New York Supplemental Executive Retirement Plan - SERP

Description

How to fill out Supplemental Executive Retirement Plan - SERP?

If you have to total, acquire, or produce lawful record themes, use US Legal Forms, the biggest assortment of lawful types, that can be found on the Internet. Utilize the site`s simple and practical look for to find the paperwork you need. Different themes for business and individual functions are sorted by categories and claims, or key phrases. Use US Legal Forms to find the New York Supplemental Executive Retirement Plan - SERP within a few click throughs.

When you are presently a US Legal Forms consumer, log in for your bank account and then click the Download option to find the New York Supplemental Executive Retirement Plan - SERP. You may also access types you earlier downloaded inside the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your proper city/country.

- Step 2. Utilize the Preview solution to check out the form`s information. Do not forget to learn the outline.

- Step 3. When you are unhappy using the develop, take advantage of the Research industry on top of the screen to get other variations from the lawful develop web template.

- Step 4. When you have discovered the shape you need, go through the Acquire now option. Opt for the pricing program you like and include your credentials to sign up to have an bank account.

- Step 5. Process the transaction. You can utilize your charge card or PayPal bank account to perform the transaction.

- Step 6. Choose the format from the lawful develop and acquire it on the system.

- Step 7. Complete, modify and produce or indication the New York Supplemental Executive Retirement Plan - SERP.

Each lawful record web template you get is your own property for a long time. You possess acces to each and every develop you downloaded within your acccount. Go through the My Forms portion and choose a develop to produce or acquire yet again.

Be competitive and acquire, and produce the New York Supplemental Executive Retirement Plan - SERP with US Legal Forms. There are thousands of skilled and express-particular types you can use for the business or individual demands.

Form popularity

FAQ

The funds can be withdrawn, without penalty, before you turn 59½, nor do you need to begin required minimum distributions at age 73. Although most employers require distributions to begin at retirement or when you are no longer employed. SERPs can be designed with many different options or configurations.

SERP withdrawals are taxed as regular income, but taxes on that income are deferred until you start making withdrawals. Much like other tax-deferred retirement plans, SERP funds grow tax-free until retirement. If you withdraw your SERP funds in a lump sum, you'll pay the taxes at all once.

Distributions from SERPs are taxed at ordinary income rates, but tax is deferred until the employee starts taking withdrawals. SERP holders therefore benefit from the accumulation of funds without any tax erosion.

The employee receives supplemental retirement income paid for through the insurance policy. Once the employee receives income in retirement, that benefit is taxable. At that point, the employer receives a tax deduction.

SERPs are paid out as either one lump sum or as a series of set payments from an annuity, with different tax implications for each method, so choose carefully.

Although SERPs could be paid out of cash flows or investment funds, most are funded through a cash value life insurance plan. The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy.

Risk of forfeiture. Forfeiture can occur if the employee has not met the requirements to ?earn? or ?vest? in the future SERP payout. This usually occurs when the employee leaves the company prior to retirement. This also can happen when leaving the company prior to vesting or not achieving performance thresholds.

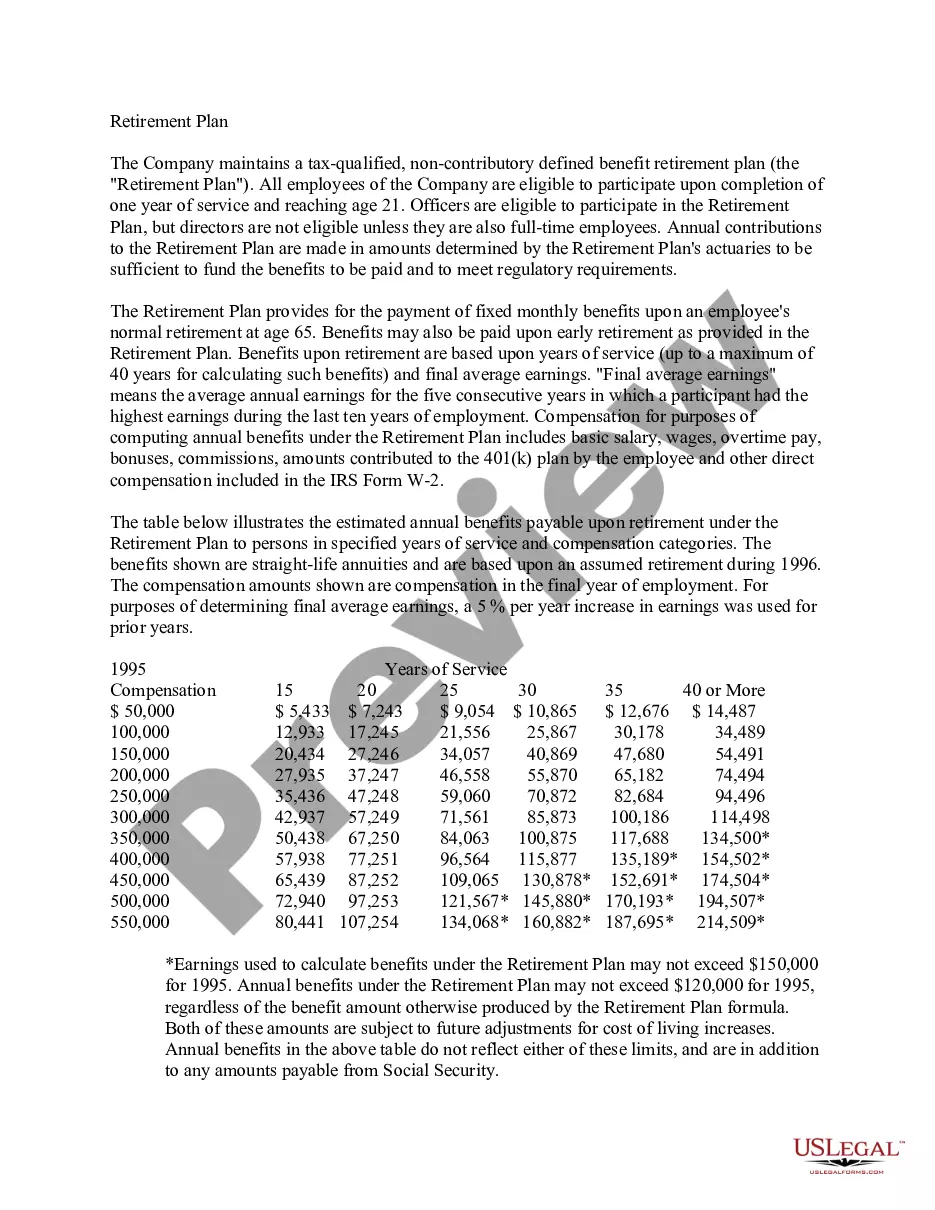

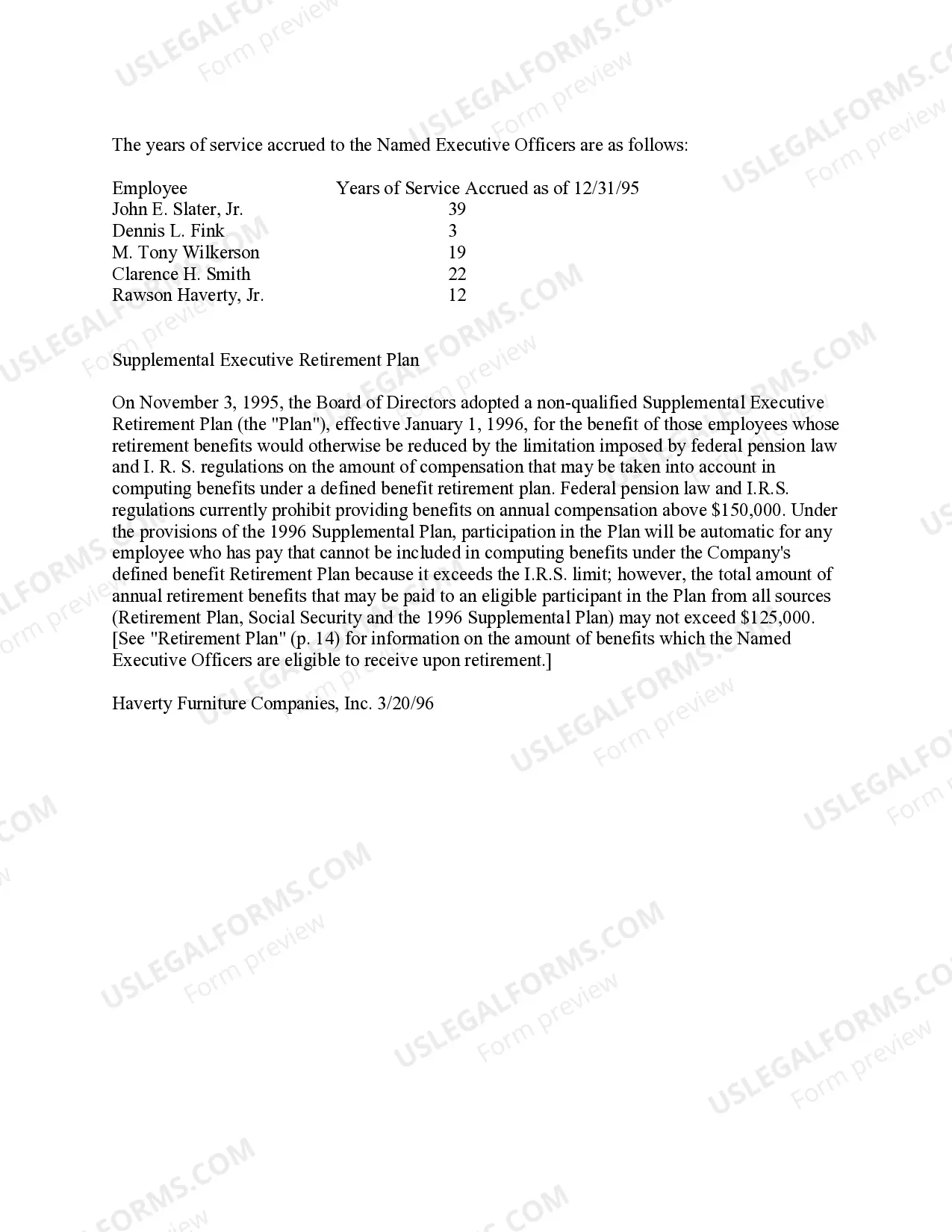

A supplemental executive retirement plan is a deferred compensation agreement between the company and the key executive whereby the company agrees to provide supplemental retirement income to the executive and his family if certain pre-agreed eligibility and vesting conditions are met by the executive.