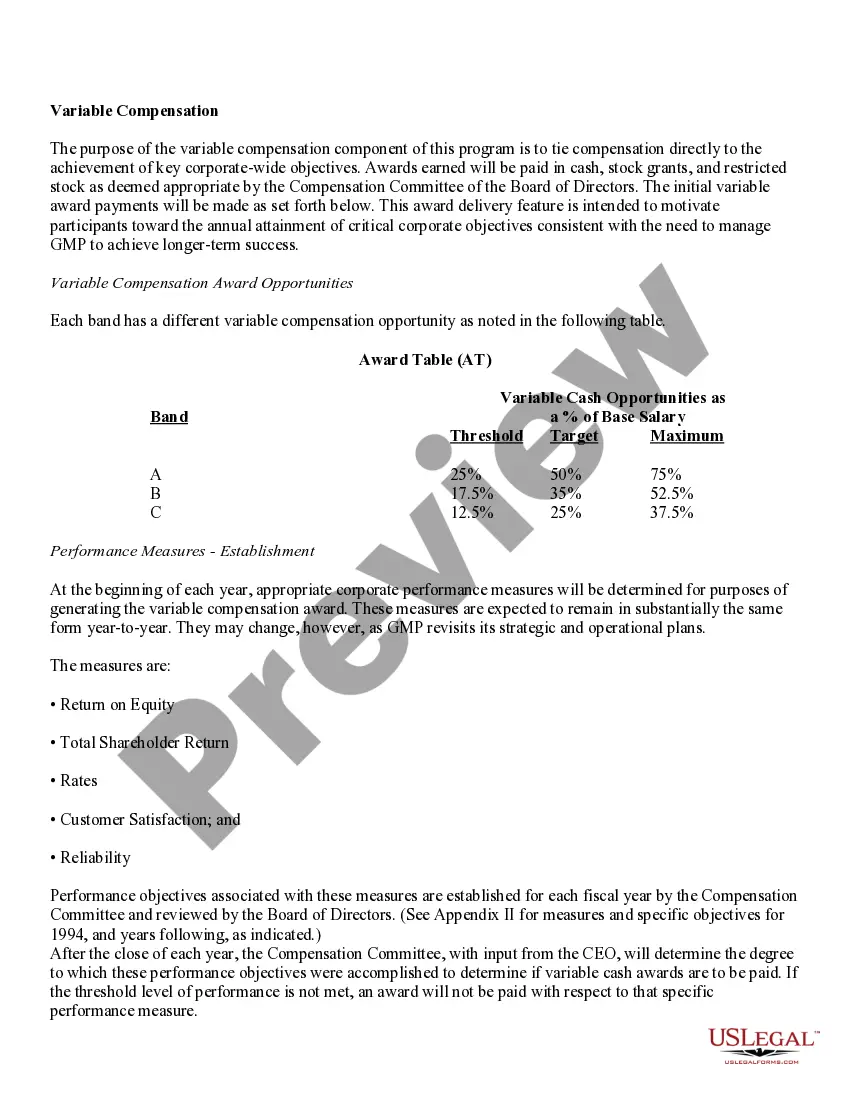

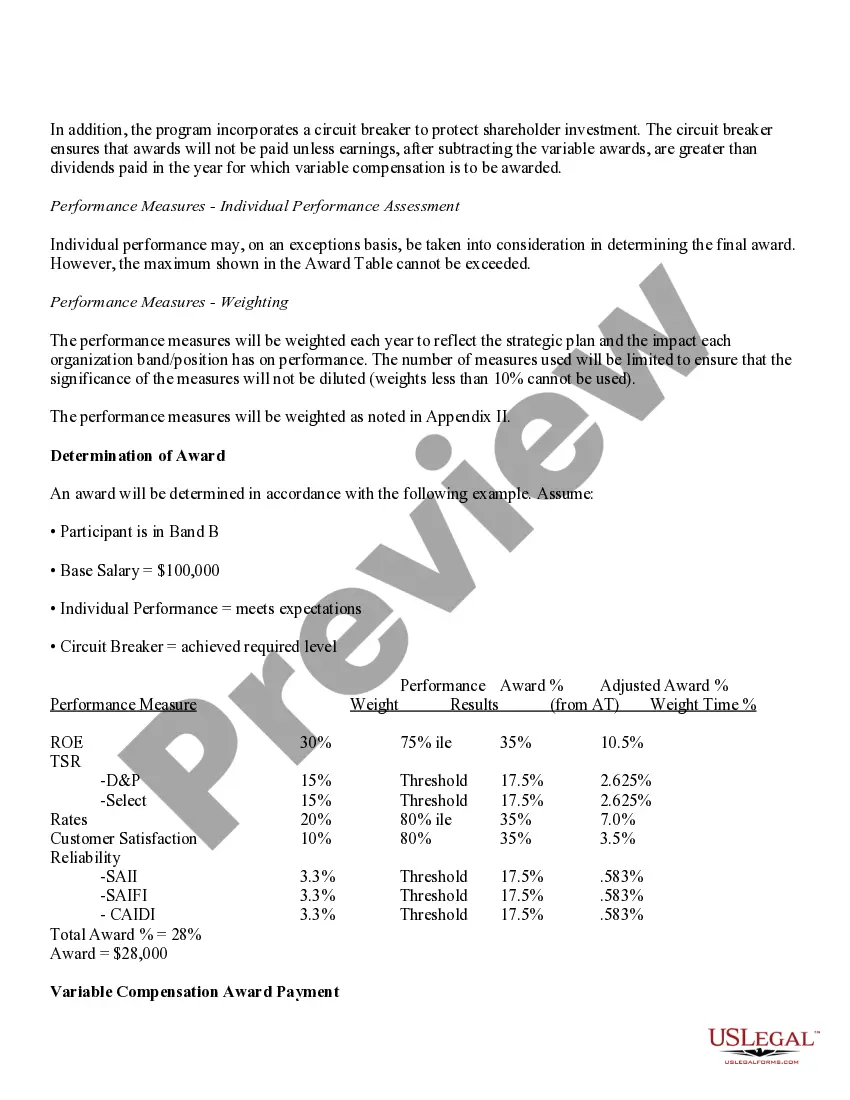

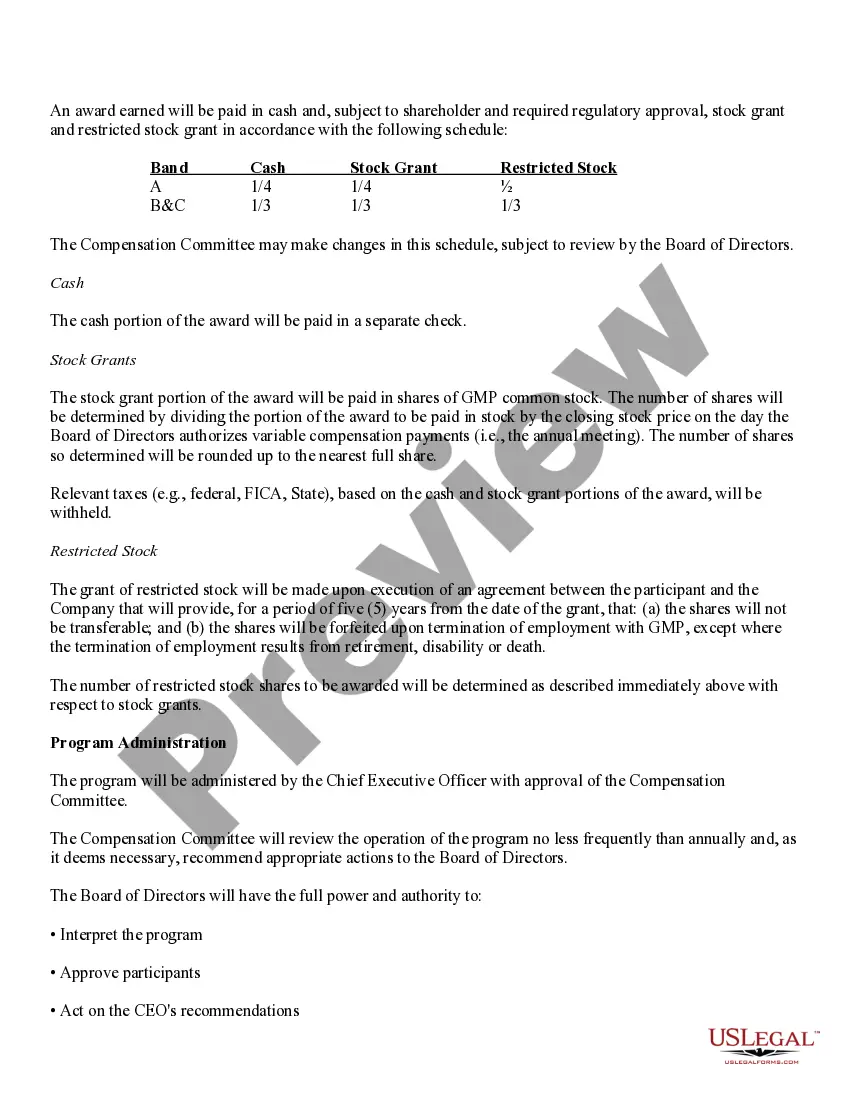

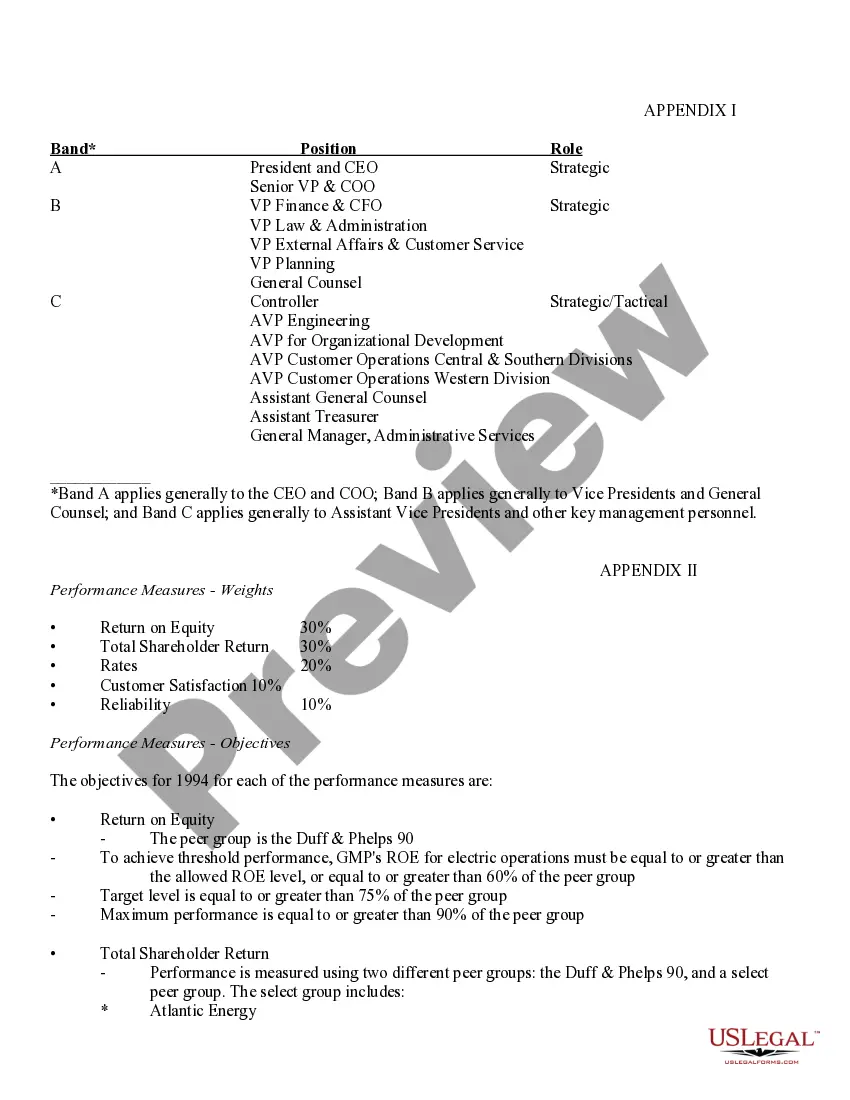

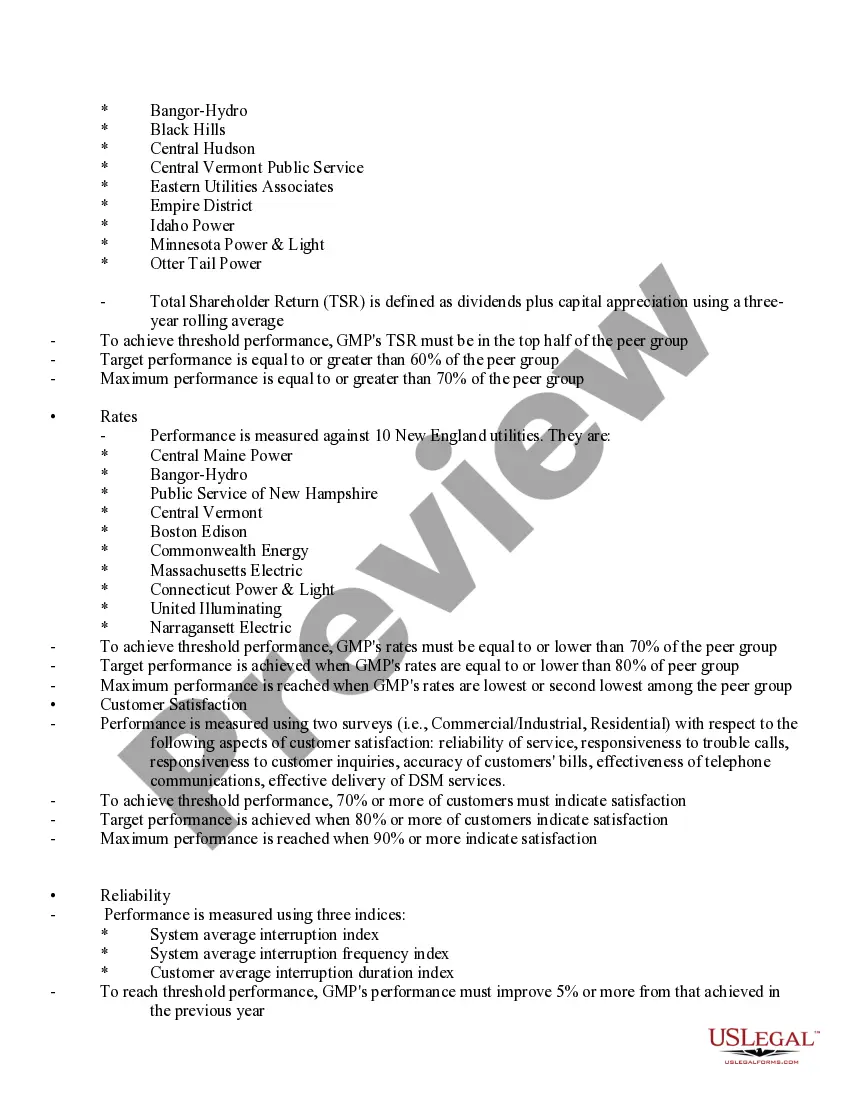

Title: Overview of New York Compensation Program for Officers and Key Management Personnel Keywords: New York, Compensation Program, Officers, Key Management Personnel, Overview, Attachments Introduction: The New York Compensation Program for Officers and Certain Key Management Personnel is a comprehensive framework implemented to ensure fair and appropriate remuneration for individuals in crucial positions within public and private organizations. This program caters to various industries and entities across New York, offering different types of compensation schemes to address specific organizational needs and priorities. This article provides a detailed overview of the program and highlights some common types of compensation plans. Attachment 1: NYC Guidelines and Policy Document Attachment 2: Sample Compensation Agreement for Key Management Personnel Section 1: New York Compensation Program — Purpose and Scope The New York Compensation Program aims to attract and retain talented executives and key management personnel by offering competitive compensation packages. These individuals play critical roles in driving organizational success, decision-making, and ensuring effective governance. The program's scope extends to both public and private organizations operating within the geographical boundaries of New York. Section 2: Types of Compensation Plans 1. Executive Salary Incentive Plan (ESP): ESP is a performance-based compensation plan that provides eligible officers and key management personnel with bonuses linked to achieving predetermined goals and objectives. Performance metrics can include financial targets, strategic milestones, and individual performance indicators. 2. Long-Term Incentive Plans (TIP): Lips are designed to reward officers and key management personnel for long-term performance and sustained organizational growth. These plans typically comprise equity-based compensation instruments such as stock options, restricted stock units (RSS), or performance shares, which provide individuals with future financial gains based on specific conditions and tenure. 3. Non-Cash Benefits and Perquisites: Apart from base salaries and performance-based incentives, the New York Compensation Program may offer additional non-cash benefits and perquisites. These can include but are not limited to healthcare coverage, retirement plans, life insurance, car allowances, and club memberships. 4. Deferred Compensation Plans: The program may incorporate deferred compensation plans to align the interests of officers and key management personnel with long-term organizational success. These plans allow individuals to defer a portion of their current compensation to be received in the future, often with additional interest or investment-related returns. Section 3: Roles and Responsibilities The New York Compensation Program establishes clear guidelines and responsibilities for the board of directors, compensation committees, and human resources departments. These entities are responsible for designing, implementing, and regularly reviewing compensation plans to support organizational goals while ensuring fairness, compliance, and transparency. Section 4: Compliance and Reporting Requirements The program complies with all applicable laws, regulations, and industry best practices. Organizations are required to maintain accurate records, submit annual reports detailing compensation structures, and disclose relevant information to shareholders, regulatory bodies, or any other stakeholders as necessary. Conclusion: The New York Compensation Program for Officers and Certain Key Management Personnel is a vital tool for organizations looking to attract, retain, and motivate senior executives. By offering various types of compensation plans, organizations can tailor packages to match their specific needs and enhance organizational performance. This program fosters fairness, accountability, and ensures compliance with regulatory requirements, further strengthening the corporate governance framework across New York.

Title: Overview of New York Compensation Program for Officers and Key Management Personnel Keywords: New York, Compensation Program, Officers, Key Management Personnel, Overview, Attachments Introduction: The New York Compensation Program for Officers and Certain Key Management Personnel is a comprehensive framework implemented to ensure fair and appropriate remuneration for individuals in crucial positions within public and private organizations. This program caters to various industries and entities across New York, offering different types of compensation schemes to address specific organizational needs and priorities. This article provides a detailed overview of the program and highlights some common types of compensation plans. Attachment 1: NYC Guidelines and Policy Document Attachment 2: Sample Compensation Agreement for Key Management Personnel Section 1: New York Compensation Program — Purpose and Scope The New York Compensation Program aims to attract and retain talented executives and key management personnel by offering competitive compensation packages. These individuals play critical roles in driving organizational success, decision-making, and ensuring effective governance. The program's scope extends to both public and private organizations operating within the geographical boundaries of New York. Section 2: Types of Compensation Plans 1. Executive Salary Incentive Plan (ESP): ESP is a performance-based compensation plan that provides eligible officers and key management personnel with bonuses linked to achieving predetermined goals and objectives. Performance metrics can include financial targets, strategic milestones, and individual performance indicators. 2. Long-Term Incentive Plans (TIP): Lips are designed to reward officers and key management personnel for long-term performance and sustained organizational growth. These plans typically comprise equity-based compensation instruments such as stock options, restricted stock units (RSS), or performance shares, which provide individuals with future financial gains based on specific conditions and tenure. 3. Non-Cash Benefits and Perquisites: Apart from base salaries and performance-based incentives, the New York Compensation Program may offer additional non-cash benefits and perquisites. These can include but are not limited to healthcare coverage, retirement plans, life insurance, car allowances, and club memberships. 4. Deferred Compensation Plans: The program may incorporate deferred compensation plans to align the interests of officers and key management personnel with long-term organizational success. These plans allow individuals to defer a portion of their current compensation to be received in the future, often with additional interest or investment-related returns. Section 3: Roles and Responsibilities The New York Compensation Program establishes clear guidelines and responsibilities for the board of directors, compensation committees, and human resources departments. These entities are responsible for designing, implementing, and regularly reviewing compensation plans to support organizational goals while ensuring fairness, compliance, and transparency. Section 4: Compliance and Reporting Requirements The program complies with all applicable laws, regulations, and industry best practices. Organizations are required to maintain accurate records, submit annual reports detailing compensation structures, and disclose relevant information to shareholders, regulatory bodies, or any other stakeholders as necessary. Conclusion: The New York Compensation Program for Officers and Certain Key Management Personnel is a vital tool for organizations looking to attract, retain, and motivate senior executives. By offering various types of compensation plans, organizations can tailor packages to match their specific needs and enhance organizational performance. This program fosters fairness, accountability, and ensures compliance with regulatory requirements, further strengthening the corporate governance framework across New York.