The New York Adoption of Stock Option Plan of WSFS Financial Corporation is a comprehensive compensation program designed to incentivize employees and executives by offering them the opportunity to acquire company stock options. This plan allows eligible recipients to purchase a predetermined number of company shares at a specified price within a certain timeframe. The purpose of the New York Adoption of Stock Option Plan is to attract and retain talent, align employee interests with the company's success, and motivate employees to contribute towards the long-term growth and profitability of WSFS Financial Corporation. By providing employees with the potential to become shareholders, the plan serves as a powerful tool for fostering a sense of ownership and commitment. There are several types of New York Adoption of Stock Option Plans that WSFS Financial Corporation may offer: 1. Non-Qualified Stock Option (NO) Plan: This plan provides employees with the opportunity to purchase company shares at a predetermined price, regardless of the market value of the stock. SOS are subject to tax implications. 2. Incentive Stock Option (ISO) Plan: SOS are typically offered to key employees and executives. These options provide favorable tax treatment, as gains are taxed at a lower rate if certain holding period requirements are met. SOS often come with restrictions on exercise and sale of the acquired shares. 3. Restricted Stock Unit (RSU) Plan: RSS are not technically stock options but rather a promise to deliver company shares in the future. RSS are typically subject to vesting conditions, and once vested, employees receive the equivalent value of company shares. 4. Performance Stock Option (PSO) Plan: SOS are awarded based on the accomplishment of predetermined performance criteria. This plan motivates employees to achieve specific goals or targets to receive stock options. 5. Employee Stock Purchase Plan (ESPN): An ESPN enables eligible employees to purchase company stock at a discounted price. Contributions are made through payroll deductions over a specific period, usually six months. It is important to note that the specific terms, eligibility criteria, and other details of the New York Adoption of Stock Option Plan may vary based on the company's policies, legal requirements, and regulatory framework. In conclusion, the New York Adoption of Stock Option Plan of WSFS Financial Corporation is a multi-faceted compensation program that provides employees and executives with the opportunity to acquire company stock options. By offering various types of stock options, WSFS Financial Corporation aims to attract and retain top talent, align employee interests with the company's success, and ultimately drive long-term growth and profitability.

New York Adoption of Stock Option Plan of WSFS Financial Corporation

Description

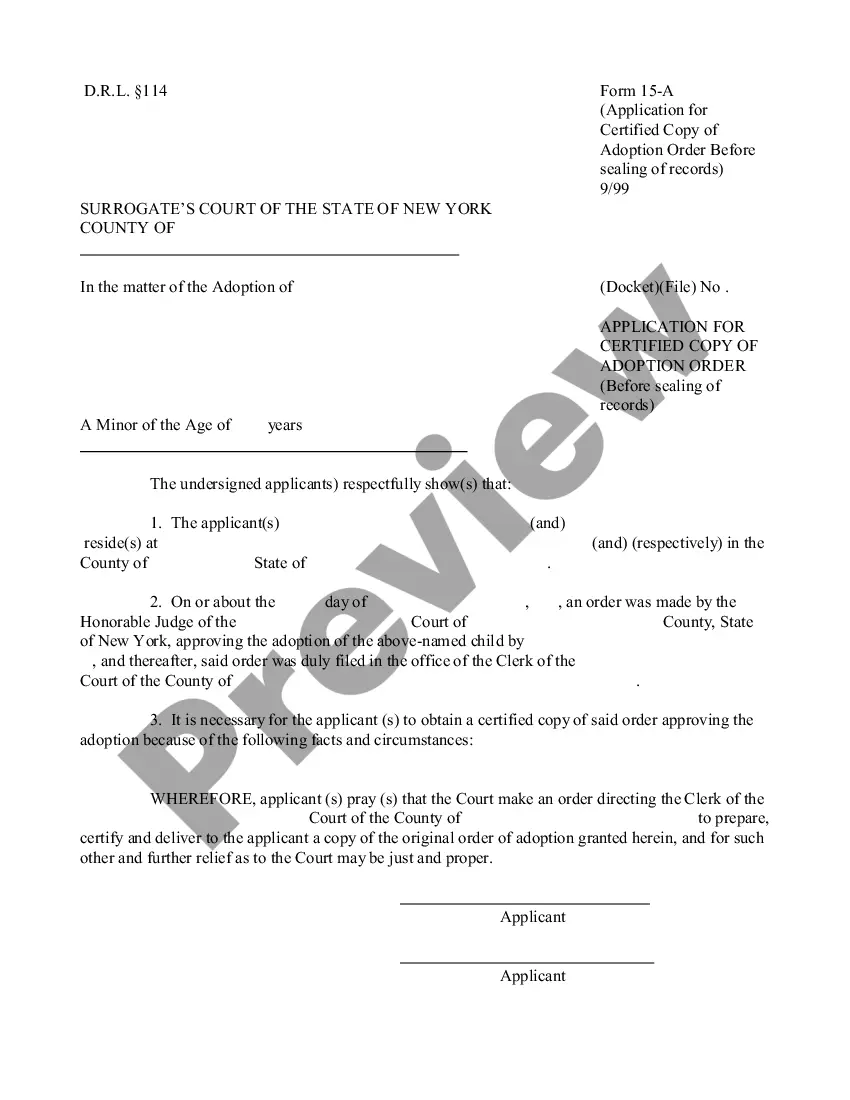

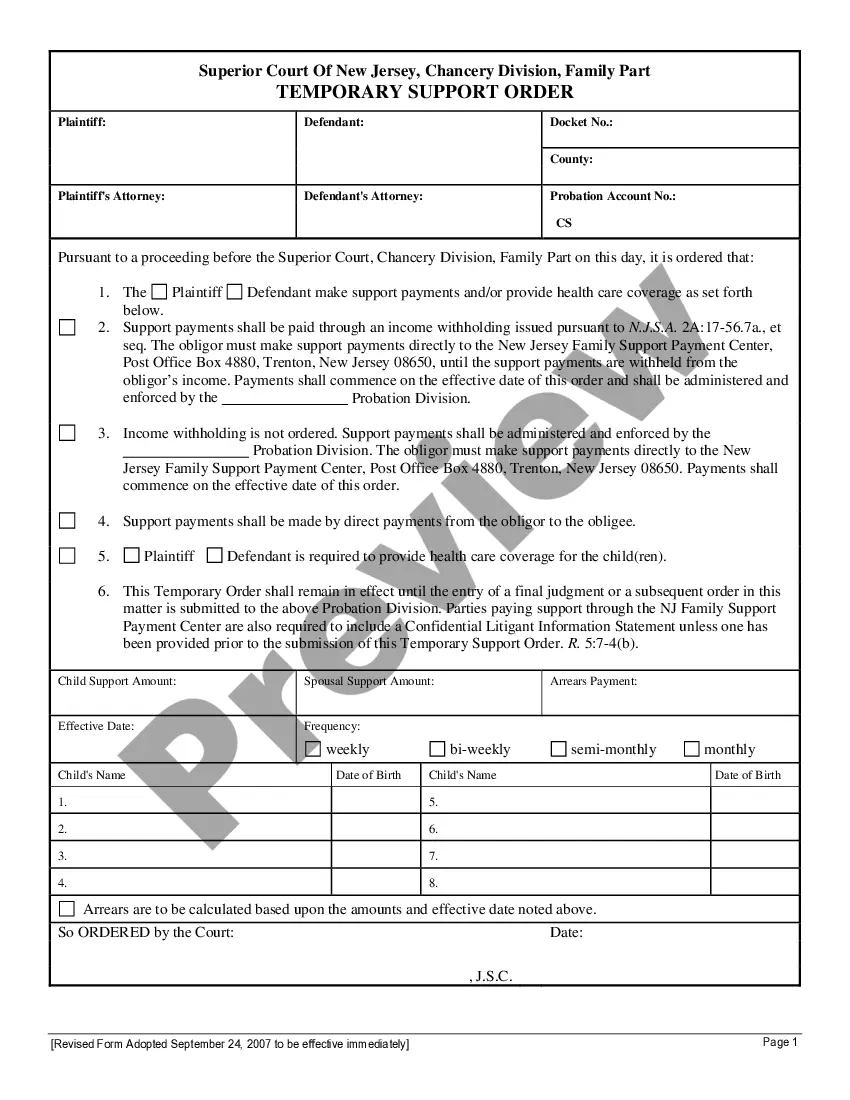

How to fill out New York Adoption Of Stock Option Plan Of WSFS Financial Corporation?

Have you been in the situation that you will need papers for sometimes company or individual uses virtually every working day? There are tons of lawful record templates available on the net, but discovering types you can trust is not straightforward. US Legal Forms gives a huge number of type templates, like the New York Adoption of Stock Option Plan of WSFS Financial Corporation, that happen to be written to meet federal and state demands.

If you are presently familiar with US Legal Forms website and get a free account, basically log in. After that, you may obtain the New York Adoption of Stock Option Plan of WSFS Financial Corporation format.

If you do not come with an profile and wish to begin using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is for that right metropolis/region.

- Use the Review key to examine the shape.

- Browse the information to ensure that you have selected the right type.

- When the type is not what you are looking for, utilize the Research industry to find the type that fits your needs and demands.

- When you find the right type, just click Purchase now.

- Select the pricing strategy you desire, fill out the necessary details to make your money, and buy an order utilizing your PayPal or credit card.

- Pick a practical file structure and obtain your duplicate.

Find each of the record templates you have purchased in the My Forms menus. You can get a additional duplicate of New York Adoption of Stock Option Plan of WSFS Financial Corporation whenever, if required. Just go through the essential type to obtain or print out the record format.

Use US Legal Forms, by far the most extensive variety of lawful varieties, to save efforts and avoid faults. The assistance gives professionally manufactured lawful record templates that can be used for an array of uses. Create a free account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

WSFS celebrated its 35th year of being a publicly traded company with Chairman, President and CEO Rodger Levenson, joined by members of the executive leadership team, Associates and friends of WSFS, ringing The Nasdaq Stock Market Opening Bell.

List of WSFS Bank 's Bryn Mawr Trust acquired by WSFS Bank. ... West Capital Management acquired by WSFS Bank. ... Powdermill Financial Solutions acquired by WSFS Bank. ... Christiana Bank & Trust acquired by WSFS Bank. ... Penn Liberty Bank acquired by WSFS Bank. ... Beneficial Mutual Bancorp acquired by WSFS Bank.

WSFS common stock is traded on the NASDAQ stock exchange under the symbol WSFS.