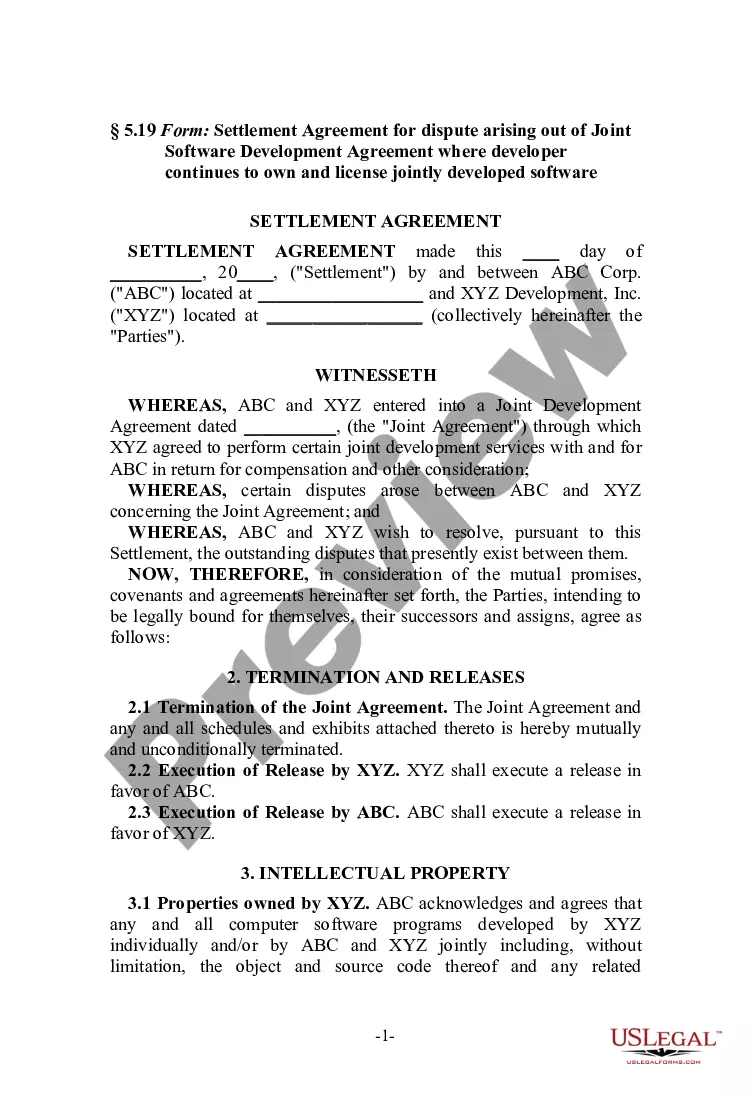

The New York Stock Incentive Plan of Abase Corp. is a comprehensive program designed to provide employees and executives with financial incentives tied to the company's stock performance. This plan, which is specific to Abase Corp., allows employees to benefit from the company's success while promoting employee retention and motivation. It offers various types of stock-based compensation, including stock options, restricted stock units (RSS), and performance shares. Stock options are a key component of Abase Corp.'s Stock Incentive Plan. They grant employees the right to purchase company shares at a predetermined price, known as the exercise price or strike price. These options typically have a specified vesting period and expiration date, encouraging employees to stay with the company and contribute to its long-term growth. Another type of incentive granted through the plan is RSS. RSS represents a promise to give employees a specific number of company shares at a predetermined future date or upon meeting certain performance criteria. RSS provide employees with a tangible ownership stake in the company, further aligning their interests with Abase Corp.'s success. Performance shares are a performance-based form of stock incentive offered by Abase Corp. This type of award is tied to specific performance goals established by the company, which may include financial targets or other key milestones. Employees who meet or exceed these goals are eligible to receive shares of company stock, providing additional motivation for exceptional performance. It's important to note that Abase Corp.'s Stock Incentive Plan will have specific terms and conditions, including vesting schedules, performance target requirements, and any additional restrictions. These details ensure that the plan aligns with the company's growth objectives while incentivizing employees. Overall, the New York Stock Incentive Plan of Abase Corp. is a robust program that aims to attract, motivate, and retain talented individuals by offering stock-based incentives. This plan provides employees with an opportunity to benefit directly from the company's success and fosters a culture of ownership and alignment between employees and shareholders.

New York Stock Incentive Plan of Ambase Corp.

Description

How to fill out New York Stock Incentive Plan Of Ambase Corp.?

Choosing the best legitimate file design can be quite a have difficulties. Obviously, there are a variety of themes accessible on the Internet, but how do you find the legitimate type you will need? Utilize the US Legal Forms web site. The support gives a huge number of themes, like the New York Stock Incentive Plan of Ambase Corp., which can be used for company and private needs. Each of the forms are checked out by specialists and meet federal and state demands.

In case you are already authorized, log in to the bank account and click the Obtain option to find the New York Stock Incentive Plan of Ambase Corp.. Utilize your bank account to appear from the legitimate forms you might have bought formerly. Proceed to the My Forms tab of your own bank account and get another copy of the file you will need.

In case you are a whole new customer of US Legal Forms, listed below are basic instructions that you can adhere to:

- First, ensure you have chosen the appropriate type for your town/county. You can examine the form making use of the Preview option and study the form explanation to make certain it is the best for you.

- If the type will not meet your preferences, make use of the Seach discipline to find the correct type.

- When you are positive that the form is acceptable, go through the Buy now option to find the type.

- Choose the costs program you would like and enter the essential info. Create your bank account and pay for your order making use of your PayPal bank account or bank card.

- Opt for the file file format and acquire the legitimate file design to the gadget.

- Total, revise and print and signal the obtained New York Stock Incentive Plan of Ambase Corp..

US Legal Forms will be the greatest local library of legitimate forms that you can discover different file themes. Utilize the company to acquire appropriately-manufactured files that adhere to status demands.