New York Stock Option and Stock Award Plan of American Stores Company

Description

How to fill out Stock Option And Stock Award Plan Of American Stores Company?

Choosing the best lawful papers template could be a struggle. Needless to say, there are plenty of web templates available online, but how would you find the lawful form you want? Make use of the US Legal Forms web site. The services delivers a huge number of web templates, for example the New York Stock Option and Stock Award Plan of American Stores Company, which you can use for company and personal needs. All the forms are inspected by experts and fulfill federal and state needs.

In case you are presently authorized, log in to the bank account and click on the Download key to have the New York Stock Option and Stock Award Plan of American Stores Company. Make use of bank account to check with the lawful forms you may have ordered in the past. Visit the My Forms tab of your respective bank account and have yet another backup of your papers you want.

In case you are a brand new end user of US Legal Forms, allow me to share easy recommendations that you should comply with:

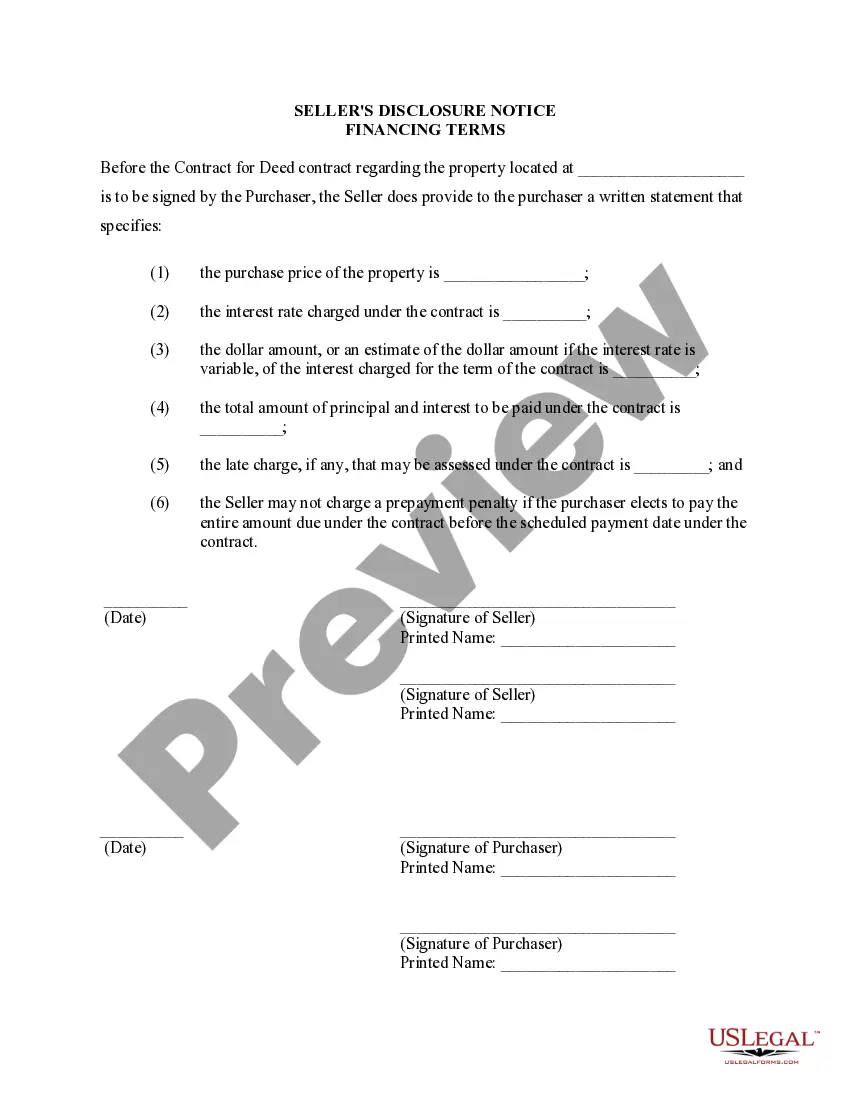

- Initially, be sure you have chosen the correct form to your area/region. It is possible to look through the shape making use of the Review key and look at the shape description to ensure it will be the best for you.

- If the form is not going to fulfill your preferences, make use of the Seach discipline to discover the right form.

- When you are sure that the shape is suitable, click the Buy now key to have the form.

- Pick the pricing program you would like and type in the essential information and facts. Make your bank account and buy the transaction with your PayPal bank account or credit card.

- Select the document file format and down load the lawful papers template to the device.

- Total, change and printing and indication the acquired New York Stock Option and Stock Award Plan of American Stores Company.

US Legal Forms is the greatest library of lawful forms for which you will find different papers web templates. Make use of the service to down load professionally-created papers that comply with status needs.

Form popularity

FAQ

These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time. ESOs can have vesting schedules that limit the ability to exercise.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.