New York Authorization to purchase 6 percent convertible debentures

Description

How to fill out Authorization To Purchase 6 Percent Convertible Debentures?

If you want to total, obtain, or print legal document templates, use US Legal Forms, the biggest assortment of legal forms, that can be found online. Take advantage of the site`s easy and handy research to obtain the files you want. Different templates for company and individual reasons are categorized by classes and states, or key phrases. Use US Legal Forms to obtain the New York Authorization to purchase 6 percent convertible debentures in a handful of click throughs.

Should you be already a US Legal Forms consumer, log in in your account and click the Download button to obtain the New York Authorization to purchase 6 percent convertible debentures. You can also accessibility forms you formerly saved in the My Forms tab of your respective account.

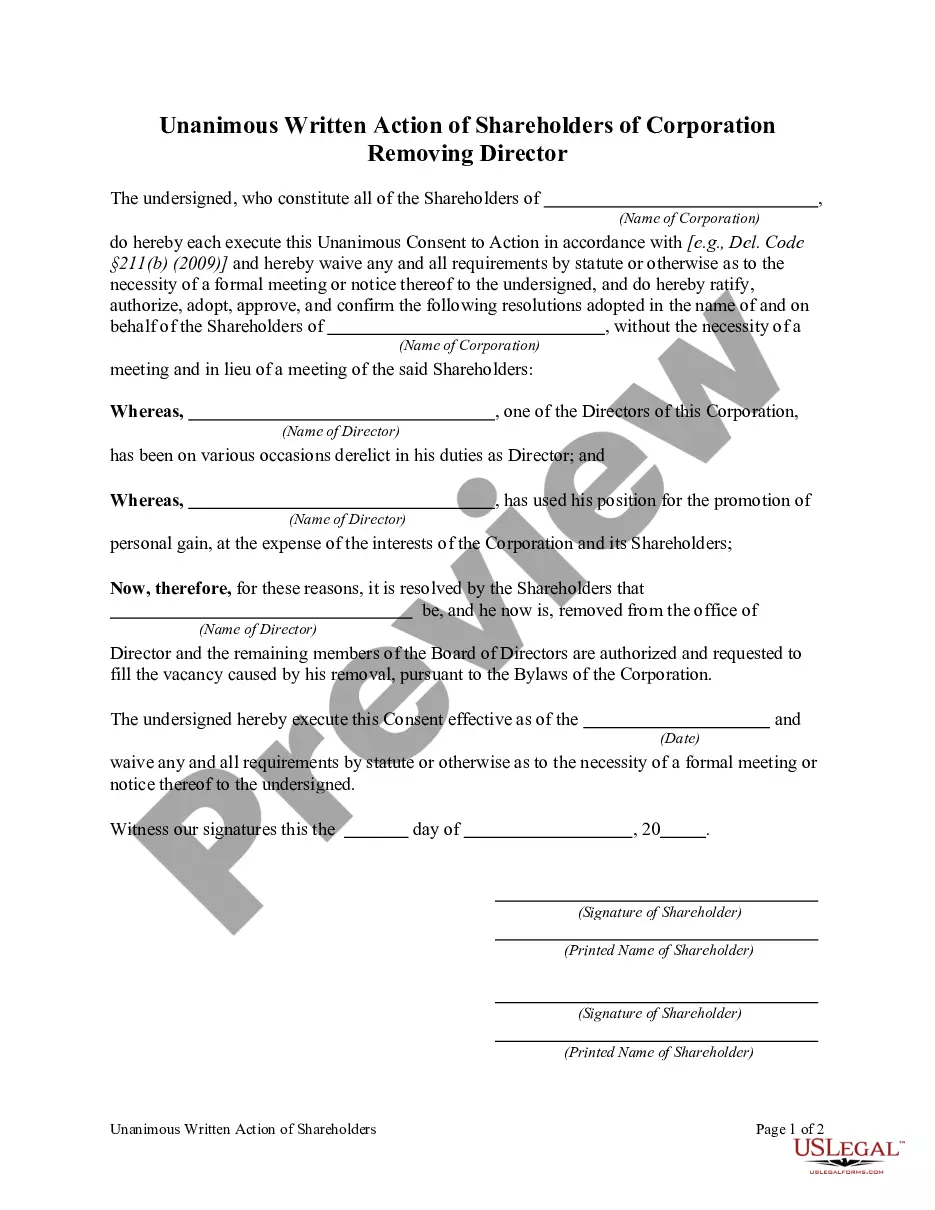

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your proper area/region.

- Step 2. Use the Review option to check out the form`s information. Never forget to see the information.

- Step 3. Should you be unhappy with the develop, utilize the Look for area towards the top of the screen to locate other types from the legal develop format.

- Step 4. Once you have located the form you want, go through the Buy now button. Opt for the rates plan you choose and put your references to sign up on an account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to finish the deal.

- Step 6. Find the file format from the legal develop and obtain it in your system.

- Step 7. Complete, edit and print or indication the New York Authorization to purchase 6 percent convertible debentures.

Every legal document format you buy is the one you have for a long time. You possess acces to each develop you saved within your acccount. Click on the My Forms section and select a develop to print or obtain again.

Compete and obtain, and print the New York Authorization to purchase 6 percent convertible debentures with US Legal Forms. There are many professional and condition-particular forms you can use for your company or individual demands.

Form popularity

FAQ

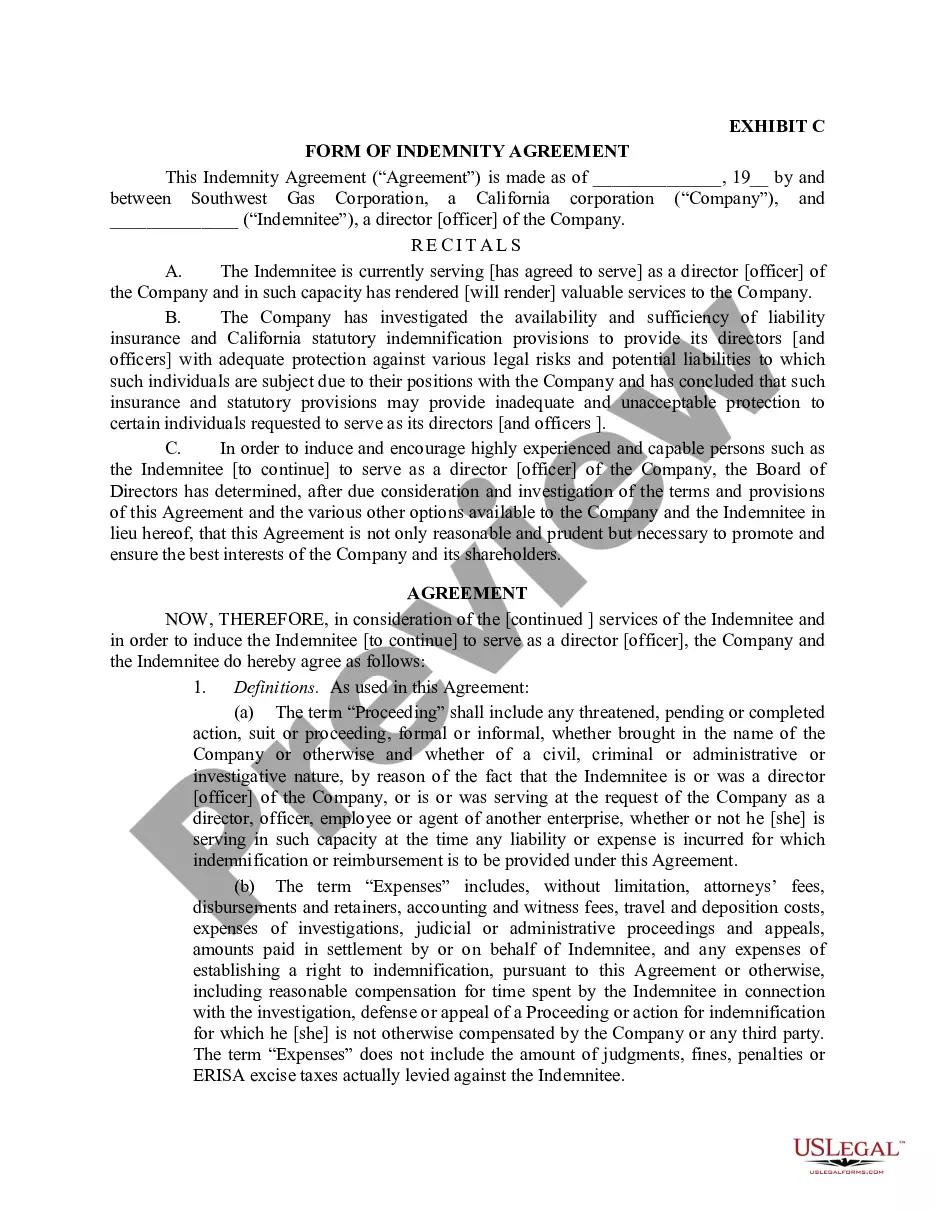

Convertible debentures are issued by companies as a means of deferred equity financing in the belief that the present share price is too low for issuing common shares. These securities offer a conversion into the underlying issuer's shares at prices above the current level (referred to as the conversion premium).

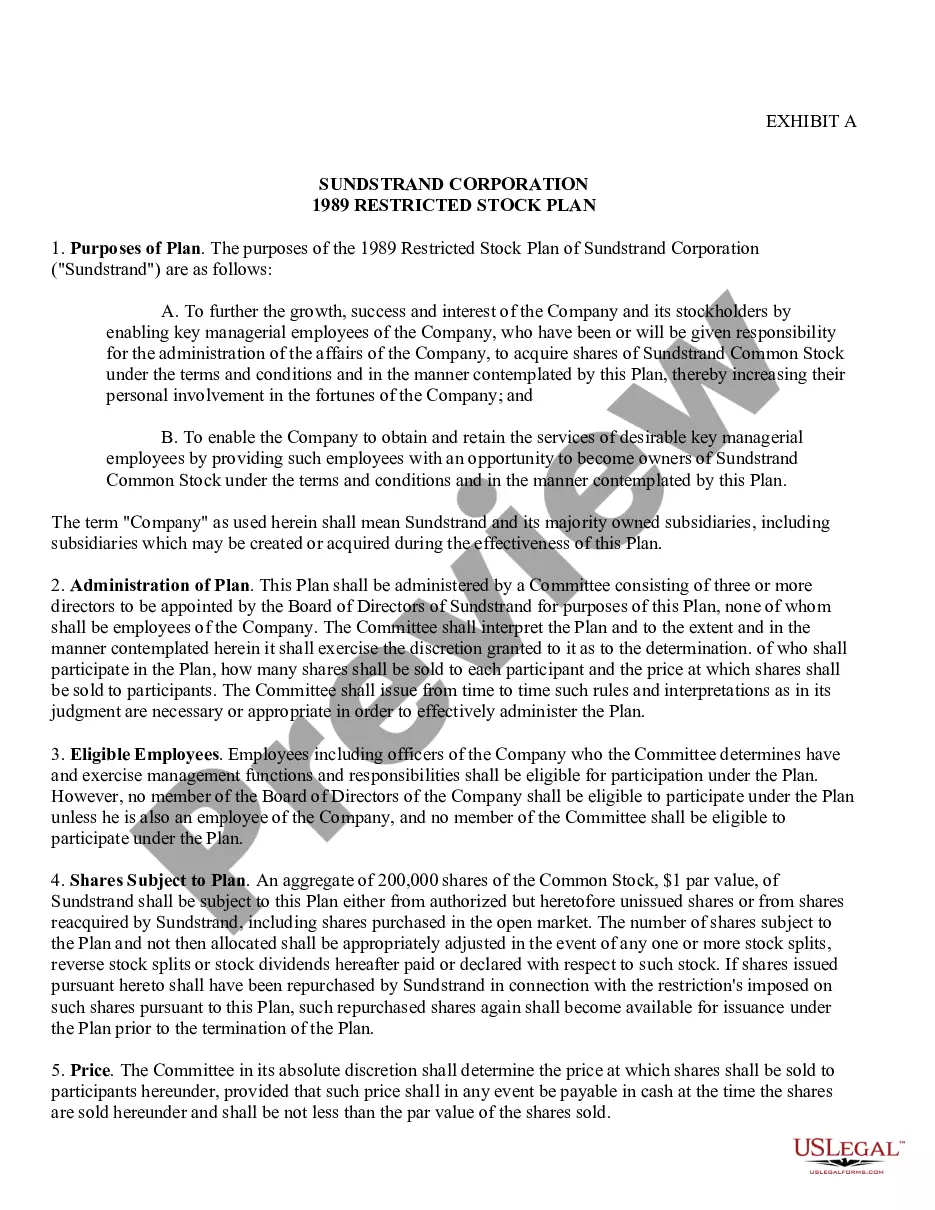

Also commonly known as loan stock, loan notes constitute a particular type of debt security called debentures. Loan notes can be issued by corporate entities as well as individuals for a number of different purposes.

A convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. It's a common way for investors to invest in early stage startups, particularly ones that are pre-valuation.

A convertible debenture differs from convertible notes or convertible bonds, generally in that debentures have longer maturities.

Fully Convertible Debenture: These are debentures in which the whole value of debentures can be converted into equity shares of the company. Partly Convertible Debenture: In this kind of debentures, only a part of the debentures will be eligible for conversion into equity shares.

Section 71(1) permits companies to issue debentures with an option to convert such debenture into shares, either wholly or partly at the time of redemption, provided that it shall be approved by a special resolution passed at a general meeting.

A company can issue any type of debenture based on its requirement. A convertible debenture is one among them, which is a hybrid debt instrument that strikes a balance between equity and debt. This debt instrument is where the company can convert into equity shares fully or partially.