New York Proposed issuance of common stock

Description

How to fill out Proposed Issuance Of Common Stock?

Choosing the right legitimate file template can be quite a have a problem. Obviously, there are tons of web templates available on the Internet, but how will you discover the legitimate develop you need? Use the US Legal Forms site. The assistance offers a large number of web templates, for example the New York Proposed issuance of common stock, that can be used for enterprise and private requirements. All of the forms are checked out by pros and meet federal and state needs.

In case you are previously registered, log in in your profile and click on the Down load switch to find the New York Proposed issuance of common stock. Use your profile to search from the legitimate forms you might have bought formerly. Proceed to the My Forms tab of the profile and acquire another copy of your file you need.

In case you are a whole new user of US Legal Forms, here are simple guidelines that you should stick to:

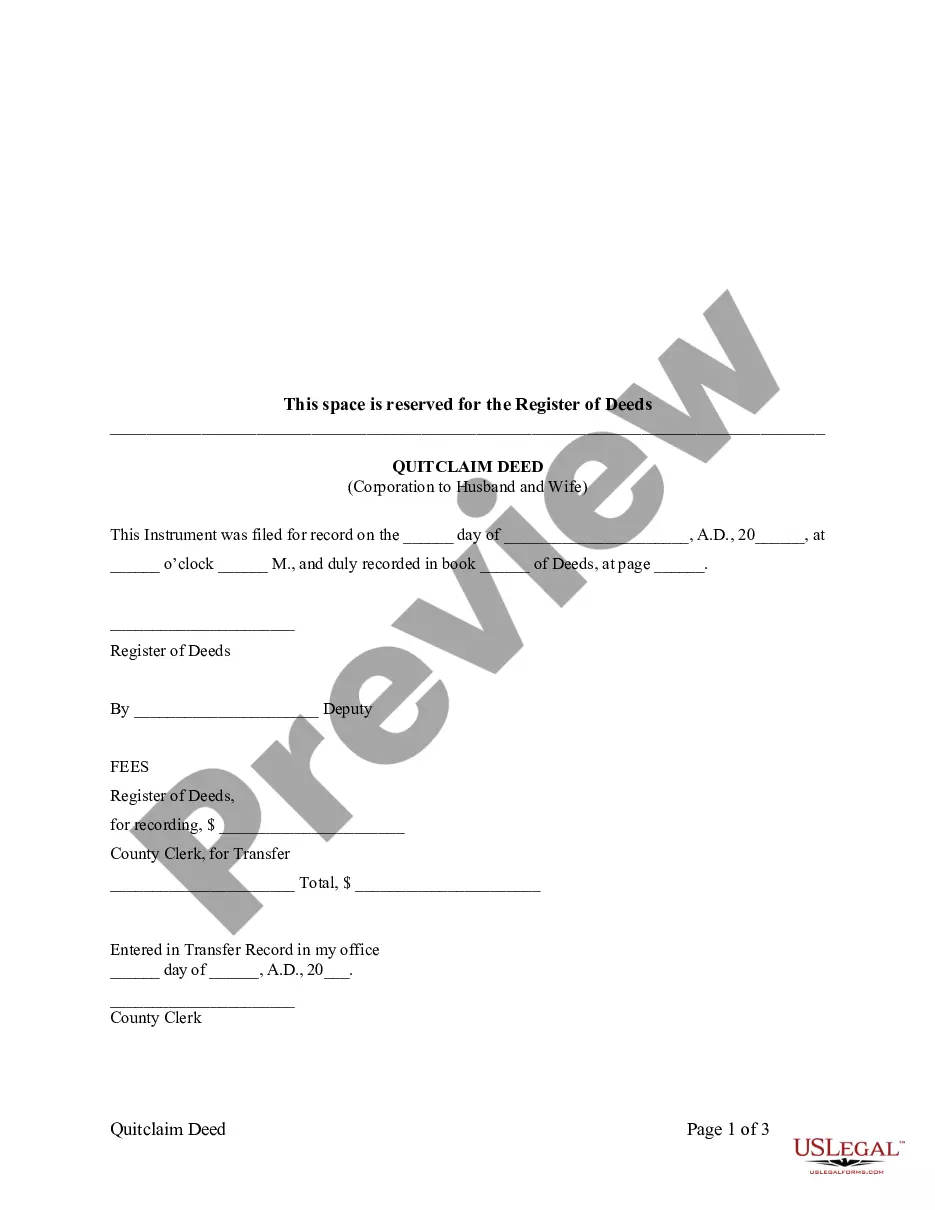

- Very first, be sure you have selected the correct develop to your metropolis/area. You may examine the form utilizing the Review switch and look at the form explanation to make certain it will be the right one for you.

- In case the develop does not meet your expectations, use the Seach area to discover the appropriate develop.

- When you are sure that the form would work, select the Get now switch to find the develop.

- Pick the costs prepare you need and enter in the necessary details. Make your profile and pay for the order using your PayPal profile or charge card.

- Select the file format and down load the legitimate file template in your gadget.

- Full, revise and produce and indication the received New York Proposed issuance of common stock.

US Legal Forms is the largest catalogue of legitimate forms in which you can discover various file web templates. Use the service to down load appropriately-created papers that stick to state needs.

Form popularity

FAQ

A waiver is a legally binding provision where either party in a contract agrees to voluntarily forfeit a claim without the other party being liable. Waivers can either be in written form or some form of action.

Stock-Based Waiver means (i) the waiver of Deferrable Stock-Based Compensation, (ii) a Mandatory Waiver of Stock and (iii) a Cash-Based Waiver from and after the time the Participant requests that such waived amount's reference investment be Stock.

This is to certify that I, as parent/legal guardian with legal responsibility for this participant, do consent and agree to his/her release as provided above of all the Releasees, and, for myself, my child and our heirs, assigns, and next of kin, I release and agree to indemnify and hold harmless the Releasees from any ...

Types of Waivers Waiver of Liability. A waiver of liability is a provision in a contract by which any person participating in an activity forfeits the right to sue the organization conducting the activity in case of injuries. ... Waiver of Premium. ... Waiver of Subrogation. ... Loan Waiver.

Under the NYSE's temporary waiver, a company may issue shares of common stock to Related Parties and their affiliates without complying with the 1% or 5% limitation, if the issuance is a cash transaction that meets the Minimum Price requirement.

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.