New York Proposal to amend the restated articles of incorporation to create a second class of common stock

Description

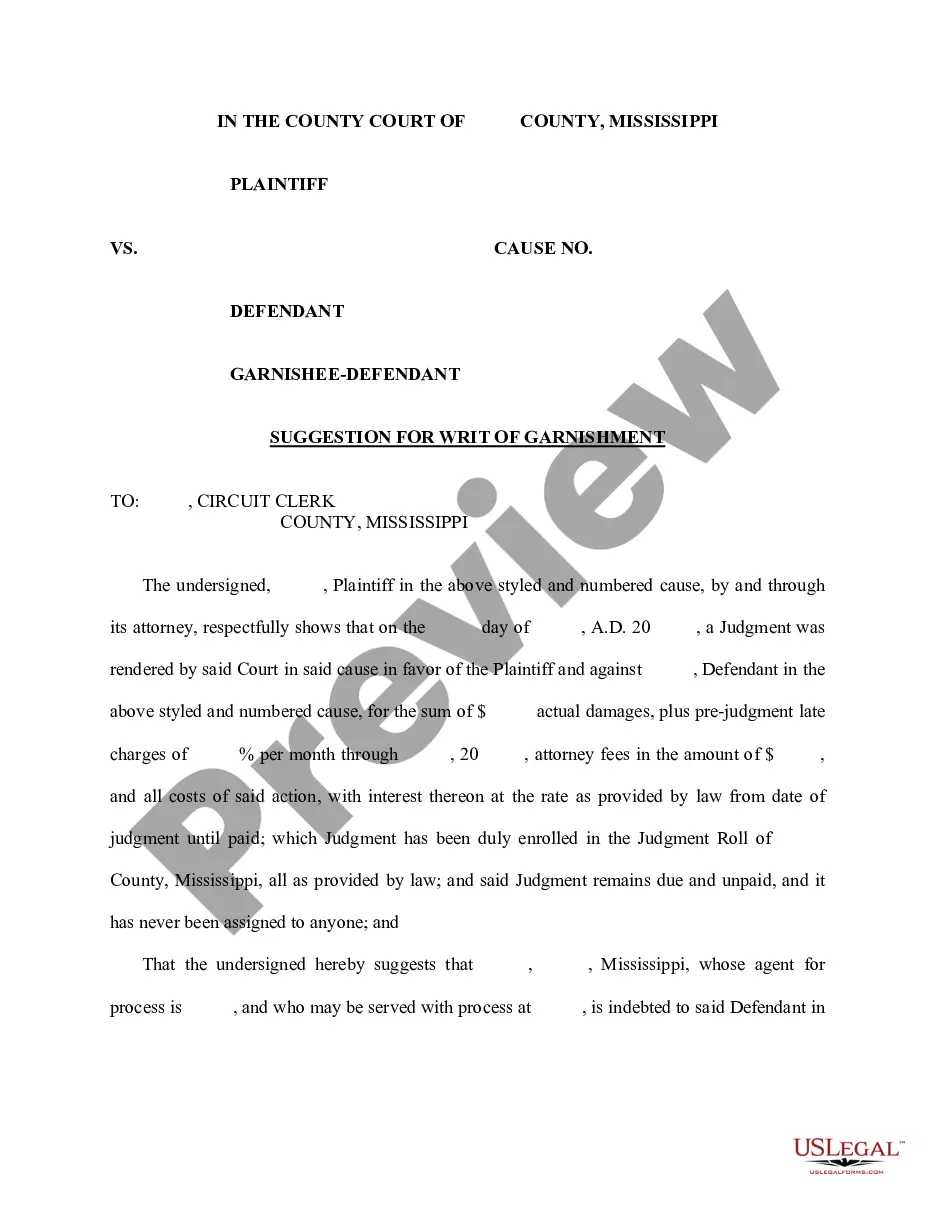

How to fill out Proposal To Amend The Restated Articles Of Incorporation To Create A Second Class Of Common Stock?

If you wish to comprehensive, obtain, or print lawful papers themes, use US Legal Forms, the largest variety of lawful forms, that can be found on the Internet. Use the site`s simple and easy handy look for to obtain the documents you require. Various themes for company and specific reasons are sorted by classes and says, or keywords. Use US Legal Forms to obtain the New York Proposal to amend the restated articles of incorporation to create a second class of common stock in a number of clicks.

If you are presently a US Legal Forms buyer, log in to your profile and then click the Down load switch to find the New York Proposal to amend the restated articles of incorporation to create a second class of common stock. You can even access forms you previously acquired from the My Forms tab of your profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your right town/nation.

- Step 2. Utilize the Review option to look through the form`s information. Do not overlook to read through the description.

- Step 3. If you are not satisfied together with the type, utilize the Lookup field at the top of the screen to discover other types from the lawful type template.

- Step 4. Once you have located the shape you require, click the Purchase now switch. Pick the rates program you like and add your references to sign up on an profile.

- Step 5. Approach the purchase. You can use your bank card or PayPal profile to accomplish the purchase.

- Step 6. Pick the structure from the lawful type and obtain it on your product.

- Step 7. Full, change and print or sign the New York Proposal to amend the restated articles of incorporation to create a second class of common stock.

Each and every lawful papers template you purchase is your own for a long time. You have acces to every type you acquired with your acccount. Click on the My Forms segment and decide on a type to print or obtain again.

Compete and obtain, and print the New York Proposal to amend the restated articles of incorporation to create a second class of common stock with US Legal Forms. There are many skilled and express-certain forms you can use for your company or specific requires.

Form popularity

FAQ

Anytime you change information included in your company's Articles of Incorporation or Articles of Organization, you typically need to file an Article of Amendment. Change Business Information with an Amendment Filing Wolters Kluwer ? ... ? BizFilings Wolters Kluwer ? ... ? BizFilings

How to File Articles of Amendment Entity name and state. Date of amendment. Article number being amended. Statement that the article cited is being amended. Amendment. Statement that other sections of the articles remain in full force and effect. Signatures. How to File Articles of Amendment - Northwest Registered Agent Northwest Registered Agent ? amendment Northwest Registered Agent ? amendment

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting. Amended Articles of Incorporation Change of Address - UpCounsel upcounsel.com ? amended-articles-of-incorp... upcounsel.com ? amended-articles-of-incorp...

Restated Articles of Incorporation are an updated and consolidated version of a company's foundational document, outlining its structure, purpose, and key provisions, which may be amended to reflect changes in the company's structure or goals.

A company can change its articles of association by calling a meeting of the shareholders and passing a resolution. A company can amend the articles for any reason that involves improvement of the business prospects. Amendment of Articles of Association - IndiaFilings indiafilings.com ? learn ? amendment-of-art... indiafilings.com ? learn ? amendment-of-art...

Articles of Incorporation must be amended to alert the state to major changes. Changes that qualify for state notification include changes to: address. company name.

The process of amending a corporation's articles is typically done through a special resolution. This can be achieved by a resolution approved by no less than two-thirds of the votes cast at a meeting of shareholders, or by a written resolution signed by all eligible shareholders.

Generic Procedure Plan to Amend a Company's Articles Firstly, the directors must convene a board meeting and provide appropriate notice. The director must obtain a quorum to approve the proposal and submit a resolution to the shareholders to amend the company's articles.