New York Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

US Legal Forms - one of many most significant libraries of lawful varieties in the States - provides a wide array of lawful papers layouts you can acquire or print out. Using the website, you may get thousands of varieties for organization and person uses, sorted by categories, claims, or search phrases.You can get the most up-to-date variations of varieties just like the New York Split-Dollar Life Insurance within minutes.

If you have a registration, log in and acquire New York Split-Dollar Life Insurance from your US Legal Forms catalogue. The Down load option will appear on every single develop you view. You get access to all earlier acquired varieties from the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, listed here are straightforward instructions to help you began:

- Make sure you have selected the best develop for your area/region. Go through the Preview option to review the form`s content. Look at the develop information to actually have selected the proper develop.

- When the develop doesn`t match your specifications, take advantage of the Search discipline near the top of the display screen to get the one that does.

- Should you be content with the form, validate your option by clicking the Purchase now option. Then, select the pricing plan you prefer and provide your accreditations to sign up to have an bank account.

- Procedure the financial transaction. Use your credit card or PayPal bank account to finish the financial transaction.

- Choose the formatting and acquire the form in your product.

- Make alterations. Fill up, edit and print out and indicator the acquired New York Split-Dollar Life Insurance.

Each web template you included in your account does not have an expiration day and is also your own property eternally. So, if you wish to acquire or print out another version, just go to the My Forms section and click on the develop you need.

Get access to the New York Split-Dollar Life Insurance with US Legal Forms, the most extensive catalogue of lawful papers layouts. Use thousands of skilled and state-particular layouts that fulfill your small business or person requires and specifications.

Form popularity

FAQ

Premiums for group life insurance are often paid in full or partially by the employer. If you pay a portion it can be deducted from your paycheck. Your premium can depend on factors such as your age, salary and whether you smoke.

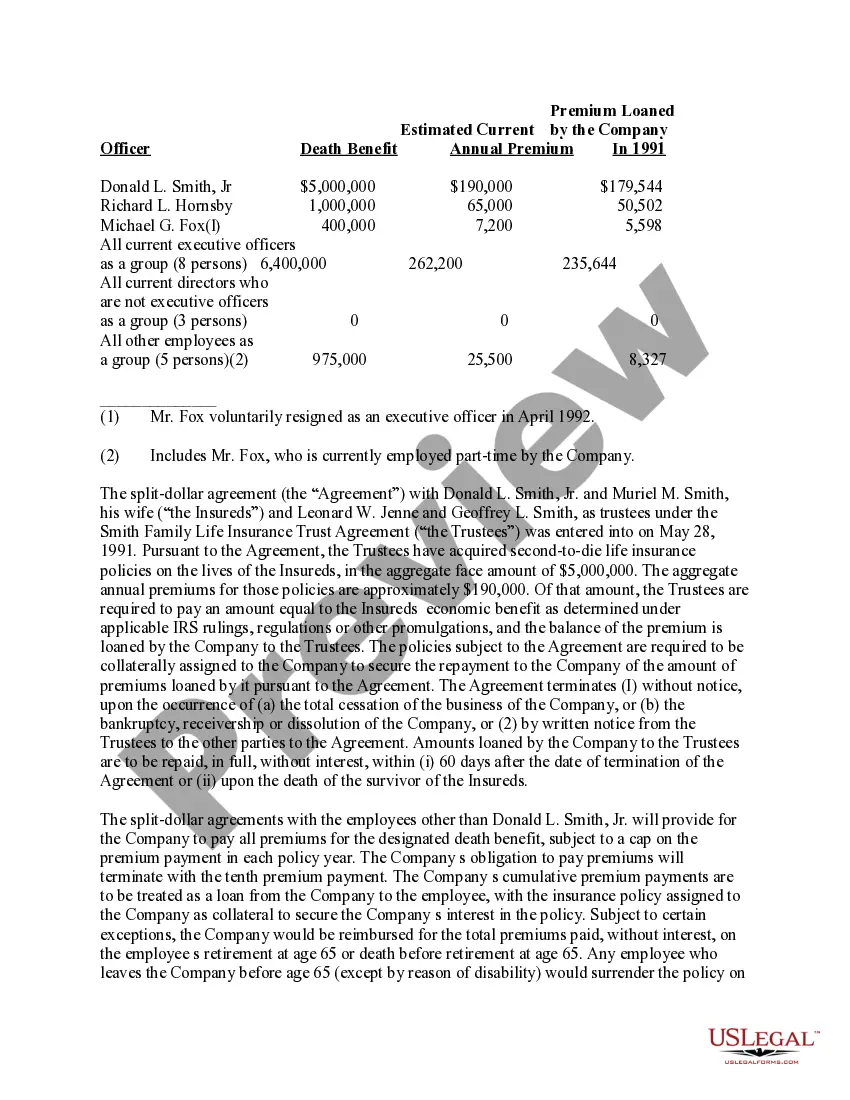

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

The coverage is generally guaranteed issue, which means you don't need to take a life insurance medical exam or answer health questions to qualify. Since employers usually cover premiums and you won't be declined for coverage, there's no reason not to sign up for group life insurance.

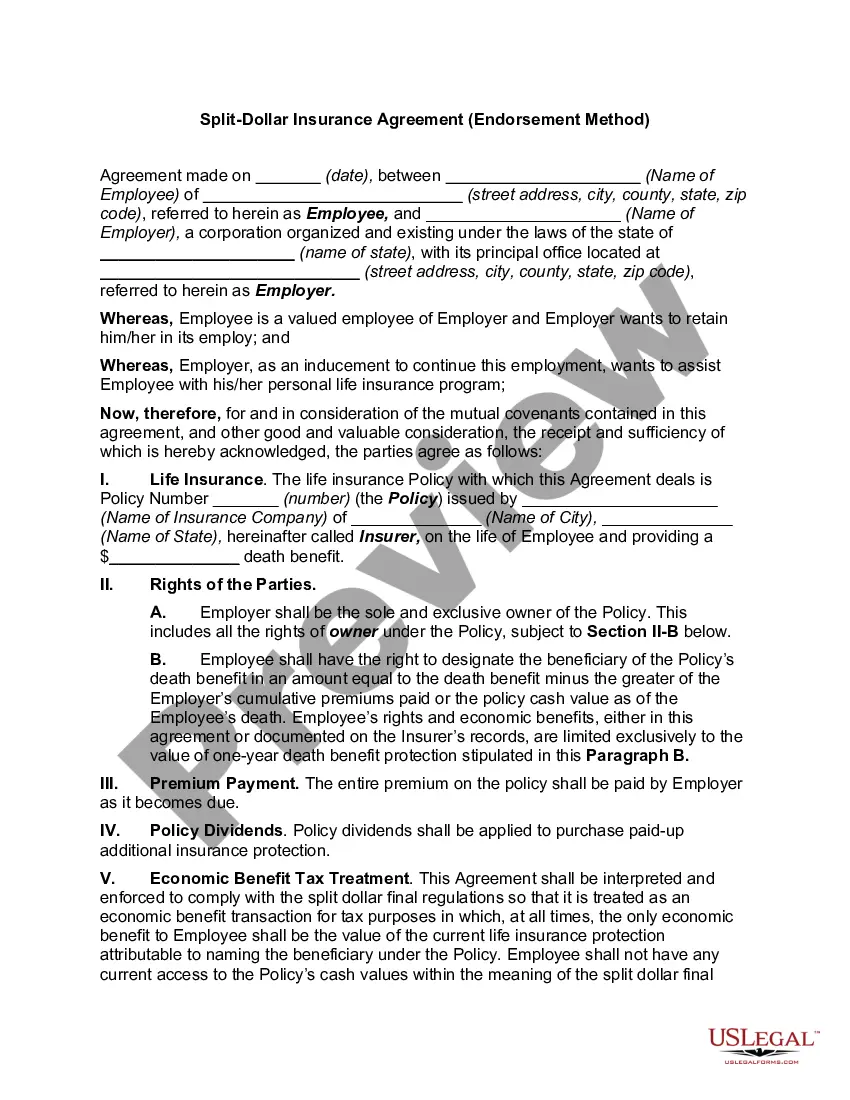

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a life insurance policy. Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability.

Employers are responsible for making split-dollar life insurance premiums, regardless of the plan's type. However, it is important to note that under loan arrangements, employees must repay the premiums via collateral assignments made to their employer.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability. Both employers and employees must carefully weigh the benefits and disadvantages of this type of arrangement before deciding to pursue it.