New York Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

You may invest several hours online searching for the lawful record template that fits the state and federal demands you require. US Legal Forms supplies thousands of lawful types which are examined by specialists. You can easily down load or print the New York Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. from your services.

If you already have a US Legal Forms bank account, you are able to log in and click on the Download key. Next, you are able to comprehensive, modify, print, or indication the New York Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.. Every single lawful record template you get is your own property for a long time. To obtain yet another duplicate of any acquired form, go to the My Forms tab and click on the related key.

If you are using the US Legal Forms site the first time, stick to the simple instructions under:

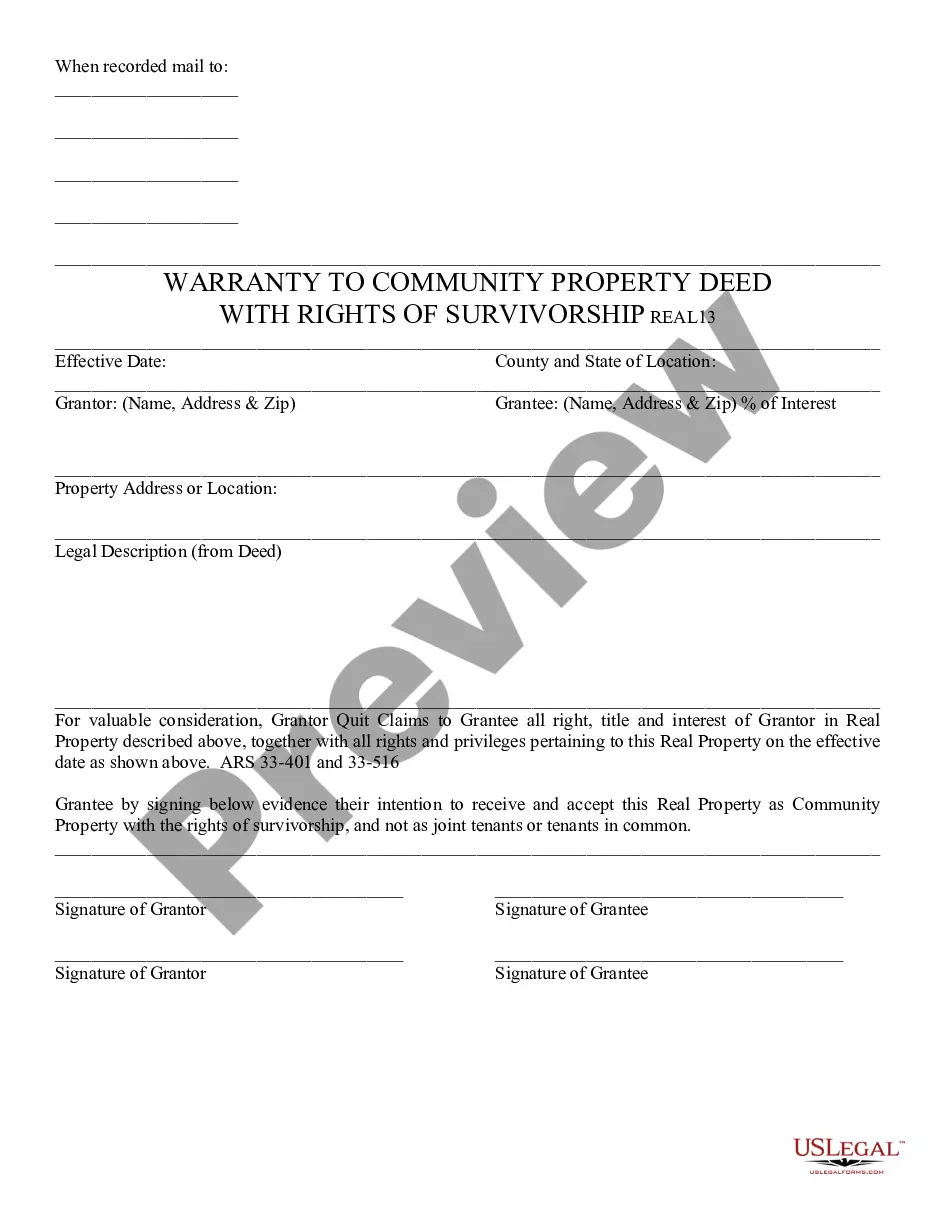

- Initially, be sure that you have chosen the right record template for your region/metropolis of your choice. Browse the form information to ensure you have chosen the proper form. If offered, make use of the Preview key to appear through the record template as well.

- If you would like get yet another version of the form, make use of the Lookup field to discover the template that fits your needs and demands.

- When you have discovered the template you desire, simply click Get now to proceed.

- Find the pricing prepare you desire, type in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal bank account to purchase the lawful form.

- Find the file format of the record and down load it for your gadget.

- Make adjustments for your record if needed. You may comprehensive, modify and indication and print New York Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

Download and print thousands of record web templates making use of the US Legal Forms site, which provides the biggest selection of lawful types. Use skilled and condition-certain web templates to tackle your organization or specific needs.

Form popularity

FAQ

If not, you must add it to Form 1040, Line 7 when you fill out your 2023 tax return. Because you sold the stock, you must report the sale on your 2023 Schedule D. The stock sale is considered a short-term transaction because you owned the stock less than a year.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company.

Non-qualified stock options benefit employers in ways that are similar to all other stock options. By serving as an effective compensation method, it reduces the potential cash outflow and allows the company to retain higher cash and liquidity for other needs.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Reporting income on the exercise of NSOs is a no-brainer. So long as the amount is reported properly on your W-2 or 1099-MISC, it should appear correctly on your tax return.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

How are NSOs taxed when exercised? In short: You pay ordinary income tax rates on the difference between the strike price and the 409A valuation. Your employer already withholds a part, but it's the bare minimum (usually 25%)