Title: Understanding New York Proposed Amendments to Restated Certificate of Incorporation to Authorize Preferred Stock Introduction: New York Proposed amendments to the restated certificate of incorporation in relation to the authorization of preferred stock play a crucial role in shaping the corporate structure and capitalization of a company. This article aims to provide a detailed description of what these amendments entail, along with highlighting different types of preferred stock that may be authorized. 1. Overview of Proposed Amendments: New York Proposed amendments to the restated certificate of incorporation refer to changes made to the existing governing document of a corporation, allowing for the authorization of preferred stock. These amendments provide flexibility to corporations to issue and manage preferred shares as a part of their capital structure. 2. Purpose of Proposed Amendments: The purpose of proposed amendments is to empower corporations by expanding their financing options. By authorizing preferred stock, corporations can attract investors who seek additional benefits, such as priority dividend payments or priority liquidation preference, compared to common stockholders. It also allows companies to customize the rights, preferences, and limitations associated with preferred stock to suit their specific needs. 3. Key Features of Preferred Stock: Preferred stock represents a unique class of equity ownership in a company. Under New York proposed amendments, corporations can authorize preferred stock with various features, including: a) Dividend Priority: Preferred stockholders typically receive dividends before common stockholders, ensuring a regular dividend stream, even if the company faces financial challenges. b) Liquidation Preference: Preferred stockholders enjoy preference over common stockholders during liquidation events, ensuring they are repaid first from the remaining assets of the company. c) Convertibility: Some preferred stock may offer the option to convert into common stock, providing investors with potential upside if the company's value appreciates. d) Voting Rights: While preferred stockholders usually do not have voting rights, companies may authorize preferred stock with limited or full voting rights on certain matters. e) Cumulative or Non-cumulative Dividends: Preferred stock may accumulate unpaid dividends, ensuring that if the company misses dividend payments in any fiscal year, those dividends will accrue and must be paid in future years. 4. Different Types of Preferred Stock: Under New York Proposed amendments, corporations have the flexibility to authorize various types of preferred stock, including: a) Cumulative Preferred Stock: This type accumulates unpaid dividends, which must be paid to preferred stockholders, along with the current year's dividend, before common stockholders receive any dividends. b) Non-Cumulative Preferred Stock: Unlike cumulative preferred stock, non-cumulative preferred stockholders do not accumulate unpaid dividends. If a dividend is not declared in a particular year, it does not carry over to future years. c) Convertible Preferred Stock: This type allows preferred stockholders to convert their shares into a predetermined number of common shares, providing potential capital gains if the value of the company's common stock rises. d) Redeemable Preferred Stock: Redeemable preferred stock can be repurchased by the corporation after a specified period or under certain conditions, allowing flexibility in managing the company's capital structure. e) Participating Preferred Stock: This type grants preferred stockholders the right to participate in additional dividends, beyond the fixed dividend rate, along with common stockholders based on predefined terms. Conclusion: New York Proposed amendments to the restated certificate of incorporation to authorize preferred stock bring significant advantages and flexibility to corporations. By understanding the different types and features of preferred stock, corporations can make informed decisions regarding their capitalization structure. These amendments provide the tools to attract investors, raise capital, and tailor financial benefits to various stakeholders, ultimately aiding the growth and development of businesses in New York.

New York Proposed amendment to the restated certificate of incorporation to authorize preferred stock

Description

How to fill out New York Proposed Amendment To The Restated Certificate Of Incorporation To Authorize Preferred Stock?

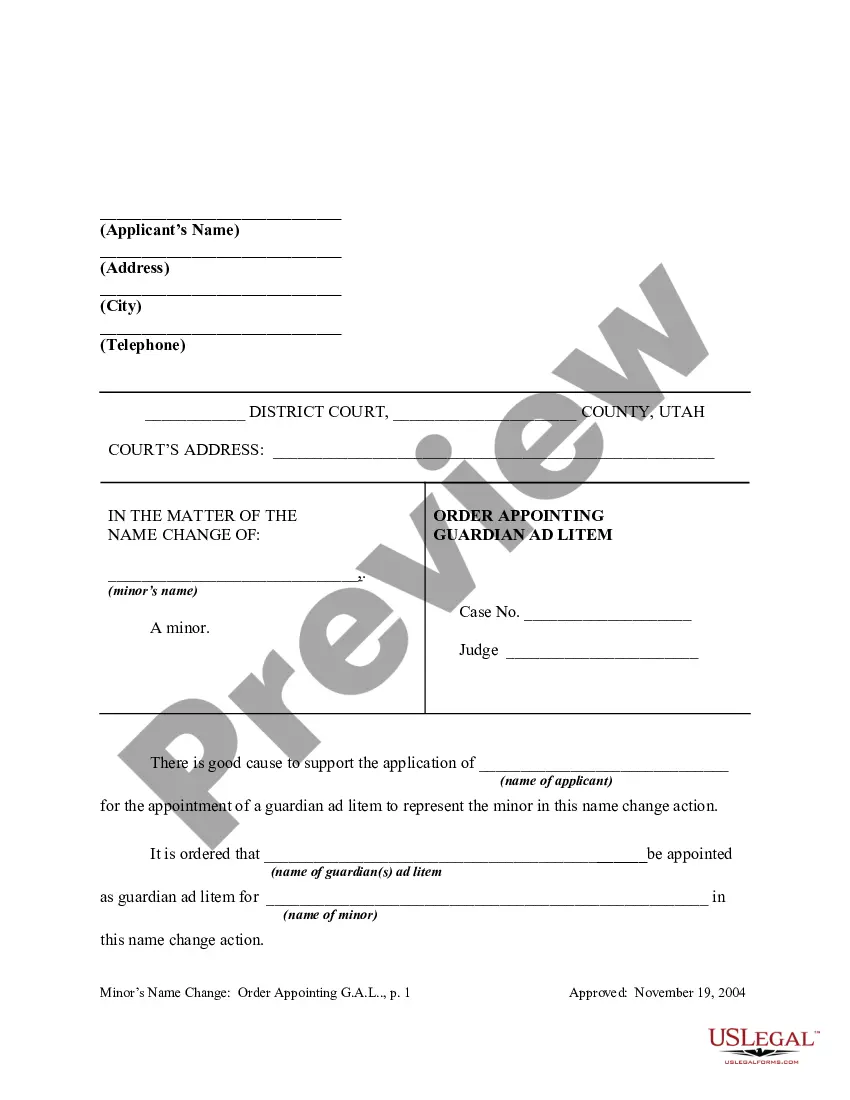

It is possible to devote time online trying to find the authorized file web template that fits the state and federal requirements you need. US Legal Forms supplies a large number of authorized types that are examined by specialists. It is possible to download or print the New York Proposed amendment to the restated certificate of incorporation to authorize preferred stock from our assistance.

If you currently have a US Legal Forms account, you can log in and click on the Download key. Following that, you can complete, modify, print, or signal the New York Proposed amendment to the restated certificate of incorporation to authorize preferred stock. Each and every authorized file web template you purchase is yours for a long time. To have yet another duplicate associated with a obtained form, check out the My Forms tab and click on the related key.

If you use the US Legal Forms website for the first time, follow the easy directions under:

- Initial, be sure that you have chosen the proper file web template for your state/area of your choice. See the form outline to make sure you have chosen the right form. If accessible, utilize the Review key to look from the file web template at the same time.

- In order to discover yet another variation in the form, utilize the Search area to find the web template that meets your needs and requirements.

- Once you have identified the web template you desire, click Buy now to proceed.

- Choose the rates strategy you desire, type in your accreditations, and register for an account on US Legal Forms.

- Complete the deal. You should use your bank card or PayPal account to purchase the authorized form.

- Choose the format in the file and download it to the product.

- Make adjustments to the file if necessary. It is possible to complete, modify and signal and print New York Proposed amendment to the restated certificate of incorporation to authorize preferred stock.

Download and print a large number of file themes using the US Legal Forms Internet site, which offers the biggest collection of authorized types. Use expert and condition-specific themes to take on your company or personal requires.

Form popularity

FAQ

Definition of Corporation It is an artificial being, created operation of law, having the right of succession and the powers, attributes, and properties expressly authorized by law or incident to its existence.

To make amendments your New York Corporation, you must provide the completed Certificate of Amendment of the Certificate of Incorporation form to the new York Department of State by mail, fax or in person, along with the filing fee.

It is called a legal person because it can enter into a contract, own property in its own name, sue and be sued by others, etc. In essence, it is not human, but it acts through human beings. It is called an artificial person because it is invisible, intangible, and exists only in the vision of the law.

DEFINITION: A corporation is an artificial being created by operation of law, having the right of succession and the powers, attributes and properties expressly authorized by law or incident to its existence.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

In other words, the theory posits that it is an act of the state, i.e. the issuance of the charter, that creates a corporation as a legal fiction. ingly, ?a corporation is an artificial being, invisible, intangible, and existing only in contemplation of law?.

Complete and file the Certificate of Amendment with the Department of State. The completed Certificate of Amendment, together with the statutory filing fee of $60, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.