of both. Time-based vesting means that the RSS granted to employees will vest over a specific period of time, providing a gradual path to ownership. On the other hand, performance-based vesting is tied to predetermined performance benchmarks or goals set by the company. This type of vesting requires employees to achieve certain milestones or targets to unlock the shares. The New York Adoption of Restricted Stock Plan of RPM, Inc. safeguards the interests of both the company and the employees by including provisions for stock forfeiture in the event of termination or resignation before full vesting. This ensures that only employees who remain committed to the company's vision and goals reap the full benefits of the plan. By implementing the New York Adoption of Restricted Stock Plan, RPM, Inc. aims to attract and retain top talent, foster a culture of ownership and accountability, and drive employee motivation and loyalty. This stock plan not only provides employees with a tangible stake in the company's success but also offers a potential financial reward as the stock value appreciates over time. In summary, the New York Adoption of Restricted Stock Plan of RPM, Inc. is a comprehensive equity compensation program that provides eligible employees with restricted stock units as a form of long-term incentive. Through various vesting structures, the plan aligns employee interests with company performance, fostering a mutually beneficial relationship for all parties involved.

New York Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Adoption Of Restricted Stock Plan Of RPM, Inc.?

If you wish to total, obtain, or print out authorized document web templates, use US Legal Forms, the biggest selection of authorized types, which can be found on the web. Utilize the site`s easy and handy research to discover the files you will need. Numerous web templates for business and personal functions are categorized by classes and claims, or keywords. Use US Legal Forms to discover the New York Adoption of Restricted Stock Plan of RPM, Inc. in just a couple of clicks.

In case you are currently a US Legal Forms client, log in for your bank account and then click the Down load button to obtain the New York Adoption of Restricted Stock Plan of RPM, Inc.. Also you can accessibility types you previously saved from the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for the proper town/country.

- Step 2. Take advantage of the Review option to check out the form`s articles. Don`t neglect to see the information.

- Step 3. In case you are unhappy using the form, utilize the Search area towards the top of the display to get other models in the authorized form web template.

- Step 4. After you have located the shape you will need, click the Buy now button. Pick the rates strategy you choose and add your references to sign up for an bank account.

- Step 5. Procedure the purchase. You should use your charge card or PayPal bank account to complete the purchase.

- Step 6. Pick the structure in the authorized form and obtain it on your gadget.

- Step 7. Comprehensive, edit and print out or indicator the New York Adoption of Restricted Stock Plan of RPM, Inc..

Every authorized document web template you acquire is the one you have eternally. You have acces to each form you saved with your acccount. Go through the My Forms section and pick a form to print out or obtain again.

Contend and obtain, and print out the New York Adoption of Restricted Stock Plan of RPM, Inc. with US Legal Forms. There are many skilled and status-particular types you can use for the business or personal requirements.

Form popularity

FAQ

RSUs are converted to shares once they are vested, and therefore do not expire. Options have a stated expiration date (often, but not always, 10 years from the date they are granted.) RSUs are taxed as ordinary income at the time they become vested and liquid.

If you are on track toward meeting a retirement goal that is 10+ years out, it makes sense to choose options over RSUs. On the other hand, if you want to earmark this equity compensation for a retirement or education goal that is in five years or less, opting for more RSUs might be a better choice.

If your company's stock is performing well and you believe it will continue to appreciate, holding onto your RSUs may be a wise choice. Conversely, if you anticipate a downturn in the stock price, selling your RSUs upon vesting may be more prudent.

RSAs and RSUs are both restricted stocks but they have many differences. An RSA is a grant which gives the employee the right to buy shares at fair market value, at no cost, or at a discount. An RSU is a grant valued in terms of company stock, but you do not actually get the shares until the restrictions lapse or vest.

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.

Restricted stock and restricted stock units (RSUs) are different things. "Units," which are used in a variety of different executive compensation instruments, generally represent a measurement of contractual rights to a company's stock.

Restricted stocks are unregistered shares that are non-transferable for holders until they meet certain conditions. Well-established companies offer restricted stocks to company executives and directors as a form of equity compensation. Some restrictive conditions may be particular tenure or specific performance goals.

With restricted stock and RSUs, you almost always forfeit whatever stock has not vested at the time of your termination, unless your grant specifies another treatment or the company decides to continue or accelerate vesting.